Climate Bonds Conference2020, 5-7th May, London – Green Transition - Opportunity of the Decade

Just 11 weeks away, Agenda now available - Don’t miss the premier green finance event of 2020!

More information & registration is here.

Welcome to the new Markets Monthly!

We have changed the format slightly and would love to hear your feedback…

In 2020 we are looking to provide a more holistic view of the green bond market, integrating analysis and reading lists, with a focus on selected deals by new issuers.

If you’re interested in offering feedback or would like to know more about our Market Data please reach out at: dataenquiries@climatebonds.net

What’s New

Our Green Bonds Market Summary 2019 analyses the record annual green bond and green loan issuance to 30 December of USD257.7bn. The total is up by 51% on the final 2018 figure of USD170.6bn. USD10bn (4%) of the total are green loans.

Our Green Bonds Market Summary 2019 analyses the record annual green bond and green loan issuance to 30 December of USD257.7bn. The total is up by 51% on the final 2018 figure of USD170.6bn. USD10bn (4%) of the total are green loans.

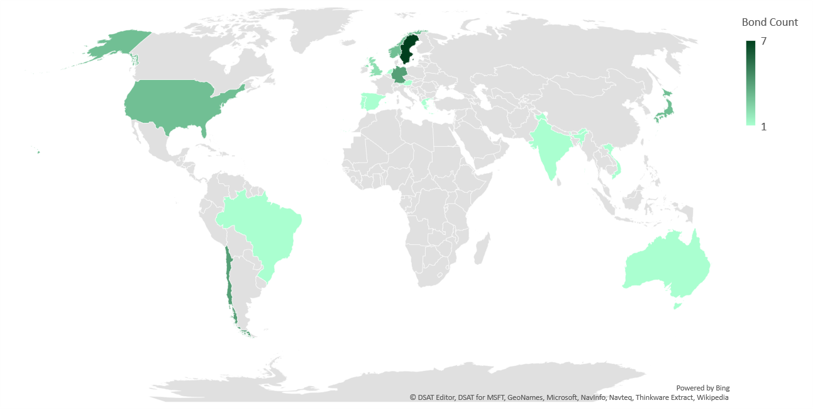

Green bond deal count across the globe: January 2020

January at a glance

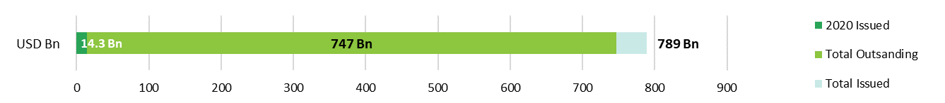

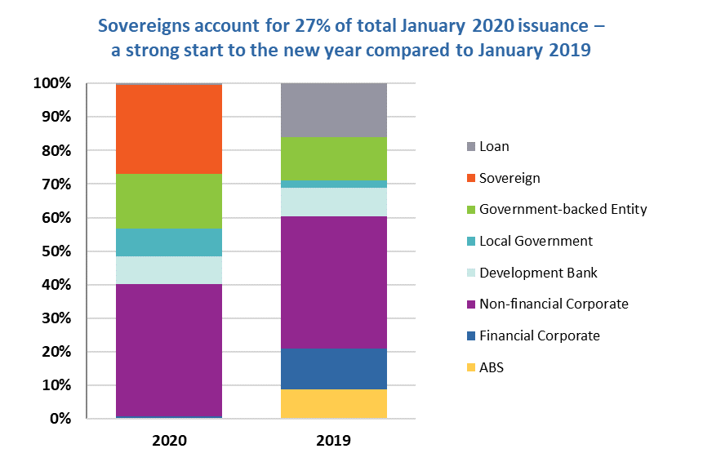

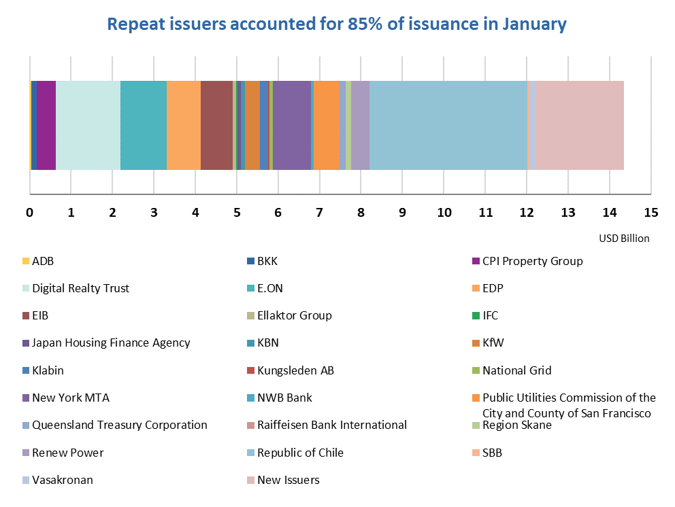

The year started off with total January issuance of USD14.3bn (a drop of 29% compared to January 2019), taking the total cumulative issuance volume to date up to USD789bn.

