Highlights:

- USD13.3bn green bonds in November to date

- ING issues USD2.95bn Certified Climate Bond – largest Certified deal to date and largest from a European bank

- Royal Schiphol Group NV comes to market with fist Certified Climate Bond for airport terminal buildings upgrades

- Fannie Mae publishes Green MBS and Credit Facility deals for October: USD1.3bn

- NSW TCorp issues largest ever Australian GB (& its Certified)

Don’t miss:

- Climate Bonds’ newly launched Forestry Criteria is now available for Certification – details & supporting documents available here.

- Climate Bonds has convened a high-level Adaptation and Resilience Expert Group (AREG) to determine overarching principles for defining climate resilient assets and bonds.

Go here to see the full list of new and repeat issuers in November.

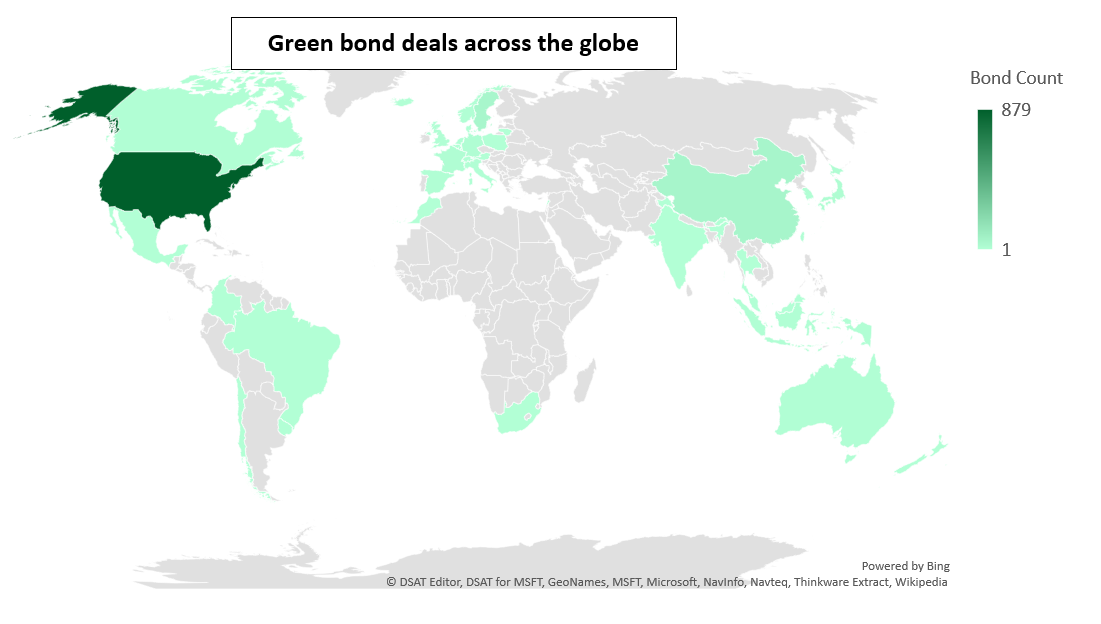

At a glance

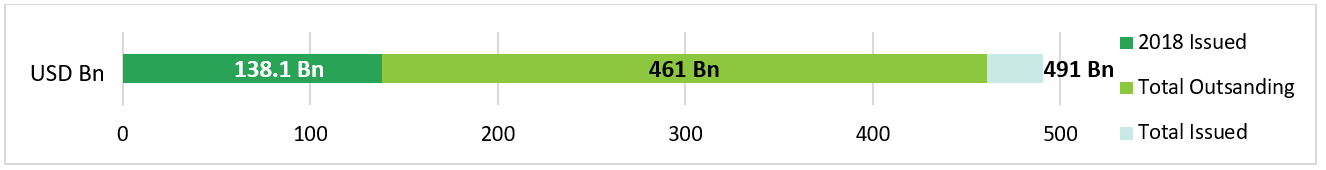

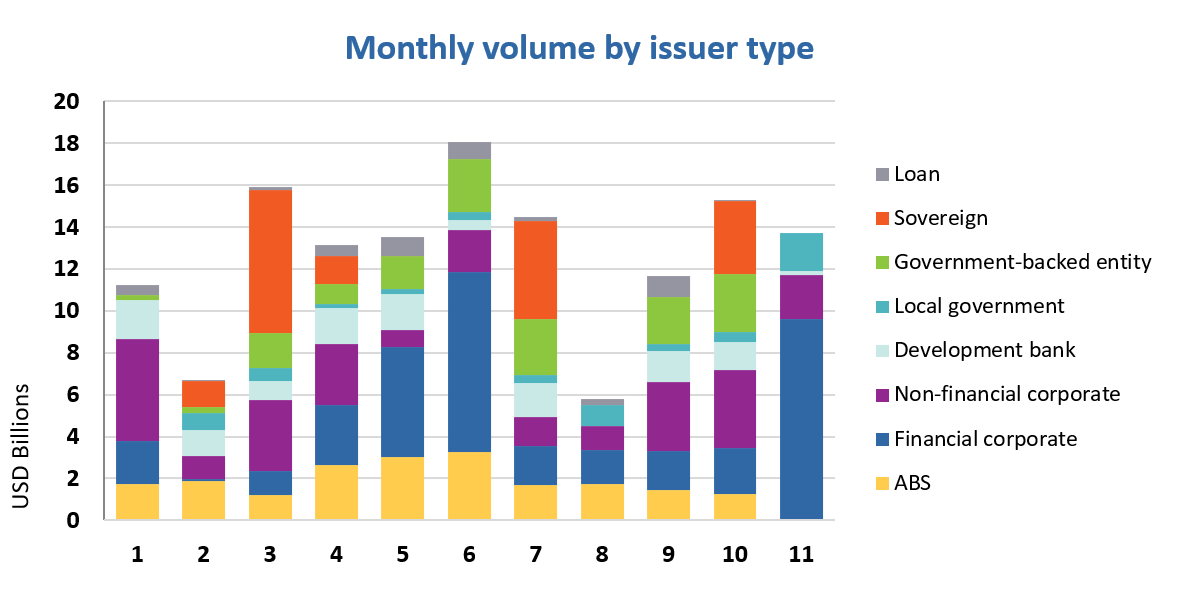

As of November 20th, monthly green bond issuance totalled USD13.3bn. Almost 70% of issuance came from financial corporates, with China Industrial Bank’s CNY30bn (USD4.3bn) green bond accounting for a third of total volumes.

Certified issuance has been plentiful so far in the month, reaching USD5.8bn! ING, a repeat issuer in the green bond market, broke the record for largest Certified Climate Bond with its USD2.95bn deal. The other three issuers are New South Wales Treasury Corporation (USD1.3bn), Industrial Bank Co. - Hong Kong Branch (USD943m) and Royal Schiphol Group (USD569m).

China dominated country issuance at 40%, followed by the Netherlands (26%) and the US (13%). Other than from Certified bonds, benchmark size deals came from MünchenerHyp (Germany) and Duke Energy Carolinas LLC (USA).

October update

Fannie Mae’s October Green MBS drove October green bond figures to USD15.2bn, just 6% below 2017’s monthly volume. Cumulative issuance from January to October stands at USD125.6bn, or slightly (0.2%) higher than 2017 volumes over the same period. There is still time for a sprint during the final months of the year to take annual green bond issuance to a new record.

> The full list of new and repeat issuers here.

> Click on the issuer name to access the new issue deal sheet in the online bond library.

Certified Climate Bonds

Industrial Bank Co., Ltd. - Hong Kong Branch (USD600m; EUR300m/USD343m), China, issued a two-tranche senior secured Certified Climate Bond. The deal is Certified under the Wind, Solar and Low Carbon Transport Criteria of the Climate Bonds Standard. The proceeds will be used to refinance loans funding one solar PV and four wind power generation projects, as well as four urban rail and metro network projects in four different cities. The combined generation capacity of the renewable energy projects is 323 MW.

