Highlights:

- 2019 volume reaches USD173.2bn, surpassing 2018 total issuance on 17 September

- China: September issuance surpasses USD4.8bn, boosted by ICBC

- BIS launches green bond fund for central banks

- Climate Bonds launched the Climate Resilience Principles

- Climate Bonds & Credit Suisse to build roadmap for leveraging bonds to accelerate sustainable transition

Don’t miss!

CBI’s Climate Resilience Principles (CRP) are a new framework, intended for a wide audience, including but not limited to bond issuers, investors and other stakeholders, seeking guidance on the potential range and type of climate resilience investments; how to define and assess physical climate risks; and how to credibly demonstrate climate resilience outcomes.

CBI published the Latin America & Caribbean: Green finance state of the market 2019. It is the first detailed analysis of the LAC green finance market since the first issuer from the region entered the market in 2014. The report covers green bond issuance, other labelled deals, climate aligned issuers, a scoping study on existing public sector issuers, as well as spotlight sections on agri-finance and blue bonds. There are also profiles for Brazil, Chile, Mexico, Peru, Argentina, Colombia and Central America & the Caribbean.

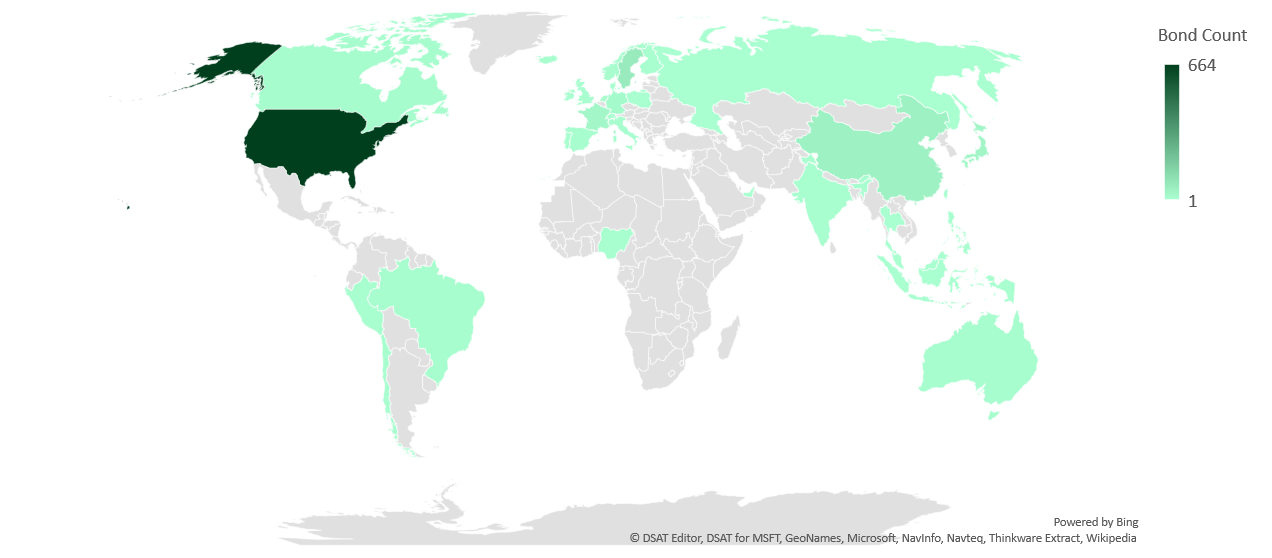

Green bond deals across the globe: 1 Jan – 20 Sep 2019

> The full list of deals here.

At a glance

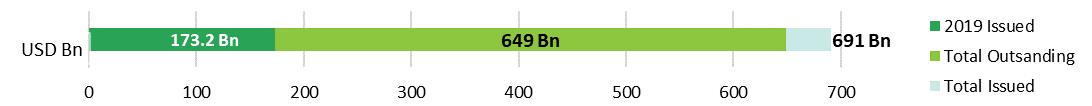

Green bond issuance as of 20 September reached USD15.7bn for the month, already surpassing September 2018 issuance. This takes the 2019 total to date to USD173.2bn, surpassing total 2018 annual issuance on 17 September.

