Highlights:

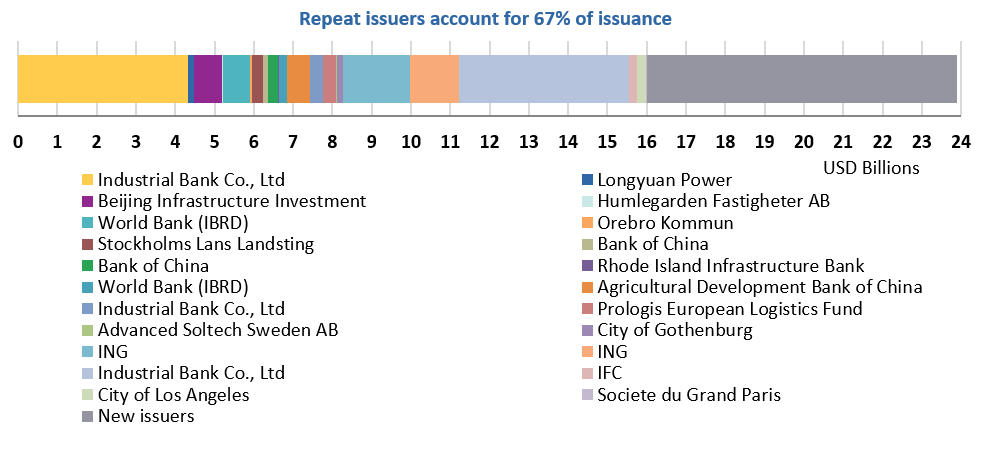

- USD23.9bn green bonds in November – new record for monthly issuance!

- Le Poste issues first green bond from a French postal company

- TransLink issues first green bond from Canadian public transport entity

- Industrial Bank Co., Ltd (China) accounts for 40% of November issuance

Don't miss:

- See the Green panda bond handbook released on 30 November in Shanghai

- Green City Bonds Pooled Green Bond Financing Webinar: Monday 17 December at 2PM GMT/ 3PM CET / 9AM EST

- Surge in Climate Bonds Certifications: see our special update

Go here to see the full list of new and repeat issuers in November.

