Highlights:

- USD6.8bn green bonds in October so far

- First Irish sovereign green bond takes green sovereign cumulative issuance to USD29.1bn

- EDP issues first Portuguese green bond

- New issuers from China, France, Germany, Japan and US

- Fannie Mae publishes Green MBS and Credit Facility deals for September: USD1.4bn

Don’t miss:

California Treasurer John Chiang gives a succinct 40 secs from San Francisco on green finance and the green bond pledge.

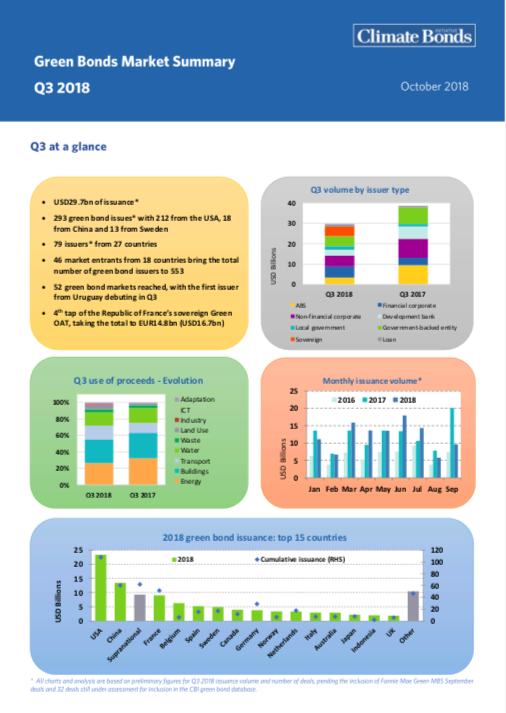

Green Bond Market Summary – Q3 2018

- Quarterly green bond market statistics and trends

- Spotlight on US, UK and Japanese climate aligned bond issuers

- League tables and rankings of green bond underwriters, trading venues and SPO providers

Go here to see the full list of new and repeat issuers in October.

At a glance

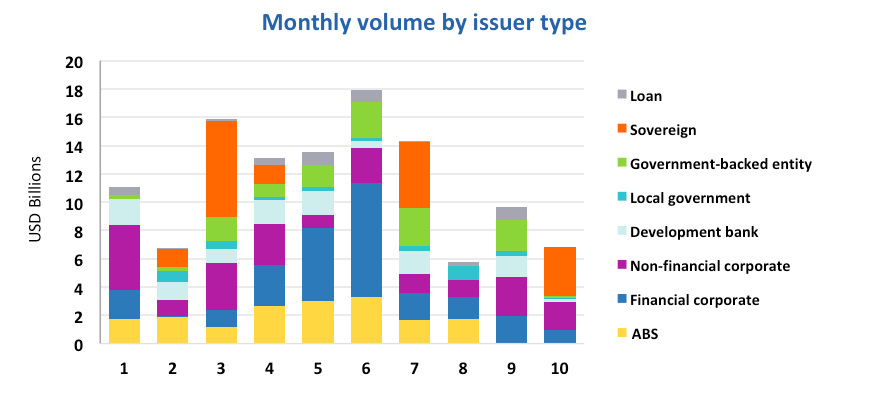

Fannie Mae’s September Green MBS and Credit Facility deals have taken our Q3 figures up to USD31.4bn, 18% down from Q3 2017. The US continues to dominate country issuance at 20% of quarterly volumes, followed by France (15%) and China (13%). Buildings take the lead in use of proceeds allocations accounting for almost a third of the share, with Energy coming second at 25%.

As of 19th October, monthly green bond issuance totalled USD6.8bn with over half of the volume coming from Ireland’s debut sovereign green bond.

84% of issuance originated in Europe, with benchmark deals coming from ALD SA (France, Certified Climate Bond), EDP (Portugal) and Getlink SE (France).

90% of volume is EUR-denominated, the remainder USD, CNY, JPY and GBP. Japanese financial corporate Mitsubishi UFG was the only issuer to not have denominated its deal in local currency, with its EUR500m green bond.

> The full list of new and repeat issuers here.

> Click on the issuer name to access the new issue deal sheet in the online bond library.

