2017 Green Bond Issuance Passes $100 Billion

New Global Green Finance Record Comes at Peak of COP23

LONDON: 15/11/2017 19:00 GMT: The latestClimate Bonds Initiative analysis shows green bond issuance in 2017 passing the significant $100bn benchmark, setting a new global record.

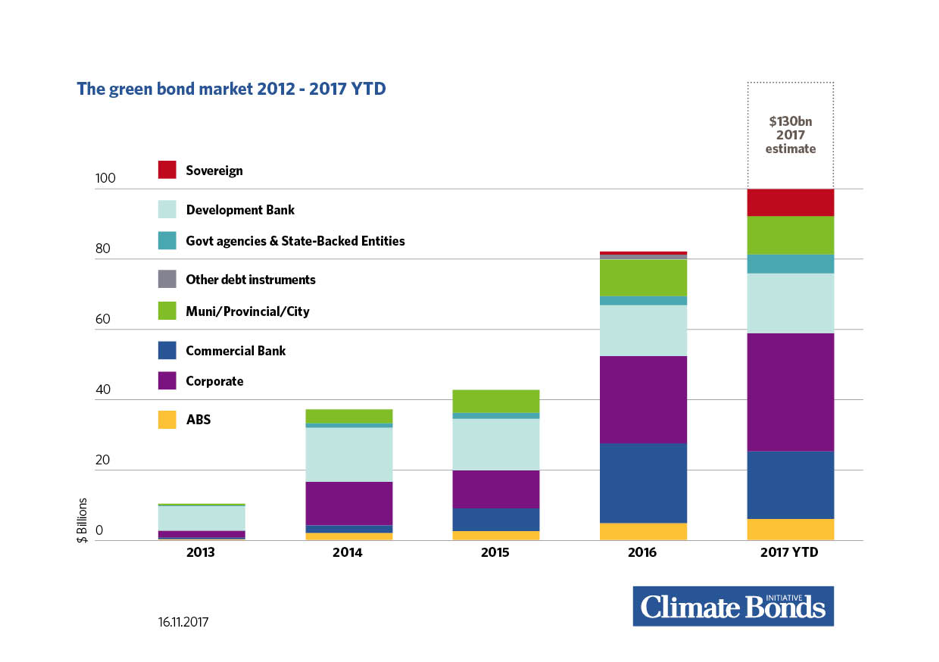

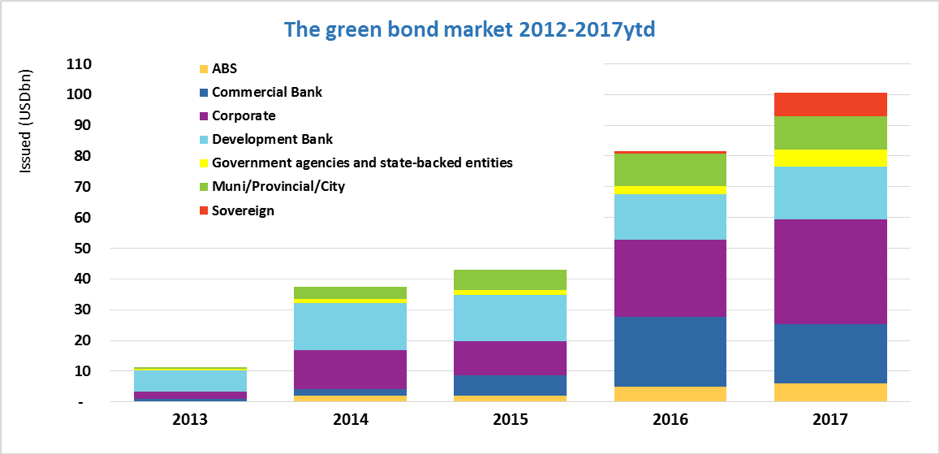

Issuance will reach USD101.4bn via the China Development Bank with a USD1.5bn+ green bond due to settle tomorrow (16thNovember). This bond will take the Climate Bonds figure on labelled green issuance from today’s USD99.79bn total to well over the USD100bn. The new record comes just six weeks after 2017 issuance overtookthe previous 2016 record of $81.6bn on 28thSeptember.