Sustainalytics provided the Pre-Issuance Verification Report.

ING Bank N.V. (USD1.25 billion; EUR1.5bn/USD1.7bn), Netherlands, issued a two-tranche senior unsecured Certified Climate Bond – the largest Certified bond to date. The deal is Certified against the Marine Renewable Energy, Wind, Solar and Low Carbon Building (Commercial and Residential) Criteria of the Climate Bonds Standard. Proceeds will be earmarked to finance and refinance loans for onshore wind farms, offshore wind farms, solar energy farms, as well as commercial and residential buildings belonging to the top 10% of low carbon buildings in the Netherlands.

ING is a repeat issuer with two 2015 deals totalling USD1.3bn. In seeking Certification for its latest green bond, the bank demonstrates its commitment to complying with best-in-class requirements for its eligibility criteria and transparency practices. This green deal is also the largest from a European bank.

ISS-Oekom issued the Pre-Issuance Verification Report.

New South Wales Treasury Corporation (TCorp) (AUD1.8bn/USD1.3bn) issued a 5-year senior unsecured Certified Climate Bond - the largest green bond from an Australian issuer to date and the third Certified bond from an Australian municipality following Treasury Corp Victoria and Queensland Treasury Corp. The bond is Certified under the Low Carbon Transport and Water Infrastructure Criteria of the Climate Bonds Standard. Proceeds of the debut deal will be used to finance and refinance the construction of the Sydney Metro Northwest and Newcastle Light Rail projects, as well as water treatment systems projects including the Quakers Hill and St Marys Water Recycling Plants Process and Reliability Renewal. Future deals may also allocate proceeds to other transport-related infrastructure.

EY provided the Pre-Issuance Verification Report.

Royal Schiphol Group NV (EUR500m/USD569m), Netherlands, issued a senior unsecured Certified Climate Bond, becoming the first airport to issue a Certified green bond. Mexico City Airport and the Greater Orlando Aviation Authority have also issued labelled green bonds to finance the construction/upgrades of airport buildings. The majority of the proceeds will be used for the refurbishment for existing airport buildings and the construction of several new buildings that comply with the Low Carbon Buildings Criteria. A smaller portion of the proceeds will be used for acquiring new electric vehicles for passenger transport and for the installation of the related charging infrastructure.

Vigeo Eiris provided the Pre-Issuance Verification Report.

New issuers

California Educational Facilities Authority (USD87m), USA, issued a 30-year US muni green bond to finance projects within the Loyola Marymount University. Proceeds are allocated to the construction of approximately 625 new undergraduate housing beds on the Westchester campus. The issuer intends to pursue a minimum certification level of LEED Silver for the project. Both project development and in-use stages have been commissioned with the objective to achieve low-energy and sustainable targets. In addition, instalment of bicycle facilities and access for green vehicles will facilitate local transportation around the campus.

Climate Bonds view: This is the second green US muni bond from the education & research sector in 2018.

Dominion Energy Inc (USD362m), USA, issued a debut green private placement. The deal will refinance the acquisition, development and construction of 20 solar projects located in Virginia, North Carolina, South Carolina and California. The projects became operational between 2016 and 2018 and have a combined capacity of 574MW.

Climate Bonds view: It’s great to see a diversified energy company entering the green bond market to refinance green assets within its portfolio. We hope to see Dominion Energy and its peers becoming repeat issuers in the market and taking advantage of the green label to finance their brown-to-green transition.

Duke Energy Carolinas LLC (USD1bn), USA, issued a two-tranche senior secured green bond (longest dated bond: 10 years) – the largest green bond from a US-based utility company. The deal is secured by a continuing lien on the issuer’s selected properties and franchises. According to the Green Bond Framework incorporated in the deal’s prospectus supplement, the First and Refunding Mortgage Bonds will finance solar energy projects, including PPA agreements and rebates for rooftop solar installations, as well as energy storage related to distributed and grid assets and pumped-storage at existing hydro facilities. Projects are located in North and South Carolina.

