Leadership in Asia: Support for SDGs: Assistance from ADB: Twin Climate Bonds Certifications: Low Carbon Transport

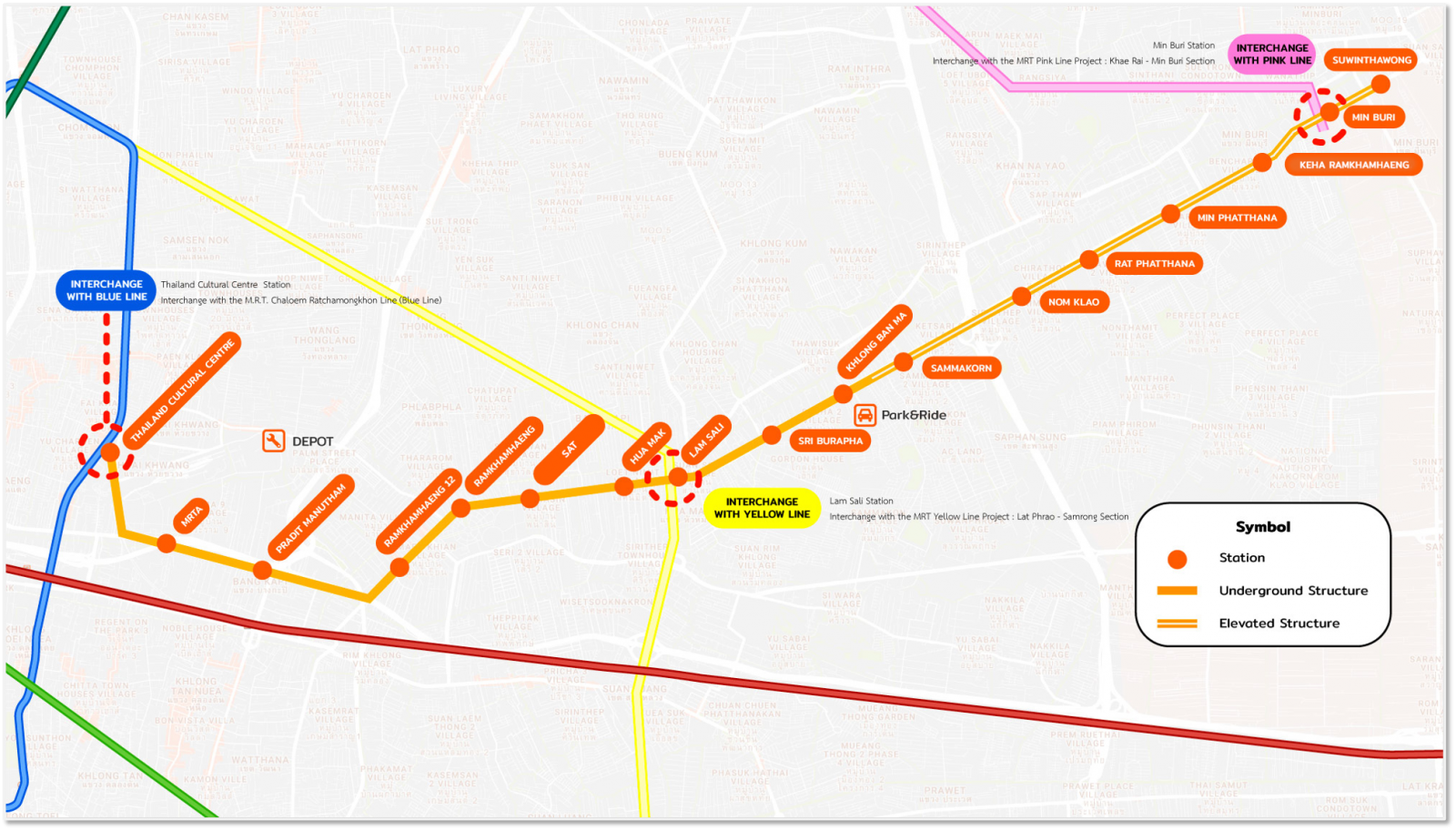

The Kingdom of Thailand has concluded 2020 with a tap of its sovereign green issuance, a follow up from its inaugural THB 30 billion (USD 944.88 million) sustainability bond deal in August. The new THB20bn November issuance has been immediately allocated towards the construction of Bangkok's Mass Rapid Transit Orange East Line. The first phase of the line is due to become operational in 2024.