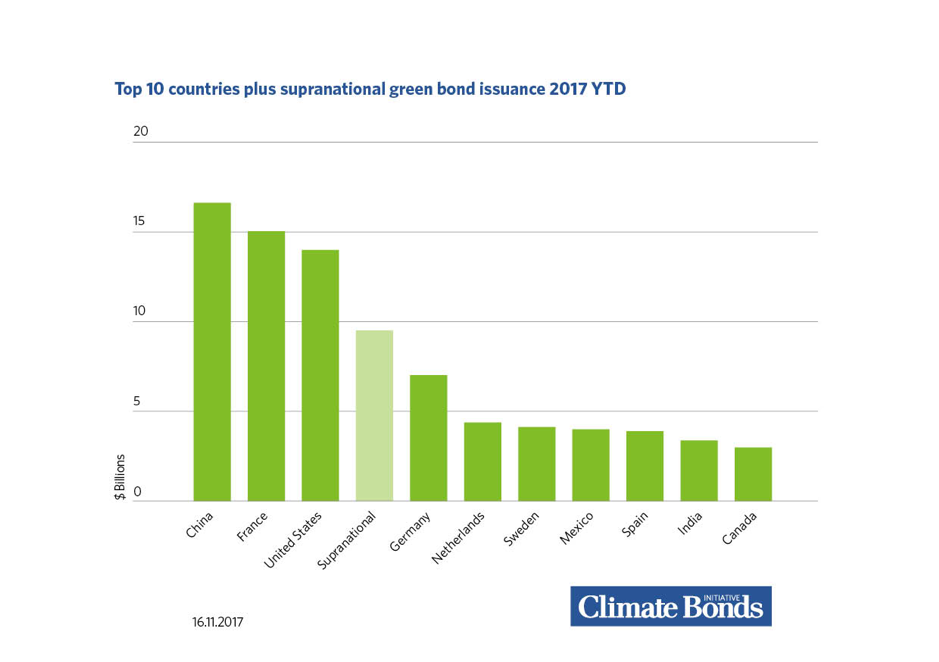

Leading the Top 10 national green bond issuance for 2017 to date is China followed by France, the United States, Germany, Netherlands, Sweden, Mexico, Spain, India and Canada. European nations have maintained their representation in the top 10, with emerging economies of Mexico and India prominent, reflecting the growth in their green finance markets. Full details in Table 1.

Major green bond issuers in the leading nations include China (China Development Bank, Bank of Beijing and ICBC), France (Republic of France, Engie & SNCF), United States: (New York MTA, Fannie Mae and Apple INC). Full details in Table 1.

Among recent announcements, the world’s biggest public company and bank, the Industrial and Commercial Bank of China (ICBC) issuing their inaugural green bond followed by the China Development Bank on November 10th. The moves send a strong signal to other global banks to step up their green bond commitments.

The ICBC and CDB bonds have all been Certified by the Climate Bonds Initiative, a positive indicator that China’s largest banks are pursuing global best practice in labelled green bond issuance.

During 2017, France became the second nation to issue a sovereign green bond and Fiji has become the first emerging economy, Pacific Island nation and first from the Southern Hemisphere to issue a sovereign green bond. Nigeria is expected to become the first African nation to issue a sovereign green bond in coming weeks.

Climate Bonds estimates a final figure for 2017 of up to USD130bn in green bond issuance.

Christiana Figueres, former UN Climate Chief, Convenor of Mission 2020

“Passing $100bn in green bond issuance shows we are moving capital flows in the right direction. The priority is to accelerate green finance and climate investment between now and 2020 at a scale never seen before.”

“A systemic response from global finance is required. Asset owners and managers need to adjust their capital allocations. Banks and corporates need to commence large scalegreen bond programs. Funding clean energy and green infrastructure to meet NDC goals is the objective. $1 trillion in green finance by 2020 is the performance measure.”

Nick Robins, Co-Director, UNEP Inquiry

"Green bonds are at the forefront of the wider shift to a sustainable financial system. Achieving the symbolic US$100bn milestone is a tangible sign that investors are willing to allocate capital at scale for climate action.”

