Highlights:

- March issuance reaches USD12.4bn (Fannie Mae deals have yet to be included)

- Nigeria: Access Bank issues the first Certified Climate Bond from an African corporate

- Australia: UBank launches a Certified Climate Bond fixed-term deposit, targeting millennials

- Denmark: Danske Bank is the first financial corporate to enter the country’s GB market

- USA: City of Santa Fe issues first Certified Climate Bond from New Mexico under the Water Infrastructure Criteria

Go here to see the full list of new and repeat issuers in March.

At a glance

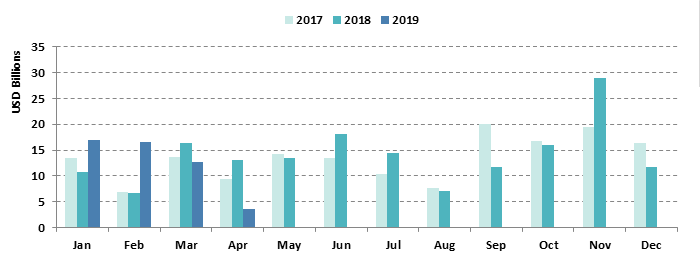

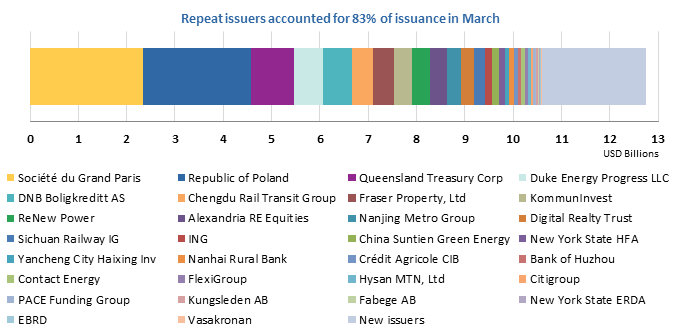

Monthly green bond issuance in March reached USD12.4bn, down 24% year-on-year against 2018 figures. However, this excludes Fannie Mae, as its March numbers have not yet been released.

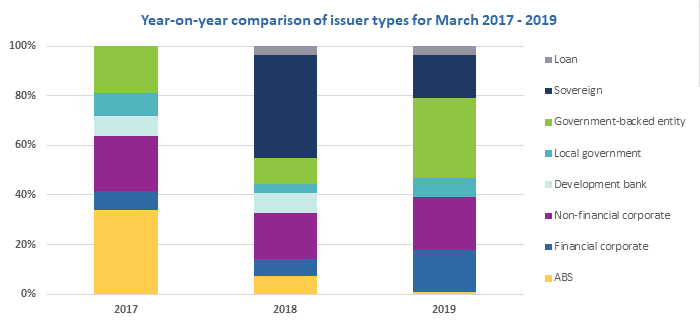

Government-backed entities were particularly active in March, representing a third (32%) of issuance compared to 10% in 2018 (nine deals versus last year’s seven). The strong issuance is driven by repeat issuer Société du Grand Paris, which made up over half (57%) of government-backed issuance.

Corporates were also relatively active, altogether accounting for 38% of issuance. On the non-financial corporate side (21% of monthly volume), US repeat issuer Duke Energy, and Dutch and Japanese debut issuers LeasePlan and Tokyo Tatemono issued the three largest bonds, which made up 60% of non-financial corporate issuance.

On the other hand, financial corporates (17%) saw volumes almost doubling compared to March last year. Norwegian repeat issuer DNB Boligkreditt AS was the largest issuer in this group, contributing 28% of issuance.

Sovereigns comprised the next largest issuer type with 18% of February issuance. This was entirely attributable to the Republic of Poland’s EUR2bn dual tranche green bond, its third overall. As the chart below shows, sovereign issuance was higher in March 2018, driven by the Kingdom of Belgium’s inaugural EUR4.5bn green bond.

