Embargo: 06:00 GMT/ 14:00 MYT

Climate Bonds releases Malaysia GIIO Report

Green Infrastructure Investment Opportunities for Green Bond, Loan & Sukuk Investment

KUALA LUMPUR/LONDON: 08/03/2021, 14:00 MYT/06.00 (GMT): The Climate Bonds Initiative has released the Green Infrastructure Investment Opportunities Malaysia (Malaysia GIIO) report, identifying and analysing multiple green infrastructure projects open for potential investment and development. Malaysia GIIO has been produced with the support of Capital Markets Malaysia (CMM).

Thirteen (13) green projects in renewable energy, low carbon transport, water infrastructure & waste management are showcased and a sample pipeline of approximately sixty (60) projects in low carbon transport, renewable energy, sustainable water & waste management is identified.

Malaysia GIIO has been prepared to help meet the growing demand for green investment opportunities and to support transition to a low carbon economy. It aims to support Malaysia’s economic and climate goals by stimulating engagement around the financing of climate resilient infrastructure between project owners and developers and development finance institutions and international investors.

The report also analyses current trends in global and domestic green sukuk issuance policy support and the development of Malaysia’s role as an emerging centre for green and sustainable finance and domestic initiatives including the Sustainable and Responsible Investment (SRI) Sukuk Framework, Sustainable and Responsible Investment (SRI Roadmap), the SRI Sukuk and Bond Grant Scheme, and Green Technology Financing Scheme (GFTS).

Zalina Shamsudin, General Manager, Capital Markets Malaysia:

“Capital Markets Malaysia, as an affiliate of the Securities Commission Malaysia, positions investment opportunities in the Malaysian capital market and our interest to sponsor this GIIO report was to showcase how Malaysia has leveraged our depth and breadth in Islamic Finance and pioneered the use of Green Sukuk to fund green projects in Malaysia. In addition, the report also highlights developments in Malaysia to cultivate a sustainable economy through renewable energy, green buildings, low carbon transport and water management initiatives.”

Sean Kidney, CEO, Climate Bonds Initiative:

“Accelerating large scale capital flows towards climate resilient infrastructure, involving governments, DFI’s and global investors is vital to meeting 2030 targets and the transition to zero carbon. This landmark report identifies a pipeline of domestic investment opportunities against the backdrop of Malaysia’s efforts to expand green sukuk and sustainable investment markets in the region.”

<Ends>

A Launch Webinar with Climate Bonds & CMM will be held on Monday 8th March 2021.

London 08:00/ Kuala Lumpur /HK 16:00/Sydney 19:00.

Details & Registration here.

GIIO Malaysia report is available for download here.

For more information, please contact:

Leena Fatin,

Communications & Digital Manager,

Climate Bonds Initiative (London)

+44 (0) 7593 320 198

Notes for journalists:

Acknowledgements: Climate Bonds would like to thank Report Partner Capital Markets Malaysia (CMM). Climate Bonds also thanks the other organizations that contributed to the report: Securities Commission Malaysia (SC), Telekosang Hydro One Sdn Bhd, CIMB Islamic Banking Group, Maybank Investment Bank.

About the Climate Bonds Initiative: Climate Bonds Initiative is an investor-focused not-for-profit, promoting largescale investment in the low carbon economy. Climate Bonds undertakes advocacy and outreach to inform and stimulate the market, provides policy models and government advice, market data and analysis, and administers an international Standard & Certification Scheme for best practice in green bonds issuance. For more information, please visit www.climatebonds.net.

About the Green Infrastructure Investment Opportunities Reports: Climate Bonds Green Infrastructure Opportunities (GIIO) report series aim to identify and analyse green infrastructure investment opportunities on a regional basis. In the Asia-Pacific an initial Indonesia GIIO report was launched in 2018 with an Update in 2019, Australia and New Zealand reports were released in 2018 & 2019. The series continued in 2020 with Vietnam GIIO released in April and a Philippines report in November.