Certified Climate Bonds

ALD SA (EUR500m/USD580m), France, issued a 4-year senior unsecure Certified Climate Bond. The inaugural green bond is the second from a French issuer to be Certified under the Low Carbon Transport Criteria of the Climate Bonds Standard after SNCF.

Proceeds of the Certified Positive Impact bond will be used for financing and refinancing the acquisition of 14,000 low carbon emissions vehicles across 22 countries. Eligible assets include electric vehicles, fuel cell vehicles and hybrid electric and plug-in hybrid vehicles with GHG emissions of at most 85gCO2 per passenger kilometre travelled (gCO2 p/km).

Vigeo Eiris provided the Pre-Issuance Verification Report.

New issuers

DZ Bank (EUR250m/USD289m), Germany, issued a 5-year senior unsecured green bond. S&P Global Ratings awarded the deal a E1/85 Green Evaluation. Proceeds will be earmarked to finance onshore wind energy production located in Germany. Eligible assets primarily include green loans granted by DZ Bank to fund existing and new wind energy production. Market green bonds – or green bonds issued by other issuers that are aligned with the Green Bond Principles, have obtained an external review and allocate proceeds to wind projects – are also eligible.

The issuer released their first green bond investor report stating that as of July 2018 eligible green assets are exclusively made up of green loans and that 100% of the deal’s proceeds have been allocated. The report also includes an environmental impact analysis of the green asset pool covering year 2017. Metrics include installed capacity (MW), annual renewable generation (MWh) and annual global GHG emissions avoided (tCo2e).

Climate Bonds view: The issuer has demonstrated a high commitment to transparency by publishing its first allocation and impact report at issuance. We look forward to seeing future reports disclosing the environmental impact of green bond proceeds. As no “market green bonds” are part of the eligible green asset pool yet, there is no risk of double counting.

Multinational energy company Energias de Portugal Group (EDP) (EUR600m/USD695m) issued a 7-year senior unsecured green bond, becoming the first Portuguese green bond issuer. The deal obtained a Sustainalytics Second Party Opinion. Proceeds will finance the design, development, construction and maintenance of renewable energy projects including solar photovoltaic, solar concentrated power, onshore wind and offshore wind.

Climate Bonds view: With this debut benchmark deal, EDF has become the frontrunner in the Portuguese green bond market. We hope to see more Portuguese issuers in the near future.

Getlink SE (EUR550m/USD631m), France, issued a 5-year senior secured bond, which benefits from a DNV GL Second Party Opinion. Proceeds are to be earmarked for refinancing a bridge loan (also known as bridging loan) used to construct the Eurotunnel Fixed Link, financing the construction of the cross border electrical interconnector ElecLink project, as well as financing upgrade projects related to Fixed Link falling under clean transport, energy efficiency and pollution prevention and control categories.

The ElecLink project is expected to increase electricity transmission between France and the UK by 50% and to avoid 6.1 million tonnes of CO2. The interconnector will be built in the Channel Tunnel, taking advantage of the Fixed Link infrastructure. Fixed Link upgrade projects include the replacement of cooling systems creating energy savings of at least 33%, replacement of Halon gas with Novec gas - generating 7,000 times less CO2 - and a 76% reduction of cooling system gas.

Climate Bonds view: We view both the ElecLink and Fixed Link projects positively as they are expected to yield significant energy and emissions savings.

Ireland’s National Treasury Management Agency the NTMA (EUR3bn/USD3.5bn) came to market with a 12-year senior unsecured sovereign green bond – the first Irish green sovereign and second from an Irish issuer after Gaelectric Holdings’ green private placement in January 2016.

The deal benefits from a Sustainalytics Second Party Opinion. Proceeds will finance projects in renewable energy, green buildings, transport, water and wastewater, land use and adaptation, and the Green Bond Frameworksets out high-level examples of eligible green projects for each category. For green buildings, for instance, support schemes for residential, commercial, public and industrial energy efficiency programmes are listed as eligible.

Climate Bonds view: This is the fifth sovereign green bond to come to market in 2018 and ninth overall, taking global sovereign green bond issuance to a total of USD29.1bn. There’s a host of other European nations that should also issue.

