Privacy laws are changing. We want to stay in touch. Do you?

Please reconfirm your Blog Subscription here: A couple of clicks is all it takes.

Highlights:

- Lithuania is 4th Sovereign to issue in 2018

- 18 green bonds totalling USD6.7bn for May so far

- Volkswagen Immobilien issues Certified Climate Bond for Low Carbon Buildings

- Lebanon’s green bond market launched via a Fransabank private placement

- Market firsts from Spanish bank BBVA, Swiss bank Zürcher Kantonalbank, Brazilian gridco ISA CTEEP and Korean company K-Water

Go here to see the full list of new and repeat issuers in April

At a glance

May marks the fourth month in a row we have seen a sovereign green bond on the market with the Lithuanian issuance of EUR20m, the first tranche of a EUR68m programme.

We forecast continuing development of green sovereigns way back in January in our Super Trends for 2018 and would be happy to record a new nation stepping up every month for the remainder of the year.

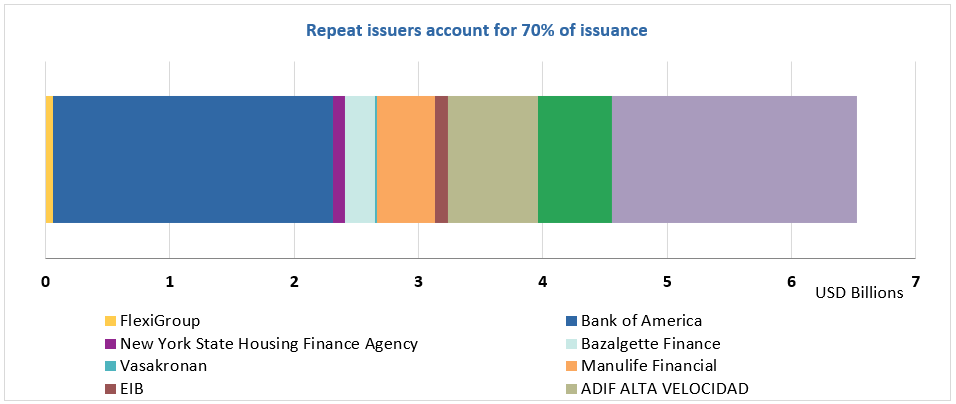

As of 17 May, financial corporates are driving green bond issuance for the month, with debut issuer BBVA and repeat issuer Bank of America accounting for 52% of the USD6.7bn volume.

Over 80% of issuance volume has been denominated in EUR and USD. Amongst the USD deals is South Korean K-Water’s debut green bond. Manulife’s second green bond made the Canadian dollar the third most popular currency.