Climate Bonds view: This debut benchmark issuance from one of the largest US energy holding companies provides yet another example of how large utility companies can use the green bond market as a source of finance to expand their exposure to green assets.

Fuyo General Lease Co., Ltd. (JPY10bn/USD88m), Japan, issued a 5-year senior unsecured green bond which obtained a Green 1 Green Bond Evaluation from Japan Credit Rating Agency. Deal proceeds will finance the redemption of commercial paper and the construction of four solar power generating facilities. The targeted total annual average generation is 98,428 MWh, which is estimated to represent an annual CO2 reduction of 51,650 tCO2.

Climate Bonds view: Disclosing expected generation and CO2 reduction figures at a pre-issuance stage is encouraged to provide more clarity on the financed assets. The replacement of commercial paper – which is a debt instrument with a maturity of up to a year – is also favourable as the 5-year bond provides more certainty of funding for the life of the project: developing the solar assets and bringing them online.

Japan Real Estate Investment Corporation (JPY10bn/USD 89m) issued a 5-year unsecured green bond, benefiting from a Sustainalytics Second Party Opinion. Proceeds will be used to finance and refinance buildings that have or will obtain the top three levels of green building certification schemes including DBJ Green Building Certification, BELS and CASBEE. Refurbishments of buildings are also eligible if they meet the framework requirements, such as achieving a one level improvement of the green building certification, or a minimum 10% reduction in CO2 emissions, energy consumption or water consumption.

Climate Bonds view: We hope that this deal, together with issuance from Mitsubishi Real Estate and a few REITs, will encourage more real estate players to come to market. We would, however, prefer to see issuers implement stricter eligibility criteria for green buildings, namely targeting the highest levels of green building certifications and a minimum of 20%, but preferably over 25%, in energy efficiency improvements for refurbishments and upgrades.

MünchenerHyp (EUR500m/USD568m), Germany, issued a 5-year mortgage covered bond. Proceeds are allocated to (re)-finance residential and commercial property mortgages. Residential mortgages are eligible for residential buildings with a maximum annual energy performance of 70kWh/m2 or that have obtained an energy performance certificate of “B” or above (on a scale of H to A+). For commercial properties, mortgages are eligible for projects that have obtained one of the following energy certificates: DGNB (min. Gold or Platinum), BREEAM (min. Very good or Platinum), LEED (min. Gold or Platinum), HQE (min. Excellent or Exceptional), or 15% of national building stock by energy performance.

Climate Bonds view: This is the fifth covered bond to be issued by a German green bond issuer this year, taking the country’s 2018 cumulative total to USD7.5bn.

Schertz-Seguin Local Government Corporation (USD19m), USA, issued a 22-tranche green US Muni (longest dated bond: 22 years), becoming the first issuer from Texas to come to market with a green bond in 2018. The deal will finance projects related to the development and operation of the water supply system of the cities of Seguin and Schertz, including the construction of a cross-country pipeline, treatment facilities, pumping stations, water storage and gathering lines from the well-field.

Climate Bonds view: Water is the largest sector financed by US Muni green bonds, with over half of proceeds from US municipal deals being allocated to water-related projects in 2018, or USD1.7bn. What is notable about this deal is that it involves inter-governmental cooperation. The cities of Schertz and Seguin recognized the interconnectedness of the issues at stake related to their water system and identified a common solution. We hope to see more US municipal agencies using green bonds as a means to cooperate with other agencies in obtaining financing for green infrastructure projects.

Småkraft AS (EUR50m/USD5.9m), Norway, issued a 5-year senior secured green bond, which benefits from a CICERO Second Party Opinion (not publicly available). The deal is secured by 11 hydropower plants across Norway, with annual production of around 160 GWh. Proceeds will finance small scale hydro power plants across Norway. According to the issuer, the ceiling of 100g of CO2/kWh for inclusion in the green bond database has to be seen as very high in the context of Norwegian hydropower. Due to the sparse vegetation in the areas where Norwegian hydropower plants are located, typically in mountainous regions at higher altitudes, there is little biomaterial that could be the source of emissions.