November at a glance

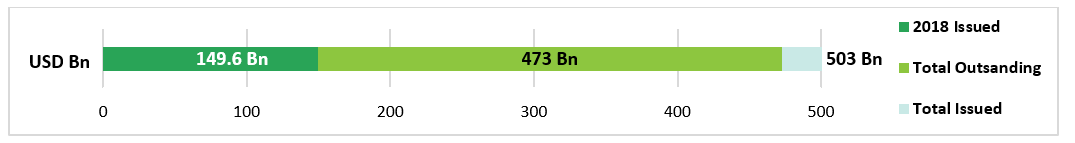

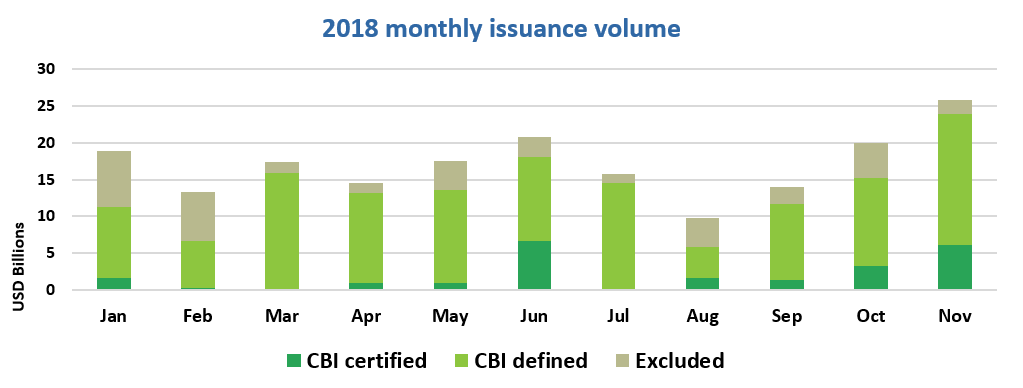

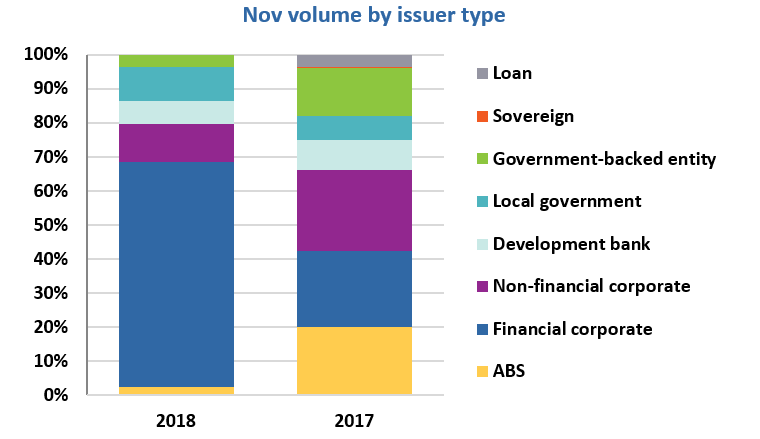

November green bond issuance reached USD23.9bn, setting a new monthly record! That’s 23% above the corresponding 2017 monthly figure – with Fannie Mae’s November deals yet to be included.

Cumulative green bond issuance (since market inception) surpassed the half a trillion mark and now stands at USD503bn.

China’s Industrial Bank CO., Ltd drove 40% of issuance, with a two-tranche Certified Climate Bond totalling USD943m and two senior unsecured green bonds of CNY30bn (USD4.3bn) each.

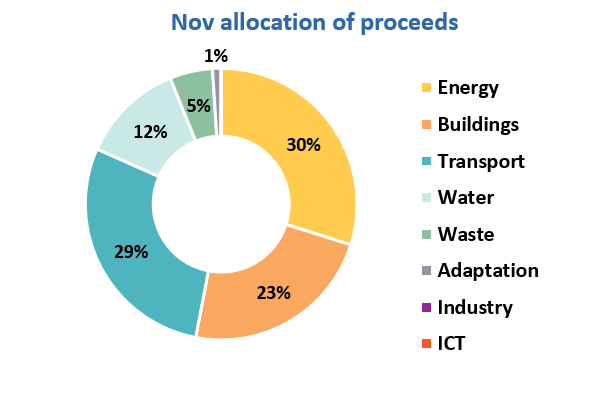

The deals contributed to spurring use of proceeds allocations to low carbon transport, which increased its share to 29% – second to renewable energy at 30%.

The TransLink green bond marks the ninth new Canadian issuer into the market in 2018. Will a tenth squeeze in by Dec 30th?

Sustainability bonds add up to USD19.3bn year to date (+135% over 2017). Sustainability bonds include both climate and social projects. If the social-only projects exceed 5% of proceeds, we do not include the bond in the CBI green bond database. Including these sustainability bonds would take 2018 figures year to date to USD168.9bn, or on par with total issuance in 2017 for green and sustainability bonds combined.

We will be taking a closer look at the rise in sustainability, SDG and social bond issuance in our January report.

> The full list of new and repeat issuers here.

> Click on the issuer name to access the new issue deal sheet in the online bond library.

New issuers

Bank of Guizhou (CNY3bn/USD437.5m), China, issued a 3-year debut green bond, which benefits from a CECEP third party report. Proceeds will be used for the construction of facilities and the operation of urban and rural infrastructure, energy saving efficiency, pollution prevention and control, water saving and unconventional water use, railway and public transportation, and for natural ecological protection.

According to the third party report, the proposed green projects have a total energy saving of about 27,061 tce/a, CO2 emission reduction of about 66,230 t/a, about 500,000 t/a of waste disposal, about 12.23 million t/a of treated sewage, and a chemical oxygen demand reduction of about 1,342 t/a. The amount of biochemical oxygen demand reduction is about 604t/a, and the amount of ammonia nitrogen reduction is about 184t/a.

Climate Bonds view: Bank of Guizhou has brought two green bonds to the market during the past two weeks, totalling CNY5bn. We strongly support clarity on the use of proceeds for each bond issued – particularly in the case of banks and local governments, who may have wide-ranging green bond frameworks. Ideally, transparency around funded projects should be a feature of both issuance disclosure and post-issuance reporting.

