Climate Bonds has released the China Green Securitization State of the Market 2020 report, an analysis of China’s green ABS market growth for both international and domestic investors. Supported by UK PACT China, the report reviews the policy initiatives that are guiding the market development in the country, while analyzing the market data and best practices.

Being the first iteration of China Green ABS research, the Climate Bonds Initiative plans to conduct an in-depth analysis and provide more detailed recommendations and roadmaps for the development of China’s green ABS market.

In the meantime, here’s what you should know about it:

An overview of the green ABS market in China

China has become the largest ABS market in Asia and second largest globally since the first transaction in 2005. The Green ABS market in China has also seen a big surge in the past three years with the green bond market further deepening.

China’s maturing green economy and green finance policy framework are increasing the potential for green securitization (a securitization can be defined as green when the underlying cash flows relate to low-carbon assets or where the proceeds from the deal are earmarked to invest in low-carbon assets). In fact, green ABS, as a crucial component of green finance (especially green debts), has already been mentioned by several policy initiatives. Considering the scale and impact of the environmental and climate crisis, the financing need for green industry will keep growing.

Sean Kidney, CEO, Climate Bonds Initiative:

"We have a huge job to finance our green and 30:60 objectives. Green securitization helps free up bank and municipal balance sheets so they can do more with limited capital, and lowers capital costs in doing so. Essential."

The rationale of green securitization

Green securitization covers a range of benefits:

- Tagging the securitization as ‘green’ enables issuers to tap into the increasing demand for securities with environmental benefit.

- The expenditures of low-carbon projects are usually higher than other projects. In high interest environments, asset-backed securities issued in bond markets can offer lower cost of capital compared to bank financing.

- An ABS program can vary maturities according to the existing demand in the market and replenish the collateral pool with new assets during the life of the ABS program, which assists match investors’ liabilities with asset tenors.