Previous milestones for 2019 include reaching USD100bn in June and USD150bn in August. Forecasts for 2019 are up to USD250bn. The global climate finance goal is annual USD1tn issuance early in 2020s.

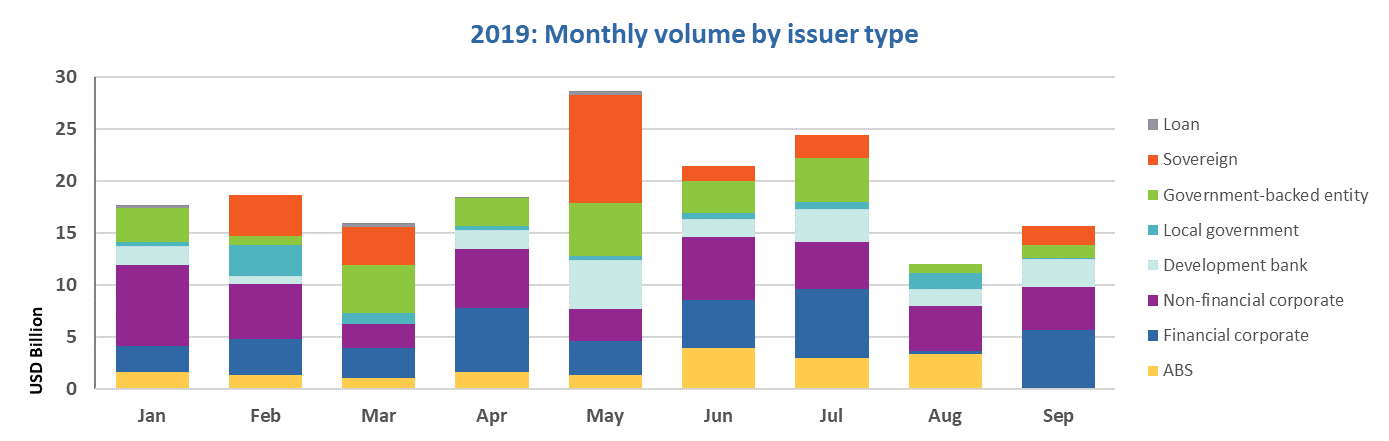

Financial corporate issuance has picked up, going from USD300m in August to USD5.7bn or 36% of current September volume, mainly driven by ICBC’s three green bonds (USD3.2bn). Non-financial corporates follow at 26%, with the largest September deal (so far) coming from Energias de Portugal SA: a EUR600 (USD663m) bond for renewable energy projects. After a quiet August for Sovereigns, France came back to market this month, tapping it for EUR1.7bn (USD1.8bn).

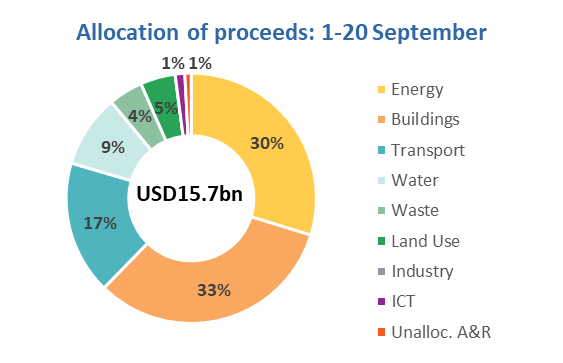

The highest volume of green bond allocations relate to Buildings (33%) with Covivio (France), Vasakronan (Sweden), Mitsui Fudosan (Japan) and De Volksbank (Netherlands) raising approximately USD500m each and dedicating 100% of the proceeds to properties. Energy currently accounts for the second largest volume with 30%. Allocations to low-carbon transport (USD2.7bn) are already more than double compared to September 2018 volume (USD1bn).

Two-thirds of September issuance has come from developed markets and about 30% from emerging markets – roughly the same split as overall issuance in September 2018. EM issuers came from the Philippines (USD300m) and China (USD4.8bn, Sep 2018: USD2.2bn). In DM markets, Sweden has recorded a quadrupling of issuance year-on-year (Sep 2019 v Sep 2018), and Germany a tripling.