Daiwa Securities Group Inc. (JPY10bn/USD78m), Japan, issued a 5-year senior unsecured green bond, benefiting from a Sustainalytics Second Party Opinion. Proceeds are earmarked to finance and refinance loans and direct investments allocated to green buildings and renewable energy projects, including solar PV, wind, geothermal, hydropower with 20MW of capacity or below, and biomass exclusively utilising waste as a feedstock. Eligible green buildings are required to have obtained a DBJ Green Building Certification of 3 or above or a CASBEE certification of B+ or above.

Climate Bonds view: In order to meet climate related national and international goals, it is essential that all sectors find channels to finance their low carbon assets. Bonds that include loan creation are therefore welcome to the market as they can encourage further spending in the low carbon economy.

Fastpartner (SEK1bn/USD110m), Sweden, issued a 3.5-year senior unsecured green bond. CICERO provided the Second Party Opinion on the Green Bond Framework. Proceeds will be directed towards financing new and existing buildings that have obtained a minimum Miljöbyggnad Silver, LEED Gold, BREEAM SE Very Good or BREEAM Very Good and have an energy performance of at least 25% below the current Swedish building regulation.

Building renovations are required to meet at least 25% reduction in energy consumption for new buildings and to aim at an energy performance of less than 110kWh/sqm/year for existing properties. Onsite renewable energy systems, such as rooftop solar and geothermal installations are also eligible, as well as energy efficiency solutions for new and existing premises. Among these, heat pumps, LED and district heating are just some of the solutions put forward, but in the SPO, CICERO notes that “the share of fossil fuels in district heating networks in Sweden is low”.

Climate Bonds view: Sweden ranks seventh in the top countries for green bond issuance in 2018 to date, behind USA, China France, Germany, Netherlands and Belgium. The bond issued has a short tenor (3.5 years), which could play an important role in increasing the appetite of asset investors in a scenario of rising interest rates.

Guilin Bank (CNY2bn/USD289m), China, issued a 3-year green bond benefiting from a G3 green rating from China Bond Rating (not publicly available). All proceeds will be allocated to three solar farms with a combined installed capacity of 200MW, two inter-city railway lines and a sewage treatment project.

China Bond Rating Co. Ltd carried out an evaluation on the expected environmental impact of this bond, where the solar projects are expected to avoid 62,615 tons of TCE, 165,305 tons of CO2, 25.4 tons of SO2, etc. The two electrified railway lines, with 11km and 5.3km in length respectively, will also deliver a positive climate impact. The sewage treatment project is located in Guangxi Province, southwest China, which is expected to avoid 117 tons of COD, 14.3 tons of NH3, 1.7 tons of TP.

Climate Bonds view: The issuer provided a great level of clarity on the proceeds allocation and the climate impact to be achieved by each of the projects. Although we understand the complexity for bank issuers to have full disclosure on their green asset pool, it is encouraged that they should disclose project level proceeds allocation and impact as required by best practice.

Kilroy Realty LP (USD400m), a US real estate investment trust (REIT), issued a 10-year senior secured green bond. According to the Green Bond Framework incorporated in the prospectus supplement, the transaction will finance developments or refurbishments of properties which have received a building certification of LEED Gold or above. Investments leading to significant energy and water efficiency improvements are also eligible and include onsite renewable energy systems, LED lighting, smart meters, battery storage and charging stations and sustainable construction materials.

Climate Bonds view: Issuers are encouraged to seek external reviews of their green bond frameworks to align with best practice.

La Poste (EUR500m/USD566m), France, issued a 10-year senior unsecured green bond, becoming the first French postal and services group to debut in the market. The deal benefits from a Sustainalytics Second Party Opinion. Proceeds will be allocated to transport, buildings and renewable energy. Part of the proceeds will be dedicated to electric vehicles, since La Poste aims at having one of the largest fleets of electric vehicles for their postal services with a target of 10,000 units.

Climate Bonds view: The deal is a good example of how service companies can reduce their carbon footprint across their operations by implementing energy savings measures, increase their share of in-house renewable energy generation and reduce emissions from delivery-related activities.

