November was a good month for the green bonds market: the largest month of issuance to date, the first green bond from Mexico and a first green bond from Indian development bank IDBI.

There was also a flurry of banks with USD1 billion or more mandates including Credit Agricole, HSBC, Barclays, Deutsche Bank, KfW and IFC. We also had some prominent joiners to the Climate Bonds Partners programme including Blackrock, Thomson Reuters, EY and IDBI.

Run up to COP21

Bloomberg, Global Climate Deal Would Increase Green-Bond Issuance, IFC Says, Andrew Mayeda

Author argues that a global deal to reduce emissions will directly translate into further growth of the green bonds market.

A global deal to reduce greenhouse-house gas emissions at talks beginning this month in Paris would boost issuance of so-called green bonds linked to projects that combat climate change, according to the World Bank Group’s International Finance Corp.

Deutsche Welle, Financing Climate Protection, Nils Zimmermann

Author blandly states that climate talks are all about money. He lists measures necessary to shift private investment money away from carbon-intensive investments and towards climate-friendly spending. Climate bonds make top of his list.

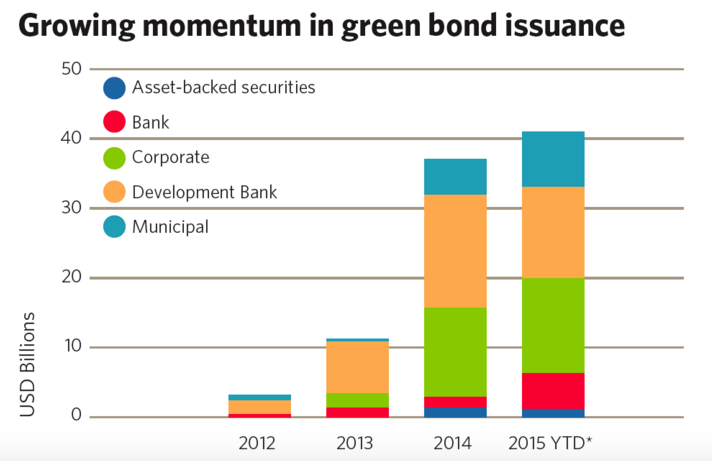

While green bonds remain a very small proportion of all bonds sold - just $40 billion for 2015 –the Climate Bonds Initiative hopes that by setting up green bonds standards and recruiting influential financial industry players in support, it's laying the groundwork for the green bond market to grow rapidly in future.

Business Green, Global CEOs issue rallying call for 'ambitious' COP21 deal, Madeleine Cuff

In the run up to COP21, global business leaders voice their expectations for the conference. Their statement includes a call for a greater use of green bonds.

The business leaders also said they support calls for companies to assess their resilience to climate risks and would welcome greater use of green bonds and other financial tools to stimulate investment in clean energy and energy efficiency projects.

Environmental Finance, Green bond comment, November, Graham Cooper

EF, in its monthly green bonds market summary, says that the strong November brought “Indian summer” to December COP21 meetings.

A second strong month in the green bond market, after a lacklustre summer, has seen new issue volumes in 2015 already surpass last year's total. And market insiders are bullish about prospects for next year.

The Fifth Estate, Green bonds could bridge the world’s carbon commitment gap, David Thorpe |

The Fifth Estate reports on the November’s G20 leaders meeting and circumstances of coming to an agreement on the communiqué on climate change ahead of COP21.

Focus on China

Global Capital, China: a laboratory for green finance

A deep-dive into climate finance made in Asia. Talking about China’s global climate finance leadership, author says green bonds are at the heart of greening country’s financial system. He analyses resentments of Asian developing nations against the industrialised countries and difference between green and climate finance. Well-worth reading!

Others agree that China, in particular, has taken giant strides towards greening its financial system. Speaking at a conference on Chinese green bonds hosted by the London Stock Exchange in October, Sean Kidney, CEO of the Climate Bonds Initiative (CBI), described China as a “laboratory” for green finance.

Global Capital, China’s challenge — the pursuit of ecological civilisation

Author looks at the mind-bogging infrastructure developments in China and analyses the environmental cost of the rapid growth. At the same time, he argues that only further – but climate smart - investments in infrastructure may heal the noxious state of its environment.