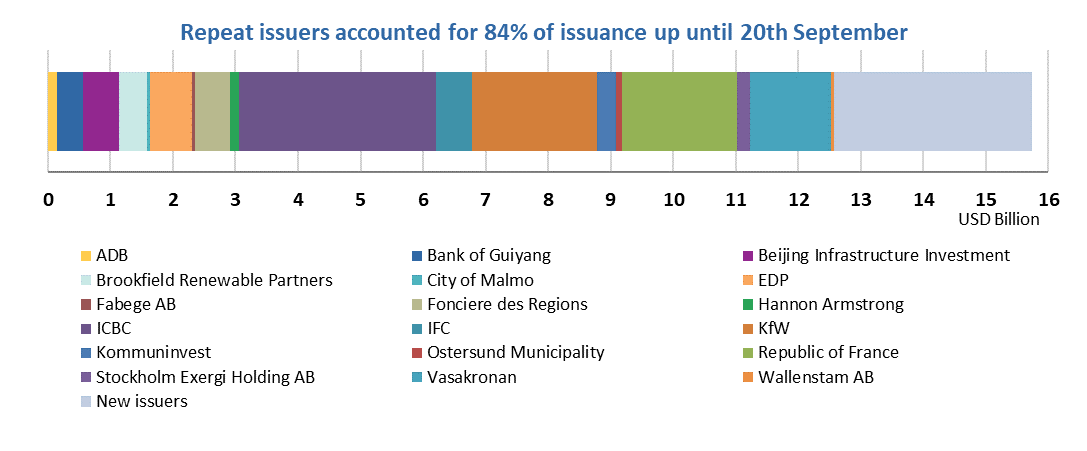

Repeat issuers accounted for 84% of issuance up until now. We saw 9 debut issuers.

Note: In September, we included Fannie Mae Green MBS issuance of USD3.2bn in August figures.

> The full list of new and repeat issuers here.

> Click on the issuer name to access the new issue deal sheet in the online bond library.

Certified Climate Bonds

Akiem Group SAS (EUR360m/USD398m), France, issued two green bonds (10Y and 15Y original term), which are Certified against the Low-Carbon Transport Criteria of the Climate Bonds Standard. It will finance or refinance its fleet of electric-powered rolling stock.

Annual reports will be made available to the bondholders only. These reports will have information on the allocation of proceeds, as well as quantitative impact indicators such as the estimated GHG emissions avoided. The issuer will report on an aggregated basis on the allocation and impact of the green financial instruments.

Akiem, a joint venture between subsidiaries of SNCF (itself a multiple issuer under Programmatic Certication) and a private wealth fund, owns a fleet of 440 locomotives, which may be attached to either passenger or freight trains.

De Volksbank (EUR500m/USD554m), Netherlands, came to the market with a 5-year bond. It is Certified against the Low-Carbon Buildings Criteria under the Climate Bonds Standard. The proceeds will be used to refinance residential mortgage loans to properties with an Energy Performance Certificate (EPC) Label A in the Netherlands.

There will be an annual report made available publicly on the issuer’s website. It will contain information on the allocation of proceeds and will be independently audited by EY. The annual reports will also include data on the energy consumption and estimated avoided emissions at the portfolio level.

De Volksbank, a mainly retail bank, has made a commitment to achieve a carbon neutral balance sheet by 2030.

Energy Absolute (THB3bn/USD97.4m), Thailand, debuted in July with a 10-year green bond, recently Certified against the Wind Criteria under the Climate Bonds Standard. The funds will be used to refinance the development of the Hanuman Wind Power Project in Chaiyaphum Province, which became operational in May 2019. It is one of the largest wind farms in southeast Asia and comprised of 103 wind turbines.

The issuer will report on their website on an annual basis, with a summary of projects and the amounts of allocated and unallocated proceeds. Where possible, the issuer will also provide information such as the amounts of energy generation.