Climate Bonds view: Issuers are encouraged to make Green Bond Frameworks and external reviews publicly available to increase transparency.

New issuers – deal issued prior to November 2018

Solis S.r.l. (EUR5.4m/USD6.3m), Italy, issued an 18-year green project bond in June 2018, becoming the first Italian green bond issuer to allocate proceeds exclusively to finance a biomass project. The bond will refinance a biomass combined heat and power (CHP) project located in the Municipality of Settimo Torinese, Piedmont, Italy. The Project uses virgin wood biomass to generate 22 MWh of electricity and 85 MWh of thermal power per day.

Climate Bonds view: While the deal was not labelled as green in the prospectus, Elaris Holdings’ CEO referred to it as a green bond in the official press release. Issuers are encouraged to enhance the visibility of the green label by including it in the prospectus or any other public documents related to the deal to make it easier for investors to identify the bond.

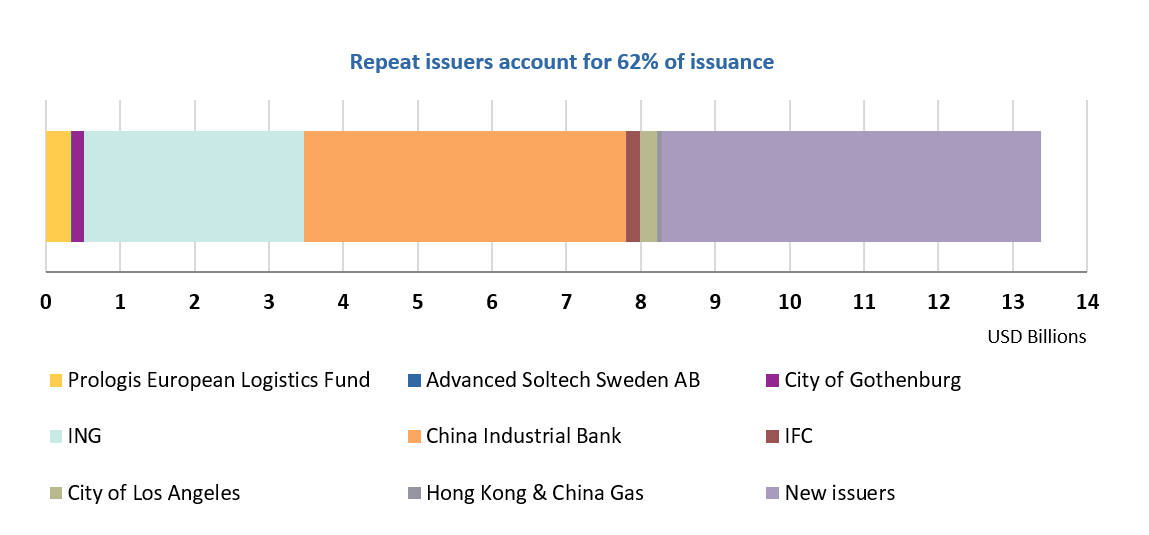

Repeat issuers

- Advanced Soltech Sweden AB: SEK70m/USD8m

- China Industrial Bank: CNY30bn/USD4.3bn

- City of Gothenburg: 2 tranches for a total of SEK1.5bn/USD166m

- City of Los Angeles: 22 tranches for a total of USD220.5m

- Hong Kong & China Gas: HKD600m/USD77m

- IFC: GBP150m/USD197m (tap)

- ING: EUR1.5bn/USD1.7bn; USD1.25bn (Certified Climate Bond)

- Prologis European Logistics Fund: EUR300m/USD339m

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Though we support the Sustainable Development Goals (SDG) overall and see many links between green bond finance and specific SDGs, the proportion of proceeds allocated to social goals needs to be no more than 5% for inclusion in our database.