Sean Kidney, CEO of the Climate Bonds Initiative (CBI), says that lifting one billion people out of poverty probably ranks as the achievement of the millennium in terms of its socioeconomic impact, both within China and elsewhere. But he adds the significant rider that this economic transformation has come at a very high ecological cost.

South China Morning Post, China’s green bond market set to rocket in the next five year

An article based on an interview with Sean Kidney, CEO of Climate Bonds Initiative. In the run up to launch of new financial regulations by the People’s Bank of China, he calls allowing foreign investors invest in green projects in China a “revolution”.

Mainland China’s green bond market could grow up to 10-fold by 2020 as Beijing is expected to soon roll out regulations on its development. “In China, it is a top down revolution, the government has decided the economy needs to go green … [It] has lifted a billion people out of poverty … but at an incredible sacrifice to the environment which can’t go on,” Kidney said in an interview with the South China Morning Post.

IDBI first green bond & Climate Bond partnership

Indian development bank IDBI came to the market with their first green bond, joining pioneer Indian issuers Yes Bank, Exim Bank and CLP. The bond is “Climate Bonds Taxonomy” aligned. More so – IDBI joined the Climate Bonds Partners programme and undertook to apply for certification early in 2015, as soon as relevant Climate Bond Standards criteria are published.

All that news got media excited!

Reuters, Green bond offerings rise on govt's clean-energy push, Umesh Desai

"There has been this extraordinary policy push in India. State companies have taken up Prime Minister Modi's mission to grow clean energy and green infrastructure," said Sean Kidney of the London-based Climate Bond Initiative.

Live Mint, IDBI Bank raises Rs2,310 crore via green bonds

IDBI Bank launched a “$350 million five-year Reg S green bond issue on 23 November” and the issue was oversubscribed by three times.

DNA India, IDBI Bank raises Rs 2,310 crore via green bonds to fund energy projects

Commenting on the development, IDBI Bank MD K.P. Kharat said the bank is keen to work in growing green debt capital market and supports government's initiatives for a green Indian economy.

Hindu Business Line, IDBI Bank mops up $350 mn via Green Bonds

Further, IDBI Bank has also decided to become a member of Climate Bonds Initiative - an international organisation focusing on mobilising huge funds for climate change solutions

Switchboard - NRDC blog, Financing Clean Energy Growth - Scaling up Green Bonds in India, Sameer Kwatra

With finance as a major point of discussion at the climate summit, next week, India is moving forward with innovative instruments such as green bonds to achieve its ambitious climate targets.

PV Tech, India’s IDBI Bank raises US$350 million through Green Bond issue

Sean Kidney said: “IDBI has been ramping up it’s lending in green infrastructure – but not just for the big stuff. They’re also supporting distributed generation: for example, they’re providing the capital for roll-out of loans for solar irrigation pumps for hundreds of thousands of farmers.”

Clean Technica, India’s IDBI Bank Raises $350 Million Through Green Bonds, Saurabh Mahapatra

This year saw the first green bond issue in India, and several public and private sector organisations have received tremendous response to green bond issues.

Mexico’s first green bond from Nafin

Switchboard - NRDC blog, Latin America Green News: Colombia ill-prepared for effects of climate change, Mexico issues first green bond, Don Diego threatens to cause international conflict, Maria Martinez

Mexico is the third country in Latin America to issue a green bond, but is the first to gain Climate Bond Certification from the Climate Bonds Standard Board. Proceeds from the bonds will be used exclusively on wind energy projects.

SeeNews Renewables, Dev bank Nafin issues USD-500m green bond for Mexican wind, Tsvetomira Tsanova

“A Mexico based bond issuance with Climate Bonds Standard Board certification sends a positive signal throughout Latin America and internationally that green bonds can be a valuable source of development capital for a range of low carbon projects,” said CBI head Sean Kidney

Read our press release and our blog announcement

Barclays commitment

Barclays (Climate Bonds Partner) this month announced it had invested its first USD 1 billion in green bonds within 12 months of making the commitment, and then committed to a second $1 billion.