Stockton Public Financing Authority (USD145m), USA, issued a 19-tranche US muni green bond (longest dated bond: 19 years). According to the prospectus, proceeds will be used to refinance previously completed projects for the distribution of water via the “North” and “South” Water System(s). While the importance of floods prevention is also taken into consideration, this bond aims only at refinancing water distribution infrastructure. The prospectus’ section on bondholder risks discusses various risks associated to climate change, including droughts, floods and wildfires and acknowledges that these effects could be material to the city’s revenue streams.

The deal is insured by Build America Mutual Assurance Company (BAM) and was designated as BAM GreenStar Bonds, a new label aimed at facilitating the identification of US Muni green bonds aligned with the ICMA’s Green Bond Principles.

Climate Bonds view: The BAM GreenStar Bonds is a welcomed labelling tool highlighting good transparency standards in the US muni market. We haven’t seen many US Muni issuers incorporating climate change considerations in their risk disclosure as yet.

Acknowledging the potential severity of the impacts from climate-related events is a positive first step towards the development of response plans and we encourage other issuers to follow the Stockton example.

SunStrong (USD400m), a joint venture between SunPower (CA, USA) and Hannon Armstrong (MD, USA), issued a solar ABS – the second largest solar ABS following Vivint Solar’s USD932m deal in June 2018. The deal obtained a Moody’s GB1 Green Bond Assessment rating. The Notes are secured band payable from the cash flow generated by more than 37,500 residential solar leases owned by SunPower.

Climate Bonds view: ABS are a very important tool to finance the transition to a low carbon economy by providing a secured source of financing. The price of producing electricity from solar panels has been consistently decreasing and it’s becoming increasingly economic for households to install rooftop solar. This is even more so in California, where most new units built after 1st January 2020 will be required to include solar systems as part of the standards adopted by the California Energy Commission.

Taiwan Power Company (TWD2.9bn/USD93.8m) issued a 5-year green bond. All proceeds will finance local renewable energy projects, including one offshore and two onshore wind farms, three solar farms, one small hydro and one project dedicated to developing small solar and wind facilities on a number of outlying islands. These projects are expected to generate an average of 74,464 GWh of electricity per year and help to avoid 412,530 tones CO2 emission combined.

Climate Bonds view: We strongly support clarity and regular reporting on the use of proceeds for each bond issued. The use of proceeds for this bond is bound by the April 2018 Taipei Exchange Green Bond Operational Directions which incorporate regular checks and evaluations. As the Liyu Tan hydro project is based on an existing reservoir and we couldn’t identify any relevant controversies regarding social and environmental issues, all projects are aligned with CBI taxonomy.

TransLink (CAD400m/USD303m), Canada, issued a 10-year senior unsecured green bond, becoming the first Canadian issuer from the public transport sector to come to market. The deal benefits from a Sustainalytics Second Party Opinion. The Green Bond Framework includes a range of eligibility criteria: renewable energy, transport, buildings, waste, water and adaptation.

New and existing properties are required to achieve a minimum LEED Gold certification. Renewable fuel technologies, such as renewable natural gas and diesel (HDRD), are eligible as long as the fuel sources come from waste or local sources. Eligible adaptation project types include vulnerability studies and asset management programs, resilient property infrastructure redesign and upgrades and early warning systems.

Climate Bonds view: This is the 9th Canadian green bond issuer to enter the market in 2018, taking the country’s cumulative total to USD11.9bn. We look forward to the issuer’s annual reporting to identify the financed projects and their environmental impacts.

New issuers – deal issued prior to November 2018

PROTISA Peru (PEN100m/USD30m), a subsidiary of Chilean based Compañía Manufacturera de Papeles y Cartones (CMPC), issued a 6-year senior unsecured green bond in October 2018. The deal benefits from a Sustainalytics Second Party Opinion and according to Protisa’s Green Bond Framwork proceeds will be spent mostly on sustainable water management and energy efficiency. There will be investments to reduce pollution, water and energy consumption of the Cañete Paper machine. Some funding will be allocated to Cañete’s Clarified Water Recirculation and Waste Water Treatment plants, and some to a Secondary Water Treatment System at a different location.

