Climate Bonds Blog

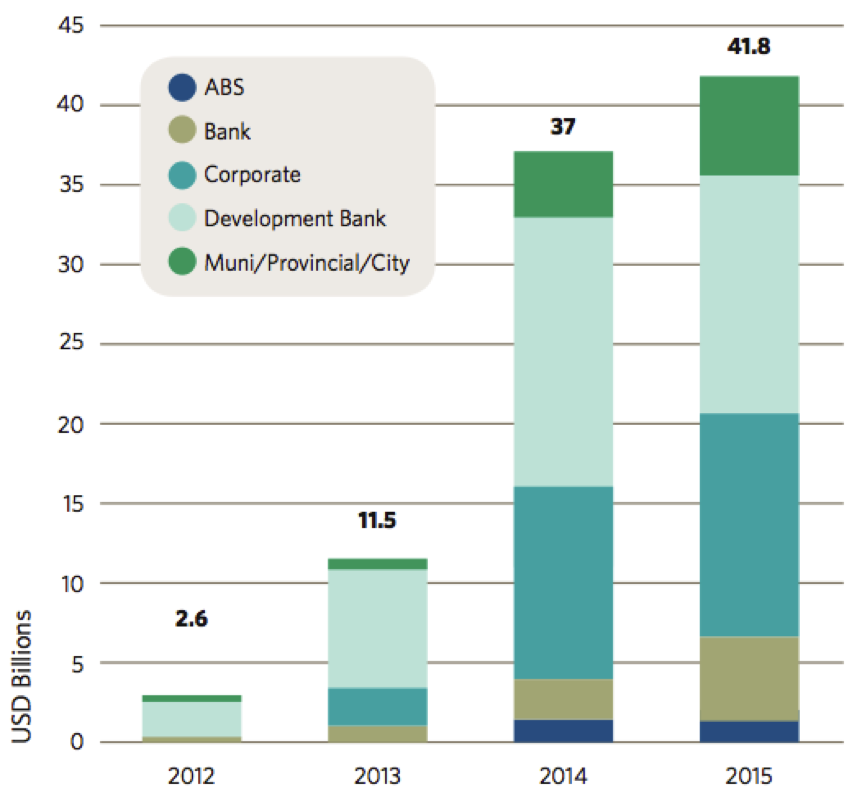

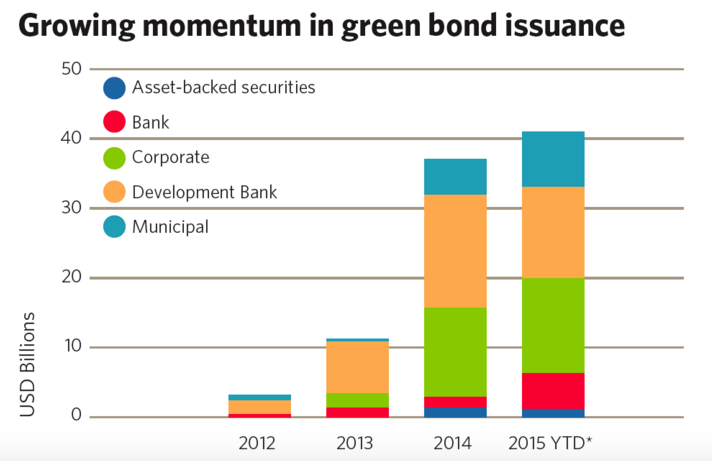

2015 was a magnificent year for green bonds (look out for our year-end market summary coming soon!). Q4 is in particular a busy quarter for green bonds – a total of $14.87bn were issued, and November was the largest monthly issuance EVER with $7.4bn of green bonds. The 3 largest individual issuances of the year also hit the market in Q4 with a €1.5bn ($1.66bn) bond issued by KfW, two tranche deal of €0.5bn and $0.8bn ($1.3bn) issued by ING Bank; and a green bond totalling $1.25bn from EDF.

The Low Carbon Transport Standard has been out for public comment since late October and is now nearing the end of its consultation phase. We welcome all interested parties to submit comments to Justine Leigh-Bell before COB 31 December.

The Climate Bonds Initiative is an investor-focused NGO working to mobilise the largest capital market of all, the $100 trillion bond market, for climate change solutions.

We're looking for an energetic and organised

Office and Administration Manager

Reporting to the CEO, the job involves a mix of hands on financial management of the organisation's accounts and associated reporting, and general administration support. We're looking for a self-starting motivated individual ideally with previous experience in small organisations.

November was a good month for the green bonds market: the largest month of issuance to date, the first green bond from Mexico and a first green bond from Indian development bank IDBI.

There was also a flurry of banks with USD1 billion or more mandates including Credit Agricole, HSBC, Barclays, Deutsche Bank, KfW and IFC. We also had some prominent joiners to the Climate Bonds Partners programme including Blackrock, Thomson Reuters, EY and IDBI.

It’s been a busy year for green bonds, how much have you been paying attention?

Take the 2015 Climate Bond quiz

Last year’s top climate bonds boffin was SEB’s Marianne Gut.

The green bonds market has developed a lot in the past year. It’s time we celebrated that!

On 3 February 2016 the Climate Bonds Initiative will announce the 2015 Green Bond Pioneer Awards, kindly hosted by the London Stock Exchange (and its green bond listing).

Come and celebrate! The Awards will honour pioneering organisations and individuals whose green bond activities have been leading the market in creating climate finance solutions.

London: The alliance that launched the Green Infrastructure Investment Coalition at COP21 are inviting institutional investors & development banks to join the coalition in 2016 to promote the large scale financing of green infrastructure

What’s the GIIC coalition for?

People’s Bank of China (PBoC) today announced new guidance on green bond issuance in China’s inter-bank bond market.

中国人民银行(央行)在今天发布了银行间市场绿色债券发行公告。

The PBoC has also published Green Projects Catalogue developed by Green Finance Committee, China Society for Finance & Banking (GFC), defining assets and projects qualified for green bonds.

同时,央行也公布了《绿色债券支持项目目录》。该目录由中国金融学会绿色金融专业委员会(简称“绿金委”)开发,为绿色债券融资项目提供界定标准。

Streamlined assessment tool for investors and intermediaries

Climate Bonds Initiative has released the Climate Bonds Standard V2.0, the next iteration of an overarching multi-sector standard that allows investors and intermediaries to easily assess the environmental integrity of bonds claiming to be green and funding the low carbon and climate resilient future.