Highlights:

- USD3.3bn bonds issued from 20 issuers in August

- Certified Climate Bonds account for almost half of monthly issuance

- First green loan from a Singaporean issuer

- 2nd green bond from a Canadian city and 2nd from the shipping sector

Don't miss:

- The 400+ assets and projects that could push Australia and New Zealand to their Paris targets. Climate Bonds latest Green Infrastructure Investment Opportunities Report delves down under.

- California Treasurer signs up to the Green Bond Pledge as part of new green finance initiatives from world’s 5th biggest economy’.

Coming up:

- Climate Bonds is releasing updated versions of the Climate Bonds Taxonomy and the Green Bond Database Methodology later in September. The new taxonomy is part of a sereies of upgrades to the Standard & Certification scheme. The release of a the new Standards V3.0 is also set to follow in Quarter 4 as Climate Bonds expands it proceeses for green bond market stakeholders.

Go here to see the full list of new and repeat issuers in August.

August at a glance

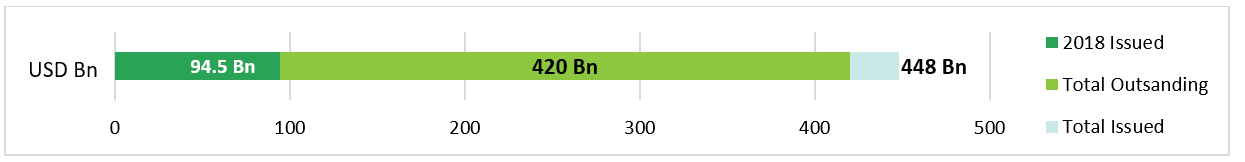

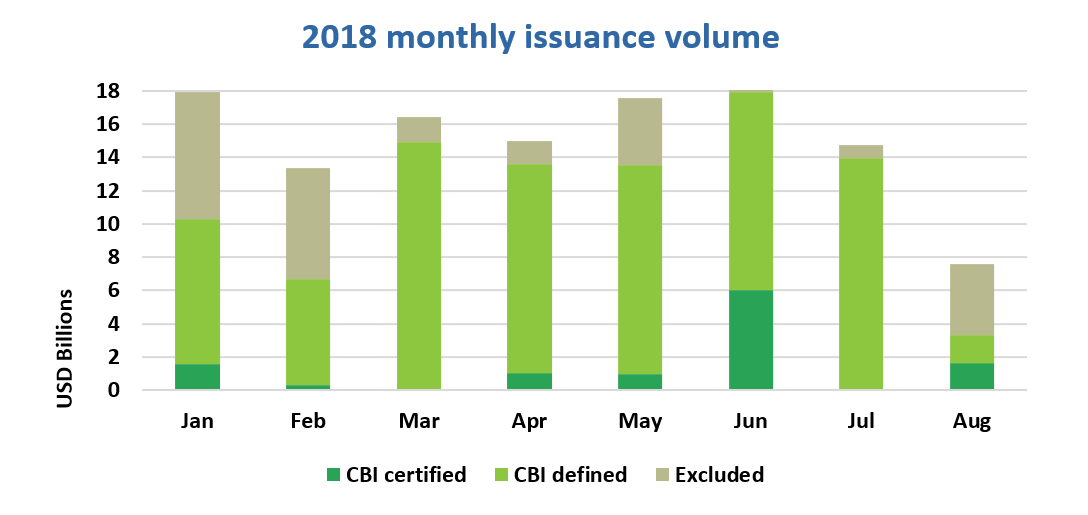

The pace of green bond issuance slowed down in August reaching just USD3.3bn – or 58% below 2017 monthly figures.