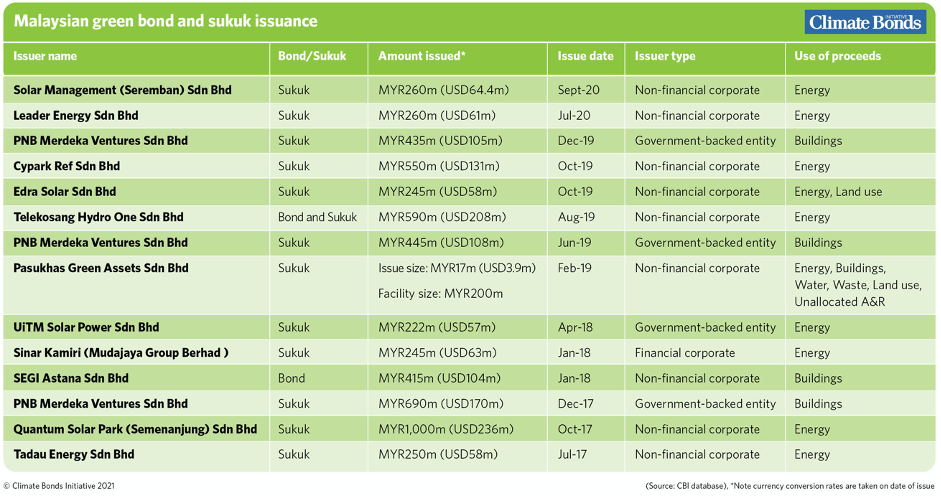

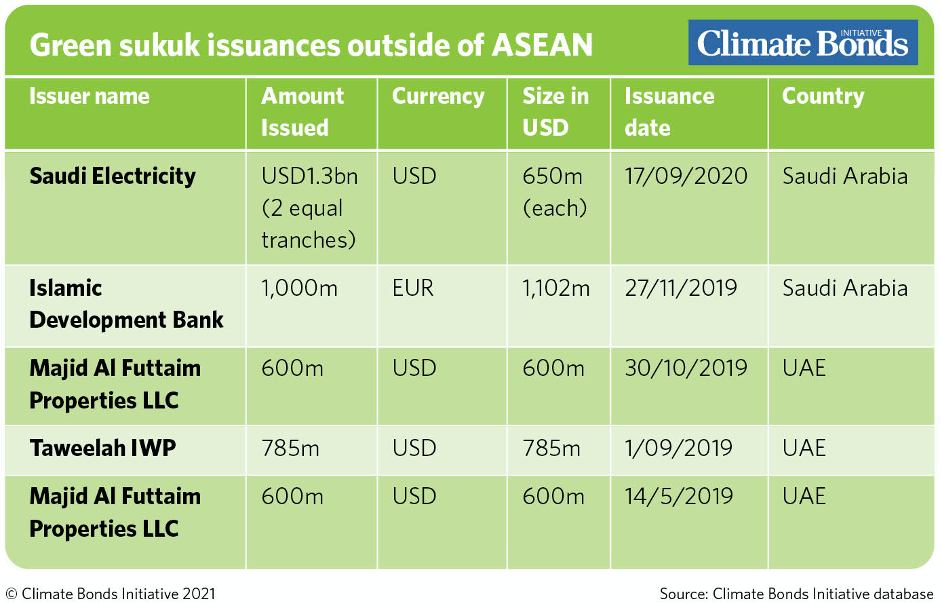

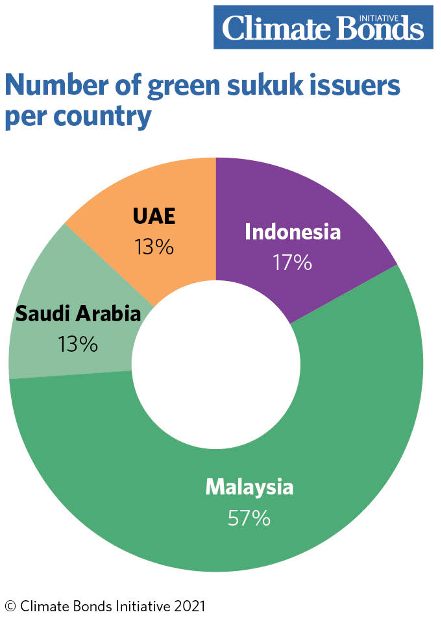

Green Sukuk Snapshot: The world’s first green sukuk was issued in July 2017 by Tadau Energy for MYR250m (USD58m) to finance solar projects in Malaysia. Since then, global issuance has reached cumulative USD8.8bn from 16 different issuers. While Malaysian issuers account for only 15% of deals by value, it is by far the most diverse market with 13 deals from 11 different issuers (out of a global total of 23 deals and 16 issuers).

Other countries (Indonesia and UAE) have larger deal sizes but less diversity. Indonesia has one issuer (Republic of Indonesia Sovereign) while UAE has two.

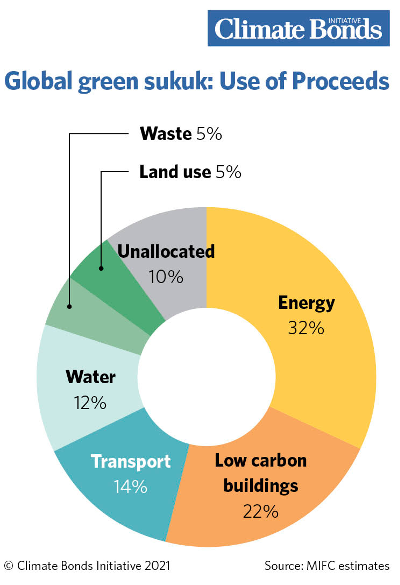

To date, the green sukuk market has primarily focused on financing projects relating to renewable energy, low carbon buildings and low carbon transport. This is broadly in line with the global green bond market although there are some small differences – transport, for example accounts for 20% of global green bond market spending while it accounts for 14% of the green sukuk market. (See Images 1-4 below.

Images:

- Malaysia Green Bond & Sukuk Issuance to Dec 2020

- Green Sukuk Issuance outside of ASEAN to Dec 2020.

- Global Green Sukuk Use of Proceeds to Dec 2020

- Green Sukuk Issuers per Country to Dec 2020

ENDS

ENDS

------------------------------------------------