About two-thirds of EA’s revenues are derived from solar and wind power generation, and year-end, it will have 664MW of installed capacity. In 2019, it launched an electrical car and began investing in EV charging infrastructure.

Elliot Green Power (AUD260m/USD183m), Australia, entered the green bond market with a Certified Climate Bond under the Solar Criteria of the Climate Bonds Standard. The proceeds will finance the development of three solar farms across Queensland and New South Wales in Australia.

Annual reports will be made available to the lenders, as well as to the Climate Bonds Initiative. These reports will have details on the allocation of proceeds, as well as the locations and installed capacities of the solar farms. The reports will also include estimates of the avoided GHG emissions.

EGP is an Independent Power Producer (IPP) of solar PV projects in Australia. It is owned by Elliot Management Corporation (EMC), a global hedge fund, which also has investments in solar energy in the UK and Spain.

New issuers

Public Sector

Dormitory Authority of the State of New York (USD121.4m), USA, issued its debut green bond, maturing in 2036. It will go towards the construction of Cornell University’s north campus, including buildings and infrastructure for housing. The project is expected to contribute to the university’s climate action plan and the buildings are expected to achieve LEED Silver or Gold certifications.

Cornell University plans to publish information on their website when buildings have achieved LEED certification. Furthermore, there will be voluntary annual updates on the use of proceeds until they have been fully spent.

Climate Bonds view: As our Post-issuance reporting study notes, most municipal bonds provide little or no information on the allocation of proceeds and funded projects. It is welcome to see the ambition of this issuer and funding recipient to disclose information voluntarily until the proceeds are fully spent. Many US universities have raised green bonds to fund building improvements, but few provide post-issuance reporting. It would be a positive for market transparency for more such issuers report on actual allocations and impacts.

Financial corporates

September saw debut issuance from three financial corporates, which will allocate proceeds to Buildings:

- Nomura Real Estate Master Fund (JPY3bn/USD28m), Japan, 10Y original term, rated Green 1 by JCRA.

- Sparebank 1 SMN (EUR500m/USD552m), Norway, 7Y original term, SPO provided by Sustainalytics.

- Bank of the Philippine Islands (USD300m) (BPI), Philippines, 5Y original term, SPO provided by Sustainalytics.

In addition to property, Sparebank 1 SMN will also finance circular economy projects, while BPI will also provide financing for renewable energy, energy efficiency projects, water and waste management. All are planning to provide annual allocation and, if feasible, impact reports.

Climate Bonds view: Building eligibility criteria are strong, but we would encourage issuers to keep raising the bar and aim to exceed threshold levels where possible, given the sector’s existing high carbon footprint and impact potential.

BPI’s deal is the largest green bond issued by a bank in the Philippines, while Nomura’s REIT adds to already strong issuance from J-REITs in 2019. As a general point, we welcome the commitment to annual reporting, particularly the inclusion of environmental impact indicators, which is now developing as a best practice in for green bonds.

Sparebank 1 SMN has identified a number of certification schemes required for project to qualify for circular economy financing. These include schemes such as Nordic Swan Ecolabel, Eco-Lighthouse Label, the Marine Stewardship Council (MSC), the Aquaculture Stewardship Council (ASC) and the GLOBAL GAP – The Worldwide Standard for Good Agricultural Practices. While it is not clear what specific projects will be financed, we have taken the view that the use of certification schemes to screen projects is a good approach. It is advisable for issuers to provide more information on potential types of projects. We will monitor issuer reporting to confirm that the financed projects align to the Climate Bonds Taxonomy.

China Zheshang Bank (CNY5bn/USD704m), China, debuted with a 3-year bond, which benefits from an external assurance provided by EY. The proceeds will be allocated to 11 projects, including 3 solar farms, a wastewater treatment plant, a waste to energy plant, a land remediation project, 3 metro construction and extension projects and a programme to finance the purchase of more than 2,000 LNG and electric buses.

Climate Bonds view: The issuer has provided detailed information on the use of proceeds and expected climate and environmental impact which follows PBoC’s green bond guidelines and green bond principles. We hope to see more green bonds with the same level of clarity and transparency.