Green Sovereigns had a strong start to the year with USD3.8bn solely coming from the Republic of Chile. Chile first joined the sovereign green bond market in June 2019 with a ground-breaking Climate Bonds Certified issuance, Latin America’s first sovereign to issue a green bond, generating very high demand.

January saw four deals; two of them were taps of 2019 issuances and two were new bonds, again denominated in USD and EUR. All were Certified Climate Bonds. The new deals achieved historically low rates and financed mainly low carbon transport projects.

Overall, Latin America is expecting further growth in green bond volumes. Juan Antonio Ketterer from the IDB is optimistic about the region, outlining the some of the development banks’ green finance directions in this special Environmental Finance feature.

On the sovereign side, Mexico is planning its inaugural issuance sometime this year.

Sovereign greens from Europe are also gaining attention as Danish pensions administrator PKA made a further investment of DKK1.5bn (USD221.1m) in the Dutch sovereign bonds financing renewable energy, low-carbon transport and climate adaptation projects.

Denmark is also planning an innovative structure for green bonds where a vanilla issuance would be combined with a “green certificate” – both individually tradable. The Danish Treasury is considering this from a liquidity management perspective and to protect its AAA-rating.

Only two Financial Corporates issued green bonds in January 2020 with a total of USD115.9m, one newcomer to the market, Orix (Japan) and one repeat issuer, Raiffeisen Bank International (Austria). However, there are already four deals announced by banks and REITs for February 2020 (see Green Bond Outlook).

Non-financial Corporates made up the largest segment of January volume with USD5.6bn. Two large deals contributed to this figure: Digital Dutch Finco B.V. (Digital Realty Trust), Netherlands, with EUR1.4bn (USD1.6bn) and E.ON, Germany, raising EUR1bn (USD1.1bn), both repeat issuers.

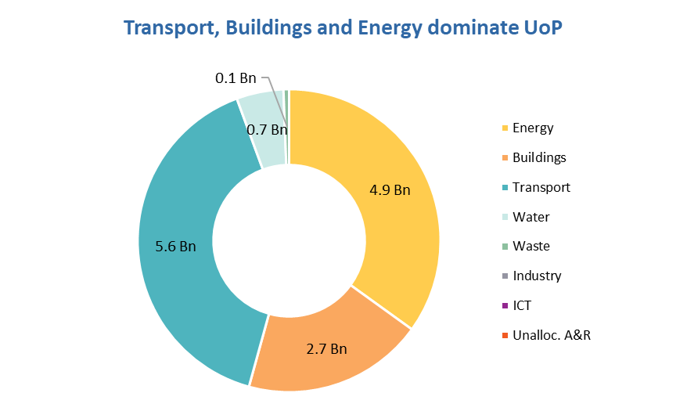

Renewable Energy took up 34% of the overall Use of Proceeds (UoP) allocation for the month (Digital Dutch Finco B.V. and E.ON allocating 33% and 50% of their issuance volume, respectively).

ReNew Power, India’s largest independent power producer, returned to the market with a USD450m deal which will be used for refinancing instruments maturing next year. Such repeat issuance shows an ongoing commitment to energy sector decarbonisation, crucial to meeting India’s ambitious clean energy goals. Financial risks for carbon intensive industries are increasing, as reported by Lex: Stranded energy assets could make up as much as USD900bn in the energy sector.

Two energy grid operators (National Grid and Red Eléctrica) had their inaugural green bond issuance in January and contributed to the 34% UoP figure (see New Issuer Spotlight).

The Water sector saw the lowest issuance volume since March 2019 at USD0.7bn. Similarly, funds for Waste projects were significantly lower compared to individual monthly issuance all year in 2019. In January 2020 no Industry or ICT projects were financed.

Worth Reading

Manuel Adamini, Head of Investor Engagement at Climate Bonds, discusses the brown-to-green transition in depth with Natixis. Read the full interview here.

