China Remains a Green Bond Market Leader Despite Evident Impacts of Pandemic

China's green bond market is recovering from the COVID-19 pandemic and continues to grow, according to a new report released by Climate Bonds Initiative (CBI) and China Central Depository & Clearing Co. Ltd Research Centre (CCDC Research).

Produced with the support of HSBC, the China Green Bond Market Research Report analyses key developments in China’s green bond market. The 2020 report is the fifth in an annual series from Climate Bonds, focusing on policy developments, market segmentation, use of proceeds & issuers profile, and a wider market of social and sustainability bonds.

China was the second-largest source of green bond issuance last year, with a total of USD44bn issued in 2020. The total outstanding amount of China’s domestic green bond market stood at USD139bn (RMB917bn).

The full report is available now in both English and Chinese.

On the Road to Recovery

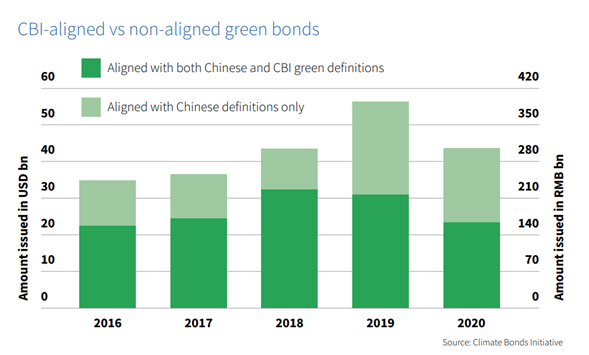

The COVID-19 pandemic had clear implications for the green finance universe. In China, overall issuance slowed down in H1 2020 but picked up momentum in the second six months of the year, reaching a total of USD44bn (RMB289.5bn). This marks a 21% decrease from the USD55.8bn (RMB386bn) achieved in 2019.

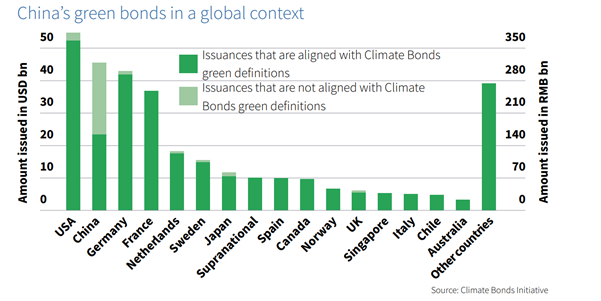

The US, China, and Germany led the annual country rankings in 2020 by the total amount of labelled green bonds.

A Developing Taxonomy

Of the USD44bn (RMB289.5bn) worth of green bonds issued in 2020, USD23.8bn (RMB157.5bn) was aligned with both Chinese & CBI green definitions. We welcome efforts at increasing the rigour of green labelling in the Chinese markets and we have already seen progress in the last couple of years.

May 2020 saw the release of a consultation draft of China’s 2020 Green Bond Catalogue, removing clean coal-related projects and bringing the China and EU Taxonomy into closer alignment. The final draft was published in April 2021 and has improved the prospect of taxonomy harmonisation.

Sectors and Certifications

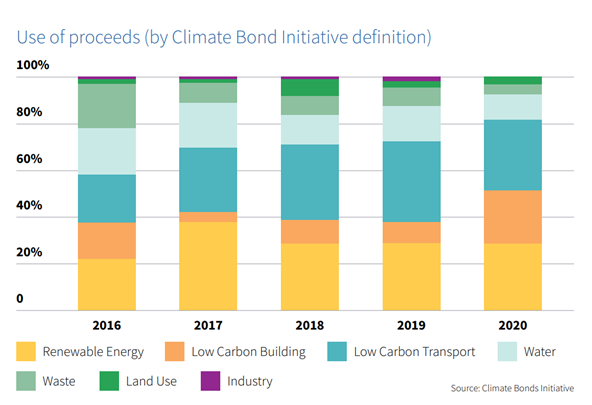

Low Carbon Transport remained the largest sector being financed by green debt (30%), followed closely by Energy (29%). Proceeds going to low carbon building assets have seen a big surge in both absolute values and shares.

China remains one of the largest global sources of bonds certified under the Climate Bonds Standard (Certified Climate Bonds). In 2020, Chinese issuers brought four new Certified deals to the market, totalling USD3.6bn.

From the Low Carbon Transport sector, we saw the first Certified issuance from China Merchants Bank (CMB) after the joint stock commercial bank financed 7 urban metro projects with an USD800m Certified green bond.

Issuer Types

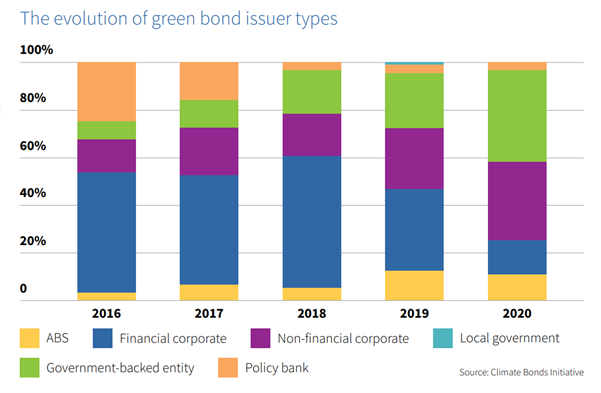

2020 was marked by new developments in China’s profile of issuer types. The most noticeable was the strong growth in the total volume of green bonds issued by government-backed entities that increased by 18%, representing 38% of the total volume of issuance in 2020.

Beijing Jingneng Clean Energy was the largest Chinese issuer in 2020. This was the first time that a non-financial corporate became the largest issuer.

Looking Forward

The report identified several key themes to watch in the development of one of the world’s most important green financial markets. These include:

- Transition Finance is becoming a prominent theme;

- A China sovereign green bond is expected to be released;

- Carbon neutrality bonds are expected to expand China’s green bond market and bring it closer to international green definitions; and,

- Sustainability linked-bonds are expected to fuel transition finance.

The report highlights the importance of the government’s role in providing consistent and credible policy signals to the sustained and orderly growth of China’s domestic green bond issuance volume. However, it also notes that market stakeholders will need to keep abreast of the rapidly evolution and proliferation of debt instruments in the country.

The Last Word

After a difficult 2020, we are filled with hope that 2021 will mark a real turning point for Climate Action. With COP26 on the horizon, we are looking to policymakers and investors to be a real catalyst for change.

Already in 2021, we have seen some positive signs for green finance. Climate Bonds Market Intel revealed that issuance reached USD227.8bn in H1 2021, already more than three-quarters of 2020’s annual total.

We have now revised our 2021 forecast and project 2021 will see the first half-trillion year for green bond investment. This would mark an exciting moment of progress for green finance with the first annual trillion being a long-held objective for us at Climate Bonds.

Stay tuned for more market coverage!

‘Til next time!

Climate Bonds