|

Issuer Name |

Amount issued |

Issue date |

Reason for exclusion/ pending |

|

Qilu Bank |

CNY3bn/USD433m |

05/11/2018 |

Not aligned |

|

Bank of Jiujiang |

CNY3bn/USD433m |

06/11/2018 |

Not aligned |

|

BNG Bank |

EUR500m/USD568m |

08/11/2018 |

Sustainability/Social bond |

|

Pingmei Coal |

CNY970m/USD139.9m |

08/11/2023 |

Not aligned |

|

Xinhua Hydropower |

CNY1bn/USD143.7m |

09/11/2018 |

Working capital |

|

NWB Bank |

EUR600m/USD673 |

12/11/2018 |

Sustainability/Social bond |

|

University Properties of Finland |

EUR100m/USD113.9m |

02/11/2018 |

Pending |

|

Bank of Chongqing |

CNY3bn/USD431.2m |

09/11/2018 |

Pending |

|

Yancheng City Haixing Investment |

CNY100m/USD14.4m |

09/11/2018 |

Pending |

|

LG Display |

USD300m |

15/11/2018 |

Pending |

|

Orebro Kommun |

SEK500m/USD55m |

20/11/2018 |

Pending |

|

World Bank (IBRD) |

EUR600m/ USD682.2m |

20/11/2018 |

Pending |

|

World Bank (IBRD) |

USD600m |

20/11/2018 |

Pending |

Green bonds in the market

- Flemish Community: EUR500m – closing November 21

- Al Omrane: MAD500m - closing November 23

- TransLink: CAD400m – closing November 23

- Agricultural Development Bank: EUR500m – closing November 26

- Boston Properties: USD1bn - closing November 28

- Kilroy Realty LP: USD400m - closing November 29

- City of Bloomington – closing December 5

Investing News

Deutsche Börse has launched a new segment for green bonds on the Frankfurt Stock Exchange. It currently includes about 150 bonds that comply with the Green Bond Principles.

BlackRock launched its first green bond exchange traded fund, iShares Global Green Bond ETF. The ETF will track the Bloomberg MSCI Global Green Bond Index.

UBS Global Wealth Management has contributed to the development of Align17, a new platform that facilitates high network individuals and family offices to make investments that generate social and environmental benefits in alignment with the UN Sustainable Development Goals.

Green Bond Gossip

Pepper Group, a mortgage and consumer lender and loan servicer, published a Green Bond Framework. Sustainalytics provided the Second Party Opinion.

Stockholm-based private investment firm Baseload Capital obtained a Sustainalytics Second Party Opinion on its Green Bond Framework.

French postal services group Le Poste developed a Green Bond Framework, which benefits from a Sustainalytics Second Party Opinion.

DNV GL provided the Second Party Opinion for Snam SpA’s Green Bond Framework.

Japanese construction company Toda Corp developed a new green bond framework which obtained a Sustainalytics Second Party Opinion.

Renewable Japan Co., Ltd. obtained a GA1 Green Bond Assessment from R&I for its JPY8.9m green bond scheduled to come to market in January 2019.

Ence Energia obtained an E1/79 Green Evaluation from S&P Global Ratings for its proposed EUR69.4m green debt facility.

Invesco Office J-REIT published a Green Bond Framework, which benefits from a Sustainalytics Second Party Opinion.

New World China Land has hired bookrunners and obtained a "pre-issuance stage certificate" under the Hong Kong Quality Assurance Agency's green finance certification scheme for a 5-year bond under its USD2bn MTN programme.

Reading and Reports

The International Energy Agency (IEA) recently published its World Energy Outlook 2018 flagship report.

Moody’s launched a report focusing on green ABS: Structured finance - Global: Green finance sprouts across structured finance sectors

Climate Bonds Reports

The State of the Market 2018 Portuguese Edition: TÍTULOS DE DÍVIDA E MUDANÇAS CLIMÁTICAS ANÁLISE DO MERCADO 2018

Can green bonds finance Brazil’s agriculture? Available in English and Portuguese.

Moving Pictures

Watch how Boston is implementing a new long-term solution to combat flooding.

Learn how a Colombian archipelago is farming corals to repair damaged reefs.

‘Till next time,

Climate Bonds