…and:

- Who Are The 100 Most Sustainable Companies Of 2020? - Forbes

- ESMA sets out sustainable finance strategy - Finextra

- Investors and the Blue Economy - Credit Suisse

- European boost for green bonds - Private sector must finance Brussels’ environmental plans - HSBC

- RobecoSAM fund seeks opportunity in ‘circular economy’ - funds europe

- Singapore advances its role as green finance hub with a $44m green loan into Myanmar - Shwe Taung

> Check out the full list of new and repeat issuers.

> Click on the issuer name to access the new issue deal sheet in our online Bond Library.

New Issuer Spotlight

Porsche AG (EUR1bn/USD1.1bn), Germany. The luxury car maker issued its first green instrument; a green Schuldschein which is Certified against the Low Carbon Transport Criteria of the Climate Bonds Standard. It finances and refinances previous and future investments in the development and manufacture of the new Porsche Taycan.

This is the first fully electric sports car to be produced by the iconic auto maker.

Porsche is the first car maker to obtain Certification for a green bond under the Low Carbon Transport Criteria, a signal to the automotive industry for adopting best practice towards the manufacture of a greener sports car.

Porsche Taycan’s production was announced in August 2019 and the car will be available in various markets in the coming months. The manufacturing plants are based near Stuttgart, Germany. Until the proceeds are fully allocated, annual reports will be made available to bondholders only. These reports will have details regarding the allocation of proceeds.

In January 2020, two major grid operators from the United Kingdom and Spain entered the green bond market financing a variety of projects collecting more than USD1b of funding together. These players are crucial in spurring the shift to renewable energy, as acknowledged at the Future Energy Summit in Abu Dhabi in the middle of January.

National Grid (EUR500/USD554m), a non-financial corporate from the United Kingdom, issued its inaugural green bond maturing in 5 years’ time. This senior unsecured green bond benefits from an SPO issued by DNV GL. Emphasising the importance of decarbonising the energy sector, the National Grid will contribute to the UK’s Net Zero Carbon by 2050 target.

Eligible categories include renewable energy, which covers grid connection, transmission and distribution infrastructure, and renewable energy generation. Further projects will focus on energy efficiency, green buildings, clean transportation, pollution prevention and control, as well as sustainable natural resource management and land use.

Allocation and impact reporting will be available through the company’s website or the annual report within a year from the first borrowing date and will continue until full allocation. The allocation report will include: the list of eligible green projects, the aggregated amount of allocated proceeds to each eligible project category, the ratio of financing and refinancing, and management of unallocated proceeds. The impact report will include indicators such as CO2 emissions avoided, and renewable energy sources connected (MW).

Climate Bonds view: Decarbonising the energy sector plays a major role in shifting to a low-carbon economy. In addition to the process of power generation itself, it is vital to invest in grid infrastructure and storage technologies. The National Grid is doing exactly this in order to contribute to the UK’s target of becoming carbon neutral by 2050, whilst adding to the yet sparse pool of 15 British green bond issuers. Volume is currently at a total of USD15.3bn in green bonds outstanding with the largest proportions going towards renewable energy (29%) and water (23%) projects.

The Green Bond Framework covers a broad spectrum of eligible categories on the core business side (such as connection infrastructure and retrofits to reduce energy losses) as well as the operational side (e.g. green buildings).

To date grid operators from 10 different countries have issued green bonds, mainly from Europe. We hope that this encourages issuers from other regions to consider such projects in the future.

Red Eléctrica (EUR700/USD775m), a government-backed entity from Spain, joined the green bond market with a senior unsecured instrument that will mature in 8 years. Sustainalytics issued a SPO for the framework, whose eligible project categories include renewable energy and clean transportation. This ranges from investments in integrating and enhancing the transmission capacity for renewable energy and the direct integration of renewable energy generation to the grid to decarbonisation projects enabling renewable energy integration, as well as investments in high speed rail lines and electrical connections.

Information on allocation and impact of the green financing will be provided on an annual basis on the company’s website until full allocation of the net proceeds. These reports will include information such as the total amount invested in the eligible projects, the ratio of new and existing projects, the year of investment, the balance of unallocated proceeds and the geographical distribution of assets.

Key measures disclosed in the impact report will be the increase of renewable energy capacity and estimated annual CO2 emissions avoided. The impact report may also include case studies.

Climate Bonds view: Spain ended 2019 with renewables accounting for almost half of the total installed energy generation capacity. Red Eléctrica’s green bond underpins this trend and the country’s ambition to decrease its carbon footprint and to switch to 100% renewable electricity by 2050.