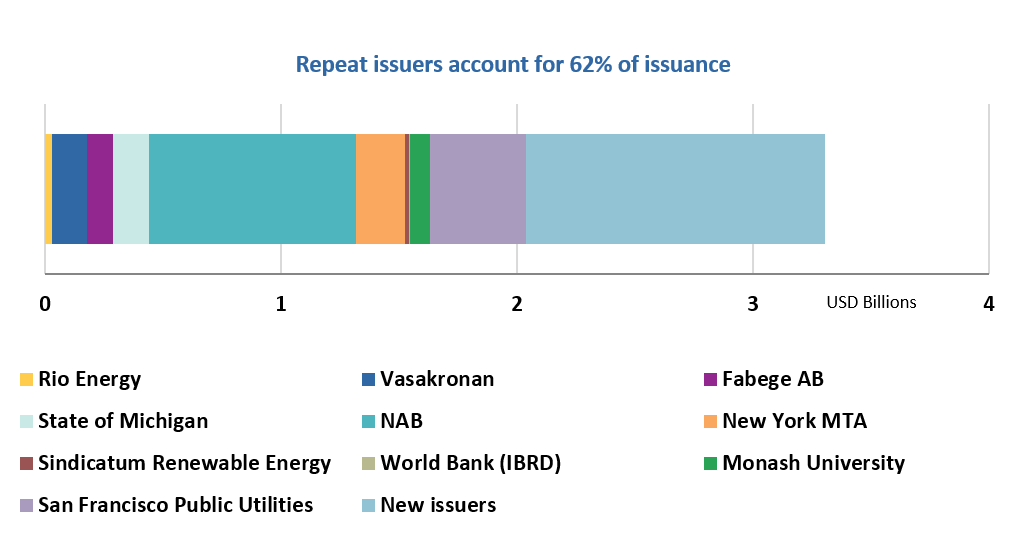

On a brighter note Certified Climate Bonds contributed to almost 50% of issuance volumes, with deals coming from Australian, US Muni and Brazilian repeat issuers: Monash University, NAB, New York MTA, San Francisco Public Utilities (SFPUC) and Rio Energy. Both MTA & SFPUC use the streamlined Programmatic Certification process for their repeat issuance. NAB’s EUR750m Certified SDG green bond was the largest deal of the month, accounting for 27% of the total.

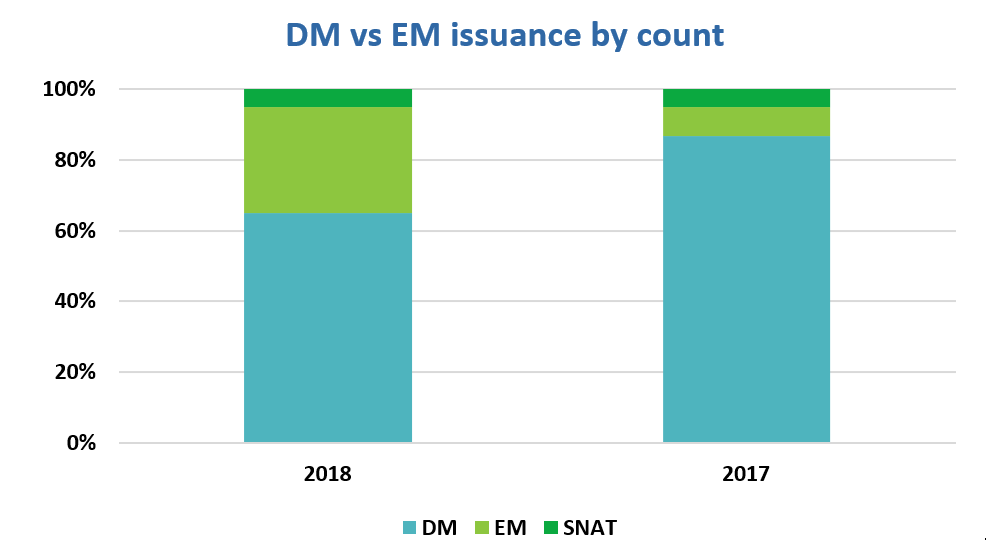

Developed markets drove issuance both by volume and by number of deals, accounting for 80% and 65% of August’s figures respectively. Emerging market issuance by number of deals surpassed 2017’s monthly share: 30% compared to 8%. China accounts for over a fifth of bonds in the month, all from financial and corporate new issuers. Brazilian Rio Energy’s second Certified Climate Bond makes up 5% of the share. The remaining 5% comes from South Korean debut issuer Lotte Property & Development.