Finally, local government issuance was substantially higher in March this year, whilst development bank and ABS issuances were low (however, this again excludes Fannie Mae, as its figures have not been released yet).

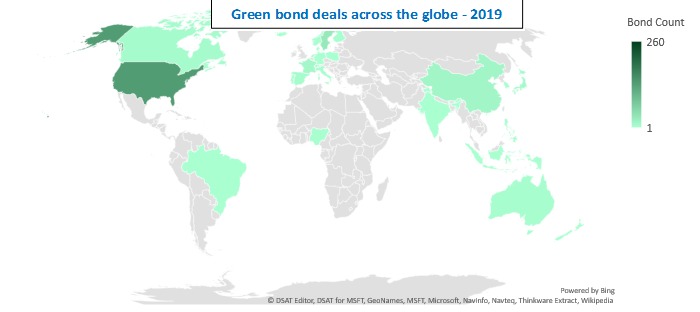

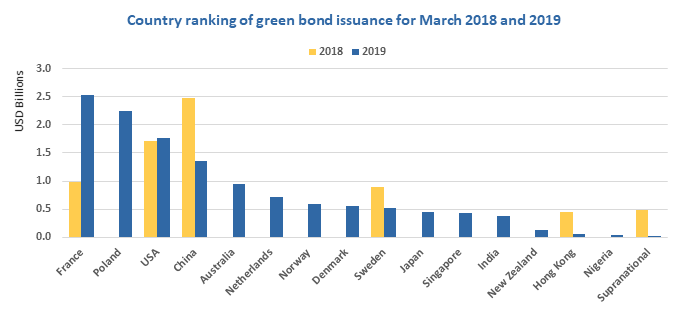

In terms of geographical market share, France ranked at the top with 20%, up 150% compared to March 2018. Poland was second at 18% (due to its sovereign issuance), which compares with no issuance in March last year. The USA saw similar volumes to 2018, but without Fannie Mae’s March figures, so the USA’s actual issuance is likely to be higher. China completes the top 4 as the only other country with issuance exceeding USD1bn, although this volume is significantly lower than last year. Among the remaining 11 countries with issuance in March 2019, only Sweden and Hong Kong issued in March 2018. Furthermore, Supranational issuance was also weaker this year.

Issuance from developed markets (DM) accounted for 68% of the total volume, in line with last year’s figure of 69%. Emerging markets (EM) issuance represented 32% of issuance in March 2019, which is higher than last year’s 28% despite weaker Chinese issuance, spurred by the Republic of Poland’s third green bond.

> The full list of new and repeat issuers here.

> Click on the issuer name to access the new issue deal sheet in the online bond library.

Certified Climate Bonds

Access Bank (NGN15bn/USD42m), the largest bank in Nigeria after its merger with Diamond Bank on 1 April 2019, issued a 5-year Certified Climate Bond under the Water Infrastructure and Solar Criteria. About 80% of proceeds will finance projects related to coastal flood defences to protect against sea level rise in Eko Atlantic City, a new costal urban development near Lagos. The rest will be allocated towards solar energy generation facilities. The bank will produce an annual Green Bond Report with information on allocations and the projects financed, and will post on its Investor Relations website.

Access Bank’s deal is the first Certified Climate Bond from an African corporate. It is the second Certified Climate Bond from Nigeria, following Nigeria’s sovereign issuance back in December 2017, and the third green bond from a Nigerian issuer. Access Bank is also setting a positive precedent by allocating a significant amount of proceeds to climate-change adaptation and resilience.

City of Santa Fe (USD13.6m), USA, the capital of the state of New Mexico, issued a 19-year US Muni Certified Climate Bond. It will finance an improvement project for Santa Fe's Wastewater Utility System, including two new anaerobic digesters, a new automated control system and a cogeneration facility that will generate electricity from the biogas produced by the digesters. The upgrades will enable the treatment facility to consume no net electricity, as well as reduce GHG emissions that would otherwise result from the wastewater. Annual reports will be made publicly available on the EMMA website.