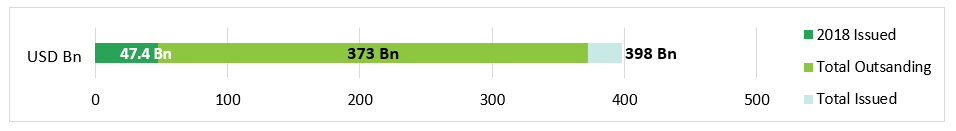

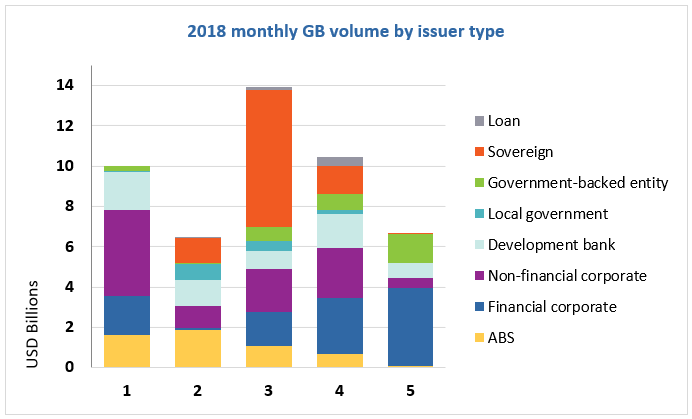

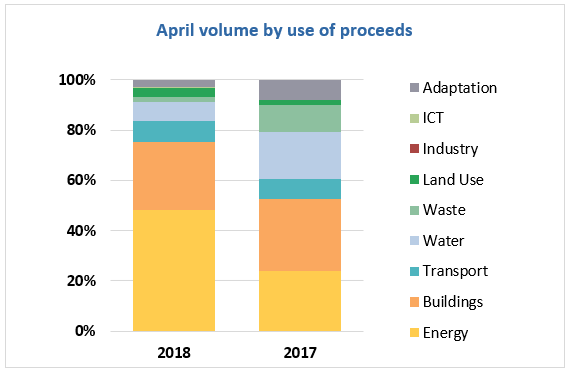

Green bond issuance in April surged 14.3% above 2017’s monthly figures, and Fannie Mae issuance is not included in figures yet. The EIB, Republic of France and ABN AMRO topped the ranks with the largest deals.

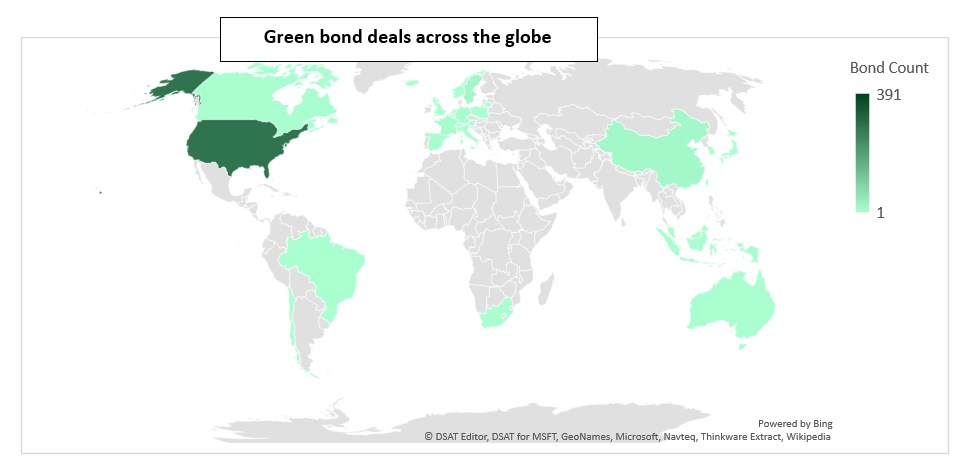

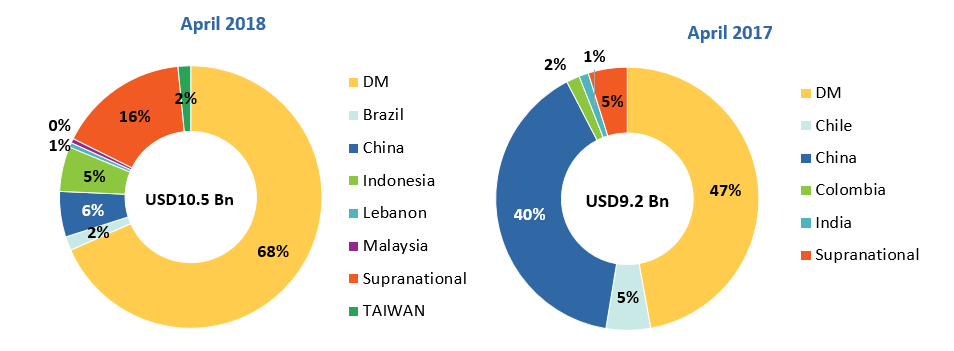

April issuance from developed markets this year was higher than in 2017 – 68% compared to 47%. China accounted for only 6% of volumes, down from 40% last year. While other emerging markets still represent a small share of total volume (10%), we are seeing an increasing geographical diversity.

Emerging Vs Developed countries comparison

>The full list of new and repeat issuers here.

>Click on the issuer name to access the new issuer deal sheet in the online bond library.

Certified Climate Bonds

Volkswagen Immobilien (EUR107m/USD128m) issued a Certified Climate Bond comprised of five tranches with terms from 5 to 15 years (71.5% by issue amount falls in 10-15 year range). The bond is Certified under the Low Carbon Buildings (Residential) Criteria of the Climate Bonds Standard. Proceeds will be allocated to residential buildings which have obtained an EPC rating of B or above. Eligible categories within the Green Bond Framework also include office and logistics buildings, but these asset classes have not been included in this deal or the certification. ISS-oekom provided the Pre-Issuance Verification Report.

