Huge oversubscription for UK & EU green bonds underlines the strength of investor demand

The last two months have seen two incredible green sovereign level debut bonds:

- In September the UK government, host of COP26 which kicks off today in Glasgow, issued an AA rated, GBP10bn (USD13.6bn) green gilt, on the back of a 10 times oversubscribed order book.

- A month later the European Commission (technically a supranational, but here lumped together with sovereigns) issued a AAA EUR12bn green bond (USD14bn), 11 times oversubscribed, the first of what has been telegraphed as a EUR225bn green program.

Last week the UK issued a second UK green gilt of GBP6bn, with a substantial retail offering included; this one was 12 times oversubscribed.

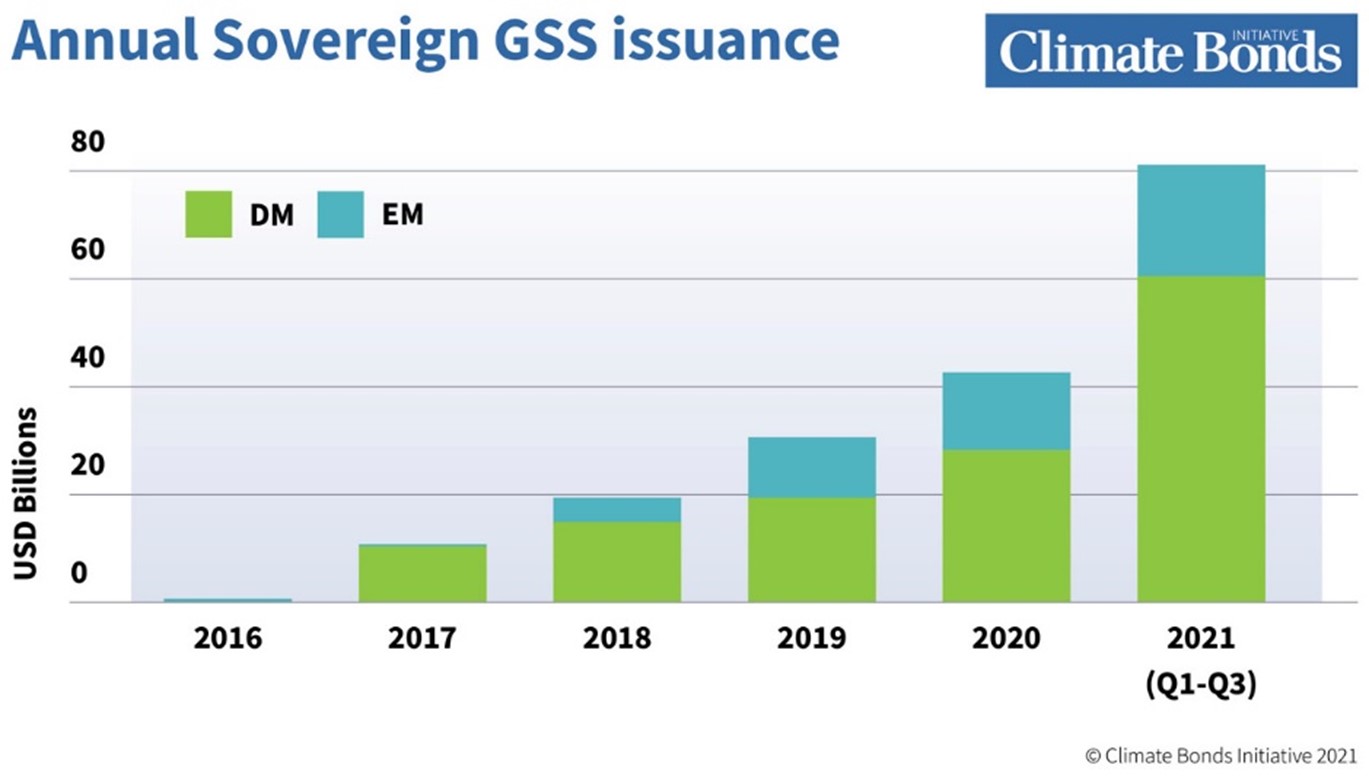

2021 has seen a major acceleration of sovereign issuance, with six debut green or sustainable bonds issued and three returns-to-market in the third quarter (Q3) of 2021 alone.

GSS bonds offer governments an opportunity to rethink their spending

The last two years have seen the growth of the daughters of green bonds such as social and sustainability bonds. Sovereign green, social and sustainability (GSS) bonds have shown that they allow issuers to increase and diversify their investors; in liquid and other currencies they achieve notable price benefits.

Issuance also energises internal government discussions about growing green assets and projects that allow repeat issuance.

