Highlights:

- Monthly GB issuance as of 18 October reached USD11.4

- Kenya: Acorn Holdings’ debut GB, Certified under the Low Carbon Buildings Criteria

- UAE: Noor Energy 1’s CSP project with 700MW design capacity due for completion in 2022 funded with CCB

- USA: Host Hotels & Resorts becomes first US lodging REIT to issue GB, opening up US issuance potential

Don’t miss!

The Green bond market summary Q3 2019 provides an overview of green bond issuance, as well as the wider labelled market. The spotlight sections this time are on blue bonds and blue economy, and on green loans. The report also features underwriter and listing venue league tables for Jan-Sep 2019.

The Green bond market summary Q3 2019 provides an overview of green bond issuance, as well as the wider labelled market. The spotlight sections this time are on blue bonds and blue economy, and on green loans. The report also features underwriter and listing venue league tables for Jan-Sep 2019.

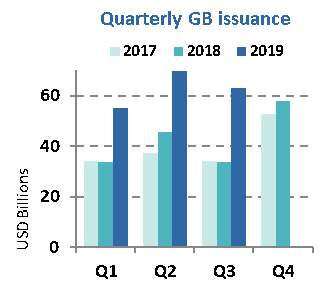

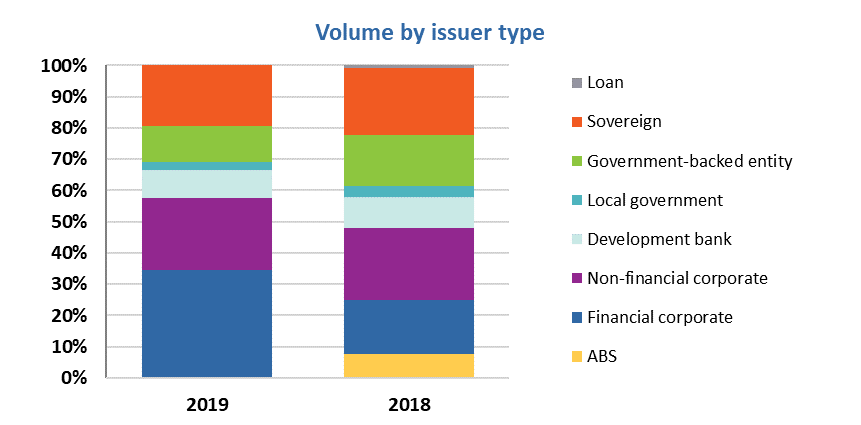

Q3 2019 issuance is 87% higher than Q3 2018, and 2019 quarterly issuance has been consistently higher than 2018. Financial corporates led the way in Q3 with 24% of total quarterly volume. Emerging market issuance represented 26% of Q3 2019 volume, with strong issuance from LAC, bringing Q1-Q3 2019 EM issuance, including supranationals, to USD51.7bn (Jan-Sep 2018: USD32.5bn).

The Green Bond Pricing in the Primary Market January - June 2019 monitors the performance of 46 EUR and 15 USD denominated benchmark size green bonds with a total value of USD56.6bn issued during H1 2019. 12 GBs priced with new issue premia, 15 priced on their curves, and 6 exhibited a greenium: EIB 2042, Terna 2026, Vodafone 2026, KfW 2027, Netherlands (Sovereign) 2040 and Chile (Sovereign) 2050. In spotlight studies of TenneT, Vodafone and development banks KfW and NRW positive pricing differentials between green and vanilla bonds in the sample were observable.

The Green Bond Pricing in the Primary Market January - June 2019 monitors the performance of 46 EUR and 15 USD denominated benchmark size green bonds with a total value of USD56.6bn issued during H1 2019. 12 GBs priced with new issue premia, 15 priced on their curves, and 6 exhibited a greenium: EIB 2042, Terna 2026, Vodafone 2026, KfW 2027, Netherlands (Sovereign) 2040 and Chile (Sovereign) 2050. In spotlight studies of TenneT, Vodafone and development banks KfW and NRW positive pricing differentials between green and vanilla bonds in the sample were observable.

Greening the Financial System: The role of Central Banks and Financial Regulators highlights the role that Central Bank and Financial Regulators can play in incorporating climate change risk into the financial system. This report recommends that central banks should develop a brown taxonomy, their asset purchasing programmes should be skewed towards buying green assets, and they should test whether green supporting factors could be applied to offset some of the impact of using the brown penalising factors to encourage investment in green technologies.