New issuers

The Republic of Lithuania (EUR20m/USD24m) issued a 10-year sovereign bond, the first tranche of a EUR68m programme. This is the first green sovereign from Lithuania and second in the CEE region! The 10-year bond will finance a loan to its Public Investment Development Agency to fund renovations to improve energy efficiency and reduce heating costs in 156 multi-apartment buildings.

Climate Bonds view: Market best practice for energy performance improvements in buildings is set at 20-30%. It would be good to see energy efficiency performance thresholds set out in the eligibility criteria.

BBVA (EUR1bn/USD1.2bn) become the first Spanish bank to enter the green bond market with a 7-year deal. The bond is issued under BBVA’s SDG Framework, which distinguishes between green and social eligibility criteria and allows the issuer to classify a bond as “green”, “social” or “sustainability” depending on the use of proceeds.

The EUR1bn deal will finance projects under the green eligibility categories of renewable energy (83%), energy efficiency (4%), sustainable transport (8%), water and waste management (5%). For energy efficiency, performance improvements of at least 30% apply both to retrofits/upgrades of assets and to new technologies. Buildings that have obtained a green building certification of at least LEED Silver, BREEAM Good, HQE Good, DNGB Silver España – VERDE or equivalent. The deal benefits from DNV GL’s Green Bond Eligibility Assessment.

Climate Bonds view: BBVA’s innovative SDGs Framework enables the issuer to keep a clear distinction between bonds that finance environmental projects and social projects. This makes it easier for investors with a dedicated mandate to identify bonds that comply with their investment criteria.

We also note that the SDG Framework BBVA has adopted for green bonds mirrors five of the six SDG goals Climate Bonds has identified (SDGs 6,7,9,11 & 13) that have direct benefits from increased green issuance.

Lastly, we note that the green building certificate thresholds are not on the high-end of the scale and hope to see this eligibility criteria tightening in the future to align with market best practice.

China Jushi (CNY200m/USD31m) issued a 3-year green bond. All the proceeds will be allocated to the construction of the 12-ton Melt Glass Fibre Production Line project. It includes purchasing manufacturing equipment, constructing plant infrastructure and building facilities.

Climate Bonds view: The melt glass fibre production line will use pure nitrogen gas to replace air for combustion leading to a reduction of 80% in air pollution and 99% of NOx emissions. By implementing more energy efficient equipment, it could potentially improve energy efficiency in production processes by approximately 27%. Overall the new production line creates significantly less pollution.

City of Tampa, Florida, (USD84.6m) issued a 23-tranche green US Muni deal (longest dated bond: 28-year term). The deal will finance projects related to improving the City’s storm water management system and reducing surface and ground water pollution. More details on the specific projects can be found in the prospectus.

Climate Bonds view: This is the first Florida US Muni issuing a green bond this year. For future deals, it would be good to see US Muni issuers adhering to best practice by seeking external reviews.

We’re hoping to see US states and cities gradually sign up to the Green Bond Pledge launched in March and begin to discuss how they can green up infrastructure borrowing programs.

Fransabank SAL (USD60m) became the first Lebanese issuer to debut in the green bond market with a 7-year private placement funded by the IFC (75%) and EBRD (25%). The bond is the first tranche of a USD150m green medium-term note programme and will finance renewable energy and energy efficiency for green buildings projects. Moody’s assigned a GB1 Green Bond Assessment to the deal.

Climate Bonds view: Although this is a private placement deal – and, in this case, we take comfort in the fact that both the IFC and EBRD have strong criteria for green bond investing – it would be good practice for private placement issuers to provide more transparency by making their green bond frameworks publicly available.

Hua Nan Commercial Bank (TWD1bn/USD33.5m), Taiwan, issued a 3-year green bond. Proceeds will be allocated to eligible low carbon and adaption projects including renewable energy development and technologies, such as solar and wind farms; industrial energy efficiency improvement; water savings, recycling; and pollution control projects. KPMG provided the Assurance report (not publicly available).