It’s positive to see such transparency in post-issuance reporting, which will also include the geographical distribution of assets financed. Not only is this level of detail rare to see in green bond reports, but it is also particularly important for industries comprised of interconnected networks of operational assets, which grid operators clearly fall under.

New Issuers continued...

Public Sector

- Ferde AS (NOK2bn/USD223m), Norway, 4.5Y original term, SPO provided by CICERO.

- Nord/LB (EUR300m/USD331m), Luxembourg, 5Y original term, SPO provided by Sustainalytics.

- San Lorenzo Valley California Water District (USD14m), USA, 18.1Y original term, assurance provided by BAM GreenStar - issued in August 2019.

- The State of Nevada Department of Business and Industry Environmental Improvement (USD50m), USA, 18.5Y original term, SPO provided by Sustainalytics - issued in September 2019.

Financial Corporates

- Orix (JPY10bn/USD92m), Japan, 5Y original term, SPO provided by Sustainalytics.

- Sunndal Sparebank (NOK75m/USD9m), Norway, 3Y original term, SPO provided by CICERO - issued in February 2019.

ABS & Loans

- BYD Company Limited (CNY3.7bn/USD521m), China, 3Y original term, SPO provided by Lianhe EQ - issued in August 2019.

- Capital Court Limited (HKD3.6bn/USD460m), Hong Kong, 4Y original term, no third-party review - issued in September 2019.

- Ningbo Beilun Public Traffic Co., Ltd. (CNY615m/USD88m), China, 10Y original term, no third-party review - issued in December 2019.

- Qingdao International Shipping Building Management Co., Ltd. (CNY1.9bn/USD270.1m), China, 17.7Y original term, no third-party review - issued in November 2019.

- State Power Shanxi New Energy Development Co., Ltd (CNY405m/USD58m), China, 3Y original term, SPO provided by The iGreen Bank - issued in December 2019.

- The Wharf (Holdings) Limited (HKD2.0bn/USD2.6m), Hong Kong, no third-party review - issued in January 2019.

- Tongren Jiaotong Group Public Transportation Co., Ltd. (CNY220.0m/USD31.0m), China, 1Y original term, no third-party review - issued in December 2019.

- Vietnam Prosperity Joint-Stock Commercial Bank (USD71m), Vietnam, 5Y original term, no third-party review.

Non-financial Corporates

- EEW Capital Finance PLC (EUR25m), UK, 5Y original term, Certified Climate Bond - issued in August 2019.

- GSP Renewable Energy Pte Ltd (USD15m), China, 5Y original term, SPO provided by HKQAA - issued in July 2019.

- Jiangxi Provincial Water Conservancy Investment (USD300m), China, 3Y original term, assurance provided by HKQAA - issued in December 2019.

- Tokyu Fudosan Holdings Corp (JPY10bn/USD91m), Japan, 5Y original term, rated Green 1 by JCR.

- Zhuhai Da Heng Qin Invest Co (CNY800m/USD114m), China, 2Y original term, assurance provided by EY - issued in November 2019.

Visit our Bond Library for more details on January deals and a full history of debut issuances going back to 2017.

Green Bond Outlook

|

Issuer Name |

Closing Date |

Link |

|

LBBW |

03/02/2020 |

|

|

Rikshem |

03/02/2020 |

|

|

Shwe Taung Group |

05/02/2020 |

|

|

Bankinter |

06/02/2020 |

|

|

Prologis |

06/02/2020 |

|

|

MünchenerHyp |

10/02/2020 |

|

|

Telia Co |

11/02/2020 |

|

|

Santander Consumer Bank |

12/02/2020 |

Announced for the month of February are predominantly repeat issuers, but three market newcomers have also stated their issuance already: Bankinter (Spain), Telia Co (Sweden) and Santander Consumer Bank (Norway).

Overall, deals from four financial corporates are scheduled for February. The majority of the issuers come from Scandinavia.

After Peru and Colombia’s preliminary announcements last year, Mexico is also planning to join the green bond market with inaugural issuance foreshadowed for 2020.

Ecuador came out with its first Sovereign Social Bond in January financing the country’s housing sector.

Spain will likely issue its first green Sovereign bond in the second half of 2020 with a 20-year tenor. EPSA is also expected to tap the green bond market again to finance solar projects.

