$200bn marks a solid best practice platform as Climate Bonds Standard sets to expand its reach into heavy industry

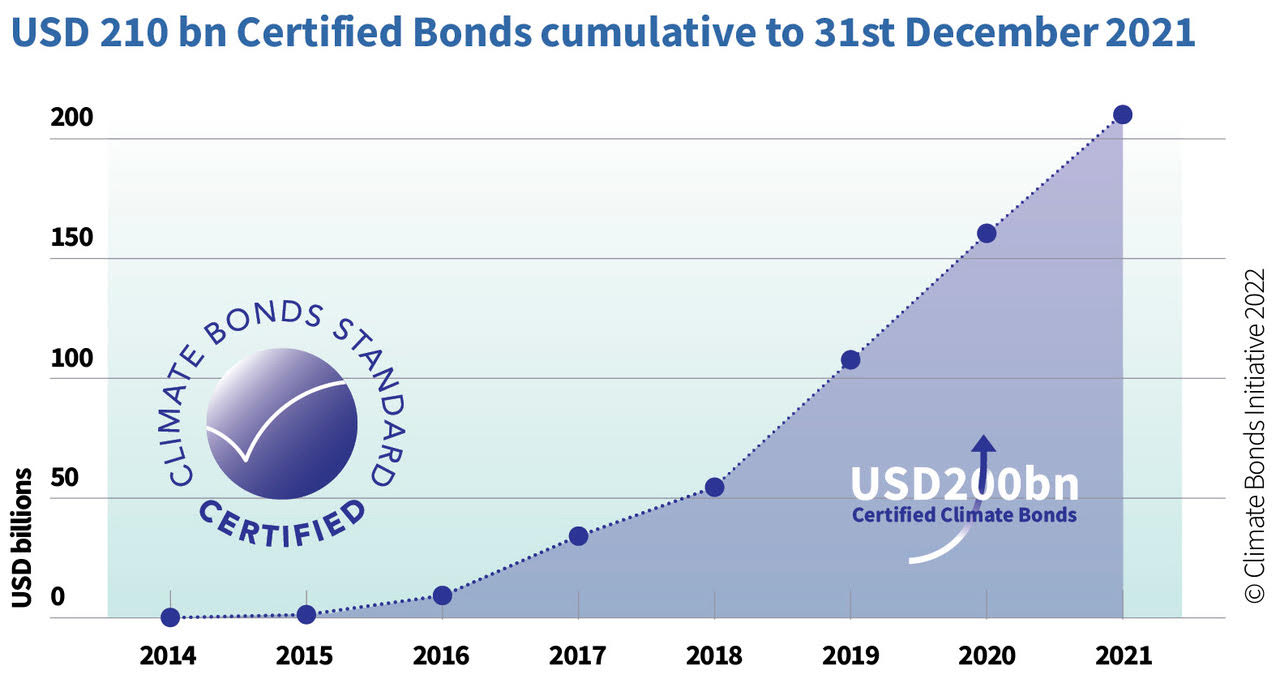

Cumulative issuance under the Climate Bonds Standard passed USD200bn in late 2021, establishing a new milestone for international best practice in green investment.

Certified green bonds, loans, sukuk (and other debt instruments such as, green deposits, leases, commercial paper and repos) have now been issued by over 220 issuers from 40 nations, helping to establish green market investment standards and harmonised definitions in multiple jurisdictions in both developed and emerging economies.

This latest milestone demonstrates that market appetite for credible, robust science-based green issuance remains strong.

Heavy emitting sectors in 2022 – Chemicals, Cement, Steel

Standards for heavy emitting sectors are currently under development with aims for release this year. Basic Chemicals, Steel and Cement criteria will be considered by the Climate Bonds Standards Board before undergoing public and industry consultation throughout the year. Consultation on Basic Chemicals is scheduled to open in February.

Entity Level Certification in Chemicals and Cement

The Basic Chemicals and Cement sector will be the first to see criteria that can be used to assess both Use of Proceeds (UoP) instruments and significantly, entity-level instruments. This will enable the Standard to encompass Sustainability-linked Bonds (SLBs) and Sustainability-linked Loans (SLLs) - a huge progression in Certification options open to issuers.

