Keeping transport on track for the Paris goals

Climate Bonds releases V2.0 of the Transport Criteria, updated to reflect the latest scientific input and market knowledge for determining whether a bond or loan is financing climate-aligned transport assets.

Climate Bonds releases V2.0 of the Transport Criteria, updated to reflect the latest scientific input and market knowledge for determining whether a bond or loan is financing climate-aligned transport assets.

Launched in early 2016 with a Certified bond from New York MTA, the Criteria form the basis for Certification of a range of land-based transport activities including vehicles, passenger trains, urban subway/metro systems and dedicated supporting infrastructure, and charging and hydrogen fuelling infrastructure.

These updated Criteria will provide a science-based assessment process on the low carbon credentials of transport assets and whether or not a green bond’s Use of Proceeds are aligned with the Paris Agreement.

What’s Changed in Version 2.0.

- Updated, stricter emissions thresholds (expressed as gCO2 per p-km) for passenger transport now apply, based on more up-to-date scientific and industry data. (See table below)

- Tighter requirements on fossil fuel transport - fossil fuels must now make up no more than 25% of freight rail cargo (rather than 50% in Version 1).

- Clearer requirements for new interurban rail projects - issuers must have an independent project appraisal demonstrating the project will result in a 25% emissions reduction in the corridor (rather than 10% / 25% in Version 1).

- Expansion of scope to include zero direct emissions miscellaneous vehicles – thing like waste collection vehicles or off-road diggers may now be eligible.

- Disclosure of compliance data used in certification.

New Emissions Thresholds

| Direct Emisssions | 2015 | 2020 | 2025 | 2030 | 2050 |

|---|---|---|---|---|---|

| Old passenger thresholds (gCO2 per p-km) | 87 | 75 | 75 | 56 | 33 |

| New passenger thresholds (gGO2 per p-km) | 50 | 0 | 0 | 0 |

Criteria Highlights

- Zero emissions vehicles are automatically eligible, along with infrastructure that is dedicated to refuelling or recharging these vehicles (note that extra criteria also apply depending on the type of asset or activity).

- Hybrid cars or commercial vehicles, or fossil fuel trains that are thus not zero-emissions must comply with an emissions intensity threshold (per passenger-km or per tonne-km depending on whether the transport is passenger or freight).

- No dedicated fossil fuel carrying railway lines or rolling stock (this means that no more than 25% of cargo can be fossil fuels).

- If the bond is financing a new interurban rail project, (for example, high-speed rail), an independent project appraisal must demonstrate a minimum of 25% emissions reduction in the corridor.

- Biofuel vehicles and dedicated supporting infrastructure are not eligible under these criteria.

- Other infrastructure for low carbon transport is eligible such as bicycle infrastructure.

Information Suite

There are 3 documents available with additional information

-

Brochure – Summary of the Transport Criteria

-

Criteria Document – Full details of the Transport Criteria

-

Background Paper – Summary of discussions and rationale for Transport Criteria.