Santa Fe is the first green bond issuer from New Mexico (following the state’s Treasurer's Office becoming a foundation signatory of the Green Bond Pledge in 2018), and the fifth city in the US to issue a Certified Climate Bond, following New York City, NY; San Francisco and Los Angeles, CA; and Columbia, SC. It is also the first Certified Climate Bond to fund a wastewater biodigester plant. We welcome US Muni issuance in new states and hope that more issuers in the country opt for Climate Bonds Certification.

UBank, Australia, a digital bank subsidiary of NAB that targets younger customers, has created the world’s first green fixed term retail deposit linked to assets Certified under the Climate Bonds Standard. Through this product, retail customers can receive up to 2.55% interest on their savings. The amount of funds raised from savings will be used to fund a portfolio of loans on renewable energy projects such as wind and solar energy and low carbon buildings, originated under NAB’s SDG Green Bond programme, which is Certified under the Climate Bonds Standard.

Research has shown the millennials demographic tend to care more about the environmental impacts of its investments, so the target segment is not surprising. Deposit products provide an easy way for retail investors to contribute towards the transition to a low-carbon economy. For further examples of green retail products, please see our recent Green bonds state of the market 2018 report, which featured a spotlight on green retail products (p.20).

New issuers

Argosy Property (NZD100m/USD68m), New Zealand, is a REIT (real estate investment trust) that invests in and manages industrial, office and retail properties throughout New Zealand. Proceeds of its 7-year secured bond will be used to finance office, industrial and/or retail buildings (including upgrades) as well as to refinance corporate debt that supports green assets. As mentioned in its Green Bond Framework (which received an independent assurance by EY), Argosy Property will report on the use of proceeds at least semi-annually.

Climate Bonds view: This is the first issuance from New Zealand aimed at financing buildings projects (previous bonds mainly funded geothermal energy generation and rail transport). It is therefore good to see not only the New Zealand green bond market growing, but also diversifying. We hope this will continue.

Baseload Capital (SEK500m/USD54m), Sweden, is a Stockholm-based private investment firm that specialises in heat-to-energy projects. The proceeds of the 4-year bond will be used to finance geothermal energy with a maximum emissions intensity of 100g CO2/kWh and waste-heat-to-energy projects, involving the conversion of heat generated as a by-product from combustion engines on LNG-fuelled cargo ships and from industrial processes in, but not limited to, factories.

Baseload Capital’s Green Bond Framework, reviewed by Sustainalytics, specifies that the issuer will produce an annual progress report on its Green Bonds, which will be provided to investors. It will include disclosure on proceed allocation as well as an impact report with pre-determined performance metrics.

Climate Bonds view: This issuance is a welcome addition to the already robust pool of Swedish green debt. The company is the first private investment firm to enter the market. Its explicit focus on heat-to-energy also brings an interesting angle to sustainable energy investment.

Companie de Phalsbourg SARL (EUR112m/USD125m), France, is a real estate company and the first to obtain BREEAM Excellent and HQE excellent certifications for its assets both in the construction phase and in operation. The proceeds will finance the development of projects with a strong environmental focus, such as Mille Arbres, Ecotone Antibes, Wood Up and Tour Occitanie in Toulouse, hotel projects such as Aurore in Paris and mixed-use projects such as Open Sky Valbonne or Central Park Valvert which will provide office, retail and hotel space. The bond received a second party opinion from Vigeo Eiris, but this is not publicly available.

Climate Bonds view: Issuers are strongly encouraged to disclose information about the eligibility criteria of projects (such as in their green bond framework or second party opinion), to comply with market best practice. Some of the examples of projects mentioned by the issuer above have met fierce opposition from local residents. Climate Bonds will thus continue monitoring for controversies and any adverse environmental effects from the construction of new assets related to the loss of natural habitat, increased flooding risks and carbon emissions from increased traffic.