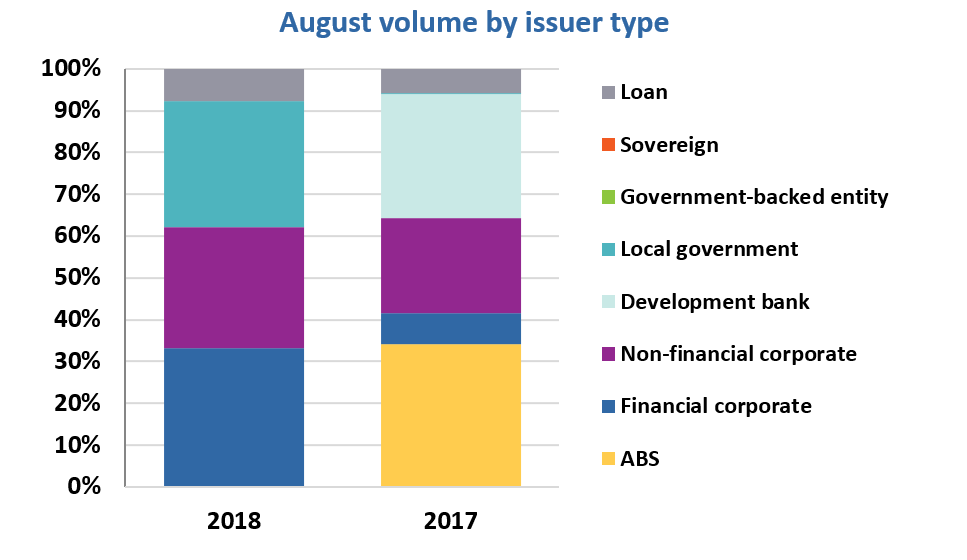

2018’s August figures saw a surge in financial corporate and local government issuance, which accounted for 33% and 30% respectively, compared to just 17% and 1% in 2017’s monthly issuance. ABS deals, which were the main driver of volumes in August 2017, have not appeared in this year’s monthly total. However, this is expected to change once Fannie Mae publishes its August deals.

> The full list of new and repeat issuers here.

> Click on the issuer name to access the new issuer deal sheet in the online bond library.

New issuers

Bank of Jiujiang (CNY1bn/USD145m), China, issued a 3-year green bond, which benefits from a Deloitte assurance report (not publicly available). The proceeds will be used for 7 proposed projects with wide coverage in energy, water and waste management, including solar projects to provide affordable electricity, recycling of disposed batteries, as well as the production of lithium-ion batteries for energy storage purposes. The proceeds will also cover wastewater treatment and increase resilience by improving the city’s drainage infrastructure. It is worth mentioning that the proposed cogeneration project intends to generate electricity and heat using biomass such as rice straw and bark.

Climate Bonds view: These projects would be expected to result in increased climate resilience at city level and reduced carbon emissions from using alternative generation sources. We are supportive of deals that cover an extensive range of environmental projects and are pleased to see the issuer has included detailed disclosure on both estimated proceeds allocation and environmental impact from each project. The proposed cogeneration project satisfies our requirement for using bioenergy as an alternative to fossil fuels.

City of Toronto (CAD300m/USD231m) issued a 30-year green debenture, becoming the second city in Canada to issue green bonds after City of Ottawa (November 2017). The debut deal will finance sustainable transport projects and related infrastructure, such as electric, hybrid and public transport systems.

The Green Bond Framework includes a wider range of eligible project categories:

- renewable energy,

- green buildings,

- water management,

- waste management,

- adaptation/resilience and

- eco-efficient and/or circular economy principles integration.

Buildings are required to meet at least a Toronto Green Standard Tier 2, LEED Gold certification or an equivalent standard/certification scheme level. Energy efficiency improvements to existing buildings are eligible, including for private buildings through the Home Energy Loan Program, Hi-rise Retrofit Improvement Support and similar initiatives where the City provides loans for energy efficiency retrofits.

Climate Bonds view: This is the third Canadian new issuer in 2018, taking the country’s pool of green bond issuers to 16. Setting a minimum energy efficiency threshold for existing buildings upgrades would further strengthen the eligibility criteria.

The formation of the Canadian Expert Panel on Sustainable Finance, similar to the EU HLEG and UK Green Finance Taskforce, is a positive indicator that policy change and hence additional growth could be on the way.