Certifications under the Transport Criteria

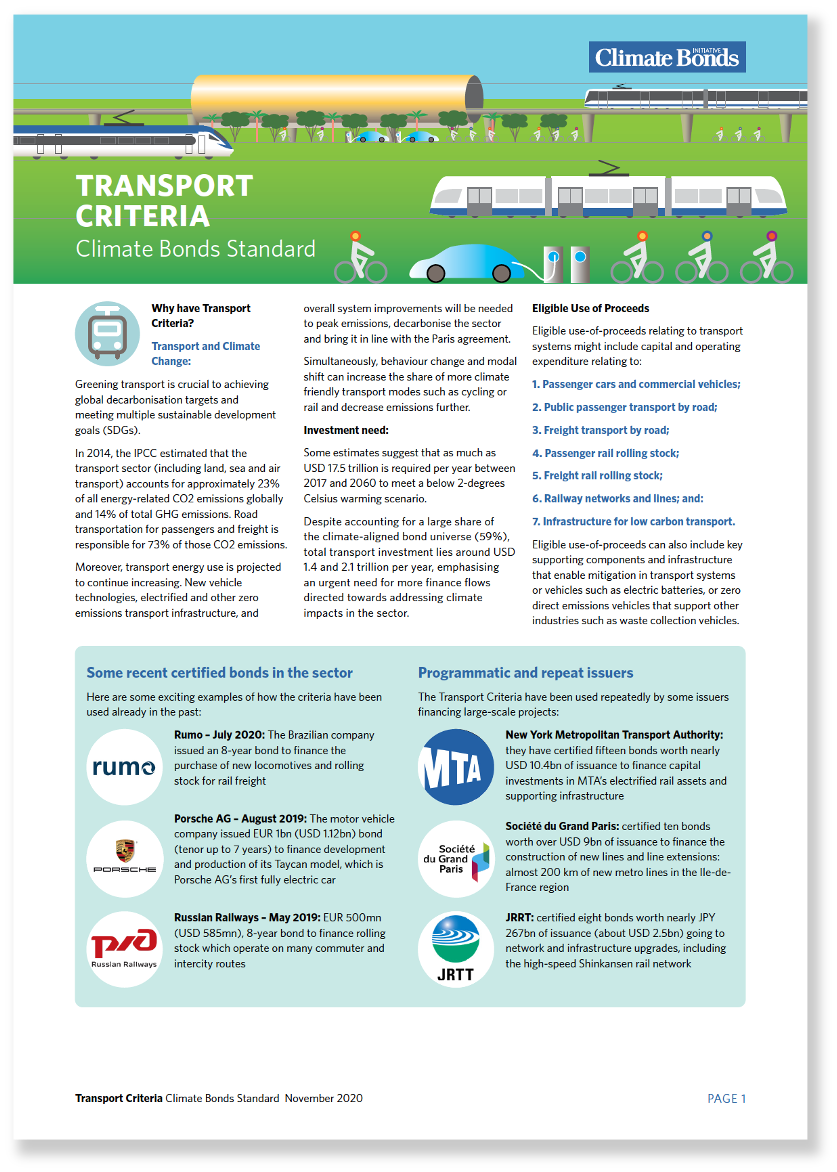

As of October 2020, approximately USD 39bn worth of green bond issuance has been Certified under the Transport Criteria. A significant number of Certified Issuers have also adopted the streamlined Programmatic Certification process for multiple bond issuance.

New York Metropolitan Transport Authority –(MTA) Are another programmatic issuer which Certified fifteen bonds worth nearly USD 10.4bn of issuance to finance capital investments in MTA’s electrified rail assets and supporting infrastructure

New York Metropolitan Transport Authority –(MTA) Are another programmatic issuer which Certified fifteen bonds worth nearly USD 10.4bn of issuance to finance capital investments in MTA’s electrified rail assets and supporting infrastructure Thailand Sovereign - August 2020 - Government of Thailand issued a THB 30 billion Sustainability Bond. 10 THB billion of this bond has been Certified under the Transport Criteria and the proceeds have been allocated immediately for the construction of the Bangkok MRT (Mass Rapid Transit) Orange line.

Thailand Sovereign - August 2020 - Government of Thailand issued a THB 30 billion Sustainability Bond. 10 THB billion of this bond has been Certified under the Transport Criteria and the proceeds have been allocated immediately for the construction of the Bangkok MRT (Mass Rapid Transit) Orange line.

Société du Grand Paris – (SGP) Have Certified more USD of issuance than any other issuer - ten bonds worth over USD 9bn of issuance to finance the construction of new lines and line extensions: almost 200 km of new metro lines in Paris

Société du Grand Paris – (SGP) Have Certified more USD of issuance than any other issuer - ten bonds worth over USD 9bn of issuance to finance the construction of new lines and line extensions: almost 200 km of new metro lines in Paris

Porsche AG - August 2019 – the motor vehicle company issued EUR 1bn to finance the development and production of its Taycan model, the first fully electric Porsche.

Volkswagen Group, September 2020 – issued their first green bond in September 2020 (USD2.34 billion), which will be used to finance the development of their electric vehicle program.

Volkswagen Group, September 2020 – issued their first green bond in September 2020 (USD2.34 billion), which will be used to finance the development of their electric vehicle program.