Greening the Financial System: The role of Central Banks and Financial Regulators highlights the role that Central Bank and Financial Regulators can play in incorporating climate change risk into the financial system. This report recommends that central banks should develop a brown taxonomy, their asset purchasing programmes should be skewed towards buying green assets, and they should test whether green supporting factors could be applied to offset some of the impact of using the brown penalising factors to encourage investment in green technologies.

Comparing China’s Green Bond Endorsed Project Catalogue and the Green Industry Guiding Catalogue with the EU Sustainable Finance Taxonomy (Part 1) provides a preliminary analysis on China's Green Bond Endorsed Project Catalogue, the Green Industry Guiding Catalogue and the EU Sustainable Finance Taxonomy in terms of their guiding principles, users, classification and screening criteria.

Comparing China’s Green Bond Endorsed Project Catalogue and the Green Industry Guiding Catalogue with the EU Sustainable Finance Taxonomy (Part 1) provides a preliminary analysis on China's Green Bond Endorsed Project Catalogue, the Green Industry Guiding Catalogue and the EU Sustainable Finance Taxonomy in terms of their guiding principles, users, classification and screening criteria.

Available in English and Chinese. 同时提供英文版及中文版.

The Climate Bonds Initiative has expanded the list of cities and countries where Certification for debt financing Low Carbon Buildings (LCB) – commercial, residential and retrofits – is available. LCB Certification is now available in multiple markets including Australia, Singapore, USA, China, Mexico, New Zealand, Europe and Korea. Relevant local proxies and measures have already been used for Certifying Green Bonds.

The Climate Bonds Initiative has expanded the list of cities and countries where Certification for debt financing Low Carbon Buildings (LCB) – commercial, residential and retrofits – is available. LCB Certification is now available in multiple markets including Australia, Singapore, USA, China, Mexico, New Zealand, Europe and Korea. Relevant local proxies and measures have already been used for Certifying Green Bonds.

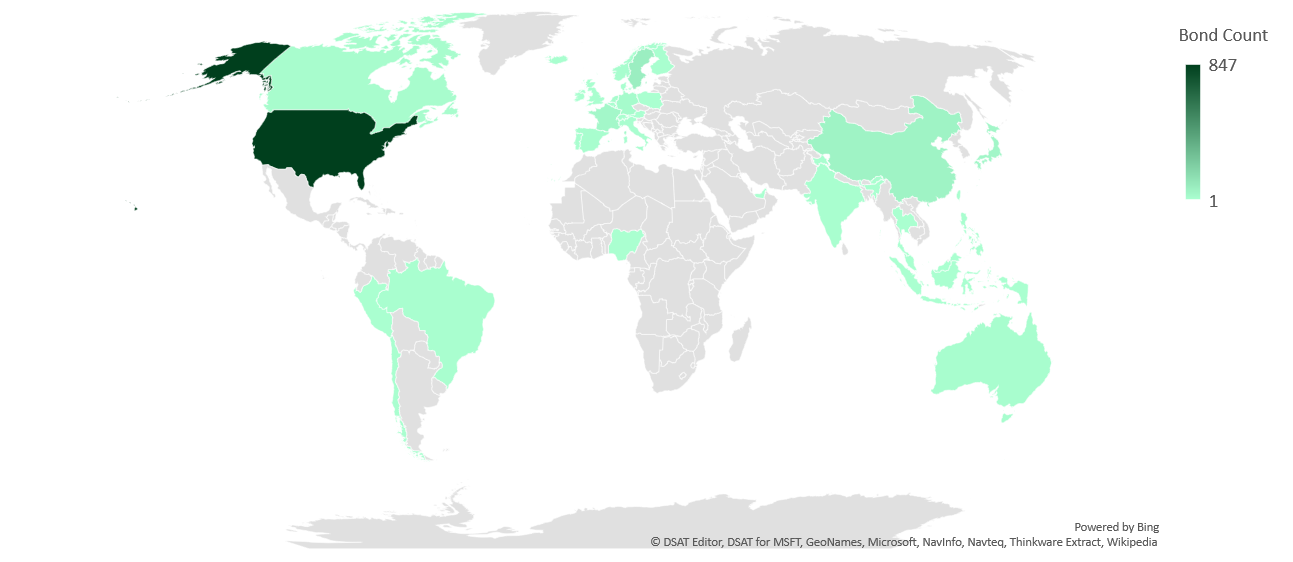

Green bond deals across the globe: 1 Jan – 18 Oct 2019

> The full list of deals here.