Climate Bonds view: Taipei Exchange, with oversight from Taiwan’s Financial Supervisory Commission, issued guidelines in 2017 endorsing the Climate Bonds Standard and Green Bond Principles (GBP). Although this bond has only disclosed broad categories of eligible assets, we agree on its green credentials as it has met Taipei Exchange’s green bond guidelines and international definitions.

ISA CTEEP (BRL621m/USD179m) is the first Brazilian energy transmission company to enter the green bond market, with a 7-year green bond. Sitawi provided the Second Party Opinion. The financed projects will contribute to distributing electricity produced by renewable energy sources.

Climate Bonds view: Grid infrastructure is essential in the low carbon transition. Sitawi notes that the issuer cannot ensure the transmission systems will transport solely electricity generated from renewables, but that developing robust grids will enhance renewables integration, as well as reduce losses and congestion. We agree.

Climate Bonds will be starting work on additional criteria in 2018, including energy distribution grids and networks.

K-Water (USD300m) issued a 5-year green bond and is the first South Korean issuer from the water & wastewater sector to come to market. The deal benefits from a Sustainalytics’ Second Party Opinion. Proceeds will be allocated to adaptation, water supply infrastructure improvement and wastewater treatment, as well as solar, tidal and hydro energy projects and assets. Examples of adaptation projects include reinforcing or constructing embankments and improvements of existing waterway structures.

Sustainalytics states that the issuer conducted an internal risk study that underlines the importance of financing this infrastructure to enhance flood protection and waterways management.

Climate Bonds view: Basing adaptation eligibility criteria on climate risk assessments provides a higher assurance of the validity of the selected adaptation measures.

Landsea Green Group (USD150m), Hong Kong, issued a 2-year green bond. Proceeds will be allocated to new and existing green buildings in China. To be eligible, the assets must have 2 Star Chinese Green Building Label or an equivalent building certification standard, while projects must target energy efficiency improvements of 15-30% for new buildings and at least 40-60% for existing buildings. The issuer also allows for 10% of the proceeds to be allocated to R&D for energy efficiency design and technology related to housing and construction. The bond was assigned an E1/84 Green Evaluation by S&P Global Ratings.

Climate Bonds view: We haven’t come across the “Three Star System” Chinese Green Building Label a lot, so let’s have a recap.

The system is based on six categories:

- land efficiency,

- energy efficiency,

- water efficiency,

- resource efficiency,

- environmental quality and

- operational management.

Each category has both regular and premium items. The scheme has three rating categories – 1 star, 2 stars and 3 stars – and is based on a credit scoring system. The rating level is determined by the minimum score in each component.

We note that, as for other green building certification systems, targeting the highest rating level would provide a stronger assurance on a building’s energy performance credentials.

Mingyang Smart Energy (CNY500m/USD78.4m), China, issued a 3-year green bond. The deal benefits from an external review by Lianhe Equitor (not publicly available). All the proceeds will be allocated to 3 onshore wind farms in China. Half the proceeds will be used to purchase wind turbine components and the remainder will be applied towards refinancing. The wind farms have installed capacity of 49.5MW, 100MW and 50MW respectively and they are expected to deliver a positive climate impact by avoiding a total of 168.3K tons of carbon equivalent per year.

Climate Bonds view: The main business of the issuer is R&D into large scale wind turbines and core components, as well as manufacture and maintenance of wind turbines. The issuer has been approved by the regulator to raise CNY1bn green bonds in total, so we expect to see more green bonds from MingYang coming to market.

UiTM Solar Power Sdn Bhd (MYR222.3m/USD56.8m), Malaysia, issued a green SRI sukuk comprised of 17-tranches, the longest with an 18-year term. UiTM Solar Power is a commercial arm of Universiti Teknologi MARA and is the first green sukuk issued worldwide by a University. The deal will finance a 50MW utility solar power plant in Gambang, Pahang, Malaysia. The plant is expected to become operational in November 2018.

Climate Bonds view: It’s encouraging to see the pool of green sukuk issuers expanding and Malaysia again taking a lead amongst ASEAN nations.