Driven by consistent premium pricing in secondary markets, tighter pricing was enjoyed by several sovereign GSS bond issuers in H1 2021, including Germany, France, Indonesia, the UK, the EU and Hong Kong. More detail on this can be found here.

Both the EU and UK issuances saw a tighter spread and tracking 5bp premium (greenium?) in the secondary market, compared to vanilla bonds, whilst the same pricing differential has been experienced by AAA-rated sovereign issuers. This lower cost of capital is particularly crucial to EMs where the cost of lending is often significantly higher than in DM.

Sovereign issuance enhances clarity on policy gaps

Sovereign green bond framework development involves a budget check (green-tagging) to determine which expenditures are suitable for inclusion in the green bond. This process can reveal gaps in government policy and information. For example, Chile’s green bond development revealed the need for clarity on government spending and led to an improvement of building codes.

Sovereigns can follow the example of France which as part of the budgeting process, assigns a green coefficient to each budget line according to how green the expenditure is relative to the six environmental priorities of the EU Taxonomy: climate change mitigation, climate change adaptation, water management, circular economy, pollution, and biodiversity.

Work on taxonomies in 2022 to extend them into adaptation and resilience criteria will offer governments additional sources of eligible expenditures for green bonds. Both the EU Taxonomy and the China Green Bond Endorsed Project Catalogue are being extended to encompass a broader range of potential assets. Taxonomies are also being extended to social objectives.

Sovereign GSS bonds can catalyse local green bond markets

Sovereign bonds provide benchmark pricing, liquidity and a demonstration effect for local issuers, helping to support the growth of a local market. They also stimulate investor appetite, opening up opportunities for other issuers.

With the IEA’s World Energy Outlook 2021 estimating that 70% of the additional USD4trn spending to reach net-zero is required in emerging/developing economies, sovereign issuance can help kickstart these large inflows of capital.

Emerging Market sovereign issuance can channel green capital flows where they are most needed.