Danske Bank (EUR500m/USD565m), Denmark, issued a 5-year green bond to finance or re-finance loans or investments that promote the transition to low-carbon, climate-resilient and sustainable economies (“Green Loans”), primarily in the Nordics. Clean transport, renewable energy, energy transmission, green buildings, sustainable resource use, water management, pollution measures and adaptation are all eligible categories. Proceeds may also be used to provide funding for pure-play companies, which Danske Bank defines as companies which derive at least 90% of their revenue from these categories.

Danske Bank will provide annual Green Bond reporting on allocations and impact until bond maturity. The reporting will be made available on Danske’s website.

Climate Bonds view: This bond is the first financial corporate issuance from Denmark and adds to the already sizeable group of Nordic commercial bank issuers. It may spur further issuance in Denmark, which so far has only seen six green bonds from five issuers, for a total of just over USD4bn. It is also good to see a diverse set of eligible project categories, such as tidal/wave energy, energy transmission and storage, and climate change adaptation.

Hayward Unified School District (USD20m), USA, a Californian provider of pre-school through adult education, issued a 12-year US Muni bond to fund the implementation of a sustainable energy plan. Several green projects linked to emission reductions via renewable energy and energy efficiency may be financed, including the installation of solar energy systems at 33 schools within the District. Annual updates regarding the use of proceeds will be provided on the District’s website.

Climate Bonds view: We are happy to see the use of green bonds to develop more climate-friendly facilities. Given the Muni bond format, we hope other similar organisations follow Hayward’s example in the US.

Tokyo Tatemono (JYP50bn/USD448m), Japan, a real estate company that develops, sells and manages commercial and residential properties, issued a 40-year hybrid green bond, which obtained a Green 1 rating from JCR. The proceeds are to be used to finance / refinance green buildings, including the acquisition and construction of Hareza Ikebukuro Toshima and Nakano Central Park South. The green finance framework defines eligibility criteria as 4 or 5 stars under DBJ’s Green Building Certification, Rank S or A under CASBEE for Building (New Construction), or 4 or 5 stars under BELS Certification.

Climate Bonds view: This bond is the largest Japanese deal in 2019, and the granularity of information presented in the Green Bond Assessment shows the issuer’s commitment to comply with best practice disclosure. Tokyo Tatemoto is a welcome addition to Japan’s rapidly growing pool of green bond issuers in the buildings sector. Furthermore, the building certification levels are at the high end, demonstrating ambition.

New issuers issued prior to March 2019

Agrosuper (USD100m), the largest producer of animal protein in Chile, obtained a green loan in October 2018 to finance its sustainable agriculture activities. This is the first Chilean green loan, as well as the first green finance product used for agricultural purposes in the country. In particular, Agrosuper will use the proceeds to finance multiple acquisitions in the salmon industry (especially linked to lower antibiotic use), certify production centres under ASC (Aquaculture Stewardship Council), and work with neighbouring communities of its production facilities.

Climate Bonds view: Global agriculture-related issuance is still very low, so it is good to see some, especially from Latin America, a region with huge potential. This green loan follows CMPC’s 2017 green bond, also related to the food industry, but whose proceeds were used for many types of projects. Agrosuper’s loan takes the total Chilean issuance to almost USD700m, and may support further Latin American issuance linked to land use/agriculture.

LG Display (USD300m), a leading global manufacturer of display panels (including LCD and OLED) from South Korea, issued a 3-year senior unsecured green bond in November 2018. It will be used to finance/re-finance investments in several areas linked to LG Display’s manufacturing activities, including buildings/energy efficiency, sustainable water/wastewater management, pollution prevention/control, and eco-efficiency/circular economy adapted products. The company will report annually on the allocation and impact of proceeds, at least until full allocation. LG Display’s Green Bond Framework received an Independent Assurance Statement from KPMG.