The framework lacks a clear set of eligibility criteria for each category. We would like to see issuers disclosing more detailed eligible project types, as well as related thresholds/requirements. For green buildings, for instance, setting a threshold of at least 25% energy efficiency improvements is aligned with best practice. We will keep monitoring proceed allocations to ensure that the nominated projects are aligned with our Taxonomy.

Public Utility District No.1 of Oreille County, Washington (USD83m), USA, issued a 24-tranche green US Muni (longest dated bond: 30 years). The deal will finance capital improvements to the Box Canyon Hydroelectric project, such as turbine upgrades and an upstream fish passage facility. The project became operational in 1956.

Climate Bonds view: Before including this deal in our green bond database we investigated a potentially controversial aspect: the flooding of some reservation lands of the Indian tribe of Kalispel caused by the dam. Our search revealed that the dispute was settled in 1999 and the District is paying annual compensation to the Tribe. As there have been no disputes since then, we consider the issue resolved.

Sichuan Railway Investment (CNY1bn/USD144m), China, issued a 5-year green private placement. All funds raised will be used for the construction of the Inter-city Railway of Southern Sichuan. The project is 220.65km in length and will connect 4 cities in the Sichuan Province of China, with a designed maximum speed of 350km/h. The project is expected to be completed in 2021, however, the issuer may rearrange the allocation of proceeds to other eligible green sectors based on the progress of the railway project.

Climate Bonds view: The passenger highspeed railway project is aligned with our Taxonomy. As the use of proceeds might be reallocated in the future, we will track further disclosure on proceed allocation.

Tokyo Century Corp (JPY10bn/USD89m), Japan, issued a 5-year senior unsecured green bond, becoming the second Japanese leasing company to enter the green bond market. The deal was assigned a GA1 Green Bond Assessment by R&I. The deal will refinance the purchase of solar power generating facilities which have been leased by the issuer to Kyocera TCL Solar LLC, a solar power generating company and subsidiary of the issuer.

Climate Bonds view: Japan has seen a doubling of green bond deals in 2018 compared to 2017. Volumes for the year so far reached USD2.9bn, or over 33% of the country’s total green bond issuance.

More new issuers from September

Chinese automobile manufacturer BYD Auto (CNY366m/USD49m) issued a 6-tranche green ABS in September 2018, including 5 senior tranches and 1 subordinated tranche(longest dated tranche: 4.8 years). The prospectus is not public available yet. However, according to the news release from Shenzhen Stock Exchange and other sources, it is secured by lease receivables from “new energy vehicles” and the proceeds will be allocated to the same category.

Climate Bonds view: China’s green ABS market has witnessed an increase since last year. This deal will further diversify the current types of green ABS underlying assets. In the meantime, we will keep tracking the use of proceeds.

Casablanca Finance City (MAD355m/USD38m), Morocco, issued a 15-year green private placement in September 2018, becoming the first finance and business hub to enter the green bond market. According to the press release, proceeds will finance part of a real estate program which includes the development of one tower and two buildings. All three new constructions will aim to achieve LEED certification.

Climate Bonds view: The bond was previously classified as pending as more information was required to ensure that proceeds were intended to be allocated to green assets and not to cover the cost of administering the program. The issuer has confirmed that the deal will fund the construction of certified green buildings.

Chongqing Qianjiang Urban Investment (CNY400m/USD59m), China, issued a 5-year green bond private placement in September 2018. According to the limited disclosure available for the deal, all proceeds will be used for a stormwater collection and distribution project in the Central Qianjiang district of China’s southwest Chongqing city. The project will play a key role in contributing to positioning the Qianjiang district as an Ecological Civilisation City.

Climate Bonds view: With increased extreme rainfall events, we see more urban pluvial flooding and precipitation incidents. The proper design and management of stormwater drainage systems and infrastructure are encouraged to ensure that the infrastructure is climate-resilient.

Sumitomo Mitsui Trust Bank (EUR500m/USD588m), Japan, issued a 2-year senior unsecured green bond in September 2018. The deal benefits from a Sustainalytics Second Party Opinion. Proceeds will finance projects in renewable energy, green buildings, energy efficiency, clean transport and pollution prevention and control. The energy efficiency category includes refurbishments of properties that yield significant energy savings, as well as projects related to smart grids, energy storage and infrastructure.