Chongqing Kangda Environmental Protection Industrial Co., Ltd CNY360m(USD52.7m) , China, issued a 15-year green ABS, secured on wastewater treatment receivables. CCX provided the green assessment certification and rated the deal as G-1 (not publicly available). More specifically, the deal securitises the next 15 years’ worth of receivables from 5 subsidiaries of Chongqing Kangda Environmental Protection Industrial Co., Ltd. The proceeds will be used to construct new and to upgrade existing wastewater treatment stations for its subsidiaries. The investment targets the reduction of local pollution, an improvement in the surrounding environment and a reduction in water usage.

Climate Bonds view: This is the first green ABS deal in Chongqing, which expands the market. We also favour deals which use green revenues and assets as security to finance investment in green assets: this deal couples refinancing with a commitment to additional green asset financing. We hope to see comprehensive post-issuance reporting and more information being disclosed. For instance, it would be helpful to understand how treated water is used and whether recycled water is used for irrigation and industrial purposes rather than treated, potable water.

Hebei Xingtai Rural Commercial Bank (CNY250m/USD36m), China, issued a 5-year green bond, which benefits from a Dongfang Jincheng Credit Management Co Second Party Opinion (not publicly available). The proceeds will be used in three main categories. Resource efficiency covers the construction of high-efficient facilities, reductions in the consumption of energy, water, raw materials and other resources for unit products or services, recycling and the utilization of biomass resources. The transport category includes construction and operation of railways, urban rail and other infrastructure. Measures such as infrastructure construction to mitigate the adverse effects of climate change on economic and social development come under adaptation and resilience.

Climate Bonds view: We welcome the issuance of this deal as it promises to allocate proceeds to categories that generate positive environmental impact. While we support this green bond, we would like to see detailed information being disclosed by the issuer regarding both proposed proceeds allocation and estimated environmental impact. We also hope to see that the issuer will establish a comprehensive post-issuance reporting system that tracks the allocation of proceeds and impact reporting.

Ho Bee Land (GBP200m/USD256m) issued a green bridging loan - the first green loan from a Singaporean issuer, and the first green bridging loan. Sustainalytics provided the Second Party Opinion. The bridging loan will finance part of the acquisition of Ropemaker Place, a commercial building located in London. The property has obtained a LEED Platinum pre-certification and a BREEAM excellent certification.

Climate Bonds view: This is the fourth Singaporean green bond issuer to enter the market, and the second in 2018 after Sindicatum Renewable Energy, taking the country’s cumulative issuance to USD887m.

Japan Excellent (JPY4bn/USD36m), Japan, issued a 10-year green bond, which benefits from a Sustainalytics Second Party Opinion. Proceeds are entirely allocated to buildings which obtain the top three levels of third-party certifications such as: 3, 4 or 5 stars under the DBJ Green Building Certification or B+, A or S rank under the CASBEE Certification.

Climate Bonds view: Green building certifications are an important indicator of a property’s green credentials. However, we encourage JEI to adopt more ambitious standards to provide substantial environmental impacts. Disclosure of key environmental parameters is essential to quantify environmental impacts, and perhaps create more stringent standards compatible with a 2-degree scenario. For this reason, we encourage companies to provide quantitative indicators to support disclosure of detailed impact reports.

Lotte Property & Development Co (USD200m) issued a 3-year senior unsecured green bond, becoming the first South Korean green bond issuer from the real estate sector. The deal benefits from a Sustainalytics Second Party Opinion. Proceeds of the deal will be allocated to commercial buildings and transport infrastructure. Commercial properties are eligible if they have been constructed/refurbished in 2017 or after and have obtained a LEED Gold or equivalent certification. The projects must also contribute to the improvement of professional conditions of low-income workers. Eligible projects under the transport category include pedestrian, public bicycle and public bus infrastructure.

Climate Bonds view: This is the fourth green bond from a South Korean issuer this year taking the country’s total for 2018 to USD1.8bn, which already represents a 73% increase on the country’s issuance in 2017.