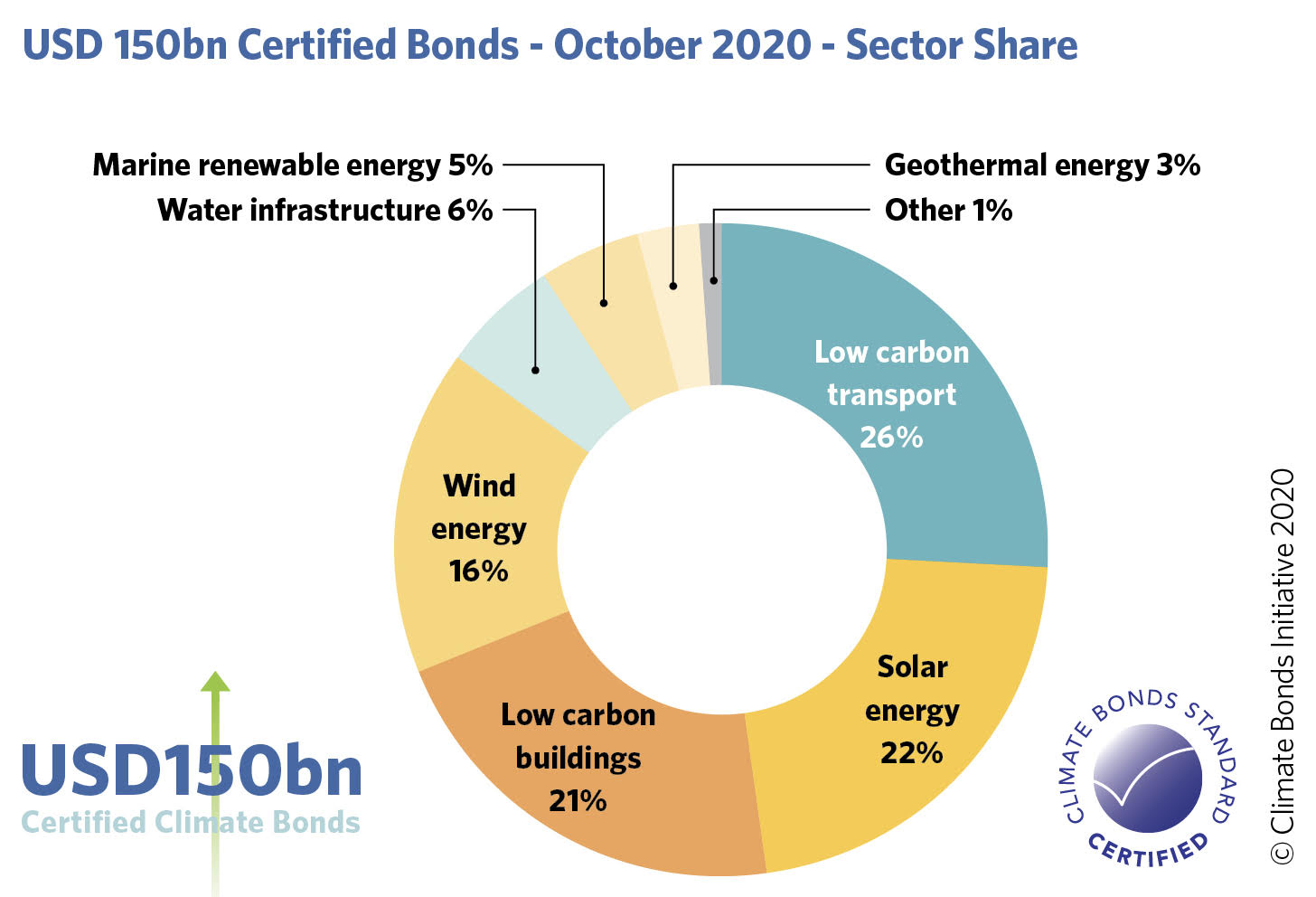

Largest sector share of Certifications to date

The last word

We will continue to develop and expand the scope of our Criteria under our overarching Climate Bonds Standard. Our aim is to uplift market confidence and transparency, and establishing benchmarks to match the anticipated growth of global green bond markets.

We would like to sincerely thank all TWG members and their constituent organisations for their invaluable support and guidance in updating and developing the Transport Criteria.

'Till next time,

Climate Bonds.

For more information on Certifications please contact Certifications Manager, Carman Mak carman.mak@climatebonds.net.