AUD10.2 billion in green bonds issued to date

Need for acceleration to address coming climate impacts

Climate Bonds' two newest reports have just been launched in Sydney today.

Climate Bonds' two newest reports have just been launched in Sydney today.

Green Infrastructure Investment Opportunities - Australia & New Zealand report (GIIO) outlines a pipeline of infrastructure investment in both nations that can be funded via green finance.

It is accompanied by the release of Australia & New Zealand Green Finance Briefing: a full analysis of green investment in both nations to date.

Both reports highlight paths for the two countries’ respective transitions to a low carbon economy, meeting the growing demand for green investment opportunities - including green bonds - and facilitating greater engagement between project owners and developers, and institutional investors including asset managers and superannuation funds.

Australia & New Zealand green finance passes the AUD10bn mark

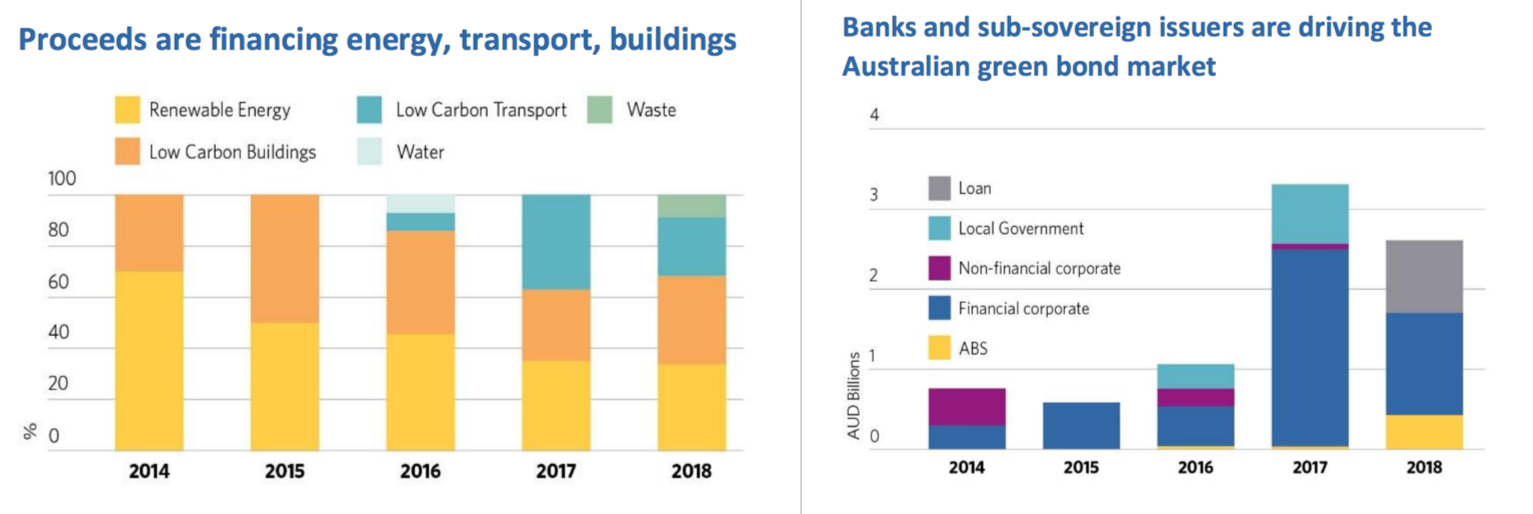

The reports note the cumulative green bond issuance – Australia: AUD8.3bn (USD6.3bn); New Zealand: NZD2.1bn (USD1.5bn) – for a combined total of AUD 10.2bn in green bond issuance to date.

Despite a challenging policy backdrop, Australia in particular has emerged over the last four years as an example of world’s best practice in market development, with commitment from the major banks and a diversity of green bond issuances including from two state governments, property and tertiary sectors, and also high levels of Certification. New Zealand’s first green issuance was in 2017 but the market is already showing growing potential.

With an overall total of eleven individual issuers [1] from Australia (some of whom are multiple issuers) and two from New Zealand, in Q1-Q2 2018 Australia is the second largest cumulative source of issuance within the Asia Pacific region – second to China and twelfth in overall world rankings – with a total issuance of AUD2.6bn (USD1.95bn). New Zealand reached NZD200m (USD136m) thus far in 2018.

Notwithstanding the positive start, both nations are yet to effectively harness capital allocation to generate the volume of green infrastructure investment required to meet international mitigation and emissions commitments, whilst improving climate adaptation and resilience.

GIIO Report identifies 400+ projects and assets across four major sectors

Green Infrastructure Opportunities Australia and New Zealand explores low carbon infrastructure opportunities on a sector-by-sector basis and is a first of its kind for Australia & New Zealand.