Mitsui O.S.K. Lines (MOL) (JPY5bn/USD45m), Japan, issued a 5-year senior unsecured green bond. In a very new area for green finance, this is the second issuer from the shipping sector into the market after Nippon Yusen Kaisha (NYK) in May 2018. As with NYK’s green bond, proceeds of the MOL bond will finance and refinance LNG-fuelled ships, LNG-bunkering ships, ballast water management systems and SOx scrubber systems. Under its Green Bond Framework, MOL has committed to ensure the financed vessels will not be used to transport products that relate to controversial activities, including, but not limited to, coal, tar sands and oil shale.

Additionally, Upgraded Propeller Boss Cap Fins (PBCF) and the Wind Challenger Project are also eligible under MOL’s. According to the issuer, the upgraded PBCF is expected to yield 5% energy savings compared to vessels unequipped with the technology. The Wind Challenger Project is a research project led by the University of Tokyo focused on the development of wind propelled ships through the use of a rigid sail system. MOL aims at deploying the technology on cargo-carrying vessels to achieve up to 50% energy savings.

Climate Bonds view: We are pleased to see that the issuer has quantified the level of emissions reductions expected for each eligible project and committed to providing annual impact reporting based on operational data. Investing in the Wind Challenger Project is a positive step towards incorporating renewable technologies in vessels. So is the commitment to not transport fossil fuel products other than LNG on the LNG bunkering ships.

As we pointed out for NYK’s green bond, switching to LNG-fuelled vessels is not enough to comply with a 2-degree decarbonisation trajectory in the long-run. However, the projects financed by the deal are currently the lowest-emission asset option until other renewable fuels become commercially viable. It is nonetheless important to ensure the vessel design is flexible enough to avoid fossil fuel lock-ins in the future. Our special briefing provides more information on our decision to include bonds financing LNG-fuelled ships and LNG-bunkering ships in our database.

Qingdao Guoxin Development Group Co., Ltd. (CNY1.45bn/USD212m), China, issued a 5-year green private placement. Proceeds will be allocated to LEED Gold certified green buildings. In addition, these projects will adopt advanced energy-saving technologies and use environment-friendly building materials.

Climate Bonds view: We are pleased to see the projects have been awarded LEED Gold. Even with limited information disclosure for this private placement, we still acknowledge the potential environmental benefits that this deal could bring to the local community. We hope that the issuer will make proper use of the proceeds and we would like to see a higher level of information disclosure and relevant post-issuance reporting.

State of Michigan (USD149m) issued a 7-tranche US Muni green bond (longest dated bond: 5 years) labelled as “Environmental Program Bonds”. The deal will finance environmental and natural resource protection programs, including:

- land remediation and redevelopment of contaminated sites,

- protection and improvement of water quality,

- pollution prevention,

- lead contamination abatement,

- reclaiming and revitalising community waterfronts,

- state park infrastructure improvement, enhancement of local recreational opportunities and

- remediation of contaminated sediments in lakes, rivers and streams.

Climate Bonds view: The State of Michigan’s debut Environmental Program Bonds were issued in June 2016 and the issuer came to market once more in September 2017. However, we had not picked up the issuer prior to its 2018 deal due to the less typical bond label. Earlier this year we expanded the scope of labels we consider for green bonds.

TMB Bank (USD60m) issued a 7-year private placement in June 2018, becoming the first Thai issuer to enter the market. Proceeds will finance solar, waste to energy, biomass and bagasse projects. To be eligible, biomass projects exclusively use sustainable biomass feedstocks.

Climate Bonds view: The deal had previously been classified as pending due to insufficient information on proceed allocation. Information provided by the IFC, sole investor in the deal, confirmed that the eligibility categories are aligned with the Climate Bonds Taxonomy.

Wuxi Huaguang Boiler Co (CNY265m/USD39m), China, issued a three-year green ABS in July. The deal is secured on revenues from the heat and power supply services of its subsidiary Huilian Co., which operates a combined power plant in Wuxi city. The proceeds will be used for two waste to energy projects, including the Gongzhuling refuse incineration project and the Leping refuse incineration project. Specifically, the Gongzhuling project is estimated to deal with 800 tonnes of daily household waste from Gongzhuling city and surrounding areas.

In comparison, the Leping refuse incineration project is designed to have the same capacity. In addition to building boilers, the Leping project also plans to build 10 waste stations and other supporting facilities.