Non-financial Corporates

Daiken Corporation (JPY5bn/USD46m), Japan, entered the market with a 3-year, unsecured bond rated as Green 1 by JCRA. They proceeds are to be used to fund the production of insulation boards from construction waste materials, namely a steel manufacturing by-product and unused volcanic soil.

The proceeds are expected to be fully allocated within one year. The issuer will disclose a summary of the funded eligible projects, allocated and unallocated amounts until full allocation, as well as several indicators of environmental improvement once a year, until maturity.

Climate Bonds view: The creation and implementation of circular economy initiatives is catching on globally, but holistic resource management is still very limited. It is encouraging to observe growth in sustainable industrial projects in Japan, as to date – on a global basis – only a small portion of green bond proceeds have been allocated to waste management and industrial processes.

Visit our Bond Library for more details on September deals.

Bonds issued in August 2019

City of Heber Springs (USD15m), USA, 25Y original term, assurance under BAM GreenStar. This US Muni bond will fund improvements to the local wastewater treatment plant and to the main sewer line amongst others.

Corporación Interamericana para el Financiamiento de Infraestructura (USD200m programme), Panama, up to 10Y term (varies by bond). Projects may include wind, solar, geothermal, hydro under 25MW, waste management, wastewater treatment, recycling and co-generation in the region. CIFI operates in Latin America and Caribbean.

Banco de Chile (USD48m), Chile, 12Y original term. The proceeds will finance or refinance renewable energy projects across Chile. This is the first green bond from a Chilean financial institution, be it private or public. It is also the first Chilean green bond to finance solely renewable energy, a very under-represented use-of-proceeds sector in the country (just 0.1% of total country volume through 2 July 2019).

Celulose Irani (BRL505m/USD131m), Brazil, 6Y original term, SPO provided by Sitawi. The proceeds will go towards refinancing paper production. Almost all of Celulose Irani’s forestry operations are in FSC-certified areas. This includes production of derivatives such as resin. In addition to that, a significant share of their energy comes from renewable sources. The issuer will report on allocations and a number of environmental impact metrics annually on its website and/or sustainability report.

Grupo Sabará (BRL20m/USD4.9m), Brazil, 5Y original term. This private placement will finance investment in the construction of an eco-efficient industrial plant that will produce sodium chlorite* in Santa Barbara d’Oeste and relies entirely on renewable energy. Sabará will disclose the use of proceeds and impacts via annual updates on its website and every three years in its Sustainability Reports, until maturity.

* Sodium clorite is a chemical compound used in the manufacturing of paper and as a disinfectant. It is used for the treatment of water to make it potable. It is also a cleaner alternative than traditional oxidants in paper production and reduces the need for energy and water in the production of sugar and alcohol.

Hezhou Public Transport (CNY60m/USD8m), China, 6Y original term. The 7-tranche green ABS is backed by bus ticket receipts, i.e. revenue from public transport. The issuer purchased a fleet of 200 electric buses early this year. We will keep an eye on the further disclosure of this ABS deal and hope to see links between the investment in electric buses and the ABS issuance.