Data and references

Repeat issuers in January

Repeat issuers: January – November 2019 (not previously included)

- ADB (Asian Development Bank): SEK1.5bn/USD155.7m - November 2019

- ADB (Asian Development Bank): SEK150m/USD15.4m - August 2019

- ADB (Asian Development Bank): SEK1.3bn/USD132.2m - July 2019

- Alperia SPA: NOK935m/USD117.8m - October 2017

- BKS Bank: EUR5m/USD5.5m - September 2019

- Eidsiva Energi AS: NOK500m/USD54.7m - October 2019

- Eidsiva Energi AS: NOK1bn/USD109.4m - October 2019

- Fastighets AB Balder: SEK1.3bn/USD136.9m - December 2019

- First Abu Dhabi Bank (National Bank of Abu Dhabi): USD50m - September 2019

- Hang Lung Properties Limited: HKD1bn/USD128.3m - December 2019

- Hysan MTN Limited: HKD500m/USD63.7m - April 2019

- Hysan MTN Limited: HKD250m/USD31.9m - May 2019

- IFC (International Finance Corporation): HKD100m/USD12.7m - June 2019

- Public Service Company of Colorado (Xcel Energy): USD550m - August 2019

- Samhällsbyggnadsbolaget i Norden AB: SEK500m/USD51.6m - September 2019

- Sparebanken Sogn og Fjordane: NOK300m/USD33.1m - September 2019

- Keppel Reit: SGD150m/USD110.1m - December 2019

- Ocean Properties: SGD505m/USD369.5m - June 2019

- Soilbuild Group Holdings: SGD248m/USD179.7m - September 2019

- OCBC: AUD500m/USD341.7m - May 2019

- OCBC NISP: USD150m - August 2018

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Although we support the Sustainable Development Goals (SDGs) overall and see many links between green bond finance and specific SDGs, in particular SDGs 6, 7, 9, 11, 13, 14 and 15, the proportion of proceeds allocated to social goals should be no more than 5% for inclusion in our database.