Climate Bonds view: We support such green bond issuance since it has multiple benefits of reducing household waste, generating clean energy as well as improving air quality due to reduced carbon emissions. However, we would like to see more disclosure about relevant information such as bond prospectus. We also hope the issuer will closely monitor this deal and publish timely post-issuance reporting.

Repeat issuers

- San Francisco Public Utilities: USD408.2m - Certified Climate Bond

- Fabege AB: SEK700m/USD76.8m; SEK300m/USD32.9m

- Monash University: AUD116m/USD86m

- NAB: EUR750m/USD878m

- New York MTA: USD207m - Certified Climate Bond

- Rio Energy (Copacabana Geração de Energia e Participações S.A): BRL12m/USD30.9m - Certified Climate Bond

- Sindicatum Renewable Energy: PHP1.1bn/USD20m

- State of Michigan: USD149m

- Vasakronan: SEK550m/USD60.4m; SEK100m/USD11m; SEK700m/USD76.8m

- World bank: INR80m/USD1m

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Though we support the Sustainable Development Goals (SDG) overall and see many links between green bond finance and specific SDGs, the proportion of proceeds allocated to social goals needs to be no more than 5% for inclusion in our database.

In this issue of our market blog we provide a more extensive list of social / SDG / sustainability bonds that have been excluded from our green bond list in 2018.

|

Issuer Name |

Amount issued |

Issue date |

Reason for exclusion/ pending |

|

Insikt |

USD25m |

31/07/2018 |

Social covered bond |

|

Industrial Bank of Korea |

USD500m |

02/08/2018 |

Social bond |

|

World Bank (IBRD) |

CAD1bn/USD770m |

03/08/2018 |

Sustainable Development Bond |

|

World Bank (IBRD) |

CAD60m/USD46m |

31/05/2018 |

Sustainable Development Bond |

|

World Bank (IBRD) |

CAD1bn/USD804m |

17/01/2018 |

Sustainable Development Bond |

|

IFC |

AUD300m/USD234m |

15/03/2018 |

Social bond |

|

Garanti Bank |

USD75m |

18/06/2018 |

Social bond |

|

NWB Bank |

EUR500m/USD606.5m |

27/04/2018 |

Affordable housing bond |

|

Council of Europe Development Bank |

EUR500m/USD620m |

27/03/2018 |

Social bond |

|

Indiabulls Housing Finance |

INR1bn/USD15.7m |

01/01/2018 |

Affordable housing bond |

|

Guangdong Guangye Group Co |

CNY1bn/USD144.2m |

15/08/2018 |

Working capital |

|

Shuye Environmental Technology Co |

CNY200m/USD29m |

14/08/2018 |

Working capital |

|

Japan International Cooperation Agency (JICA) |

JPY15bn/USD135.8m; JPY10bn/USD90.5m |

28/06/2018 |

Social bond |

|

Bank Australia |

AUD125m/USD91.1m |

30/08/2018 |

Sustainability bond |

|

Guangdong Guangye Assets Management Co.,Ltd. |

CNY1bn/USD146m |

15/08/2018 |

Not aligned |

|

GuangDong ShuYe Environmental Technology Co., Ltd |

CNY200m/USD29m |

13/08/2018 |

Not aligned |

|

Anji County Urban Construction Investment Group Co |

CNY500m/USD72.7m |

17/08/2018 |

Working capital |

|

Wuhan Metro |

CNY2.13bn/USD309.7m |

17/08/2018 |

Working capital |

|

China Three Gorges |

CNY2.5bn/USD366m; CNY1bn/USD146m |

03/08/2018 |

Pending |

|

Grand Forks County |

USD43m; USD18m |

28/08/2018 |

Pending |

|

Corporacion Andina de Fomento (CAF) |

USD30m |

21/08/2018 |

Pending |

|

Shinhan Bank

|

KRW200m/USD0.2m |

30/08/2018 |

Pending |

|

Fairfax County Economic Development Authority |

USD10.8m |

01/08/2018 |

Pending |

|

Bank OCBC NISP |

USD150m |

01/08/2018 |

Pending |

|

South Carolina Jobs-Economic Development Authority |

USD11m |

16/08/2018 |

Pending |

|

Bank of Dongguan |

CNY2bn/USD293m |

22/08/2018 |

Pending |

|

Urumqi City Construction Investment (group) Co.,Ltd. |

CNY1.5bn/USD220m |

23/08/2018 |

Pending |

Green bonds in the market

- Willhem AB: SEK800m, closing September 3

- Vasakronan: SEK750m, closing September 4

- SSE: EUR650m, closing September 4

- KBN: AUD450m, closing September 5

- City and County of Honolulu Series 2018F, 2018E, 2018D, 2018C, closing September 5