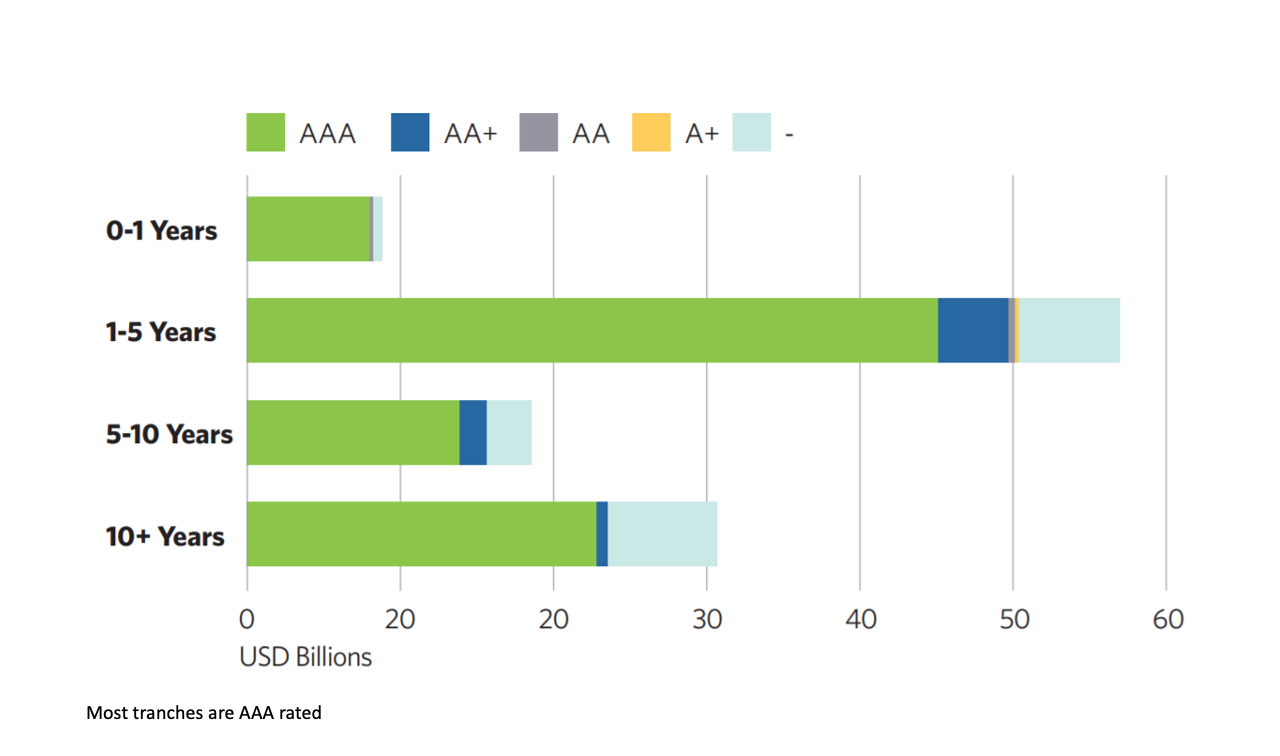

- They provide investors with a higher yield than vanilla bonds with an equivalent credit rating. This is particularly interesting for tranches with a rating (AAA or AA), as they offer an attractive yield pick-up over government securities, while carrying an equivalent rating.

- If a lender has exhausted its lending capacity, ABS allows the bank to offload loans so it can originate new loans.

- Asset securitization can restructure the underlying assets by combining individual project assets that are too small or have low credit ratings, to reduce the risk of individual assets, stabilize cash flow and address issues such as small project size and low credit ratings. It also creates more options for institutional investors, each of whom may have differing criteria regarding asset allocation, risk tolerance and diversification.