At a glance

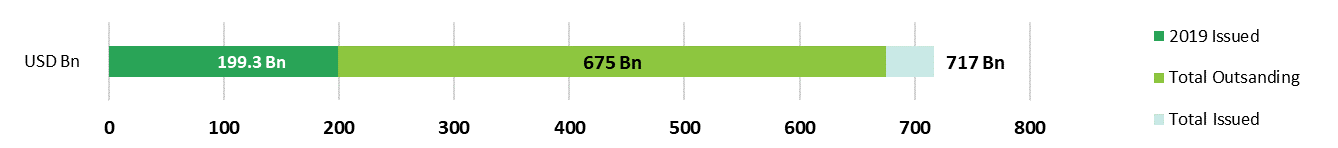

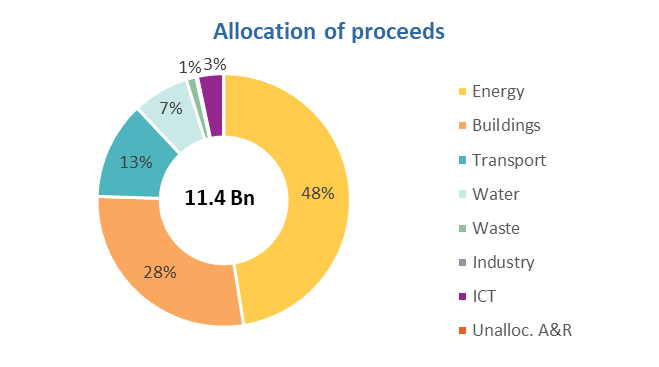

Green bond issuance as of 18 October was USD11.4 bn for the month so far, roughly 70% of last year’s October’s issuance.

The Top 3 country ranking for October as of this date features Ireland (USD2.2bn), USA (USD1.8bn) and Spain (USD1.2bn). Large deals drive the high ranking for Ireland and Spain. Ireland’s issuance came from a tap of the National Treasury Management Agency green Sovereign, and is the month’s largest deal at EUR2bn/USD2.2bn. Spain’s volume came from two deals: Banco Santander with EUR1bn/USD1.1bn and Acciona with EUR108m/USD119m. In contrast, USA volume was generated by 10 different issuers.

Developed markets accounted for 74% of issuance and EM for 17%. For the latter, largest contributor was again China, with USD963m from China Construction Bank Corporation and Bank of China.

Financial corporates accounted for 35% of overall issuance for 1-18 October, while for October 2018 they made up only 17%. There was a variety of deal sizes ranging from JPY10bn/USD93m (Ricoh Leasing Company, Japan) to EUR500m/USD549m (SR Boligkreditt, Norway) and EUR1bn/USD1.1bn (Banco Santander, Spain).

Non-financial corporates come in second with 23%, closely followed by Sovereigns at 19% market share for the month.

Almost half the proceeds raised are earmarked for Energy assets and projects (48% of current October volume), with 14 deals dedicating 100% of the proceeds to renewables, the single largest deal from Banco Santander.

Low-carbon Buildings are financed by 19 different deals, attracting USD3.1bn, while 11 deals raised funds for Transportation assets and projects.

