$1Trillion Annual Green Bond Milestone Tipped for end 2022 in Latest Survey: Sean Kidney calls for $5Trillion per year by 2025

Market Sentiment positive on growth to 2025

Green bond investment in a single year could reach the $1trillion milestone for the first time by the end of Q4 2022, according to respondents to a new Climate Bonds market survey.

353 respondents took part drawn from following categories: corporates, asset owners, asset and investment managers, development banks, regulators, ratings and verification service providers.

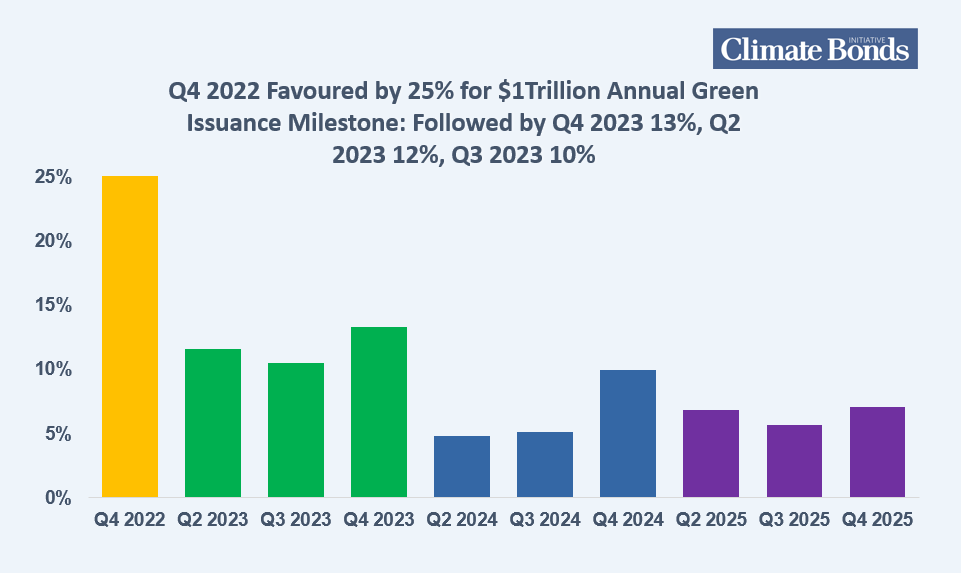

In a range from 2022 to 2025, Quarter 4 of 2022 was selected by the largest group of respondents (25%) as the quarter when green bond investment would pass $1trillion for the first time in a single year. Quarter 4 of 2023 (13%), Quarter 2 of 2023 (12%) and Quarter 3 of 2023 (10%) were the next most popular responses.

Responses aggregated by year: 2022 [25%], 2023 [35%], 2024 [20%], 2025 [20%].

Sean Kidney, CEO, Climate Bonds Initiative:

“The long-awaited $1trillion milestone is now a market reality, whether at the end of 2022 or in 2023. But the climate crisis grows. It’s time to lift our sights and aim higher. $5trillion in annual green investment by 2025 must be the new mark for policy makers and global finance to achieve. “

“Capital allocation towards clean energy, resilient infrastructure, green transport, buildings and sustainable agriculture needs to accelerate into the multiple trillions, every year, rippling through both developed and emerging economies”

“The climate capital gap still remains. $5trillion in annual green investment by 2025 is a real economy investment benchmark to judge progress in greening the financial system.”

2021 is already a record year for green finance!

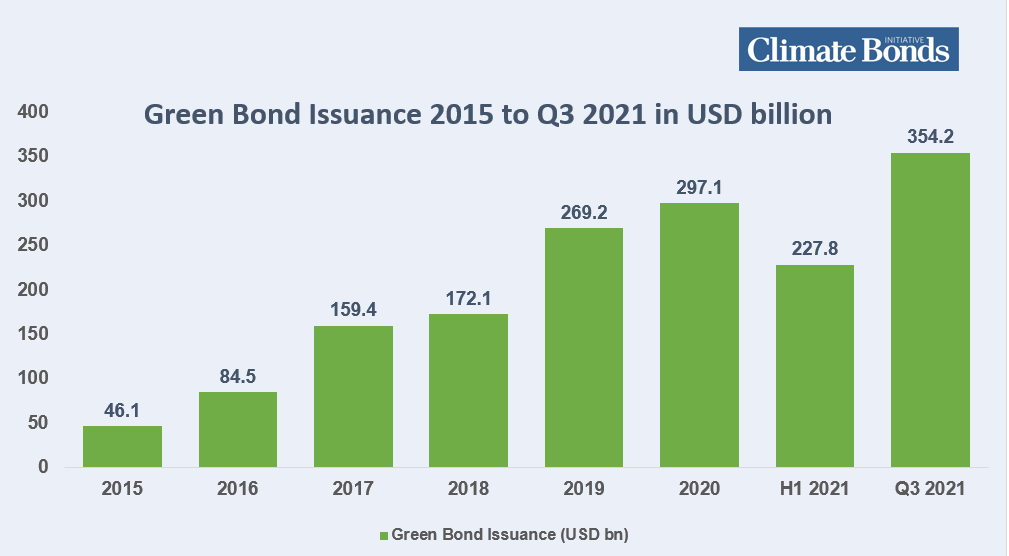

Total annual green investment (green bonds, green loans & green sukuk) reached a record $297bn in 2020. At the end of Q3 2021, green bond issuance for the calendar year stood at $354bn, surpassing last years record.

The acceleration of market growth has led Climate Bonds' Market Intel to raise its 2021 forecast to a half-trillion ($500bn), an increase of our early January 2021 forecast of $400-450bn.

The pace at which growth has accelerated this year has led our annual forecast for the end of 2021 to be lifted to reach a record half-trillion ($500bn). an increase of our early January 2021 forecast of $400-450bn.

The Last Word

Transition to a low-carbon economy necessitates a huge shift in capital across all sectors away from carbon intensive systems and processes towards net-zero models. Globally the cumulative $1trillion mark was reached in December 2020, a green investment total that was more than a decade in the making since the first green bond of 2007.

We at the Climate Bonds Initiative have long held that the most crucial milestone was reaching the first annual trillion of green investment. Our COP22 briefing back in 2017 made this very point.

The survey results indicate that market sentiment is strengthening on when this global turning point in green finance will be achieved.

As Sean Kidney points out, the climate capital gap remains and green investment trends must be accelerated in the 2020s, a challenge before both policy makers and the global financial sector at COP26 in Glasgow.

We see $5trillion in annual green investment by 2025 as the next benchmark they should be aspiring to.

Meantime, 2021 is already a record year for green finance, providing a platform for growth with labelled debt including sustainable debt figures all soaring.

Stay tuned for the full breakdown of this year’s progress in our Q3 Report!

Til’ next time!

Climate Bonds

Survey Background:

Participants to Climate Bonds annual conference of September 2021 were surveyed in from the following categories: corporates, asset owners, asset and investment managers, development banks, regulators, ratings and verification service providers.

From a selection of Quarters commencing Quarter 4 2022 to Quarter 4 2024, respondents were asked to nominate the Quarter they assessed annual green issuance would first reach USD1Trillion in a single year. Only one choice was allowed. No multiple choices. The survey period was Thursday 21st October to COB Tuesday 26th October