Over 400 projects and assets were identified (360 in Australia and 62 in New Zealand) that can be considered green and qualify for refinancing, additional financing, or new financing, in the near and medium future.

The infrastructure investment opportunities explored were based on four sectors. The Climate Bonds Taxonomy (and other international definitions of green) were used to identify eligible green projects under these sectors. Furthermore, to help define the scope and volume of projects, the following filters were also applied:

The infrastructure investment opportunities explored were based on four sectors. The Climate Bonds Taxonomy (and other international definitions of green) were used to identify eligible green projects under these sectors. Furthermore, to help define the scope and volume of projects, the following filters were also applied:

- Low carbon transport - mostly major projects valued above AUD100m (in Australia) and NZD100m (in New Zealand)

- Renewable energy - only renewable energy generation facilities above 50MW

- Sustainable water and waste management - mostly major projects valued above AUD50m (in Australia) and NZD50m (in New Zealand)

- Low carbon or green buildings - only Green Star (mostly 6-star rated) certified projects.

The Infrastructure Opportunity: Investor participation and climate targets

There is a growing opportunity for institutional investors to become more active and expand their participation in green infrastructure financing in Australia and New Zealand, building on the impressive foundation established so far, albeit with relatively minor supply of non-bank ASX 100 green issuances to date.

However, the brown-to-green transition from emissions-intensive ‘brown’ infrastructure to cleaner and ‘greener’ assets needs to attract additional support and gain considerable investment momentum in order to meet Paris Agreement goals. Essentially, investing in clean infrastructure is the most effective way to reach Australia and New Zealand’s current climate targets, whilst also preparing for a potential ratcheting up of international emissions goals.

Significantly increasing capital into green infrastructure will spur innovation, broaden the economic base, reduce urban congestion, improve the liveability of cities and support sustainable economic development and social well-being.

The Australia & New Zealand Green Finance Briefing – Points for consideration:

- Large existing potential, particularly in transport and energy for low carbon investment

- Huge opportunity for green RMBS (Residential Mortgage Backed Securities) linked to existing and new building codes

- Green bonds as a source of long-term finance for climate resilient and adaptive water infrastructure, sustainable management and resilient agricultural practices

- Establishing green finance models to support additional recycling, reuse and waste processes

- The role of Australia’s superannuation funds in driving the brown-to-green transition amongst listed companies as they respond to TCFD recommendations and reflect climate risks and opportunities in their forward capex decisions

The Asia-Pacific Picture: A regional role in green finance?

Australia and New Zealand also have the potential to be regional leaders in green infrastructure delivery.

Both governments have the capacity and economic conditions to develop a medium-term sequential pipeline of green investment opportunities.

Their financial sectors are well positioned to develop and subsequently export green finance expertise.

Australia in particular benefits from an AUD2.6 trillion national savings pool and is also uniquely placed with superannuation funds and investment managers already having a global presence in infrastructure, debt financing, direct investment and alternative assets.

A robust green domestic market would see Australia poised to become a significant source of expertise and capital flows into the region, responding to opportunity, as ASEAN nations shift towards green finance as a means to meet their intertwined national-development, energy, emissions and climate goals.

Who’s saying what?

Christina Tonkin, Managing Director, Loans & Specialised Finance, ANZ:

“The Australian and New Zealand green bond markets are representative of global best practice. The markets are underpinned by a diversity of issuance and innovation in use of proceeds, a strong commitment towards transparency, with high levels of international certification.”

“ANZ is working with investors to build confidence in market fundamentals and directions. The scale of green infrastructure investments expected to be made in Australia, coupled with strong investor demand, make the prospects for growth in green bonds bright."

Matthew Walker, Acting Group Chief Financial Officer Auckland Council:

“Auckland Council was very pleased to have issued the first Green Bond by a New Zealand issuer and pave the way for further Green Bond issuance to support the significant investment required in low carbon, climate resilient infrastructure across New Zealand.”

“The strong interest shown by investors in the issue was a very encouraging and positive signal for future green bond issuances in New Zealand.”

“Achieving a sustainable low-carbon future for Auckland and ensuring that our infrastructure is future-proofed, are integral components of the Auckland Plan 2050; our recently refreshed long-term spatial plan for Auckland. Directing capital towards more sustainable climate resilient solutions will be critical to achieving our Auckland Plan 2050 outcomes.”

Andrew Hinchliff, Group Executive, Institutional Banking and Markets, Commonwealth Bank of Australia:

“With record levels of transport infrastructure investment, often overlooked is the importance of the role this new infrastructure plays in reducing emissions and creating a more sustainable environment. Commonwealth Bank recognises this and is proud of its record in financing modern, future proofed transport infrastructure that promotes energy efficiency at its very core. Green bonds, working alongside traditional forms of finance, will ensure the continued funding of energy efficient infrastructure.”