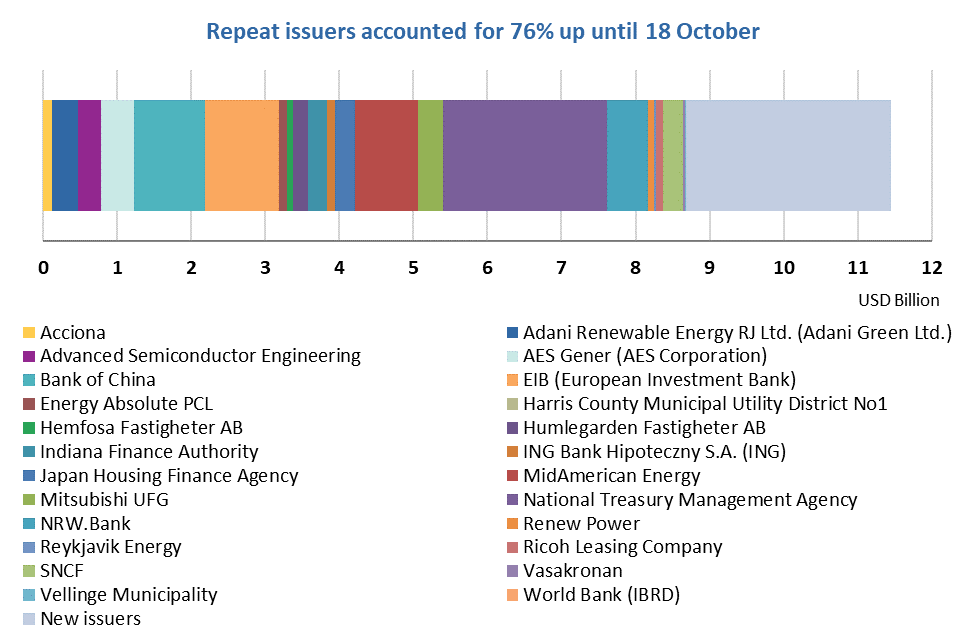

We saw 9 debut issuers, bringing the total number of new GB issuers in 2019 to 192 (2018, full year: 222). Repeat issuers accounted for 76% of monthly volume through 18 October.

> The full list of new and repeat issuers here.

> Click on the issuer name to access the new issue deal sheet in the online bond library.

Certified Climate Bonds

Acorn Holdings (KES4.3bn/USD41.5m), Kenya, issued an inaugural 5Y green bond that is Certified against the Low Carbon Building Criteria of the Climate Bonds Standard. It is the first GB issuer from Kenya. The proceeds will be used to finance the construction of residential buildings across 6 developments in Nairobi, which will provide several thousand rental housing units for students and young professionals. The buildings have received EDGE Certification and accordingly meet the requirements of the Low Carbon Buildings (Residential) Criteria.

The issuer will provide quarterly report on the allocation of proceeds to bondholders until full allocation. The reports will also include key impact indicators such as estimated ex-ante annual energy consumption (KWh/m2), estimated annual GHG emission reductions (tCO2), water savings and other efficiency improvements.

Acorn Holdings has focused its activities on developing good quality rental accommodation for students and young professionals in Nairobi since 2015.

SR Boligkreditt AS (EUR500m/USD549m), Norway, came to the market with a 7-year covered bond, Certified against the Low Carbon Buildings Criteria of the Climate Bonds Standard.

The proceeds will be used to finance and refinance mortgages related to residential buildings in Norway, which satisfy at least one of multiple Criteria such as refurbished buildings with 30% reduced energy consumption.

A report with details on the allocation of proceeds will be produced annually, until all the proceeds have been allocated. These reports will be publicly available.

Certified debt issued prior to October

Noor Energy 1 JSC (USD2.69bn), UAE, obtained a 7Y project finance loan in January, which was Certified against the Solar Criteria of the Climate Bonds Standard in October. Noor Energy is a project SPV set up by ACWA Power, a Saudi Arabian power generation and water desalination facility developer and owner with assets primarily across the Middle East and North Africa region, working in collaboration with the Silk Road Fund (China) and the Dubai Electricity and Water Authority (UAE). This is the first Certification to come from the Middle East region, and an OPEC member country.

When completed in 2022, this will be the largest Concentrated Solar Power (“CSP”) facility in the world, with a design capacity of 700MW. This development is the fourth phase of the Mohamed bin Rashid Solar Park, which is due to complete development in 2030, with a final design capacity of 5GW.

Annual reports will be made available to the lenders and the Climate Bonds Initiative. These reports will include details of the allocation of proceeds, the amount of installed generation capacity and the estimated avoided GHG emissions.

Redstone Solar Thermal Power Plant (ZAR8bn/USD567m), South Africa, obtained a 17Y loan in July, which was Certified against the Solar Criteria of the Climate Bonds Standard in October. The proceeds will refinance the development of the Redstone Solar Thermal Power Plant, which was jointly developed by ACWA Power (Saudi Arabia) and SolarReserve (USA) and became operational in late 2018.

