Egypt & UAE COPs should be springboard for surge in green & climate finance in global south & east says Sean Kidney

2021 Sovereign GSS Snapshot

Sovereign issuance expanded faster than the wider green bond market in 2021 with a growth rate of 103%, raising cumulative issuance to USD193bn compared to the USD95.2bn raised in 2020, as reported in Climate Bonds’ State of the Market 2021.

Sovereign Green Bonds Club membership grew in 2021 with debut issuance from Italy, Spain, the UK and Serbia. In total, 11 issuers went to market in 2021 with new green offerings or taps to the value of USD78.2bn.

Sovereign sustainability bonds originated from 11 emerging markets (EM) issuers to the value of USD14.8bn and Chile and Peru issued social bonds to the value of USD10.3bn, a growth rate of 392% on 2020.

Growth rates like this in sovereign issuance are encouraging, but there’s room in the clubhouse for more: As of 31 December 2021, Bloomberg recorded 11,931 sovereign bonds with a residual maturity of 1 year, and a combined outstanding amount of USD49.6tn. Sovereign GSS volumes represented less than 0.4% of this amount. More sovereign GSS issuance would help propel the market towards the USD5tn target that Climate Bonds has set for the market to be reached by 2025.

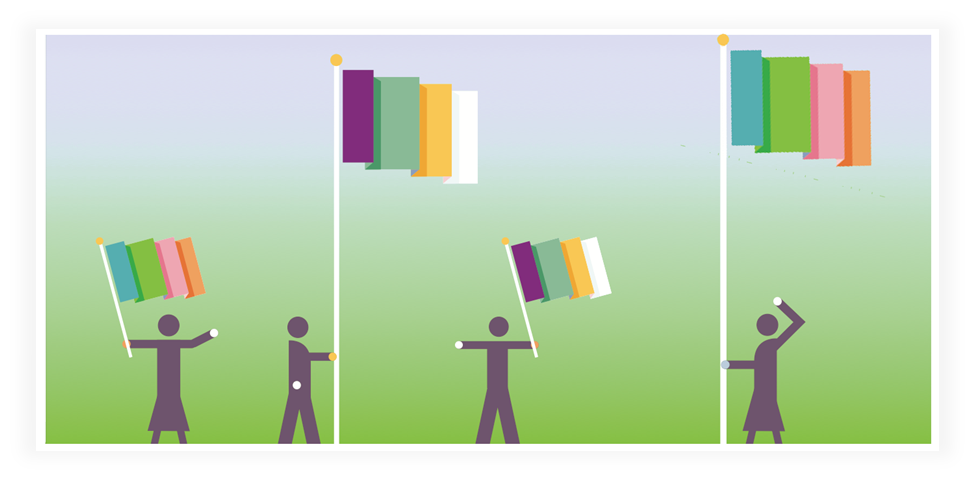

Sovereign issuance drives domestic market expansion

Climate Bonds promotes sovereign GSS issuance as a core sustainable finance policy for multiple reasons.

They offer governments multiple benefits including lower-interest rates, investor diversification, and contribute to national climate targets. However, the benefits far exceed the direct impact of individual sovereign green or sustainability issuance itself because of the green market creation benefits.

Sovereign GSS bonds provide benchmark pricing, liquidity, infrastructure development, and a demonstration effect for local issuers. They also stimulate investor appetite and develop opportunities for new issuance.

The Egypt example

In a first for the MENA region, Egypt issued its inaugural sovereign bond with a USD750m offering in late 2020. The bond was supported by the World Bank and attracted sixteen new institutional investors.

The first private sector green bond followed in August 2021, issued by the Commercial International Bank (CIB), Egypt’s largest private bank, with the IFC taking a foundation stake.

In April 2022, Norwegian-based SCATEC ASA brought a high-profile private placement for Benban, Africa's largest solar park. The green project bond was worth USD334.5m. EBRD invested USD100m and extended a further USD30m credit enhancement facility to the Certified Climate Bond that attracted support from a host of DFIs and institutional investors in a best practice example of blended finance and credit enhancement arrangements.