Climate Bonds view: CMPC is one of the largest manufacturers of paper in the world. As paper manufacturing is an energy intensive activity, any contribution to greening the industrial process is welcome as its impact could be quite substantial. It is particularly valuable in this case that impact metrics will be reported annually and will be calculated relative to a baseline benchmark and targets.

Obayashi Corporation (JPY10bn/USD89m), Japan, issued a 5-year senior unsecured green bond in October 2018, benefiting from a DNV GL Second Party Opinion and a GA1 Green Bond Assessment from R&I. Proceeds will finance three solar PV projects, an onshore and an offshore wind power facility and a BELS 5 star certified commercial property. The offshore wind project will entail the construction of a Self Elevating Platform (SEP) to support the development of large-scale bottom mounted offshore wind facilities.

Climate Bonds view: Green bond issuance from Japanese issuers has picked up significantly in 2018, with annual figures to date representing almost 40% of the country’s total USD9.2bn issuance.

European Company for the Financing of Railroad Rolling Stock EUROFIMA (USD100m), a supranational organization based in Switzerland, issued a 10-year green private placement in November 2017. Sustainalytics provided the Second Party Opinion on the Green Bond Framework. Proceeds will be disbursed only for electric vehicles in the railway sector. Loans can be allocated only to entities that invest in projects up to two years old but can also be for projects not yet started.

Proceeds from this bond will be allocated exclusively to the purchase of new electric rolling stock, financing of existing electric rolling stock and modernization / refurbishment of existing rolling stock. Currently, disbursements have been mainly in Switzerland (19%).

Climate Bonds view: EUROFIMA has committed to reporting both estimated and actual environmental impacts of the financed assets, which is aligned to best practice. Transportation is increasingly prevalent in use of proceeds figures for European green bond market and a green bond program focused entirely on electric vehicles could consolidate this positive trend further.

Repeat issuers

- Agricultural Development Bank of China: EUR500m/USD566m

- Bank of China: JPY30bn/USD264m; CNY800m/USD115m (Certified Climate Bond)

- Beijing Infrastructure Investment: CNY5bn/USD720m

- Humlegarden Fastigheter AB: SEK350m/USD38m

- Industrial Bank Co., Ltd: CNY30bn/USD4.3bn

- Longyuan Power: CNY1bn/USD145m

- Orebro Kommun: SEK500m/USD55m

- New Jersey Infrastructure Bank (formerly New Jersey Environmental Infrastructure Trust): 21 tranches for a total of USD17m

- Rhode Island Infrastructure Bank: 15 tranches for a total of USD18m

- Societe du Grand Paris: EUR20m/USD23m (Certified Climate Bond)

- Stockholms Lans Landsting: SEK2.5bn/USD275m

- World Bank (IBRD): AUD300m/USD217m

- World Bank (IBRD): EUR600m/USD682m

November trends

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Though we support the Sustainable Development Goals (SDG) overall and see many links between green bond finance and specific SDGs, the proportion of proceeds allocated to social goals needs to be no more than 5% for inclusion in our database.