“We now need to expand the asset pipeline of assets by working with banks on greening their core lending books and bringing in the policy frameworks that can enable the market to grow with integrity."

Sean Kidney, CEO, Climate Bonds

“Issuers, sovereigns, sub sovereigns, banks and corporations should respond positively to the many investor calls since COP21 in Paris for quality, investable green product, and enter the market.”

“We are looking for other nations to follow the lead of Poland, France,and Fiji on the sovereign issuance path. Nigeria is set to issue Africa’s first sovereign green bond. Now is the time for G20 and OECD countries to act and signal their intentions into 2018.”

“Our forecast of $130 billion in green bonds for 2017 is coming closer, but there’s a long way to go to reach the 2020 green finance milestone."

<Ends>

Head of Communications and Media,

Climate Bonds Initiative

+44 (0) 7914 159 838

andrew.whiley@climatebonds.net

Notes for Journalists

About the Climate Bonds Initiative: The Climate Bonds Initiative is an investor-focused not-for-profit, promoting large-scale investment in the low-carbon economy. More information on our website here.

Green Bonds Year on Year Growth:Labelled green bond issuance in CY 2016 reached USD81.6bn, 92% up on the 2015 figure of USD43.2bn. The CY 2014 figure was USD36.6bn.

2016 included the world’s first sovereign green bond issued by Poland. More information can be in our 2016 Market Highlights report here.

About the 2017 USD130bn issuance forecast: Climate Bonds forecast of $130bn was a revision and arrived at after assessment of the progress in the early months of 2017.

More information is in our Policy Highlights from Q1-Q2 2017.

About the $1tn by 2020 target:Climate Bonds identified $1trillion by 2020 as an objective in our Green Finance Briefing Paper prepared in October 2016 for COP22 Marrakesh.

About the M2020 Project: the M2020 project identifies six critical global climate actions needed by 2020. In April 2017 Christiana Figueres and other climate leaders called for tenfold increase in green bond investment from 2016 levels and setting a green finance milestone for 2020 of $1trillion as one of the actions.

The call was repeated in Nature Magazine in June and subsequently included as a forward goal in the Bonds and Climate Change State of the Market 2017 annual flagship report from Climate Bonds Initiative.

2017 Additional Information, Data, Images, Pages 4-7.

Table 1: Top 10 Nations Green Bond Issuance 2017 YTD.

|

Top 10 Nations

|

Total in USD, bn 01/01/2017-16/11/2017 |

Top 3 largest green bond issuers for each nation including supranational |

||

|

China |

16.6bn |

China Development Bank |

Bank of Beijing |

ICBC |

|

France |

15,0bn |

Republic of France |

Engie |

SNCF |

|

United States |

14,0bn |

New York MTA |

Fannie Mae |

Apple INC |

|

Supranational |

9,52bn |

EIB |

IFC |

Asian Development Bank (ADB) |

|

Germany |

8,1bn |

KfW |

Berlin-Hyp* |

Innogy |

|

Netherlands |

4,3bn |

TenneT Holdings |

NWB Bank |

Obvion |

|

Sweden |

4,1bn |

Swedbank |

Nordea Bank |

SEB |

|

Mexico |

4,0bn |

Mexico City Airport |

||

|

Spain |

3,9bn |

Iberdrola |

Gas Natural Fenosa |

ADIF ALTA VELOCIDAD |

|

India |

3,3bn |

Greenko |

IREDA |

Azure Power Energy |

|

Canada |

2,9bn |

TD Bank |

Export Development Canada |

Province of Ontario |

Table 2: CY 2016 Top 11 Nations +Supranational Green Bond Issuance

(Overall total for 2016, $81.6bn)

|

Top 11 Nations Green Bond Issuance for CY 2016, in USD amount issued |

|

|

CHINA |

22,438,195,762.00 |

|

UNITED STATES |

15,866,421,704.04 |

|

Supranational |

10,182,646,666.30 |

|

FRANCE |

4,985,914,675.00 |

|

NETHERLANDS |

4,965,542,200.00 |

|

GERMANY |

4,403,633,000.00 |

|

SWEDEN |

3,258,462,420.00 |

|

SPAIN |

2,745,650,800.00 |

|

MEXICO |

2,156,680,000.00 |

|

HONG KONG |

1,555,546,000.00 |

|

INDIA |

1,552,150,600.00 |

|

JAPAN |

1,097,780,000.00 |

Chart 1: Top 10 Countries + supranational, green bond issuance to $100bn at 16/11/2017

