Market growth to date driven by banks and sub-sovereigns

Green finance wave needed to address carbon targets, climate impacts and brown to green transition

Australia has the capability and capital to launch a wave of green infrastructure investment throughout the 2020s but is yet to take full advantage of opportunities to build climate readiness and resilience according to the latest Climate Bonds reports launched in Sydney on Tuesday.

The reports are the 2nd in Climate Bonds Initiative annual Australian series. Green Infrastructure Investment Opportunities Australia 2019 (GIIO) identifies a national pipeline of over 400 green infrastructure projects with investment potential. Green Finance State of the Market Australia 2019 (SoTM) provides a full analysis of domestic green investment as of 30th June 2019.

Together they advocate increasing green investment in the real economy including use of green bonds and other green investment products.

New Partnerships for Green Infrastructure and Brown to Green Transition

The GIIO report notes that sustained emissions reduction has not yet been effectively integrated into national infrastructure priorities and backs new long-term partnerships between banks, superannuation funds, corporations and governments to address rising emissions, urban congestion and sustainability pressures.

It calls for expanded green finance mechanisms and cooperation between the public and private sector to achieve more productive capital allocation into green infrastructure, with energy, transport, water, waste and buildings as the priority areas.

In the face of coming climate impacts, the GIIO report supports strengthening adaptation and resilience factors in social, urban and economic planning, infrastructure design and operation.

The report states that building Australia’s green finance capabilities would also support ASX listed companies in undertaking higher levels of green investment, critical to meeting increasing institutional investor expectations of brown to green transition and progress towards low carbon and ultimately zero-carbon business models.

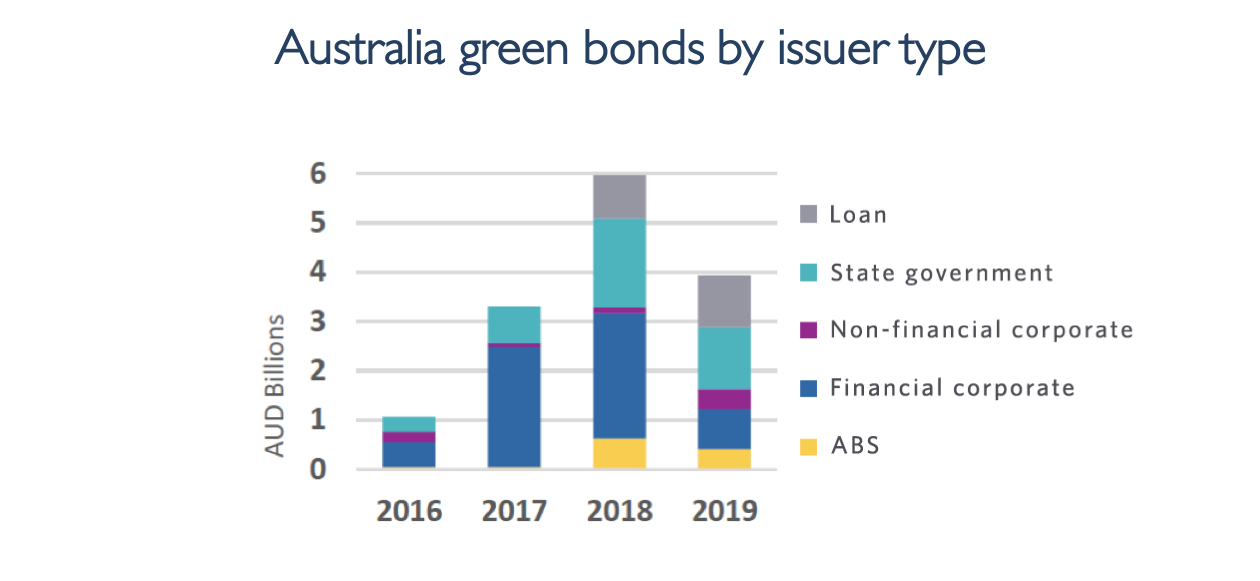

Banks and State Governments are shaping the market

Australia SoTM 2019 notes that the domestic green finance market is an example of international best practice with ongoing commitment from the banking sector acting as an underlying driver of both market growth and innovation.

The market is characterised by large scale green bond issuance from state government investment entities (TCV, QTC, NSW TCorp) with low-carbon transport (53%) and low carbon buildings (22%) dominating their green bond use of proceeds as of 30th June 2019. Since then, the Queensland government investment arm QIC has issued an AUD300m Certified Climate Bond.

The five largest green bond transactions to date have been led by New South Wales TCorp AUD1.8bn (USD1.313bn), Queensland Treasury Corporation AUD1.25bn (USD892m), NAB EUR750m (AUD1.2bn) and Macquarie Group GBP500m (AUD883m).