Repeat issuers – through 20 September

- ADB (Asian Development Bank): AUD150m/USD102.7m

- ADB (Asian Development Bank): HKD115m/USD14.7m

- Bank of Guiyang: CNY3.0bn/USD424.5m

- Beijing Infrastructure Investment: CNY4.0bn/USD566m

- Brookfield Renewable Partners: CAD600m/USD454.6m

- City of Malmo: SEK500m/USD50.85m

- Covivo: EUR500m/USD551.8m

- Energias de Portugal SA: EUR600m/USD662.6m

- Fabege AB: SEK500m/USD51.8m

- Hannon Armstrong: USD150m

- ICBC: HKD4.0bn/USD511.3m

- ICBC: CNY1.0bn/USD141.2m

- ICBC: USD2.5bn

- IFC (International Finance Corporation): CAD750m/USD568.3m

- KfW: USD2.0bn

- Kommuninvest: SEK3.0bn/USD311m

- Republic of France: EUR1.7bn/USD1.8bn

- Stockholm Exergi Holding AB: SEK2.0bn/USD206.3m

- Vasakronan: EUR600m/USD660.4m

- Vasakronan: SEK600m/USD61m

- Vasakronan: EUR500m/USD552.125m

- Vasakronan: AUD25m/USD17.11275m

- Wallenstam AB: SEK500m/USD50.85m

- Östersund Municipality: SEK825m/USD85.2225m

Repeat issuers: Jan – Aug 2019

- Energy Absolute PCL: THB3bn/USD97m - July 2019

- Energy Absolute PCL: THB4bn/USD130m - August 2019

- Fannie Mae: USD3183.7m - August 2019

- IFC (International Finance Corporation): SEK250m/USD26.7m - July 2019

- Japan Railway Construction, Transport and Technology Agency: JPY34bn/USD321m - August 2019

- Kingdom of Belgium: EUR1.3bn/USD1.4bn (re-opening, 3 bonds) - March 2019

- Kingdom of Belgium: EUR1.1bn/USD1.2bn (re-opening, 3 bonds)- July 2019

- ReNew Power: USD60m (re-opening) - March 2019

- Reykjavik Energy: ISK2040m/USD16.3m - August 2019

- SNCF: EUR100m/USD111.9m (re-opening) - August 2019

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Although we support the Sustainable Development Goals (SDGs) overall and see many links between green bond finance and specific SDGs, in particular SDGs 6, 7, 9, 11, 13, 14 and 15, the proportion of proceeds allocated to social goals should be no more than 5% for inclusion in our database.

|

Issuer Name |

Amount issued |

Issue date |

Reason for exclusion/ pending |

|

China Three Gorges Corporation |

CNY3bn/USD424.5m |

11/09/2019 |

Excluded (Working capital) |

|

China Three Gorges Corporation |

CNY500m/USD70.8m |

11/09/2019 |

Excluded (Working capital) |

|

RCBC |

USD300m |

11/09/2019 |

Excluded (Sustainability/Social bond) |

|

Enel |

USD1.5bn |

10/09/2019 |

Excluded (Sustainability/Social bond) |

|

Guangzhou Yuexiu Holding Ltd |

CNY700m/USD99.1m |

09/09/2019 |

Excluded (Working capital) |

|

Otto Group |

EUR50m/USD54.9m |

03/09/2019 |

Excluded (Sustainability/Social bond) |

|

Guangzhou Metro Group Co.,Ltd. |

CNY2bn/USD283.2m |

03/09/2019 |

Excluded (Working capital) |

|

Capital Airports Holding Company |

CNY1.5bn/USD212.9m |

02/09/2019 |

Excluded (Not aligned) |

|

Chengde City Of Control Investment Group Co.,Ltd. |

CNY840m/USD118.9m |

02/09/2019 |

Excluded (Working capital) |

|

Porter Special Utility District |

USD13.28m |

01/09/2019 |

Excluded (Not aligned) |

|

Huaneng Tiancheng Financial Leasing Co.,Ltd. |

CNY1bn/USD141.6m |

30/08/2019 |

Excluded (Working capital) |

|

Changxing Binhu Construction and Development Co.,Ltd |

CNY410m/USD58.1m |

29/08/2019 |

Excluded (Working capital) |

|

Changxing County Traffic Construction Investment Company |

CNY1.3bn/USD184.1m |

27/08/2019 |

Excluded (Working capital) |

|

Beijing Geoenviron Engineering & Technology, Inc. |

CNY600m/USD85m |

23/08/2019 |

Excluded (Working capital) |

|

Lu'An Mining Industry Group Co.,Ltd. |

CNY2.8bn/USD402.1m |

22/08/2019 |

Excluded (Working capital) |

|

Marfrig |

USD500m |

06/08/2019 |

Excluded (Not aligned) |

|

California Community Housing Agency |

USD110.8m |

28/06/2019 |

Excluded (Not aligned) |

|

Port of Los Angeles |

USD15.7m |

18/09/2019 |

Pending (Waiting for more information) |

|

Kaneka Corporation |

JPY500m/USD46.5m |

12/09/2019 |

Pending (Waiting for more information) |

|

ReNew Power |

USD300m |

12/09/2019 |

Pending (Waiting for more information) |

|

Northern States Power Company |

USD600m |

10/09/2019 |

Pending (Waiting for more information) |

|

Director of the State of Nevada Department of Business and Industry Environmental Improvement Revenue Bonds |