Geothermal energy projects that have direct emissions of less than 100gCO2/kWh are eligible. Hydro projects are required to be small run-of-river facilities with a generation capacity of 25MW or less, or refurbishments to existing large hydro that do not increase the plant’s size.

Climate Bonds view: The deal was previously classified as pending due to insufficient information on biomass projects. The issuer has confirmed that only sustainable biomass sources will be used by the financed projects, which is aligned with the Climate Bonds Taxonomy.

For geothermal projects, the threshold of direct emissions of 100gCO2/kWh shows a good level of ambition and is aligned with the Climate Bonds Geothermal Criteria. For hydro projects, the power density ratio and annual GHG emissions have not been disclosed. Energy efficiency requirements for building upgrades and refurbishments should include a minimum percentage of performance improvements of at least 25% to be aligned with best practice. We will continue monitoring reporting to ensure that at least 95% of proceeds are allocated to projects aligned with the CBI Taxonomy.

Reallocation of proceeds

Innogy’s Green Bond Committee has decided to reallocate – in full – the proceeds of the its EUR800m inaugural Green Bond from onshore and offshore wind farms to investments to connect renewables (above 30kW) to the grid, grid investments related to the Energiewende (e.g. investments in the grid to cope with more and more fluctuating feed-in from renewables), and smart meter investments.

This reallocation is due to the planned transaction by E.ON and RWE that would see Innogy’s renewables business transferring to RWE, whilst innogy’s bonds will be assumed by the new E.ON group. The original framework provides the flexibility to reallocate proceeds, and Sustainalytics has issued an assurance letter to confirm the eligibility of the assets under the issuer’s green bond framework.

Climate Bonds view: The ability to reallocate proceeds has proven useful in this corporate acquisition case where different parts of the business are transferring to different companies. On the sale / merger or other corporate action that changes the ownership of a green bond issuer we seek to determine if the green bond would remain outstanding. If it does, the hope is that the new owner will honour obligations on the use of proceeds and reporting. In this case, the allocation to grid projects is aligned with our Taxonomy, so the bond remains in our database.

Repeat issuers

- Anglian Water: GBP65m/USD85m

- CGNPC International: EUR500m/USD580m

- City of St Paul: 19 tranches, for a total of USD8m

- Fannie Mae: USD1.4bn (September)

- Mitsubishi UFG: EUR500m/USD575m

- Paprec: 2 tranches for a total of EUR800m/USD984m (issued in March 2018, reclassified from pending to included after further investigation into the business lines of acquired companies)

- Region Skåne: two tranches for a total of SEK1bn/USD116m (issued in June, reclassified from pending to included as the issuer has confirmed the green credentials of the deal)

- World Bank (IBRD): SEK1bn/USD110.4m (issued in September 2018, reclassified from excluded to included after further consideration of the water-related use of proceeds)

- World Bank (IBRD): USD200m

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Though we support the Sustainable Development Goals (SDG) overall and see many links between green bond finance and specific SDGs, the proportion of proceeds allocated to social goals needs to be no more than 5% for inclusion in our database.

|

Issuer Name |

Amount issued |

Issue date |

Reason for exclusion/ pending |

|

Korea Railroad Corporation |

EUR110m/USD127m |

02/10/2018 |

Sustainability bond |

|

Deutsche Kreditbank AG |

EUR500m/USD577.4m |

02/10/2018 |

Social bond |

|

Credit Agricole CIB |

USD1m |

29/06/2018 |

Unlabelled |

|

Credit Agricole CIB |

EUR3m/USD3.2m |

11/07/2018 |

Unlabelled |

|

Citigroup |

ZAR140m/USD11m |

12/07/2018 |

Unlabelled |

|

IFC |

SEK100m/USD12m |

28/12/2017 |

Unlabelled |

|

Iren |

EUR500m/USD587m |

24/10/2017 |

Not aligned |

|

IBRD / World Bank |

USD7.2m |

12/10/2018 |

Sustainability bond |

|

Societe Generale (Taipei Branch) |

TWD1.6tn/USD51.7m |

18/10/2018 |

Pending |

|

Development Bank of Japan |

EUR700m/USD806.4m |

10/10/2018 |

Pending |

|

Region of Pays de la Loire |

EUR75m/USD86.9m |

12/10/2018 |

Pending |

|

AfDB |

MXN32m/USD1.7m |

18/10/2018 |

Pending |

|

IFC |

IDR2tn/USD131.5m |

09/10/2018 |

Pending |

Green bonds in the market

- Societe du Grand Paris: EUR1.75bn – closing October 22 (Certified Climate Bond)