Greening of Developed Markets

The UK’s green gilt and accompanying supportive green finance policies had a pronounced effect during its COP Presidency push. The correlation between the debut green gilt and the UK’s 79% growth in non-sovereign green bond issuance in 2021 points to the impact of governments’ green issuance.

Denmark’s debut sovereign green bond arrived in January 2022 attracting a 5 basis points greenium. Denmark is seen as a frontrunner in climate action, with a 70% emissions reduction goal for 2030. This ambitious target is part of the country’s Climate Act which also requires an annual status update to ensure it stays on track for meeting these targets.

Policy frameworks accompanying sovereign issuance also play a substantial role in the growth of local markets. Climate Bonds’ support for Italy’s 2021 green bond framework was part of a wider European Commission-funded project on ‘Sustainable Finance and Investments for the Transition to a Green Economy’, providing policy recommendations to promote mobilisation of private capital flows to sustainable projects.

In the latest developments Austria’s inaugural sovereign green announced on 24th May saw strong investor demand pricing with a greenium of 2.5 basis points said Markus Stix, managing director of the Austrian Treasury. Reuters reports Austria is also the first government to include short-term debt instruments like treasury bills and commercial paper in its green debt programme.

Meanwhile the Republic of France, a founding member of the sovereign green club with Poland and Fiji back in 2016-2017, has just announced an inflation linked Green OAT in the next stage of its long term green programme.

State of the Market 2021 lists France as the largest national issuer of green sovereigns with a combined size of EUR38.2bn (USD43.6bn) followed by Germany on USD25.1bn and Italy on USD10.1bn.

The 2022 bonds from Austria and Denmark raises to 16 the number of EU 27 members to have issued at least one sovereign GSS bond.

Japan is also indicating sovereign issuance with Prime Minister Fumio Kishida foreshadowing in late May plans to issue JPY20tn (USD157bn) in green transition bonds.

Sovereign sustainability issuance

While sovereign GSS volumes are dominated by green bonds, labelled markets have diversified in recent years. Sustainability and social bonds saw rapid growth in 2021, originating almost entirely from EM sovereigns.

Chile is the leading example of the value of diversified debt issuance. It is the only sovereign to have issued under green, social and sustainability labels.

Chile has also recently issued a sustainability-linked bond (SLB), opening the possibility for it to re-structure all of its debt under the SLB theme. The SLB is linked to two key performance indicators: absolute GHG emissions and the proportion of renewables in the electricity system.

It’s a new category of membership in the club.

Egypt and UAE– A bridge to EM issuance?

In March 2021, Climate Bonds called for a doubling of both sovereign issuers and issuance as a post COP26 objective. Membership of the club then stood at twenty-two, up from twelve in February 2020.

The number of issuers is still shy of that target at thirty-six now Denmark and Austria have entered the club house, while issuance in volume has more than doubled over the course of 2021 records the SOTM.

In the countdown to COP27 at Sharm el-Sheikh, a new global target of fifty nations having issued or foreshadowed sovereign green, social or sustainability debt should be regarded as a minimum.

Governments, MDBs, DFIs and global investors are now well versed in what is required. Hosting of the next two COPs in the Middle East will inevitably draw international focus towards climate finance in the global south and east.

The May 20th election of a climate friendly government in Australia, previously under investor pressure on the sovereign front, but now eager to host the 2024 COP together with its Pacific neighbours would see that global south and east focus is enhanced and add momentum to investor interest in and action from ASEAN nations.

Climate Investment - A dangerously lagging indicator

Despite the progress in developed markets (DM), overall green and climate investment (both sovereign and private) in EM remains a dangerously lagging indicator of climate action.

As Sean Kidney puts it:

“The twin COPs in Egypt and UAE are a bridge to more sovereign issuance from emerging markets. We should be looking to a post-COP28 environment where green, social and sustainable sovereign debt from developing nations has been supported and is multiplying with new deals on horizon.”

“Sovereign issuance is an indicator of action from policymakers and financial regulators in facilitating north to south climate investment. Finance for mitigation, adaptation and resilience remains dangerously inadequate.”

“The next two years of COPs are a springboard for policymakers to turn commitments into trillions, directed where it’s needed most.”

‘Til next time,

Climate Bonds