USD50m |

05/09/2019 |

Pending (Waiting for more information) |

|

First Abu Dhabi Bank |

USD50m |

03/09/2019 |

Pending (Waiting for more information) |

|

BKS Bank |

EUR5m/USD5.5m |

01/08/2019 |

Pending (Waiting for more information) |

Green bonds in the market

- Grupo Pestana – closed 23 September

- PostNL – closed 23 September

- Bank of the Philippine Islands – closed 24 September

- City of Toronto – closed 24 September

- Sumitomo Warehouse – closed 24 September

- ING Bank Hipoteczny – closed 25 September

- Nordic Investment Bank – closed 25 September

- The Conservation Fund – closed 26 September

- Interstate Power & Light (Alliant Energy) – closed 26 September

- Acorn Holding – closing 27 September

- Tokyu Land Capital Management – closing 27 September

- EBRD – closing 27 September

- Mitsubishi Electric Credit Corporation – closing 30 September

- NCC – closing 30 September

- Renewable Japan – closing 1 October

- Generali – closing 1 October

Investing News

The Bank for International Settlements (BIS) has launched an open-ended fund for central bank investments in green bonds.

Kenya is aiming to make green bond investments more attractive with MPs backing a tax exempt plan for green bonds.

China may include clean coal projects in their catalogue of eligible categories of their green bond programme. The decision is yet to be made but causes a debate on China’s ambitions to fight climate change.

EBRD issues its first climate resilience bond under the new CBI Climate Resilience Principles.

Enel issued its first bond linked to the achievements of the UN’s Sustainable Development Goals. The issue will fund projects related to clean energy and smart meter infrastructure amongst others.

BBVA launched an extensive green loan programme for SMEs and freelancers to fund electric or hybrid cars for business purposes. This extends BBVA’s efforts to fight climate change after launching eco-car loan for consumer customers.

Asset manager Amundi launched a climate bond fund together with the Asian Infrastructure Investment Bank. For this purpose a framework has been developed that assesses issuers’ ability to cope with climate change.

Green Bond Gossip

The Stevens Institute (USA) will raise USD270m in green bonds to fund student housing projects comprising of two new student residential towers and a university centre in Hoboken, NJ.

Urja Global (India) is considering issuing a green bond of up to USD500m to fund projects on renewable energy and electric vehicles.

Kerala Industrial Infrastructure Fund Board (India) is planning to be the first entity owned by an Indian State, Kerala, to issue a green bond. The use of proceeds will be used to fund non-conventional energy sources.

BMO (Canada) published its Sustainable Financing Framework under which social bonds, green bonds and sustainability bonds will be issued. The framework benefits from an SPO provided by Sustainalytics.

Readings & Reports

The EU sustainable finance taxonomy raises questions of being too stringent and therefore discouraging for issuers. Analysis shows that only 17% of the bonds within the widely-used Bloomberg Barclays MSCI Green Bond Index would meet the taxonomy’s criteria.

The Principles for Responsible Investment (PRI) have just released a set of six updated briefing papers around the Inevitable Policy Response (IPR) scenario planning for investors.

131 banks committed to align their businesses with the goals of the Paris Agreement and the Sustainable Development Goals (SDG) by signing up to the Principles of Responsible Banking.

Novethic conducted a study on the integration of Sustainable Development Goals (SDGs) amongst European asset owners that have signed the Principles for Responsible Investment (PRI). Amongst others it found that climate change is the most targeted SDG and many asset owners claim that SDGs are strategic for their investments.

According to a report by the Transition Pathway Initiative only two of the largest oil and gas companies have emission reduction targets that are aligned with the Paris agreement.

Exponential Roadmap published two reports on solutions in order to reduce greenhouse gas emissions by 50% by 2030 and why action has to be taken now.

‘Till next time,

Climate Bonds