Chart 2: Green Bond Market 2012 -2017 YTD by Issuer Type

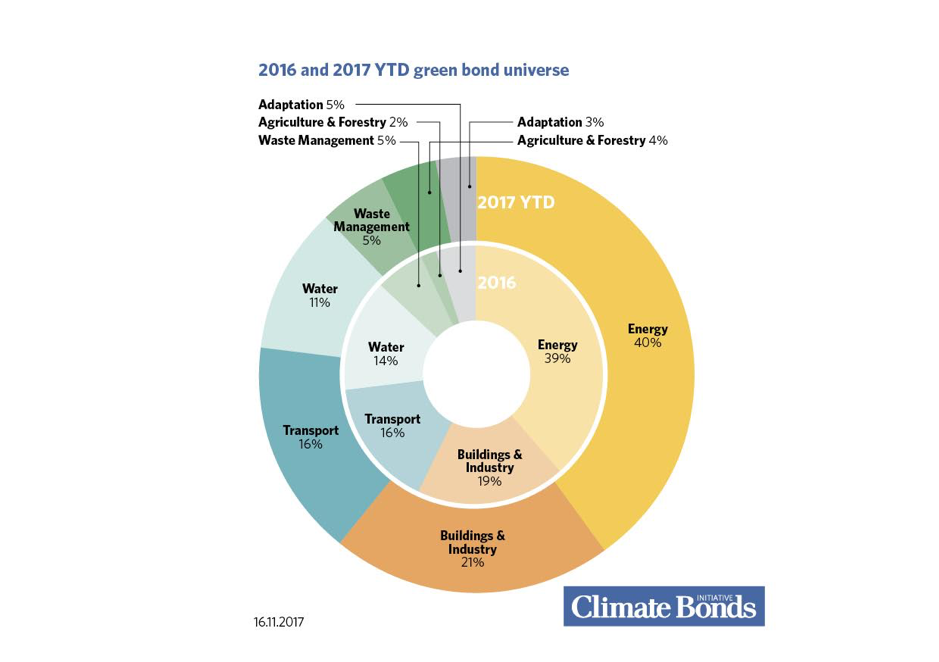

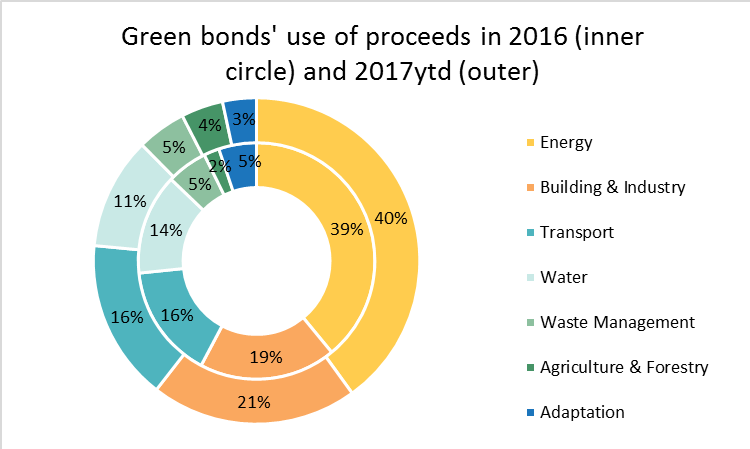

Chart 2 Use of Proceeds Comparison 2016-2017 YTD

Use of proceeds on the $100bn to date is 2017 is remaining broadly consistent with 2016 patterns, however we expect to see green buildings, water, waste management and agriculture/forestry increase in proportion over time.

<ENDS>

- Correction: An earlier version of this communication had an error in the Top 3 German issuers in Table 1 and subsequently the final figure for Germany. This has now need rectified. The error did affect the relative national rankings. Our apologies.