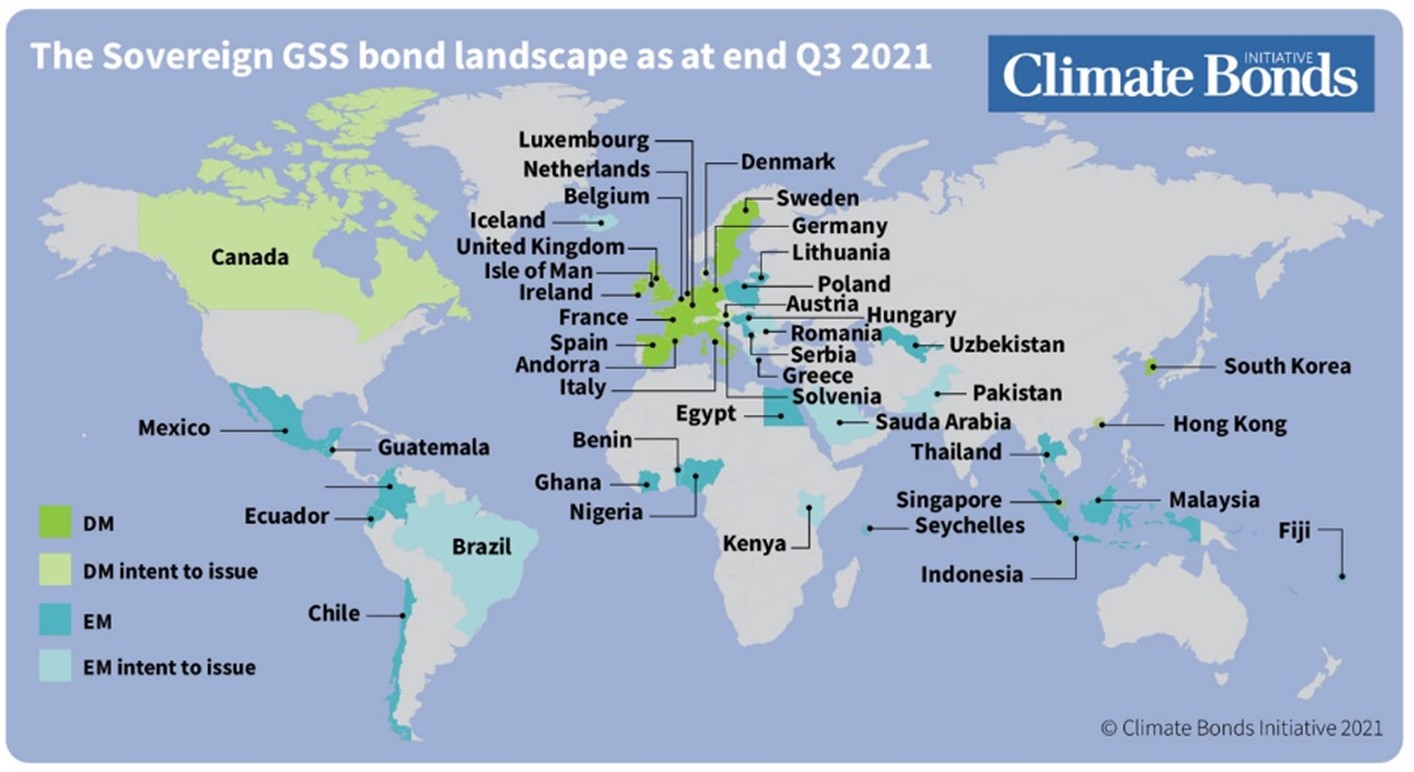

Several of 2021’s first-time sovereign GSS issuances have come from Emerging Market (EM) issuers – such as Serbia, Benin, and Uzbekistan.

Benin’s EUR500m SDG bond is the first African SDG sovereign issuance and is aligned with ICMA’s Sustainability Bond Principles. It enhances Benin’s ability to access international capital flows and will pave the way for local private issuance.

Benin was supported by the United Nations Development Programme (UNDP), the German International Cooperation Agency (GIZ) and the International Monetary Fund (IMF) in structuring the bond framework and assessing the cost for the country to achieve the SDGs.

Sovereign GSS bonds can fund climate change resilience expenditures

Several sovereign issuances have seen a strong resilience focus, such as Fiji’s 2019 green bond (90% adaptation) and the Netherlands’ 2019 green bond (29% flood risk management). This is particularly crucial for those Emerging Market states in highly climate-vulnerable areas which may not have the capital available to fund largescale infrastructure.

Fiji was the first small island developing state to issue a green bond and its proceeds significantly contributed to the country’s rehabilitation following Tropical Cyclone Winston, with 46% of bond proceeds funding school reconstruction. This demonstrates how sovereign issuance provides an innovative financing model beyond grant aid funding.

The IPR view

The Inevitable Policy Response (IPR view) 2021 Forecast Policy Scenario reflects the future gap in cumulative emissions between OECD and non-OECD countries in 2050 without a change in policy strategies. One way for many OECD nations to address this imbalance is more active assistance and support programs for green sovereign issuance from developing nations.

DFIs play a valuable role in assisting such EM issuers with constructing GSS bonds

As was the case for Benin, Development Banks can and often do provide important assistance in capacity building, framework design and project selection.

For example, the World Bank has been providing issuance advice for many years and helped with the Seychelles’ 2018 blue bond to fund marine protected areas; the Inter-American Development Bank supported Chile’s 2019 sovereign green bonds issuance (with Climate Bonds providing technical advice and certification); and the Asian Development supported Thailand’s inaugural green bond.

Building the Sovereign Green Club

Sovereign GSS issuance has recently accelerated. In February 2020 we recorded just 12 nations in the sovereign green bonds club. A year later in March 2021 at the launch of our Sovereign Green Social and Sustainability survey, we recorded 22.

At the time Climate Bonds CEO Sean Kidney called for a doubling of sovereign green issuers to forty stating:

“Sovereign green issuance sends a powerful signal of intent around climate action and sustainable development to governments and regulators. It catalyses domestic market development and provides impetus to institutional investors.“

“Multiple issuances even more so. Doubling the number of sovereign GSS issuers to forty and supporting initial emerging market transactions should be amongst the immediate climate finance objectives for governments, central banks and development finance institutions.”

Sovereign issuers now total over thirty, and ten more issuers are looking to enter the clubhouse. We expect more issuers to come to market during COP or by the end of this year, to reach the goal of forty.

Til' Next Time!

Climate Bonds

KangaNews has been Australia and New Zealand’s only specialist source of information on the institutional debt, fixed-income and structured-finance markets since 2006. In 2021, it launched KangaNews Sustainable Finance, a twice-yearly supplement that expands KangaNews’s longstanding coverage of sustainable debt finance to all aspects of sustainable capital markets with relevance to Australasia.

The first edition is for H2 2021 and includes coverage of New Zealand’s forthcoming TCFD reporting regime, uptake and funding of electric vehicles in Australia, sustainable lending in the subinstitutional sector, the KangaNews-Commonwealth Bank of Australia fixed-income investor ESG survey, how companies and investors are seeking to achieve and quantify impact, and a raft of transaction and institution-level coverage.

You can read KangaNews Sustainable Finance free of charge by clicking here: https://www.kanganews.com/

We thank KangaNews for their support during the Climate Bonds Annual Conference21.