Oct-Nov 2018 is the biggest yet! ING Certification sets record: SGP goes Programmatic for Paris' grand expansion and Westpac - World’s First Green Deposit plus more!

Three big Certifications – Three big backstories

A surge in overall Climate Bonds Certifications in the last two months; behind the billions there are some backstories worth a closer look for Blog readers.

We profile ING Groep N.V., Société du Grand Paris & Westpac.

Biggest Certified Bond Yet

It’s the largest ever Certified bond issued to date! Dutch based financial giant ING Groep N.V. came to Market in early November with a (EUR1.5bn and USD1.25bn) USD3bn equivalent offering.

Certified under the Low Carbon Buildings, Solar, Wind and the newer Marine Renewables Criteria of the Climate Bonds Standard.

ING’s leadership is beginning to steer their EUR600bn lending portfolio towards the Paris Agreement 2-degree target. ING are one of five large EU banks who launched the Katowice Commitment at COP 24: an effort to align their lending activities to Paris goals.

SGP Adopts Programmatic Certification for Paris Metro

The October EUR1.75bn (USD2.01bn) Certified green bond from the French state-owned Société du Grand Paris (SGP) is the first in a ten year EUR35bn expansion of the Paris rail network, with 200kms of new lines and 68 new stations; one of the largest infrastructure projects in Europe.

SGP have adopted the streamlined Programmatic Certification (PC) path for future green issuances that will help fund stages of this long-term upgrade of the city’s rail system.

Already adopted by 10 other issuers, PC simplifies the certification process for large or repeat green bond issuers whilst maintaining the science based rigour and investor assurance of our Standard.

Westpac’s World First

Westpac Australia is the third noteworthy Certification; announcing the launch of the world’s first Green Tailored Deposit product. It’s medium term (1-5 years) with a minimum transaction amount of AUD1m with underlying investments meeting the Climate Bonds Standard and has garnered interest from some high-profile municipalities looking for green investment opportunities.

Already a Programmatic adopter and repeat green issuer, Westpac are again leading the global banking crowd. Expect more retail products with solid green credentials to become the norm in the next few years.

Watch the Australian space for more market innovations and progress on green infrastructure.

Other Certified Bonds of Note

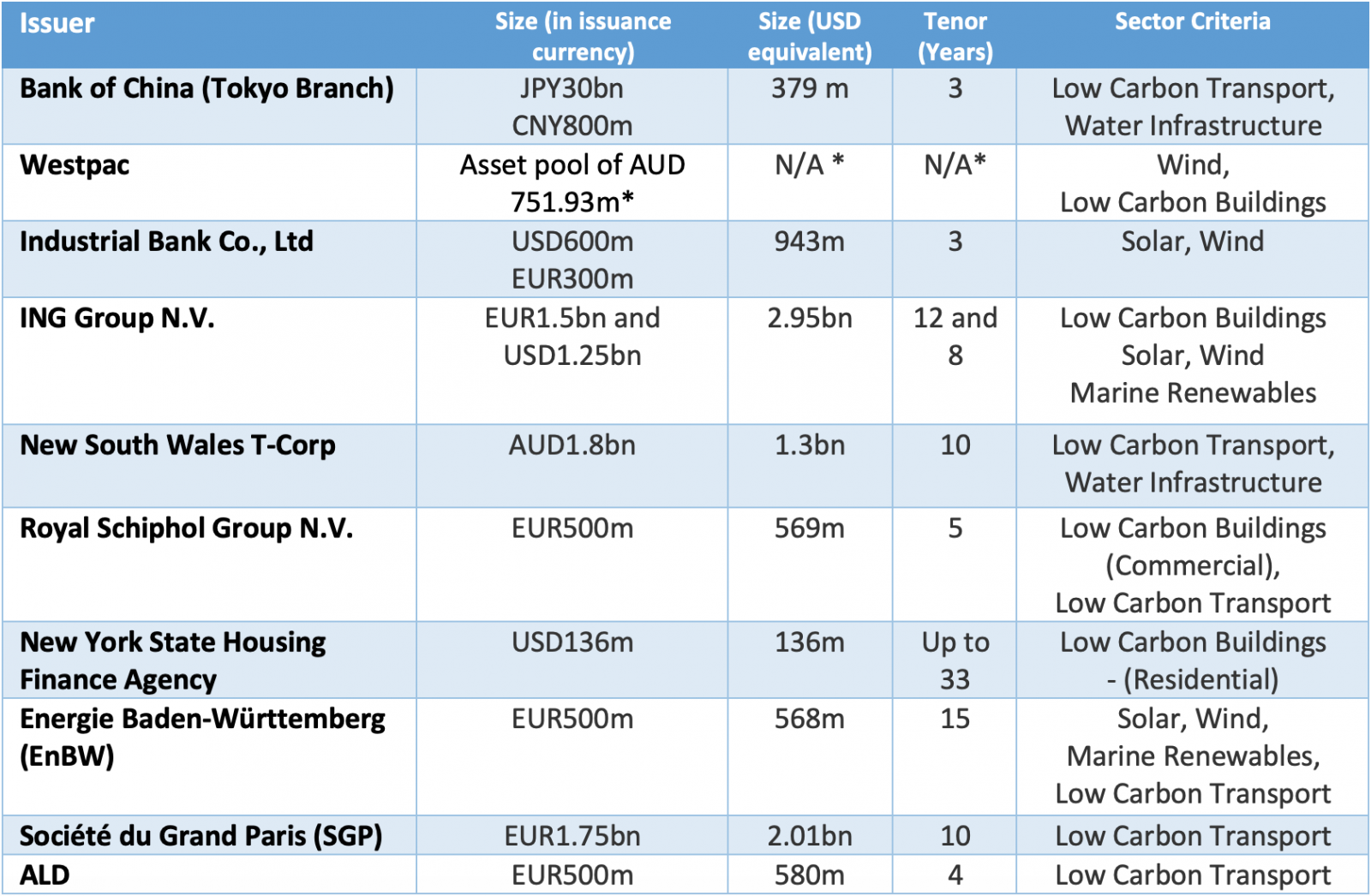

Here are some of the other Certifications in October-November. Repeat Programmatic issuer New York HFA makes an appearance and NSW Treasury Corporation debuted with an Australian record issuance as the third Australian sub-sovereign behind Victoria and Queensland to go certified green into the market.

Also notable is the ongoing march of giant Chinese banks along Certification path. Industrial Bank Co., Ltd (IB) and the Tokyo branch of the Bank of China (BoC) join the Industrial and Commercial Bank of China (ICBC), China Construction Bank (CCB) and China Development Bank (CDB) in the full list of certified issuers. ICBC is the biggest bank in the world and the others aren't far behind in the league tables.

Major Certifications Oct-Nov 2018

* Westpac Green Deposit details can be found here and Westpac Certification details are available here.

The Last Word

In anticipation of growth, much of 2018’s focus has been taken up by calls, some informed (and some others not so informed) for improved market standards, generating healthy discussion and debate about the future directions of green investment.

While that has taken place some issuers are simply following best practice in green and getting on with making a market. But looking at where global issuance will land globally at the end of the year, clearly not enough.

Too many banks and corporates are yet to act.

Meanwhile… with the recent SR15 Report highlighting some grim scenarios and other reports pointing to global emissions on the rise; 2018 marks an all-time high in global carbon emissions.

A little less emphasis on talking green and sustainability and a lot more emphasis on issuing green in 2019 is the response wanted from global finance and business.

‘Till next time,

Climate Bonds