|

Issuer Name |

Amount issued |

Issue date |

Reason for exclusion/ pending |

|

Flemish Community |

EUR500m/USD569m |

21/11/2018 |

Sustainability/Social bond

|

|

Instituto de Crédito Oficial |

EUR500m/USD566m |

26/11/2018 |

Sustainability/Social bond

|

|

Guoxuan High-Tech Co |

CNY500m/USD72m |

15/11/2018 |

R&D |

|

Shandong Public Holdings |

CNY260m/USD38m |

15/11/2018 |

Not aligned |

|

Zhejiang Anji Rural Commercial Bank Co.,Ltd. |

CNY300m/USD43m |

19/11/2018 |

Not aligned |

|

Al Omrane |

MAD500m/USD52m |

23/11/2018 |

Sustainability/Social bond |

|

Mexico City |

MXN2bn/USD112m |

19/09/2017 |

Sustainability/Social bond |

|

Mexico City |

MXN1.1bn/USD54m |

21/11/2018 |

Pending |

|

Boston Properties |

USD1bn |

28/11/2018 |

Pending |

|

Bank of Chongqing |

CNY3bn/USD432m |

23/11/2018 |

Pending |

|

Beijing Infrastructure Investment |

CNY2bn/USD288m |

23/11/2018 |

Pending |

|

Beijing Infrastructure Investment |

CNY2bn/USD288m |

23/11/2018 |

Pending |

|

ERP Operating LP |

USD400m |

30/11/2018 |

Pending |

We have moved Mexico City Airport’s green bond to pending as we await further information on the bond’s fate after the incoming government announced it is cancelling the concession for the new airport. Mexico City Airport Trust announced a tender offer for USD1.8bn of the USD6bn international green bonds on 3 December. It is also soliciting consent from bondholders on restructuring terms as outlined in the announcement. If no definitive information emerges on the use of proceeds going forward, we are likely to move the bonds to excluded.

Moody’s lowered Mexico City Airport Trust’s senior secured green notes Green Bond Assessment from GB1 to GB5. According to the rating agency:

“The lowering primarily reflects the cancellation of Texcoco Airport project, which we expect will occur in the coming months. At this time, legal cancellation of the project has not yet occurred, and the issuer confirms that construction on the new project continues. However, Moody's incorporates a view that the new Mexican government's intention to cancel the project, coupled with the publication of a press release on 3 December outlining the terms of a cash tender offer and consent solicitation plan, is sufficient to confirm a view that the project will not be completed as originally factored into the GBA.”

Green bonds in the market

- HSBC: EUR1.25bn – closing December 4

- Longyuan Power: CNY3bn – closing December 4

- Credit Agricole CIB: EUR1bn - closing December 5

- City of Bloomington: 15 tranches for a total of USD11m - closing December 5

- NWB Bank: USD500m - closing December 5

- SID Banka: EUR750m - closing December 5

- Bank of Guizhou: CNY4bn – closing December 5

- Bank Windhoek – closing December 5 (Namibia’s first green bond)

- AfDB (African Development Bank): two tranches for a total of USD600m - Closing December 6

- Dividend Finance: 4 tranches for a total of USD103m – closing December 7

- EUROFIMA: EUR500m – closing December 10

- California Pollution Control Financing Authority: closing December 19

- City of Columbia: USD37.9m - closing December 19 (Certified Climate Bond)

Investing News

Unicredit launched a green bond on XTER. The SI UCITS ETF - UC MSCI European Green Bond EUR UCITS ETF includes EUR-denominated investment grade green bonds issued in Europe.

The Nigeria SEC launched guidelines for green bonds issuance. Read our joint SEC /Climate Bonds Public Statement.

A ban on planning permissions for new coal mines is due to come into effect as part of the Welsh’s Government’s new planning policy.

French insurer Natixis Assurances is set to take the share of green investments to 10% of its Assets under Management by 2030.

The EU TEG (of which Sean Kidney is a member) has formally opened feedback and workshop participation on the proposed Taxonomy, climate mitigation and adaptation. Outreach timetable is also available.

Green Bond Gossip

Egypt expects to issue green bonds in the 2018-2019 financial year ending in June.

US cities of Atlanta and Baltimore are preparing to issue Environmental Impact Bonds in 2019 to finance green infrastructure. Investors will receive higher returns if project performance exceeds expectations.

GLP J-REIT announced that it had submitted a revised shelf registration statement for the issuance of unsecured green bonds.

Sumitomo Mitsui Financial Group, Inc. and it’s subsidiary Sumitomo Mitsui Banking Corporation developed a new Green Bond Framework that allows both entities to issue green bonds. Sustainalytics provided the Second Party Opinion.

NIB has published an updated version of its Environmental Bond Framework, which has obtained a CICERO Second Party Opinion and rated “Dark Green.”

Reading and Reports

Newly launched report from Imperial College London reveals that Denmark and the UK hold a leadership position in phasing out fossil fuels, increasing renewable energy generation, promoting EV uptake and incentivising energy efficiency in buildings.

Climate Bonds has published a Green Panda Bond Handbook to support and facilitate international issuers entrance into the Chinese green bonds market.

Moving Pictures

Learn how Bangkok is implementing infrastructure to mitigate flooding risks.

Watch how Iceland is finding innovative solutions to build more efficient greenhouses.

BAM Greenstar Assessment 00:30secs on YouTube.

‘Till next time,

Climate Bonds