Climate Bonds view: Somewhat surprisingly, this is the first issuance from a South Korean electronics company. It is therefore very positive, taking total South Korean issuance to USD4.6bn. The planned allocation of part of the proceeds to circular economy initiatives is particularly encouraging, as not many manufacturing companies have highlighted this area yet. We hope and expect that similar producers will follow suit, especially from Asia.

North South Power Company (NGN8.5bn/USD24m), a Nigerian electricity generation company, issued a 15-year green bond in late February 2019, intended to finance and re-finance investments in solar and hydro power generation. It was the first corporate green bond approved by NSEC (Nigerian Securities and Exchange Commission) and it received an SPO from TUV NORD (not publicly available).

Climate Bonds view: NSP becomes the second Nigerian green bond issuer, and the first corporate one. We are pleased that Nigerian issuance continues to grow on the back of the country’s sovereign issuance in 2017, with two corporates issuing within weeks of each other, and hope that this helps drive further issuance from Africa.

Sociedade Bioelétrica do Mondego (EUR50m/USD57m), a Portuguese wholly-owned subsidiary of the Altri Group, issued a green bond in late February 2019. It will finance the development of a 34.5MW-capacity biomass power plant, which will be attached to the pulp mill of its sister company, Celbi, and will use only FSC/PEFC biomass feedstock. The company (SBM) engaged Sustainalytics to provide an SPO on its Green Bond Framework.

SBM estimates the facility’s future carbon intensity at approximately 125g CO2eq/kWh, which is above the threshold recommended by Sustainalytics but nonetheless represents a major reduction compared to the average carbon intensity of Portugal’s national electricity supply, which is 295g CO2eq/kWh. The SPO also notes that the expected emissions intensity of the facility was not calculated using a lifecycle assessment approach, and only considers direct emissions in relation to units of energy produced, so the carbon intensity figure provided by SBM does not account for the carbon sequestration potential of the forests from which biomass feedstocks are harvested."

Climate Bonds view: It is positive to see bioenergy-related issuance, which has been relatively uncommon. We welcome the disclosure of emissions metrics, and would hope that such disclosure becomes more commonplace, ideally assessed using the lifecycle approach. SBM is the second ever Portuguese green bond issuer, following EDP’s inaugural deal in late 2018. Although SBM’s bond is of a much smaller size than EDP’s, it suggests the Portuguese green bond market is becoming active. We hope it will continue expanding, including into sectors beyond energy.

Repeat issuers – March

- Alexandria Real Estate Equities: USD350m

- Bank of Huzhou: CNY500m/USD74m

- Chengdu Rail Transit Group Co., Ltd: CNY3bn/USD447m

- China Suntien Green Energy Company Limited: CNY910m/USD136m

- Citigroup: EUR50m/USD57m

- Contact Energy: NZD100m/USD68m – Certified Climate Bond (Programmatic Certification)

- Crédit Agricole: EUR75m/USD84m

- Digital Realty Trust (tap): EUR225m/USD254m

- DNB Boligkreditt AS: SEK5.5bn/USD595m

- Duke Energy Progress LLC: USD600m

- EBRD: EUR10m/USD11m

- Fabege AB: SEK250m/USD27m

- FlexiGroup: 3 tranches for a total of AUD91m/USD65m – Certified Climate Bond

- Fraser Property, Ltd: AUD600m/USD428m

- Hysan MTN Limited: HKD500m/USD64m

- ING: EUR138m/USD156m

- KommunInvest: SEK3.5bn/USD377m

- Kungsleden AB: SEK400m/USD42m

- Nanhai Rural Bank: CNY600m/USD90m

- Nanjing Metro Group Co., Ltd: CNY2bn/USD298m

- New York State Energy Research and Development Authority: 10 tranches for a total of USD16m

- New York State Housing Finance Agency: 18 tranches for a total of USD125m – Certified Climate Bond (Programmatic Certification)