The Financial, Barclays reaches £1 billion Green Bonds target and commits to a further £1 billion

Barclays has undertaken thorough due diligence to establish the social and environmental credentials of the proposed investment portfolio, including engaging with the issuers and also the leading NGO in this area, Climate Bonds Initiative.

The Wall Street Transcript, Barclays plc: Barclays reaches £1 billion Green Bonds target and commits to a further £1 billion

Barclays today confirmed it has reached its target of investing over £1 billion in Green Bonds and has made a commitment to invest a further £1 billion. This represents one of the largest Green Bond investment commitments by any institution globally.

Energy Live News, Barclays to commit £1bn more in green bonds, Laura Buckley

Tushar Morzaria, Group Finance Director, Barclays, said: “As the green bond market matures this instrument presents an increasingly powerful proposition and one which has the potential to push green projects including renewables forwards at pace.”

Clean Technica, Barclays Hits £1 Billion Green Bond Target, Commits To £1 Billion More, Joshua S Hill

“We’re pleased to be an early adopter in the fast-growing and exciting area and will continue to support this market through our investments, products and services.” said Tushar Morzaria, Group Finance Director, Barclays.

Water Climate Bonds Standard

In November, we launched the public consultation for the proposed Water Climate Bond Standard. Remember - you can still submit your comments to Climate Bonds Standards Manager, Justine Leigh-Bell.

Global Capital, Green activity ramps-up as climate change conference approaches, Lewin McLellan

Summary of the growing activity in the green finance area including launch of the public consultation for the proposed Climate Bond Standard for water bonds.

European Investment Bank has launched its first equity index-linked bond dedicated exclusively to renewable energy and energy efficiency project as the Climate Bonds Initiative begins a public consultation on a proposed standards for water bonds.

Energy Live News, Water climate bond standard consultation opens, Laura Buckley

Climate Bonds Initiative’s (CBI) standard is expected to allow investors to prioritise projects which seriously take into consideration climate impacts and resilience.

Blackrock partnership

Pioneers Post, Blackrock backs green bonds, Ellie Ward

News of Blackrock partnership with the Climate Bonds Initiative included in the Pioneer’s Post weekly Global Social Innovation round-up.

The world’s largest asset manager Blackrock has announced it is going into partnership with the Climate Bonds Initiative to support the development of the global green bonds market.

Climate Change News, BlackRock partners with Climate Bonds Initiative, Megan Darby

The world’s largest investor has signed up to promote green bonds, as part of a push to get money flowing into climate-friendly projects.

Business Green, BlackRock to promote climate bonds in impact investment drive

Clean Technica, World’s Largest Investor, BlackRock, Eyes Green Bonds Market, Partners With Climate Bond Initiative, Smiti Mittal

BlackRock joins the likes of Barclays, Citi Group, and HSBC to partner with the Climate Bonds Initiative. BlackRock manages $4.5 trillion in assets globally

Read Climate Bonds blog announcement

EY partnership

Energy Live News, EY becomes Climate Bonds Partner

Global services firm EY has become a Climate Bonds Partner. (…) Climate Bonds Partners assist in developing initiatives which help increase investment and help tackle climate change.

Clean Technica, EY, Thompson Reuters Partner With Climate Bonds Initiative, Smiti Mittal

Financial as well as non-financial institutions and agencies continue to partner with the Climate Bonds Initiative to increase their presence in the global green bonds market.

Commercial Property Executive, EY Becomes a Climate Bonds Partner

Climate Bonds CEO Sean Kidney said, “EY has been a leader in a wide range of climate, carbon and sustainability initiatives,” in a prepared statement.

Read Climate Bonds blog announcement

Standards

Financial Times, To Thrive, Green Bonds Need Standards for Environmental Impact, Todd Cort, Cary Krosinsky

Authors explain why the market needs standardized methods for assessing the environmental impact of a project.

The convergence of these factors will either move us toward a standardized approach to “green due diligence,” or kill the green bond movement and relegate lending for environmental benefit to the purview of governments. Let’s hope for the former.