Yangzhou Traffic Industry Group (RMB500m/USD78m), China, issued a 5-year green bond. The deal benefits from an external review from Lianhe Equitor (not publicly available). Proceeds are to be allocated to clean public transportation in Yangzhou, China, including electric and hybrid vehicles. It will be used to fund clean transport procurement (87%) and capital for maintenance and replacement of worn out parts (13%). The aim is to fully replace diesel-fuelled public transport with cleaner substitutes. This would improve fuel efficiency and reduce air pollution by lowering emissions of CO2, NOx and PM10.

Climate Bonds view: We observe a strong commitment by the local government to support clean transport. The investment has a positive impact to reduce GHG emissions and air pollution associated with transport.

Zhongyuan Bank (CNY1.5Bn/USD240m), Hong Kong, issued a 3-year green bond to finance four wastewater treatment projects in China. The facilities could potentially treat up to 1130 tons of wastewater per day, which would significantly decrease water pollution and improve water availability in the region. More broadly, the framework includes four eligible categories: clean transportation (29%), pollution and waste control (28%), ecological protection and climate change adaptation (24%) and energy efficiency (19%).

Climate Bonds view: We welcome that Zhongyuan Bank has provided estimated percentage allocations per category for its green bond program. While there may be slight differences in actual allocations, the disclosed expectations provide a reference point for investors and an indicator for funding priorities.

Zürcher Kantonalbank (CHF210m/USD209m and CHF115/USD115) issued a 7-year green bond with an initial close and immediate tap and has thus become the first Swiss bank to come to market. The deal was assigned a GB1 Green Bond Assessment by Moody’s. Proceeds will be allocated to a portfolio of green loans for energy efficient buildings made up of private mortgage loans (61%), commercial real estate (25%) and housing cooperatives (14%).

To be eligible, new buildings must have obtained a Minergie certificate, a 2000-Watt Area certificate, or at least an “A” in the Swiss energy performance certificate GEAK. Refurbished buildings must have obtained a Minergie certificate for refurbishments, a GEAK Plus energy efficiency class “C”, or measures to improve energy efficiency. Moody’s GBA notes that 90% of loans qualify under the Minergie standards and that buildings with a 2000-Watt Area certificate have not yet been included in the green pool.

Climate Bonds view: The Minergie certification scheme is based on reaching a threshold level in its three performance criteria: energy efficiency, materials and comfort. This ensures a high link between certificate level and energy efficiency of the building. The GEAK standard is the official Swiss building energy certificate, which reflects the efficiency of the building’s envelope and energy usage. The certificate’s classes go from “A” to “G”, where “A” is the most efficient.

Repeat issuers - 24th April to 18th May

-

Rhode Island Infrastructure Bank: USD17.7m

-

EIB: USD1.5bn

-

World Bank (IBRD): HKD1bn/USD127m

-

Ygrene Energy Fund (GoodGreen): USD340.5m (PACE ABS)

-

District of Columbia Water: USD100m

-

Kommuninvest: SEK3bn/USD343m

-

NIB: EUR500m/USD598m

-

Adif Alta Velocidad: EUR600m/USD717m

-

Manulife Financial: CAD600m/USD464m

-

Massachusetts Water Resources Authority: USD22m

-

Vasakronan: NOK150/USD18m

-

Bazalgette Finance: GBP175m/USD236m

-

EIB (tap): AUD150m/USD112m

-

New York State Housing Finance Agency (Certified Climate Bond): USD99m

-

FlexiGroup (Certified Climate Bond): AUD81.3m/USD60.7m

-

Bank of America: USD2.3bn

April trends

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Though we support the Sustainable Development Goals (SDG) overall and see many links between green bond finance and specific SDGs, the proportion of proceeds allocated to social goals needs to be no more than 5% for inclusion in our database.