The Concentrated Solar Power plant is located in Postmasburg, in the Northern Cape province of South Africa. It has an installed capacity of 100MW and it is one of the largest renewable electricity generation plants in South Africa.

Annual reports will be produced and made available to the lenders and the Climate Bonds Initiative. These reports will have details about the project, including quantitative indicators such as the amount of electricity generated.

New issuers

Public sector

October saw debut issuance from three local governments and two government-backed entities. All the proceeds of the bonds issued by local governments will go towards water and wastewater projects, while Franklin Township Sewer Authority will fund just wastewater facilities. The Regents of the University of Colorado will invest in low carbon building projects. None of the issuers state any reporting commitments.

- City of Hot Springs, Arkansas (USD5m), USA, 20Y original term, assurance provided by BAM GreenStar.

- City of Oakland Park (USD10.7m), USA, 20.9Y original term, no third-party review.

- Harris County Municipal Utility District No1 (USD2m), USA, 19.9Y original term, assurance provided by BAM GreenStar.

- Franklin Township Sewer Authority (USD2m), USA, 19.2Y original term, assurance provided by BAM GreenStar.

- The Regents of the University of Colorado (USD215m), USA, 34.7Y original term, no third-party review.

Climate Bonds view: We welcome the debut issuers with Arkansas’ third and Florida’s sixth Municipality now entering the green bond market. It’s encouraging to observe more and more municipalities gaining assurance, usually BAM GreenStar. We encourage allocation and impact reporting in order to improve transparency for investors and other stakeholder groups.

Financial corporates

Two financial corporates have come to the green bond market in October so far.

Assicurazioni Generali (EUR750m/USD819m), Italy, 11Y original term, SPO provided by Sustainalytics. The senior subordinated bond can fund a variety of projects across sectors (energy, transport, buildings, water, waste)

Climate Bonds view: Generali has provided quite a lot of detail around the specific sectors it is financing, which is positive. We have seen limited issuance from insurance providers, so hopefully this will tempt other large financial institutions to increase green finance and issue green bonds.

Banco Santander (EUR1bn/USD1.1bn), Spain, 7Y original term, SPO provided by Vigeo Eiris. This debut senior non-preferred green bond will finance solely renewable energy projects.

Climate Bonds view: Santander has a significant portfolio of renewable energy project finance which would clearly be eligible for green bond financing. We expect further issuances, not least due to Santander’s ambitious sustainable/green finance plans, and hope that this expands to other projects, including new infrastructure given the bank’s strong presence in Latin America.

Non-financial corporates

So far in October there have been two inaugural issues by non-financial corporates: AES Gener and Ficolo.

AES Gener (USD450m), Chilean subsidiary of AES Corporation (USA), 59.5Y original term, private placement, SPO provided by Sustainalytics. The proceeds will fund renewable energy projects including energy storage. The issuer intends to publish an annual Green Bond Report on its website containing allocation and impact information.

Climate Bonds view: This is the first GB from an energy producer in Chile, a country with just over 20% of its energy mix from renewable sources and intentions to grow this share. AES Gener is one of the largest energy companies in Chile and its intentions to spend the proceeds not just on wind and solar farms but also on battery technology is promising.

Ficolo (EUR20m/USD21.8m), Finland, 4Y original term, SPO provided by CICERO. Ficolo will invest in the construction and acquisition of data centers (or companies that operate them) and are operated solely by renewable energy. The issuer will provide information once a year on the website including information such as the power usage effectiveness ratio on an individual data center level and their environmental policy.

Climate Bonds view: Ficolo joins the green bond market as the 6th issuer from Finland. The bond marks two firsts for the Finnish GB market: the first green bond to be issued by a privately-held company and the first green high yield instrument. ICT financing is still rare in the green bond market and it is encouraging to see new issuers, especially where 100% of the proceeds are dedicated to this purpose and especially since the data centres are entirely powered by renewable energy. Way to go!

Visit our Bond Library for more details on October deals.

Bonds issued before October 2019

China Jinmao Holdings Group Limited (USD250m), formerly Franshion Brilliant Ltd, a Hong Kong property subsidiary Sinochem Corporation (China), 5Y original term, came to the market in June with a senior secured bond that benefits from a second party opinion provided by Sustainalytics. The proceeds of the bond will be allocated to low carbon buildings and renewable energy (wind and solar) projects. An annual green finance report will be published, containing information such as allocation of proceeds to eligible projects and unallocated proceeds. An impact report will disclose indicators such as number and level of third-party certification(s) achieved and CO2 (or other GHG) emissions avoided.