The state of the green ABS market in China

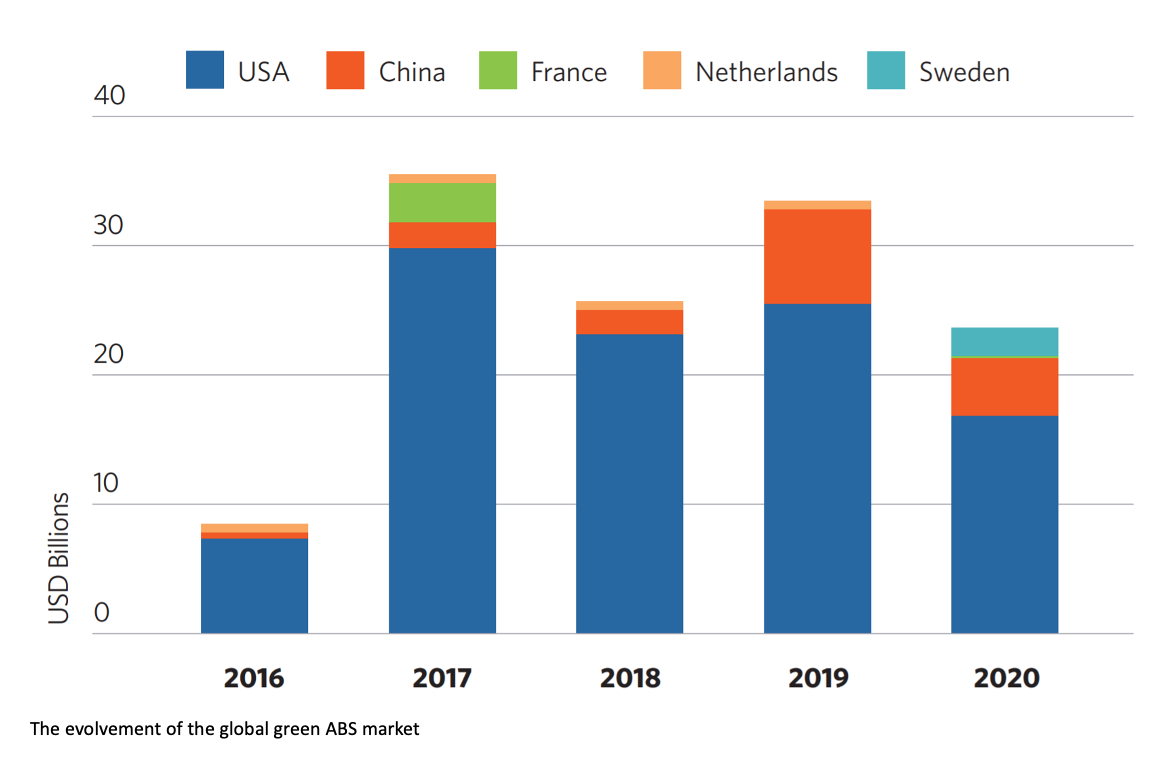

Currently, the vast majority of green ABS issuance to date has occurred in the US market. Leading examples from the US include solar developer SolarCity, energy efficiency lender Renovate America and sustainable infrastructure company Hannon Armstrong. Over the last two years green securitization in the European market has been dominated by issuance of RMBS, which accounts for almost 60% of its total issuance volumes. ABS and CDO (collateralized loan obligations)/CLO (collateralized loan obligations) follow, each accounting for 18% of market share.

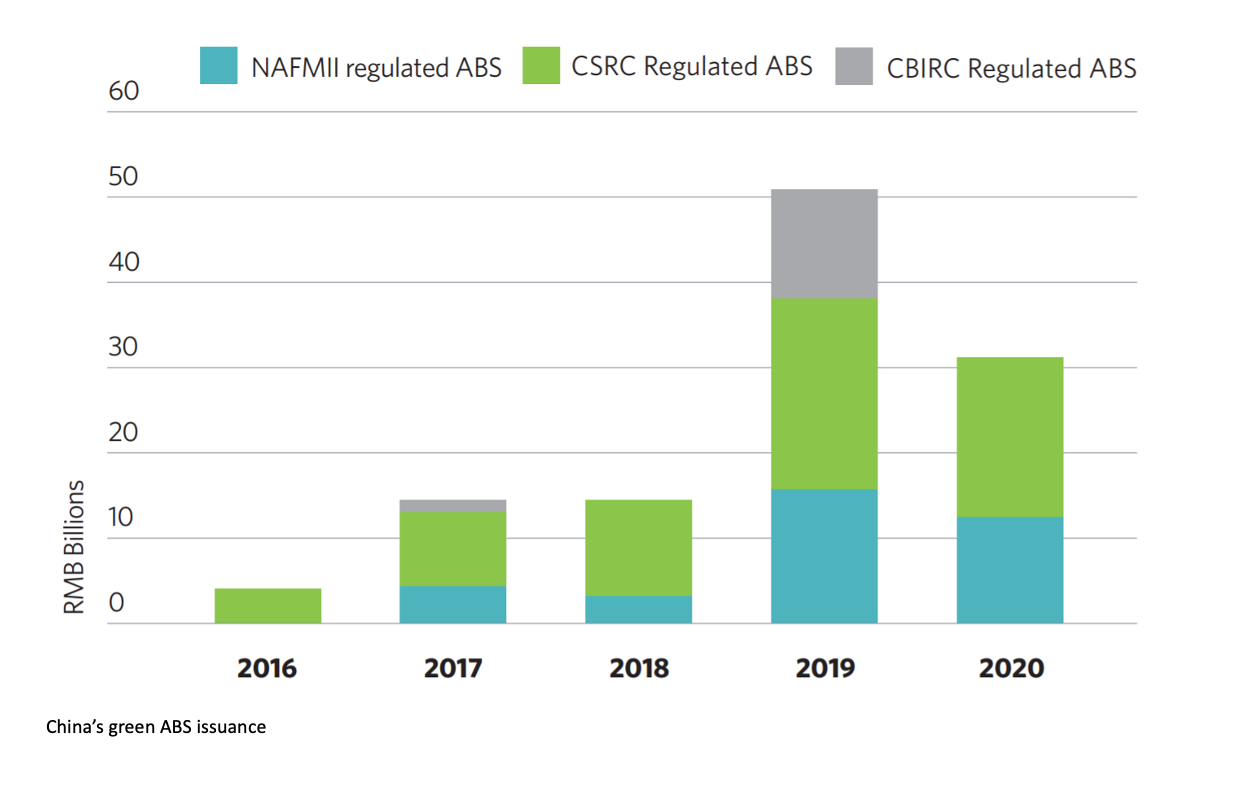

The first Chinese green ABS were issued in 2016. As of the end of 2020, there had been 85 ABS deals totaling RMB115bn (USD18bn). The proportion of green ABS increased from 1.7% of total green bond issuance in 2016 to 11% in 2020. However, green securitizations remain a small proportion of the green bond market, and the potential for growth is huge, especially with the introduction of more supportive policy and regulatory measures.