- Encevo SA: EUR250m – closing October 23

- Commerzbank: EUR500m – closing October 23

- Kommuninvest: SEK3bn – closing October 23

- Ana Holdings: JPY1bn – closing October 24

- Berlin Hyp: EUR500m green Pfandbrief – closing October 24

- Indiana Finance Authority: USD292m – closing October 24

- New York State Housing Finance Agency: USD136m – closing October 25 (Certified Climate Bond)

- AfDB: INR97m – closing October 25

- KasikornBank: USD100m – closing October 30

- Credit Agricole: USD70m index-linked green notes in Italy – closing October 31

- California Educational Facilities Authority: USD39.6m – closing November 7

- City of Bloomington– closing December 5

Investing News

The Republic of Ireland is set to collaborate with Hong Kong in an effort to position the state as a green finance hub.

IIGCC urges pension funds to improve climate risk management.

S&P Global Ratings, law firm White & Case LLP, Skandinaviska Enskilda Banken (SEB), Och-Ziff Capital Management Group LLC and Michael Sheren, co-chair of the G-20 Sustainable Finance Study Group are co-authoring a white paper which explores how a securitisation structure can be used to finance green infrastructure projects.

Sumitomo Mitsui Banking Corp is about to start roadshowing Japan’s first covered bond with a Japanese RMBS cover pool. While not a green instrument, this development widens the availability of financing structures that could be used by Japanese issuers to fund green residential property and other green assets.

Two index-linked issues have come to our attention: Credit Agricole CIB has announced the issue of index-linked green notes for its Italian clients under its Climate Action Green Notes programme, and the note coupon is linked to the performance of the MSCI Europe Green Select 50 5% Decrement index. IBRD (the World Bank) has launched USD30bn of notes linked to the Solactive SDG World MV index for Swiss investors. The first Notes have been issued on October 12 for an amount of USD7.2m.

The European Commission has proposed to invest EUR695m in 49 projects aiming to develop a more sustainable transport infrastructure in Europe. Funding includes all transport modes, from airports and ports to rail and roads, here with a nod to electric cars.

Green Bond Gossip

Japanese construction company Obayashi Corporation obtained a GA1 Green Bond Assessment from R&I for its green bond scheduled for October.

German-based ProCredit Group obtained a Sustainalytics Second Party Opinion for its Green Bond Framework.

Malaysia’s biggest plantation company Sime Darby is planning to issue an ESG bond.

Protisa Peru, a subsidiary of CMPC, one of the world’s largest forest products companies, is planning to issue Peru’s second green bond. Sustainalytics provided the Green Bond Framework Second Party Opinion.

Reading and Reports

The Intergovernmental Panel on Climate Change (IPCC) published a special report Global Warming of 1.5 °C. The findings highlight that crossing this threshold can have severe impacts such as sea level rise, extreme weather events and damages to ecosystems.

The New Climate Economy’s latest report: Unlocking the inclusive story of the 21st century - Accelerating climate action in urgent times.

The Financial Conduct Authority (FCA) published a discussion paper on climate change and green finance.

The Prudential Regulatory Authority (PRA) published a consultation paper on a draft supervisory statement focusing on banks’ and insurers’ approaches to managing the financial risks from climate change.

Climate Bonds Reports

Green Bond Market Summary – Q3 2018

Moving Pictures

Mike Brown from big West Coast green muni issuer SFPUC in a 26 secs endorsement of the Green Bond Pledge.

Global green finance expert and Chair of the new HK Green Finance Association Dr Ma Jun talks to CNBC. 1:36secs.

Take 0:48 mins to learn the benefits of planting more trees in urban areas.

Watch how the city of Austin, Texas, is tackling food waste.

‘Till next time,

Climate Bonds