|

Issuer Name |

Amount issued |

Issue date |

Reason for exclusion/ pending |

|

Japan Railway Construction Co. |

JPY24.5bn (USD228.3m) |

27/02/2018 |

Insufficient information |

|

Caja Rural De Navarra |

EUR500m (USD593m) |

08/05/2018 |

Sustainability/Social bond |

|

NWB Bank |

EUR500m (USD606m) |

27/04/2018 |

Sustainability/Social bond |

|

Longyuan Power |

CNY3bn (USD477m) |

20/04/2018 |

Working capital |

|

Guoxuan Hi-tech |

CNY500m (USD80m) |

13/04/2018 |

Working capital |

|

Wuhan Metro |

CNY2bn (USD319m) |

11/04/2018 |

Working capital |

|

Hanover |

EUR100m (USD120m) |

03/04/2018 |

Sustainability/Social bond |

|

MünchenerHyp |

EUR300m (USD284m) |

24/08/2014 |

Sustainability/Social bond |

|

DTE Energy |

USD525m |

07/05/2018 |

Pending |

|

Credit Agricole |

USD10m |

09/05/2018 |

Pending |

Green bonds in the market

-

New Jersey Environmental Infrastructure Trust – closing 22nd May

-

California Statewide Communities Development Authority – closing 23rd May

-

Renovate America/Hero Funding – closing 23rd May (PACE ABS)

-

African Development Bank – closing 24th May (social bond)

-

Landshypotek Bank – closing 25th May

-

Japan Retail Fund Investment Corp – closing 25th May

-

Obvion STORM 2018-GRN – closing 30th May (RMBS)

-

City of Palo Alto – closing 5th June

Investing News

Sixty major institutional investors representing both asset owners and managers have written an open letter, published in the Financial Times, to the oil and gas sector calling for faster action to reduce their emissions and ‘clarify how they see their future in a low-carbon world.’

Morgan Stanley commits to financing USD250bn in low carbon solutions by 2030.

Solactive joins forces with UBS to launch a range of development bank bond indices.

Barclays launched new loans product to help businesses meet working capital needs related to green projects.

Costa Rica bids to abolish fossil fuels and become the world’s first decarbonised country.

California conducts first state-wide US insurance investment climate risk study.

Lloyds Banking Group launched GBP2bn scheme offering discounted financing to commercial bank clients investing in a low carbon future.

Newton Investment Management launches its first sustainable fixed income fund.

Green Bond Gossip

The Basque government is planning to issue a 10-year sustainability bond.

Stora Enso recently launched its Green Bond Framework with eligible categories including sustainable forest management, energy efficiency, renewable energy and waste management.

Eolica Mesa La Paz proposed green bonds to finance an onshore wind farm in Mexico have been assigned an E1/91 Green Evaluation Rating by S&P Global Ratings.

Bancoldex has obtained a Second Party Opinion from Sustainalytics for its Social Bond Framework. The issuer is preparing to launch its debut social bond on the Colombian Stock Exchange. The bank has also announced it will no longer finance public transport vehicles that operate on diesel and will seek to stimulate and finance cleaner energy options.

Reading and Reports

The International Renewable Energy Agency (IRENA) published its “Global Energy Transformation: A Roadmap to 2050” report, which states that renewable energy needs to be scaled up at least six times faster if the world is to meet the Paris Agreement goals.

Legal firm White and Case have just published a paper on sustainable and green securitisation. At six pages, a compact summary.

The ADB has released Promoting Green Local Currency Bonds for Infrastructure Development in ASEAN+3. Available here.

Climate Bonds Reports:

"The Green Bond Market in Europe" report examining the latest green bond market developments in Europe both at a regional and country level.

“Green Infrastructure Investment Opportunities Indonesia” report, launched at Indonesia’s Green Finance Summit, highlights infrastructure investments that could be funded with green bonds and green sukuk.Sponsored by the Climate Works Foundation and developed in partnership with Pembiayaan Investasi Non-Anggaran Pemerintah (PINA), a project of the National Development Planning Agency (BAPPENAS), and PT. EBA Indonesia, this one is not to be missed.

Moving Pictures

Watch how American cities are taking advantage of an untapped energy supply.

Here’s how Ethiopia’s new Reppie Facility turns waste into energy, clean water and bricks.

Watch Alstom’s Coradia iLint - the world’s first hydrogen electric powered commuter train currently being tested in Germany.

Climate Bonds has released the 2nd in our “Choose your Future” series of of 30 sec video clips. Don’t miss it.

‘Till next time,

Climate Bonds

PS: Don’t forget! Reconfirm your Blog Subscription here: A couple of clicks is all it takes.

Disclosure: Some organisations named or linked to in this blog post are Climate Bonds Partners. A full list of Partners can be found here.