On a cumulative basis, low carbon buildings dominate green bond allocations with approximately 43% share of use of proceeds. Energy follows with 25%, low carbon transport at 24%, water at 6% and waste at 2%. Green bonds are yet to be issued for other industry sectors including land use and ICT.

Australia’s major banks have all issued green bonds sized at AUD500m or more, supported new issuers coming to market and the sector has achieved a series of world firsts that include a green note backed by a portfolio of loans, securitisations and green deposit products.

Low carbon buildings have been financed using green RMBS tranches and green loans. NAB subsidiary UBank & Westpac have both launched Certified green deposit products for investors that invest only in assets and projects that meet Climate Bonds Sector-based criteria, both examples of world firsts.

The Australian market also has one of the highest densities of Climate Bonds Certifications in the world - an additional indicator of best practice.

Who’s saying what:

Christina Tonkin, Managing Director, Loans & Specialised Finance, ANZ:

“The Australian and New Zealand sustainable finance market is accelerating with the emergence of loans in both green and sustainability-linked formats. This follows the growth of green bonds over the last three to four years.”

“The Australian market has developed in line with global best practice, showing the diversity of product, transparency for investors and lenders, innovation in the use of proceeds and commitment to uphold market standards.”

Andrew Hinchliff, Group Executive, Institutional Banking and Markets, Commonwealth Bank of Australia:

“We are committed to playing our role in limiting climate change and supporting Australia’s transition to a low-carbon economy, but we can only do this by working closely with our customers, communities and industry partners. The Green Infrastructure Investment Opportunities (GIIO) Australia report will help us pursue our goals, by outlining the projects that will make a direct contribution to international climate targets and long-term environmental sustainability.”

David Jenkins, Head of Sustainable Finance, Corporate & Institutional Banking, National Australia Bank:

"More and more investors are talking to us about climate resilience and how NAB can support the capacity of the financial sector to better support investments in climate-resilient and green infrastructure. The 2019 GIIO report is an essential tool for our industry because it provides a snapshot of the many projects that governments, policy, makers and investors can direct capital towards."

Lyn Cobley, Chief Executive Westpac Institutional Bank:

“Westpac recognises the transition to a net zero emissions economy cannot be achieved without the active support of major financial system actors. Banks, insurance companies and superannuation funds all have a vital role in ensuring investment flows towards the green infrastructure that will help reach this goal. Accelerating green finance, including green bonds, green loans and green underwriting is increasingly the market mechanism to support this transition.”

Sean Kidney, CEO, Climate Bonds Initiative:

“Australia has both the opportunity and the capital to meet its green infrastructure challenges and create a climate-ready, resilient and robust economy, fit for the future. Investing in low carbon transition will create jobs, boost economic growth and help Australia meet its international obligations.”

