The approach to COP26 entails a reimagination of the future for stakeholders across all sectors and nations. This defining moment in climate history has given fresh impetus to sustainable debt markets with Q3 witnessing a new record annual figure for labelled debt, months before the year’s end.

Green bond investment in a single year could reach the $1trillion milestone for the first time by the end of Q4 2022, according to respondents to a new Climate Bonds market survey.

Climate Bonds has released the Transition Finance in China’s Guangdong Hong Kong-Macau Greater Bay Area report, which discusses the principles that credible transition finance

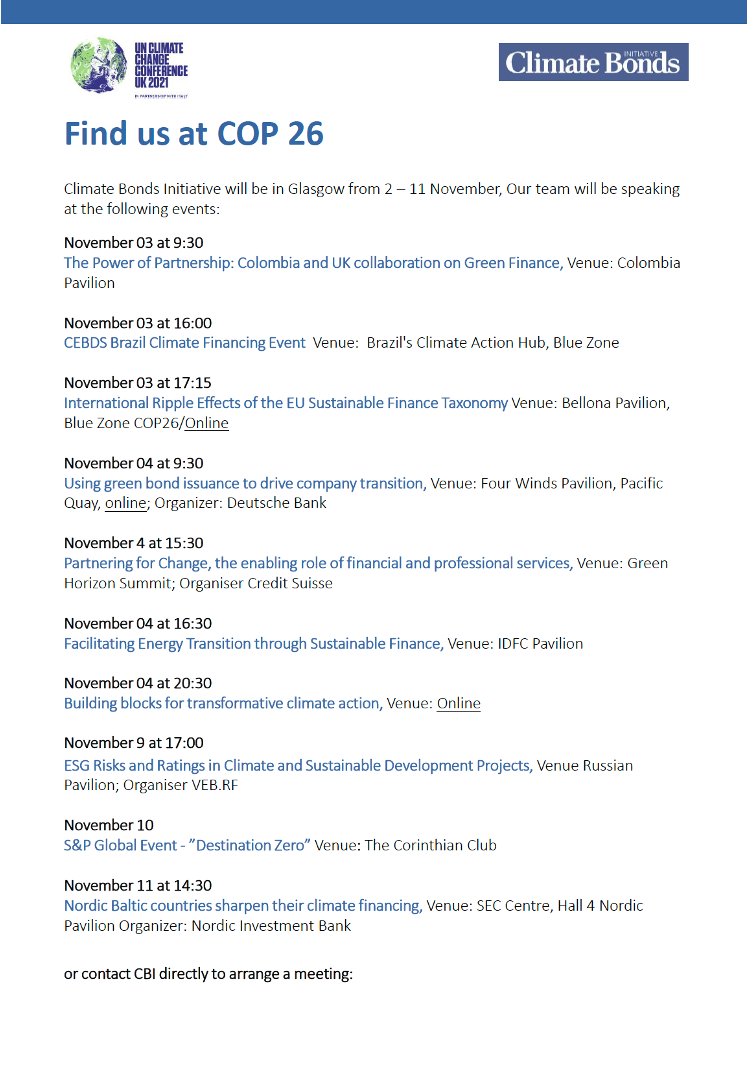

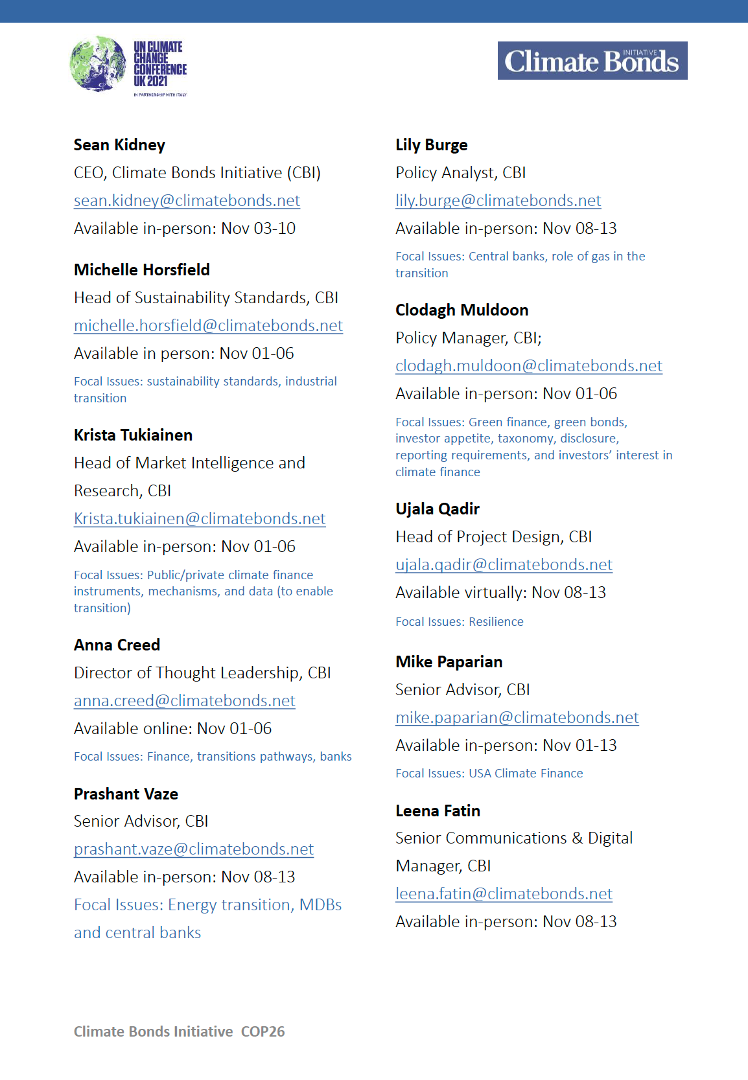

From Australia to Russia to Mexico: While our staff will not be speaking at physical events, they will still be appearing.

Can green finance and pressure from green investors help make Indian agriculture more sustainable?

Let’s look at two major Indian agricultural investment needs: adequate water supply for agriculture and maintaining soil conditions.

Water, water everywhere and not a drop to eat

China's green bond market is recovering from the COVID-19 pandemic and continues to grow, according to a new report released by Climate Bonds Initiative (CBI) and China Central Depository & Clearing Co. Ltd Research Centre (CCDC Research).