- PACE Funding Group: USD55m

- Queensland Treasury Corporation: AUD1.2bn/USD892m – Certified Climate Bond (Programmatic Certification)

- Renew Power: two tranches for a total of USD375m – Certified Climate Bond (Programmatic Certification)

- Republic of Poland: two tranches for a total of EUR2bn/USD2.2bn

- Sichuan Railway Investment: CNY1.5bn/USD224m

- Société du Grand Paris (SGP): EUR2.05bn/USD2.33bn (EUR2bn and EUR50m) – Certified Climate Bond (Programmatic Certification)

- Vasakronan: SEK163.6m/USD17.6m (SEK100m and SEK63.6m)

- Yancheng City Haixing Investment: CNY624m/USD93m

Repeat issuers – April

- Atrium Ljungberg: SEK500m/USD54m

- Fabege AB: SEK400m/USD43m

- FMO: USD500m

- Interstate Power and Light Company: USD300m

- Link REIT: HKD4bn/USD510m

- Reykjavik Energy: ISD2.11bn/USD18m

- SNCF (tap): EUR250m/USD282m – Certified Climate Bond (Programmatic Certification)

- Terna: EUR500m/USD562m

- World Bank (tap): AUD200m/USD154m

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Although we support the Sustainable Development Goals (SDGs) overall and see many links between green bond finance and specific SDGs, in particular SDGs 6, 7, 9, 11, 13 and 15, the proportion of proceeds allocated to social goals should be no more than 5% for inclusion in our database.

|

Issuer Name |

Amount issued |

Issue date |

Reason for exclusion/ pending |

|

AfDB (African Development Bank) |

NOK500m/USD58m |

11/04/2019 |

Excluded (social bond) |

|

Flemish Community |

EUR750m/USD845m |

11/04/2019 |

Excluded (sustainability bond) |

|

Housing New Zealand |

NZD500m/USD337m |

05/04/2019 |

Excluded (sustainability bond) |

|

Klabin |

USD500m |

03/04/2019 |

Excluded (unlabelled bond – climate-aligned) |

|

LG Chem |

N/A |

15/04/2019 |

Pending (waiting for more information) |

|

Construcciones el Condor S.A. |

COP100bn/USD32m |

28/03/2019 |

Pending (waiting for more information) |

|

Electrolux |

SEK1bn/USD108m |

27/03/2019 |

Pending (waiting for more information) |

|

Xinxing Ductile Iron Pipes Co., Ltd |

N/A |

27/03/2019 |

Excluded (working capital) |

|

Yunnan Provincial Investment Holdings Group Co., Ltd |

CNY1bn/USD149m |

25/03/2019 |

Excluded (working capital) |

|

Shandong Gold Mining Co., Ltd |

CNY1bn/USD149m |

25/03/2019 |

Excluded (not aligned/ working capital) |

|

Cassa Depositi E Prestiti |

EUR750m/USD845m |

21/03/2019 |

Excluded (social bond) |

|

Beijing Geoenviron Engineering & Technology, Inc |

CNY600m/USD95m |

14/03/2019 |

Excluded (not aligned/ working capital) |

|

Japan Finance Corporation |

JPY33.5bn/USD302m |

13/03/2019 |

Excluded (social bond) |

|

Land NRW |

EUR2.25bn/USD2.55bn |

13/03/2019 |

Excluded (sustainability bond) |

|

ASICS Corporation |

JPY20bn/USD180m |

13/03/2019 |

Excluded (sustainability bond) |

Green bonds in the market

- Instituto de Crédito Oficial: EUR500m – closed April 9

- Indiana Finance Authority: USD185m – closed April 10

- UBI Banca: EUR500m – closed April 10

- African Development Bank (AfDB): SEK1.25bn – closing April 11

- ERG SpA: EUR500m – closing April 11

- Orient Corporation: JPY5bn – closing April 12

- Landwirtschaftliche Rentenbank: SEK2bn – closing April 15

- ABN Amro: EUR750m – closing April 15

- Aguas Andinas: UF2m/USD83m - closing April 15

- Société du Grand Paris: EUR70m - Programmatic Certified Climate Bond - closing April 16