Reopening of Sovereign Sustainability Bond

The Kingdom of Thailand via its Public Debt Management Office (PDMO) has announced that the August bond has been re-opened as of the 24th November to secure a further THB20bn, bringing the outstanding amount to THB50bn (USD1.65bn).

The proceeds have both green and social components, financing green infrastructure through the Mass Rapid Transit Orange Line (East) Project, as well as social impact projects to assist with COVID-19 recovery, such as public health measures, job creation programs and local public infrastructure development, with attendant social and environmental benefits.

This is a first of a kind issuance by a sovereign in Southeast Asia. The government’s sustainability bond framework is aligned with international and ASEAN capital markets standards, and the bond issuance is part of a 15-year, benchmark bond program to be issued in the next two fiscal years in sectors related to green and sustainable infrastructure.

Joint Lead Managers were Bangkok Bank, Bank of Ayudhaya & Standard Chartered Bank. The PDMO has also foreshadowed intentions to continue to build the size of this bond to THB 100 billion (USD3.31bn). In a statement, the PDMO advised the November issuance was well received by investors including insurance companies, mutual funds, financial institutions and foreign investors with the yield offer of 1.652% per annum.

Twin Certifications - International Best Practice

In issuing a Certified Sovereign, the Government of Thailand provides an example to international investors, other governments and companies in the region looking to finance or refinance sustainability and climate projects with green debt instruments on a best practice basis.

Support from ADB

The Asian Development Bank (ADB) supported the issuance through the ASEAN Catalytic Green Finance Facility (ACGF) and is assisting with the development of post-issuance monitoring and reporting systems including external reviews to help the Ministry of Finance align the bonds with global and regional standards including the ASEAN Capital Markets Forum. These measures will help facilitate potential issuance of green, social or sustainability bonds in the future for the Thai government, other state-owned enterprises and more widely.

The bank has had a long-term policy to build green finance in the region, backing the first Climate bond in the Asia Pacific in early 2016. Since then, the ADB has supported multiple green bonds in Thailand. Most recently, another first, a Certified green solar loan in Vietnam amongst the range of its climate and sustainability activities.

With the assistance of the ADB, the government of Thailand’s green bond program aims to ensure that the country’s recovery from the Covid-19 Pandemic is aligned with the goals of the Paris Agreement and contributes to the achievement of the SDGs.

Thailand- Building a Green Market

Four companies have already issued Certified green bonds in Thailand to date including BTS Group, Energy Absolute, PTT Public Company & B. Grimm Power.

The latest Certified issuance came from BTS Group in November this year. The BTS bond finances expenditure on the existing network infrastructure of the Bangkok Mass Transit System as well as the construction of new lines.

The Bangkok Post reports possible green issuance in 2021 from the Bank for Agriculture and Agricultural Cooperatives (BAAC) and the National Housing Authority (NHA).

The issuance of green bonds has proven to be a catalyst for the development of low carbon transport in Thailand, one amongst many nations in South East Asia looking to deploy green finance to fund transport projects.

Regional Green Infrastructure Opportunities

Our recent Indonesia, Vietnam and Philippines Green Infrastructure Investment Opportunities (GIIO) reports, released progressively throughout the year, identifies multiple low carbon project pipelines, in transport, energy, water and waste, open for investment. The coming Malaysia GIIO report will identify an additional pipeline of investable projects.

The Last Word – The Sovereign Green Bonds Club into 2021

When we surveyed the green sovereign issuances for the year back in mid-February: (Sovereign Green Bonds Club: Who’s in the 2020 pipeline?) Thailand wasn’t on the list of prospective member nations. They now join Chile, Netherlands and Nigeria in an even more exclusive gold class of membership, issuers of Certified sovereign green.

The club counts Belgium, Chile, Egypt, Fiji, France, Germany, Hong Kong, Hungary, Ireland, Indonesia, Lithuania, Netherlands, Nigeria, Poland, Seychelles and Sweden and now Thailand amongst members and is set to grow.

The list of prospective and possible applicants now includes Bhutan, Brazil, Canada, Colombia, Cote d’Ivoire, Denmark, Ghana, Italy, Kenya, Peru, Spain, United Kingdom, Uzbekistan and Vietnam.

This still leaves plenty of room amongst OECD, ASEAN and MENA nations to act.

Congratulations to Thailand, for setting a new green leadership benchmark in the region.

‘Till next time,

Climate Bonds.