Host Hotels & Resorts (USD650m), USA, 10Y original term, debuted in the green bond market in September and is the first US lodging REIT to issue green bonds. The proceeds will finance the acquisition and development of hotels that have received or are expected to receive LEED Silver, Gold or Platinum certification, as well as refurbishments to properties in order to significantly improve energy efficiency and/or water efficiency. The deal will refinance the acquisition of Andaz Maui and the 1 Hotel South Beach, each of which has received LEED Silver certification. Host Hotels has committed to annual reporting, available on its website, until full allocation of proceeds, and this will include the LEED levels achieved.

Repeat issuers – 1 to 18 October

- AES Gener (AES Corporation): USD450m

- Acciona: EUR108.4m/USD118.9m

- Adani Renewable Energy RJ Ltd. (Adani Green Ltd.): USD362.5m

- Advanced Semiconductor Engineering: USD300m

- Bank of China: USD350m – Certified Climate Bond

- Bank of China: EUR300m/USD330.7m – Certified Climate Bond

- Bank of China: CNY2bn/USD282.5m – Certified Climate Bond

- EIB (European Investment Bank): USD1bn

- Energy Absolute PCL: THB3bn/USD98.5m – Certified Climate Bond

- Hemfosa Fastigheter AB: SEK800m/USD81.2m

- Humlegarden Fastigheter AB: SEK2bn/USD203m

- ING Bank Hipoteczny S.A. (ING): PLN400m/USD101.5m – Certified Climate Bond

- Indiana Finance Authority: USD41.55m

- Indiana Finance Authority: USD215m

- Japan Housing Finance Agency: JPY10bn/USD92.9m

- Japan Housing Finance Agency: JPY20bn/USD185.8m

- MidAmerican Energy: USD250m

- MidAmerican Energy: USD600m

- Mitsubishi UFG: AUD400m/USD270.1m

- Mitsubishi UFG: AUD100m/USD67.5m

- NRW.Bank: EUR500m/USD551.3m

- National Treasury Management Agency: EUR2bn/USD2.2bn

- Renew Power: USD90m – Certified Climate Bond

- Reykjavik Energy: ISK2.7bn/USD21.8m

- Ricoh Leasing Company: JPY10bn/USD92.9m

- SNCF: EUR250m/USD272.7m – Certified Climate Bond

- Vasakronan: SEK200m/USD20.4m

- Vellinge Municipality: SEK200m/USD20.4m

- World Bank (IBRD): INR220m/USD3.1m

Repeat issuers: Jan – 18 October 2019 (not previously included)

- Credit Agricole CIB: USD10m - September 2019

- MidAmerican Energy: USD600m - January 2019

- Natixis: EUR4.774m/USD5.3m - September 2019

- Renew Power: USD300m - September 2019 – Certified Climate Bond

- Reykjavik Energy: ISK2bn/USD16.3m - August 2019

- Fannie Mae: USD4.2bn - September 2019 (177 deals)

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Although we support the Sustainable Development Goals (SDGs) overall and see many links between green bond finance and specific SDGs, in particular SDGs 6, 7, 9, 11, 13, 14 and 15, the proportion of proceeds allocated to social goals should be no more than 5% for inclusion in our database.