- Ricoh Leasing Company: JPY10bn, closing September 7

- Independent Administrative Institution Japan Student Services Organization: JPY30bn, closing September 7 (social bond)

- Macquarie University: AUD250m, closing September 7 (sustainability bond)

- Deutsche Hypo: EUR500m, closing September 10

- Mitsui O.S.K. Lines: JPY5bn, closing September 10

- Massachusetts Clean Water Trust: Series 21, closing September 12

- Encevo SA: EUR250m, closing October 2018

- UmweltBank: up to EUR40m green bond

- UGE International: green project bond

- Business Venture Partners (BVP): EUR7.5m

- State Bank of India: Certified Climate Bond

Investing News

The Hong Kong Green Finance Association announced it will host the Green Finance Forum and an inauguration ceremony to officially launch the Association on 21 September.

California becomes the first state to pledge to use green financing to combat climate change as Treasurer Chiang commits to Green Bond Pledge.

The UK government announced it will co-fund a new Green Finance Institute with the City of London Corporation to champion sustainable finance in the UK and abroad.

World Bank to fund the five-year ‘Punjab Green Development Programme’, aiming at supporting priority green investments in both the public and the private sectors.

The IFC and the State Bank of Pakistan have signed an advisory agreement to support green banking in Pakistan.

Malaysia’s BIB Investment Management launched the world’s first ESG sukuk fund.

The Philippine Securities Exchange Commission approved the green bond framework for local retail offerings under the Association of Southeast Asian Nations (ASEAN) initiative.

Dublin has been selected as the European hub of the Financial Centres for Sustainability (FC4S) network. The Climate Bonds Initiative is a partner of the FC4S network.

Green Bond Gossip

Sunrun is planning its second Solar ABS securitisation.

Sumitomo Mitsui Trust Bank has obtained a Sustainalytics second party opinion for its green bond framework.

NordLB plots first ‘really green’ covered bond under Luxembourg law.

Hitachi Zosen plans to issue JPY5bn in green bonds in September to finance the construction and management of waste-to-energy plants.

Urja Global to raise USD500 million via green bonds for financing renewable energy projects and e-rickshaws.

Texas officials are considering partnering with private sector to design a new type of bond to finance USD15bn worth of storm-resilient infrastructure.

The State Agency for Energy Efficiency and Energy Saving of Ukraine is looking to develop Ukraine’s green bond market to finance energy efficiency projects.

Reading and Reports

The latest IFR Green Financing Roundtable report discusses recent developments in green finance and outlines the next steps that need to be taken as issuance becomes more widespread.

CoLTI, a Russian national infrastructure investor association, has recently published their quarterly review: Sustainable Developments and Green Investments (for Russian speakers).

The latest podcast from Bulletin with UBS puts green bonds in the spotlight.

Rienergia has published a series of articles (in Italian) exploring the future of coal in Europe, with a focus on Poland, Germany, France and the UK:

- La Polonia, l’Europa e il dilemma del carbone

- Quale futuro per il carbone in Germania?

- Francia: l’era del carbone sta finendo

- UK: dal carbone all’energia pulita senza passare dal gas

Climate Bonds Reports

The Green Infrastructure Investment Opportunities Australia & New Zealand report identifies projects and assets that could be considered green.

The Australia & New Zealand green finance country briefing analyses the countries’ green bond issuance to date and identifies potential growth areas.

Moving Pictures

California, first state to sign the Green Bond Pledge to fight climate change: KKFX TV report 1:53secs.

Watch how these plastic eating caterpillars could help save the planet.

Take 1:18 mins to discover which country is ready for an electric car revolution.

Watch how Pakistan, China, India and African countries are creating new forests.

‘Till next time,

Climate Bonds