Marianne Gut, Portfolio manager at the Skandinaviska Enskilda Banken (SEB) is the winner of the 2014 year-end green bonds quiz. She was the only player to score 100% at the first take of the quiz. Marianne becomes our "Climate Bonds Boffin 2014"! She wins a lifetime subscription to the Climate Bonds blog, lucky thing.

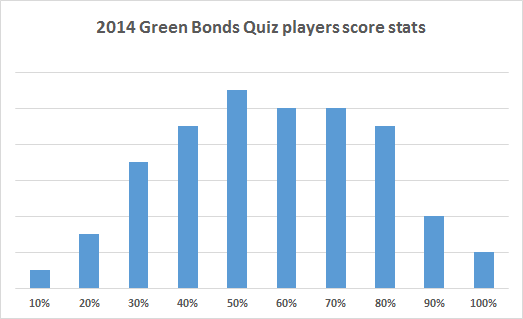

Now the rest of us just have to see how our scores compared to others - see below.

- How many green bonds were issued in 2014?

- $35bn

- $11bn

- $200bn

- $5bn

Answer is A) $35bn, more than triple 2013 (in fact we've just found some more, so the figure has crept up to $36bn since we published the quiz). Next year we're hoping for $100bn!

- What percentage of 2014 labelled green bonds had an independent review (also called a “second opinion”)?

- 10%

- 42%

- 58%

- 100%

Answer is C. Though half the remaining 42% are accounted for by European Investment Bank Climate Awareness Bonds, leaving only a further 19% without an independent review.

- How many underwriting banks have signed up to the Green Bonds Principles (as of December 2014?

- 4

- 50

- 260

- None – it’s just for NGOs battling climate change.

It's 50 - check out the full list and the guidelines. With so many dealmakers on board we expect a big 2015 for green bonds.

- “Labelled” Green bonds have been issued in Europe, Africa, Asia, North America and most recently South America. But in 2014 how many countries are home to a green bond issuer (excluding Supranational/development banks)?

- Too many to keep track. Even Saudi Arabia is going for it.

- 25

- 17

- 10

We count 17: that’s Australia, Austria, Canada, China, France, Germany, Italy, Japan, Netherlands, Norway, Peru, South Africa, Spain, Sweden, Taiwan, UK and the United States.

- What was the largest corporate bond deal of the year (in USD)?

- GDF Suez

- Iberdrola

- Toyota

- Hera SPA

GDF Suez green bond in March was the largest deal totalling a whopping EUR2.5bn ($3.5bn), followed by Toyota’s $1.75bn across 5 tranches. Iberdrola’s green bond totalled EUR750m ($1bn) in April and Hera’s was EUR500m ($680m) in June.

- Which development bank issued the largest amount (in USD) of green bonds in 2014?

- European Investment Bank (EIB)

- World Bank

- KfW (German development bank)

- Agence France Development (AFD)

EIB issued a humungous $5.6bn of “Climate Awareness Bonds” in 2014. KfW only came onto the scene in July but managed to issue $3.5bn over just two bonds. The World Bank issued $2.86bn and AFD issued its first green bond for $1.3bn.

- In July, the Climate Bonds Initiative and HSBC released a report sizing the climate bonds market. (Climate bonds are issued by companies with 100% climate related assets, or as 100% asset backed, but are not labelled as green although we consider them to be green.) What was the amount of outstanding climate bonds worldwide?

- $102.6bn

- $80.6bn

- $502.6bn

- $35 bn

Answer is C) $502.6bn is outstanding and climate focused. To find out more check out the State of the Market report.

- What issuer provided trail-blazing quantitative reporting on CO2 saving?

- Vasakronan

- KfW

- Regency

- Unilever

KfW – “KfW estimates the environmental impact of KfW’s green bond and its EUR 1.49bn net proceeds will prevent approximately 1.2mn tons of greenhouse gas (GHG) emissions per annum*. This corresponds roughly to the GHG-reducing effects of a forest of the size of London and Berlin combined”. 2015 will be an important year for reporting with so many first time issuers in 2014. KfW is leading the way with their reporting.

- Which of the following has NOT yet produced a green bond index?

- MSCI Barclays

- S&PDJI

- Solactive

- Burger King

Burger King – what are they waiting for?! S&P Dow Jones, Barclays/MSCI, Bank of America and Solactive have all created Green Bond Indices in anticipation of continued market growth.

- Sean Kidney is a busy man. In 2014 how many countries has he presented in about green bonds?

- 12

- 22

- 48

The answer is B, excluding multiple visits to a country. Now you know why he’s so keen on biofuels for aviation.