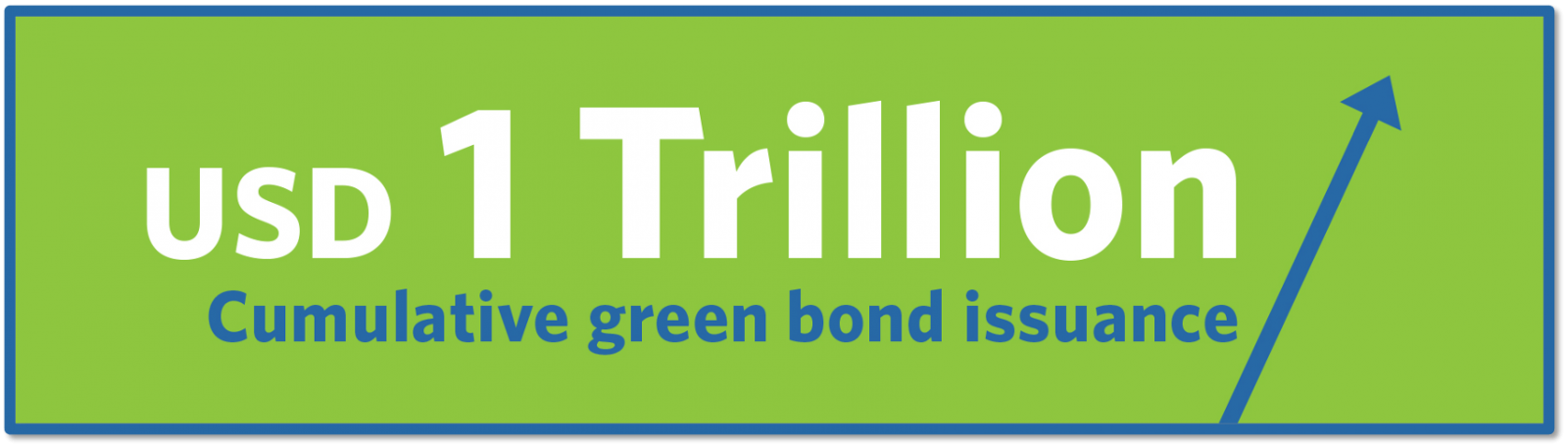

Goal of reaching $trillions in annual global issuance remains

The green finance market has reached its most substantial milestone yet, with USD 1.002 trillion in cumulative issuance since market inception in 2007, according to the Climate Bonds Green Bond Database. The milestone was passed in early December.