Ian Learmonth, CEO, CEFC:

“As a core investor in Australia’s green bond market, we are seeing growing interest from superannuation funds and managers who want to deepen their exposure to sustainable assets. This is essential if we are to achieve our national emissions reduction goals in the infrastructure sector and beyond.”

“We are confident an increasing focus from underlying investors, along with improved sophistication and understanding of fund managers, and increased diversity of supply, can attract more investor support for this critical investment class.”

Emma Herd, CEO, Investor Group on Climate Change (IGCC):

“Low carbon and green infrastructure will be a defining investment theme of the 21st century. But we must move to realise the opportunity. Investors backing green infrastructure projects in Australia that generate strong, stable and sustainable returns is critical. Developing the real-world solutions which unlock capital and embed low carbon at the heart of investment decisions requires the financial and corporate sectors to step up our ambition and act."

John Pickhaver, Co-Head of Macquarie Capital, Australia and New Zealand:

“There is increasing focus in the infrastructure investment community on the opportunities that green investment brings. Across renewable energy, sustainable transport, green buildings and communities; financial investors, corporates and governments are all looking for ways to facilitate and participate in the transition to a low carbon economy.”

Mike Baird, Chief Customer Officer, Corporate and Institutional Banking, NAB:

“Our goal is to make a positive and lasting impact on the lives of our customers, people, shareholders, communities, and our environment - and our customers are telling us they want to participate in the transition to a low carbon economy.”

“We’re continually developing and offering innovative green finance tools that enable investors to back major renewable energy projects alongside NAB, and we find new ways to support companies that deliver green infrastructure projects around the world.”

Andrew Eagles, New Zealand economist and CEO of the New Zealand Green Building Council:

“Clever, sustainable, pollution-busting investment is growing, because it makes good sense financially, economically, and for the environment. Some say that this is the future of finance, but the growing flow of investment suggests that the future is already here.”

“This report has arrived at just the right time. Low-carbon investments are increasingly popular, and investors are now searching for third party independent certification to authenticate sustainability claims. We’re currently seeing a surging wave of interest in Green Star, a trusted verification scheme for healthy, resilient buildings.”

Lyn Cobley, Chief Executive, Westpac Institutional Bank:

“Westpac recognises that climate change is an economic issue as well as an environmental issue, and banks have an important role to play in assisting the Australian and New Zealand economies transition to net zero emissions. Increasing green bonds, green loans and green underwriting is a vital part of the mix, as is supporting new issuers to come to market.”

Sean Kidney, CEO, Climate Bonds Initiative:

“Banks are involved in many financial activities and it’s vital that they are successful in the role of stimulating green investment and climate finance. The major Australian banks have done just that, leading international best practice, making benchmark size green bond issuance and supporting new issuers to market. Globally, to meet the growing climate finance and resilience challenges, more of the top 200 banks should follow this example.”

“It’s also time for Australia and New Zealand corporates to signal their brown-to-green directions and enter the market.”

“Institutional investors need to back new green offerings and work more actively across the finance sector and with policy makers to turn the plethora of opportunities identified in the GIIO report into long-term national pipelines of investable low carbon infrastructure projects.”

More GIIO reports to come!

GIIO Australia & New Zealand is the second in a series of reports from Climate Bonds Initiative that commenced with GIIO Indonesia in May 2018.

More reports investigating green infrastructure investment opportunities in SE Asian nations and other regions are planned for 2019-2020.

Download now: Green Infrastructure Investment Opportunities - Australia and New Zealand

Download now: Australia and New Zealand Green Finance Briefing

‘Till next time,

Climate Bonds

P.S.: Acknowledgement & Thank You

Production of Green Infrastructure Opportunities Australia and New Zealand has been jointly sponsored by ANZ, CBA, the CEFC, Macquarie Group, NAB and Westpac.

During development, Climate Bonds Initiative consulted with key Government bodies, industry, financial sector, peak bodies, NGOs and other stakeholders - in partnership with Australia’s four major banks, also BNZ, Macquarie Group, Mayne Wetherell, Clean Energy Finance Corporation (CEFC), IFM Investors, Investor Group on Climate Change (IGCC), PRI, and RIA.

Contributions were also made by the Australian Water Association, Green Building Council of Australia, GRESB and New Zealand Green Building Council (NZGBC).

We’d also like to thank our Event Partners Ashurst, IFM Investors, IGCC, PRI and RIAA, and our Media Partner, KangaNews for their support.

GIIO Report Lead author: Kristiane Davidson

Co-authors: Rob Fowler, Kingsley Kwadwo, Oteng-Amoako, Laurent Buzenet Drogba, Andrew Whiley and Cymroan Vikas.

We’d like to thank all of the organisations and individuals from Australia and New Zealand who assisted in preparation of the reports.

[1] This Issuer figure aggregates three FlexiGroup ABS Trusts, two NAB related entities and two Investa property funds.