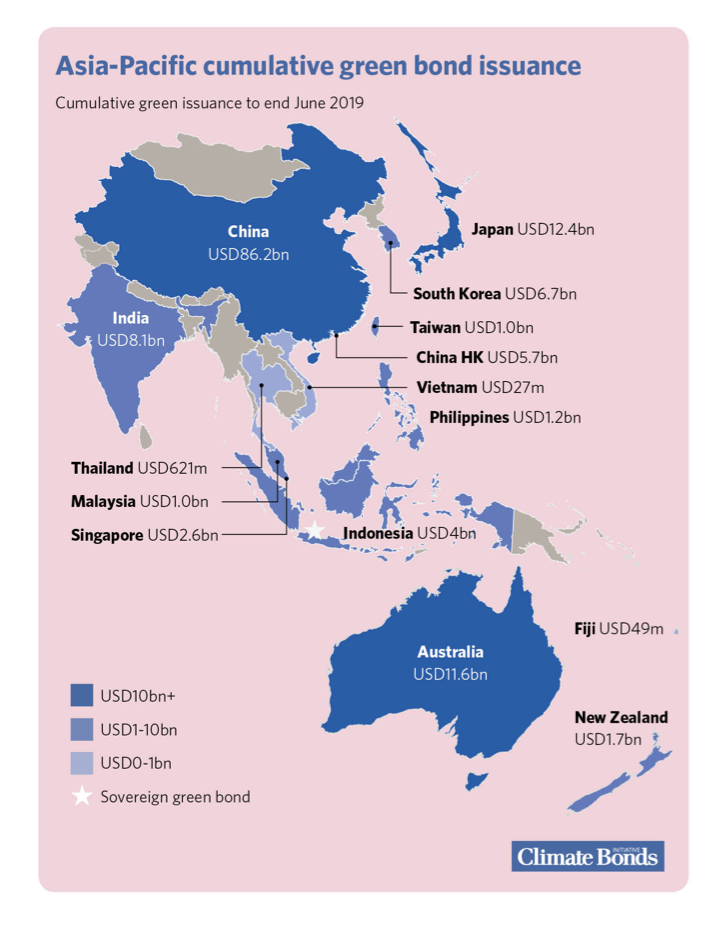

Australia and the Asia-Pacific

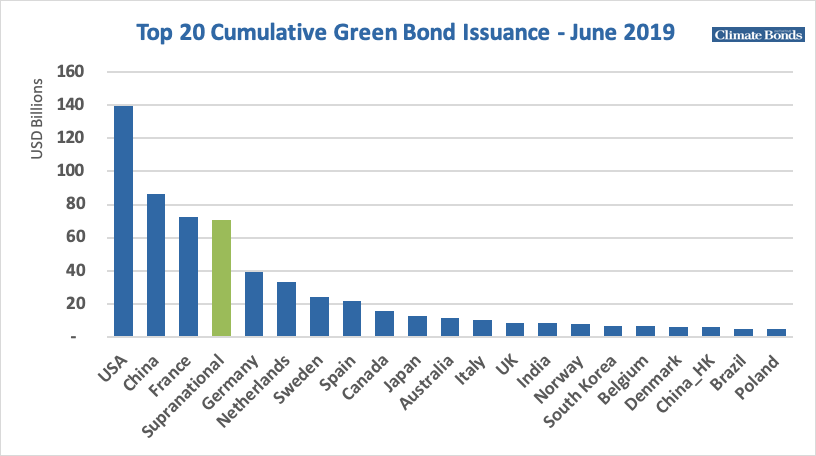

Green Finance State of the Market (SoTM) Australia 2019 reports that cumulative domestic green bond issuance reached AUD15.6bn (USD11.6bn) as of 30th June 2019, placing Australia third in the Asia-Pacific region behind China (USD91.5bn) and Japan (USD12.9bn) with South Korea at fourth (USD6.2bn).

Australia is tenth overall in cumulative global green bond rankings as of 30 June 2019. Total domestic issuance to date includes 35 deals (some comprising multiple tranches), from 15 issuers.

The 2019 GIIO report also points to Australia’s potential role as a green finance hub for Asia-Pacific in the 2020s, leveraging the green financial expertise of the banking sector and the ready capital and infrastructure investment experience of the superannuation sector, as nations in the region seek to meet their combined infrastructure, energy, development and climate goals.

We briefly pondered on this prospect way back in December 2016 and enlarged it on further in 2018. The opportunities for engagement remain.

Policy points for the 2020s

State of the Market puts forward a number of policy considerations for the 2020s including:

- Repeat Sub Sovereign issuance from state-based Treasury Corporations to advance infrastructure, resilience, congestion and emissions goals and act as a signal to markets, regulators and potential issuers.

- Building sustainability into the financial system including implementing recommendations from the Australian Sustainable Finance Initiative (ASFI) and measures to promote green finance and brown to green transition.

- Increased support for domestic green bonds and green infrastructure investment from the superannuation sector and a stronger foreign policy focus by government on green finance opportunities in the Asia-Pacific.

The Last Word

Notwithstanding limited progress in energy and state-based actions, federally, Australia has yet to develop a substantive framework of mitigation and adaptation policies to fully address the coming climate emergency and create climate resilience.

This is despite a surfeit of clean energy options and exposure to twin 21st-century climate based economic risks: A major global exporter of high carbon energy coupled with an emissions-intensive domestic economy, slow to progress on transition measures.

On the other hand, few nations enjoy such confluence of positive domestic circumstances: a robust banking sector with green finance expertise, a superannuation sector with proven infrastructure capability and willingness to explore new investment models, and widespread community support for increased government borrowing combined with new infrastructure investment partnerships.

The 2020s beckon,

Till next time,

Climate Bonds

We launch the 2019 New Zealand Green bonds and Infrastructure report on Friday 30th in Auckland. You can still register here.

Coming up later in 2019 are our 2nd Indonesia GIIO and inaugural LatAm GIIO report. Follow our Twitter and LinkedIn for details.

Acknowledgements and Thank You

Production of the Green Infrastructure Investment Opportunities Australia 2019 and the Green Finance State of the Market Australia 2019 reports has been jointly sponsored by ANZ, Commonwealth Bank of Australia, NAB and Westpac

In developing both 2019 reports, the Climate Bonds consulted with report sponsors ANZ, Commonwealth Bank of Australia, NAB and Westpac. Government, industry and financial sector bodies were also consulted.

We would also like to thank IFM Investors, CEFC, Cbus, HESTA, the Green Building Council of Australia, the Principles for Responsible Investment, GRESB and Responsible Investment Association of Australasia for their assistance.

Australian Launch events in Sydney and Melbourne kindly hosted and supported by Ashurst Lawyers.