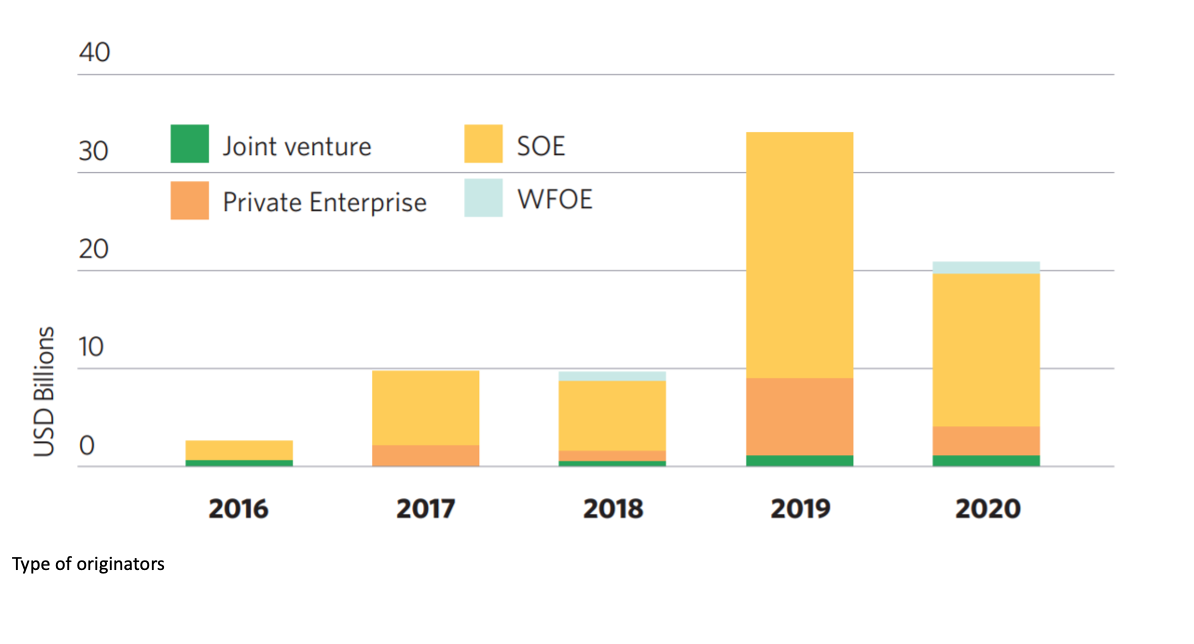

State-owned enterprises are the largest originator type: While financial corporates dominated the green bond market in China, green ABS deals are primarily coming from nonfinancial corporates, especially state-owned enterprises (SOEs).

Almost half (49%) of Chinese green ABS tranches issued by the end of 2020 had a tenor between one to five years, making up the largest category. The majority of the green ABS on the Chinese market obtained a high-grade credit rating. Except for the 15% that were not rated or rating information is not available, all Chinese green ABS received credit ratings at A+ or above from domestic rating agencies. Up to 78% of the rated ABS achieved AAA.