|

Issuer Name |

Amount issued |

Issue date |

Reason for exclusion/ pending |

|

Inter-American Development Bank |

EUR275m/USD303.8m |

22/10/2019 |

Excluded (Sustainability/Social bond) |

|

Enel |

EUR1bn/USD1.1bn EUR500m/USD552.4m EUR1bn/USD1.1bn |

17/10/2019 17/10/2019 |

Excluded (Sustainability/Social bond) |

|

BNG Bank NV |

USD1bn USD1bn |

16/10/2019 16/10/2019 |

Excluded (Sustainability/Social bond) |

|

Shinhan Bank |

USD400m |

15/04/2019 |

Excluded (Sustainability/Social bond) |

|

Crédit Mutuel Arkéa |

EUR500m/USD547m |

03/10/2019 |

Excluded (Sustainability/Social bond) |

|

OeKB |

EUR500m/USD549m |

08/10/2019 |

Excluded (Sustainability/Social bond) |

|

Jiangsu Eastern Shenghong Co |

CNY1bn/USD140.6m |

10/10/2019 |

Excluded (Not aligned) |

|

EBRD |

EUR500m/USD552.4m |

17/10/2019 |

Pending (Waiting for more info) |

|

City of Oakland Park, Florida |

USD3m |

16/10/2019 |

Pending (Waiting for more info) |

|

Shinhan Bank |

EUR500m/USD551.2m |

16/10/2019 |

Pending (Waiting for more info) |

|

PepsiCo |

USD1bn |

09/10/2019 |

Pending (Waiting for more info) |

|

Ichinen Holdings Co., Ltd. |

N/A |

30/09/2019 |

Pending (Waiting for more info) |

|

Stangastaden |

SEK750m/USD76.9m |

27/09/2019 |

Pending (Waiting for more info) |

Green bonds in the market

- AEON REIT Green Trust - close 21 October

- Sparbanken Skane - closed 21 October

- China Construction Bank Corporation (Luxembourg) - closed 22 October

- City and County of San Francisco - closing 23 October

- Renewable Japan - closing 31 October

- Ricoh Leasing Company - closing 31 October

- New York State Housing Finance Authority: USD87.3m - closing 6 November – Certified Climate Bond

Investing news

Germany-based index provider Solactive has launched an ESG screened green bond index and partnered with Lyxor Asset Management for the launch of a new ETF: Lyxor Green Bonds ESG Screened UCITS ETF (XCO2), which started trading on Deutsche Börse Xetra on 1 October 2019.

The London Stock Exchange launched a sustainable bond market (SBM) segment, adding to the green bond segment, as well as a Green Mark label to help identify green equities and a new Issuer-Level Segment which enables eligible green economy businesses with more than 90% green revenues to admit bonds to SBM. It also now has mandatory post issuance reporting requirements for the SBM segments in order to provide investors with more transparency.

Bank of England’s governor Mark Carney predicts that companies and industries that do not move towards zero-carbon emissions and do not adapt will go bankrupt. As the transition towards net zero carbon emissions changes the value of assets, the risk of potential shocks to the financial system increases.

EIB showed the ambition earlier this year to stop fossil fuel lending. However, the decision has been delayed until November due to political resistance.

Green bond gossip

Banco Pichincha, Ecuador, is planning to issue a USD150m bond in order to help consumers make eco-minded purchases and at the same time give businesses an incentive to pursue eco-friendly projects.

Chinese oil refiner Jiangsu Eastern Shenghong has issued a green bond raising CNY1bn (USD140.6m) to finance a petrochemical complex. In China oil and gas producers are allowed to issue green bonds to finance clean technology and efficiency upgrades. This has provoked controversial reactions by different stakeholder groups.

Readings & reports

The European Commission published its final report on EU climate benchmarks and benchmarks’ ESG disclosures. It concludes that there are two essential measures to be taken: creating climate benchmarks and the definition of ESG disclosure requirements. A summary of the document is also available.

The IMF published a report ‘Global Financial Stability Report: Lower for Longer’ which identifies the current key vulnerabilities in the global financial system. It suggests that policymakers should mitigate the risks and recognises the importance of integrating ESG principles into the financial system as ESG affects corporate performance and can lead to higher financial stability. In a recent blogpost entitled Fiscal Policies to Curb Climate Change, the IMF calls for changes in the tax system and fiscal policies in order to encourage less use of fossil fuels in order to reduce emissions.

Rocky Mountain Institute published two reports which find that 2019 represents a tipping point in the relative costs of clean energy portfolios and gas-fired power plants, that 90% of proposed combined-cycle gas plants in the US, if built, will face stranded asset risk by 2035, and prioritizing clean energy investment instead would unlock USD29bn in net customer savings and avoid 100m tons of CO2 emissions each year—equivalent to 5% of current US electricity-sector emissions.

The Energy & Climate Intelligence Unit created an easily accessible infographic on the IPCC’s Special Report on the Ocean and Cryosphere in a Changing Climate. It summarises relevant aspects on climate change, implications and action points.

‘Till next time,

Climate Bonds