- Illinois Finance Authority: USD450m – closing April 16

- LCDA (Louisiana Local Government Environmental Facilities and Community Development Authority): USD10.4m – closing April 16

- JACCS: JPY10bn – closing April 16

- Arizona State University: USD125m – closing April 17

- IFC: SEK100m – closing April 18

- Toyota Finance: JPY60bn – closing April 19

- Woolworths: AUD400m - Certified Climate Bond - closing April 23

- Sogn og Fjordane Energi: NOK200m – closing April 24

- Midsummer: SEK200m – closing April 25

- ADIF Alta Velocidad: EUR600m – closing April 25

- Sogn og Fjordane Energi: NOK200m – closing April 26

- Lidl: EUR/CHF300m (3 tranches, each 100m) – closing May 15

- Dutch State Treasury Agency: EUR4-6bn – Certified Climate Bond - closing May 23

- UGE International – closing N/A

Investing News

The State of the Netherlands has announced it will issue a EUR4-6bn Certified Climate Bond on 21st May 2019, becoming the first country with a triple-A rating to issue a green sovereign bond. Proceeds will be allocated towards green, or climate-related, investments undertaken by the Dutch Government, specifically related to renewable energy (SDE-arrangement), energy efficiency (STEP-arrangement), clean transportation (rail infrastructure) and climate change adaptation (Deltafund). The Green Bond Framework and SPO are available on its website.

Australian supermarket chain Woolworths has priced a green bond of AUD400m (USD285m), certified under the Low Carbon Buildings Criteria of the Climate Bonds Standard. This is a first in the Australian retail sector, and a first for a supermarket chain globally.

JACCS Co., Ltd, a Japanese consumer finance company, is in the market with green bonds to refinance its pool of solar loans (i.e. loans to install solar power generation systems). The 5-year JPY10bn/USD90m bonds are closing in April 2019. Upon its preliminary evaluation, JCR assigned a Green 1 rating to the bonds (the maximum).

A group of Southeast Asian governments, the Asian Development Bank (ADB), and major development financiers have launched the “ASEAN Catalytic Green Finance Facility”, a new initiative to spur more than USD1bn in green infrastructure investments in the ASEAN region.

ASEAN finance ministers met last week to discuss an increasing focus on giving local currencies a bigger role and further liberalising and digitalising finance in the region. The ministers will also work with ADB to promote the green bond market to support investors and businesses that want to raise funds for environmentally friendly projects. Takehiko Nakao, President of ADB, gave a presentation as part of the meeting.

Sustainability-linked loans are growing in Asia-Pacific, despite still representing a very small share of total syndicated loan volumes. One of the first examples of such loans – which include green loans – in the region was secured by an Australian unit of Singapore-based Frasers Property, for a value of AUD600m (USD428m).

The Brazil Green Finance Initiative (BGFI), aimed at channelling private green investment into a number of key sectors, held its first meeting of 2019. A main focus was on driving institutional capital into infrastructure and sustainable agriculture, the latter of which has traditionally been financed by the public sector.

As part of its Environmental Business Initiative, Bank of America has announced its third commitment to sustainable finance, pledging to mobilise an additional USD300bn in capital towards projects that address climate change by 2030. This builds on the bank’s previous commitment of USD125bn, announced in 2013, which is expected to be achieved by the end of 2019, six years ahead of schedule.

According to statistics by the Department for Business, Energy & Industrial Strategy (BEIS), 2018 was a record-breaking year for the UK in terms of low-carbon electricity generation. Renewable and nuclear energy combined generated 52.8% of electricity generated.