|

|

Issuer Name |

Amount issued |

Issue date |

Reason |

|

Excluded |

||||

|

|

RYOBI LIMITED |

JPY13bn/USD119.5m |

31/01/2020 |

GB not aligned |

|

Vasakronan |

EUR100m/USD563.7m |

12/04/2019 |

Unlabelled |

|

|

Guangxi Briwater Environmental Investment Co. Ltd. |

TBC |

TBC |

Insufficient information |

|

|

Brookfield property finance ULC |

CAD400m/USD0m |

15/01/2020 |

Unlabelled |

|

|

IBRD |

CAD1.5bn/USD1.1bn |

26/07/2019 |

Sustainability/Social bond |

|

|

Williston State College |

USD7m |

22/08/2019 |

Not aligned |

|

|

The Confederated Tribes of the Warm Springs Reservation of Oregon |

USD20.4m |

29/08/2019 |

Insufficient information |

|

|

Kaneka Corporation |

JPY5bn/USD46.4m |

12/09/2019 |

Not aligned |

|

|

Port of LA |

USD7.9m USD7.9m |

18/09/2019 18/09/2019 |

Not aligned Not aligned |

|

|

NCC |

SEK750m/USD77.3m SEK850m/USD87.6m |

25/09/2019 25/09/2019 |

Not aligned Not aligned |

|

|

Ichinen Holdings Co., Ltd. |

TBC |

TBC |

Insufficient information |

|

|

Porterbrook |

GBP100m/USD129.5m |

01/11/2019 |

Not aligned |

|

|

WB (IBRD) |

CAD1.5bn/USD1.2bn |

16/01/2020 |

Sustainability/Social bond |

|

|

Fuyo Lease |

JPY5bn/USD46.4m |

22/07/2019 |

Not aligned |

|

|

Shinhan Group Financial Group |

EUR500m/USD500m |

30/07/2019 |

Not aligned |

|

|

IFC |

SEK65m/USD6.9m |

17/07/2019 |

Not aligned |

|

|

Credit Agricole CIB |

USD300m |

09/07/2019 |

Not aligned |

|

|

Sumitomo Mitsui Finl Grp Inc |

EUR500m/USD558.6m |

22/05/2019 |

Insufficient information |

|

|

Southwestern Public Service Co |

US300m/USD300m |

11/06/2019 |

Insufficient information |

|

|

Construcciones el Condor SA |

COP100bn/USD31.4m |

28/03/2019 |

Insufficient information |

|

|

Electronica Finance Limited (EFL) |

INR709.509m/USD10m |

16/04/2019 |

Not aligned |

|

|

Lidl Austria |

EUR300m/USD335.5m |

15/05/2019 |

Not aligned |

|

|

East Renewables |

EUR75m/USD83.5m |

21/05/2019 |

Insufficient information |

|

|

City council of Stockholm |

SEK1bn/USD105.8m |

04/06/2019 |

Insufficient information |

|

|

RCBC |

PHP8bn/USD154m |

04/06/2019 |

Not aligned |

|

|

Landsea green group |

USD200m |

20/06/2019 |

Insufficient information |

|

|

Owens-Illinois Group |

EUR500m/USD550.8m EUR500m/USD550.8m |

12/11/2019 12/11/2019 |

Not aligned Not aligned |

|

|

SKF |

EUR300m/USD331m |

15/11/2019 |

Not aligned |

|

|

EIB (European Investment Bank) |

AUD250m/USD185.6m |

18/06/2018 |

Unlabelled |

|

|

Contact Energy |

NZD50m/USD33.1m |

15/01/2020 |

Sustainability/Social bond |

|

|

Shriram Transport Finance Corp |

USD500m |

16/01/2020 |

Sustainability/Social bond |

|

|

Republic of Indonesia |

USD167.9m USD1.1bn |

20/02/2019 20/02/2019 |

Not aligned (regular bond) Not aligned (regular bond) |

|

|

Pending |

||||

|

|

EUROFIMA |

EUR50m/USD55m EUR75m/USD82.7m EUR200m/USD221.9m |

30/01/2020 31/01/2020 22/01/2020 |

Insufficient information Insufficient information Insufficient information |

|

Mowi ASA |

EUR200m/USD220.4m |

31/01/2020 |

Insufficient information |

|

|

Credit Agricole |

JPY2.1bn/USD19.1m |

27/01/2020 |

Insufficient information |

|

|

ENGIE |

EUR750m/USD848.7m |

21/06/2019 |

Insufficient information |

|

|

Stockholms Lan Lansting |

SEK400m/USD42m |

22/01/2020 |

Insufficient information |

|

|

Natixis |

EUR2.149m/USD2.4m EUR30m/USD33.5m |

17/12/2019 13/12/2019 |

Insufficient information Insufficient information |

|

News and reports links

|

|

Title |

Source |

Link |

|

Investing news |

|||

|

|

Bringing Transparency to Green Bonds in Latin America and the Caribbean |

Environmental Finance |

|

|

Chile obtiene una tasa récord en emisiones de bonos verdes en dólares |

PV Magazine |

||

|

Ecuador issues world's first Sovereign Social Bond, with the support of an IDB guarantee |

IDB |

||

|

GREEN ISSUANCE |

Danmarks Nationalbank |

||

|

Green bonds: a step towards a carbon-neutral future for Latin America |

Al dia |

||

|

Green Finance in Singapore: Barriers and Solutions |

ADB |

||

|

Lex in depth: the $900bn cost of ‘stranded energy assets’ |

Financial Times |

||

|

PKA takes fifth of latest Dutch green bond issuance |

IPE |

||

|

ReNew Power Secures $450 Mn Funds Through Dollar Bonds |

Inc42 |

||

|

|

RobecoSAM fund seeks opportunity in ‘circular economy’ |

funds europe |

|

|

Reading & reports |

|||

|

|

Esma sets out sustainable finance strategy |

Finextra |

|

|

European boost for green bonds |

HSBC |

||

|

Investors and the Blue Economy |

Responsible Investor |

||

|

Walking the Talk – Transitioning Brown Industries to Green |

Natixis |

||

|

Who Are The 100 Most Sustainable Companies Of 2020? |

Forbes |

||

|

Green bond gossip |

|||

|

|

Colombia explores green bond |

LatinFinance |

|

|

El Tesoro prevé una emisión neta de 32.500 millones en 2020 y emitir bonos verdes en el segundo semestre |

El peridodico de la energua |

||

|

EPSA taps bond market to finance solar projects |

LatinFinance |

||

|

Mexico preparing ground for green bond in 2020 – Herrera |

LatinFinance |

||

|

Peru could follow Chile with green bond |

LatinFinance |

||

Don’t forget, registrations are now open for Climate Bonds Conference2020! 5th-7th May in London.

Your Feedback is welcome.

Watch this space for market developments and any if you have any data requests please send them to dataenquiries@climatebonds.net.

‘Till next time,

Climate Bonds