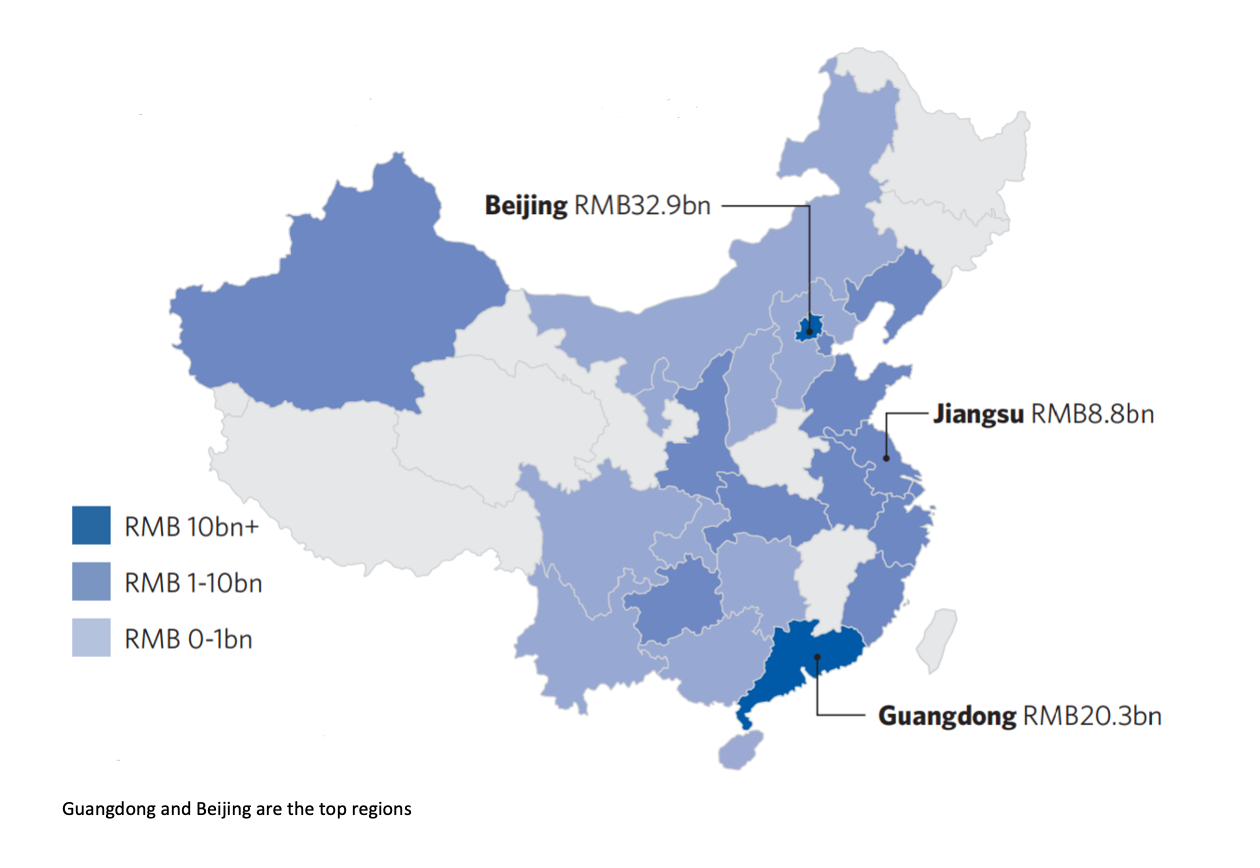

The Green ABS volumes vary across provinces. Beijing, Guangdong, and Jiangsu are the top sources. Together, they represented almost 60% of the total Chinese green ABS volume by the end 2020.

Recommendations to develop green securitization in China

- ·Conducting capacity building on green asset identification.

- ·Improving the disclosure of the credit risk and green eligibility of the underlying assets.

- ·Supporting the development of standardized green loans and leasing contracts.

- ·Incentivizing green RMBS and CMBS.

- ·Developing green incentives and monetary tools.

- ·Improving the soundness of domestic credit rating.

The Last Word

To enhance the attractiveness of China’s green ABS market to intuitional investors, the transparency on credit quality, defaults and recoveries must be improved. In addition to this, the discrepancies between China’s local green definitions and the international ones need to be further bridged. A set of policy and regulatory barriers need to be reformed until this rapidly growing segment of China’s green bond market truly opens to foreign investors.

Stay tuned as we foresee growth for the green ABS market in China. And remember to access the report to get the complete insights!

‘Til next time,

Climate Bonds.