A new study by climate think-tank Sandbag suggests the EU is on track for 50% emission cuts by 2030. The figure takes into account national pledges to phase out coal power and concludes that there is a substantial opportunity for confidently adjusting the existing 2030 target, to go beyond the new business as usual of a 50% cut.

The ICMA has published impact reporting guidelines for green buildings. A series of suggested indicators, aimed at illustrating the environmental and sustainability benefits of projects relating to green buildings, is provided.

Green Bond Gossip

German corporate Otto Group, one of the world’s largest e-commerce retailers, has developed a Sustainable Finance Framework, under which it is considering issuing green/sustainable bonds and/or loan instruments to fund responsible sourcing of certified materials. Sustainalytics has provided a SPO.

Sun Life Financial has released a Sustainability Bond Framework, under which it is planning to issue sustainability bonds. Sun Life obtained an SPO from Sustainalytics.

Nagoya Railroad Co., Ltd, one of Japan’s main private railway companies, has developed a Green Finance Framework, which will apply to bonds and loans used to finance environmental improvements. JCR evaluated the Framework and assigned a Green 1(f) rating, the highest possible.

Peruvian power transmission company Consorcio Transmantaro S.A. is planning to issue a USD400m green bond, having obtained a GB2 rating from Moody’s. Most proceeds are expected to be allocated towards refinancing existing debt, whilst a smaller portion will finance projects currently under construction.

Meidensha Corporation (Meiden) has announced it will issue JPY7bn in green bonds in June through a public offering in the Japanese domestic bond market to finance its mass-production facilities for electric vehicle parts. The issue has received a Green 1 rating by JCR on its Preliminary Evaluation and a Pre-issuance Verification Report by DNV GL.

Readings & Reports

Blackrock, the world's largest asset manager, has released a new study which claims physical climate risks are not being priced into investments, being consistently under-priced in financial assets. The study, which focuses on the US, shows how physical climate risks vary greatly by region, with coastal and southern states hit the hardest.

Mercer has performed new short-term stress-test analyses which point towards a positive re-pricing of 3% if markets were to price in a 2ºC warming scenario. However, it also found a negative re-pricing of up to 3% under a 4ºC warming scenario (report available here). This is a follow-up to Mercer’s 2015 climate change report.

Norway's USD1tn oil fund, the world's largest sovereign wealth fund, will increase its investment into renewables (especially wind and solar power projects). The fund had already divested USD6.5bn worth of coal investments in 2015 and in March announced it would sell off its stakes in 134 companies that explore oil and gas. The decision follows other oil funds, such as Saudi Arabia’s, selling off their oil and gas assets.

A new report by Friends of the Earth, entitled “Make the Polluter Pay”, has estimated that the UK Oil & Gas industry causes GBP44bn worth of costs through environmental damage, negative social impacts and healthcare spending. Friends of the Earth is using the report to call on Ministers to implement a string of policies which would make corporates in the industry pay a premium for failing to decarbonise.

IIF (Institute of International Finance) has launched a new line of topical research dedicated to sustainable finance. Its first publication focuses on green bonds but also highlights the growth of other “sustainable debt” instruments.

Novethic has conducted a study on green funds within Europe’s unlisted fund universe. Among its findings, it highlights that green funds represent less than 10% of unlisted European funds, although this is still above the <1% proportion within listed funds (Novethic had produced another study in 2017 looking at listed funds). It also finds that funds focused on renewable energy take the lion’s share of green funds.

Moody’s has released a report looking at automotive manufacturing, entitled Automakers look to electrification to avoid billions in emission-related fines. As the title suggests, the key message is that manufacturers are increasingly pursuing electrification in order to avoid fines linked to regulation on emission standards, especially in the three main auto markets (Europe, China and US).

‘Till next time,

Climate Bonds

Disclosure: Some of the organisations mentioned in this communication are Climate Bonds Partners. A list of Partners is available here.