Highlights from 2021

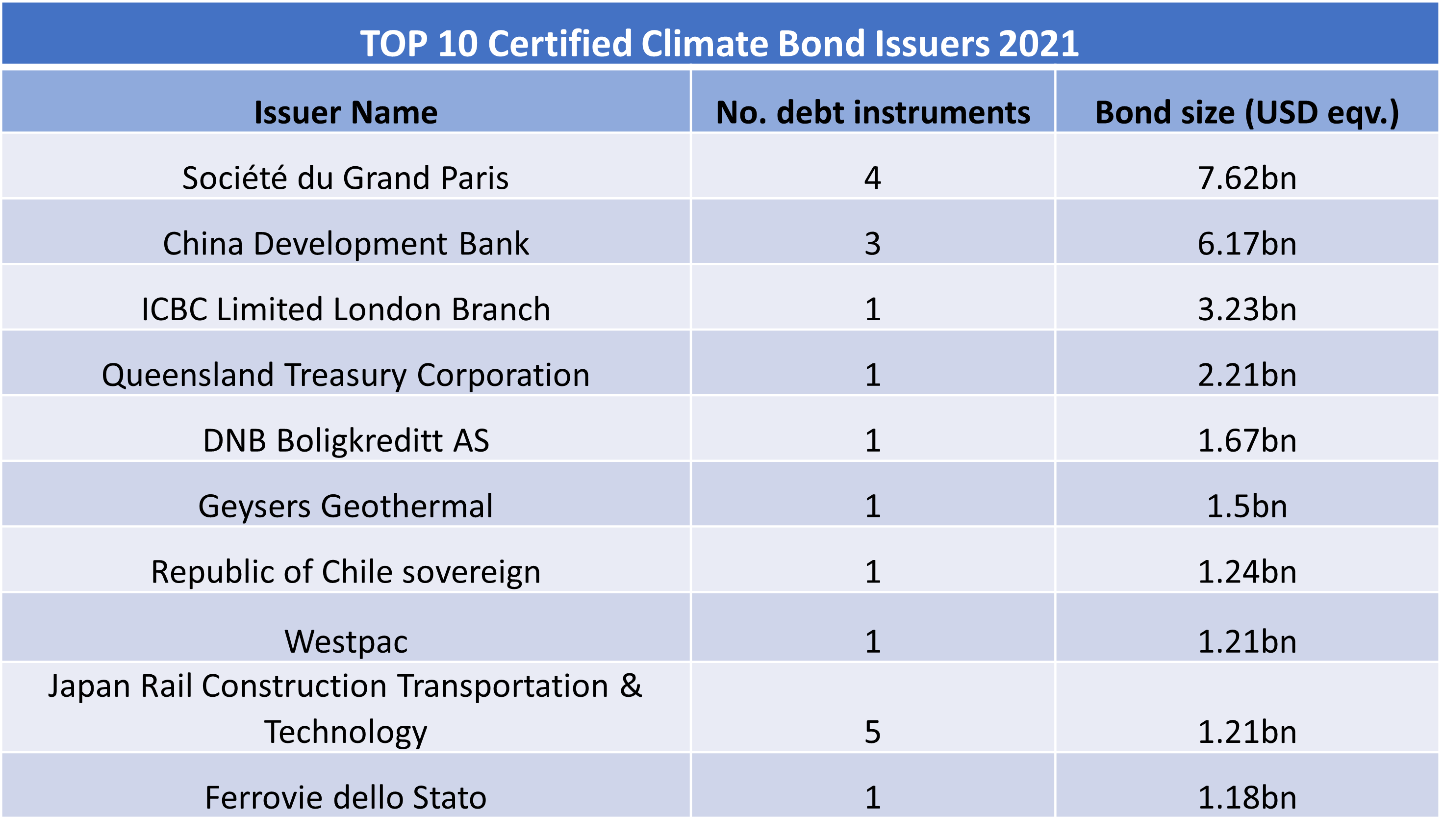

2021 saw a total of USD53.9bn in Certifications awarded under the Climate Bonds Standard. French rail operator Société du Grand Paris (SGP) was the single largest Certified Bond Issuer in 2021 with USD7.62bn in Certified green issuance and is the largest cumulative Certified issuer with USD24.98bn in multiple bonds.

The Republic of Chile issued the nation’s debut sovereign green bond (and the 7th Certified sovereign issuance to date) at the start of 2021, with its EUR400m and USD750m (total USD1.26bn eqv.) placements with the proceeds allocated to Low Carbon Buildings and Transport sectors.

In Australia, the Queensland Treasury Corporation (QTC) issued green bonds totalling AUD3bn billion (USD2.21bn eqv.) to finance low carbon transport infrastructure across the state. The QTC's continued issuance of green bonds under the Climate Bonds Standard has benefited from Programmatic Certification this year.

Elsewhere, Oberlin College issued a Certified Climate Bond as part of its strategy to reach campus carbon neutrality by 2025, following an issuance from another American Educational Institution, Stanford University, which issued in April. We foresee educational institutions increasingly taking to green finance as part of a growing trend over the coming years.

Chinese bank Certifications

China produced several prominent Certifications in 2021, with major banks continuing their previous practice of issuing multiple green bonds against the Climate Bonds Standard.

State-led China Development Bank raised over RMB40bn (USD6bn eqv.) over three issuances used for ecological protection and green development along China’s Yellow River Basin.

The world’s largest bank, Industrial and Commercial Bank of China (ICBC) returned to the market with another Certified Bond GBP2.34bn (USD3.23bn eqv.), with use-of-proceeds dedicated to Low Carbon Transport, Marine, Solar, and Wind Renewable Energy.

5 new sector criteria launched in 2021

2021 saw an expansion in the reach of the Climate Bonds Standard, enabling Certification to verify best practice climate investment in additional industry sectors.

Certifications were granted for green investment across 5 new Sector Criteria in 2021: Grids and Storage, Hydropower, Bioenergy, Geothermal, and Shipping.

We expect further Certifications from leading issuers in 2022.

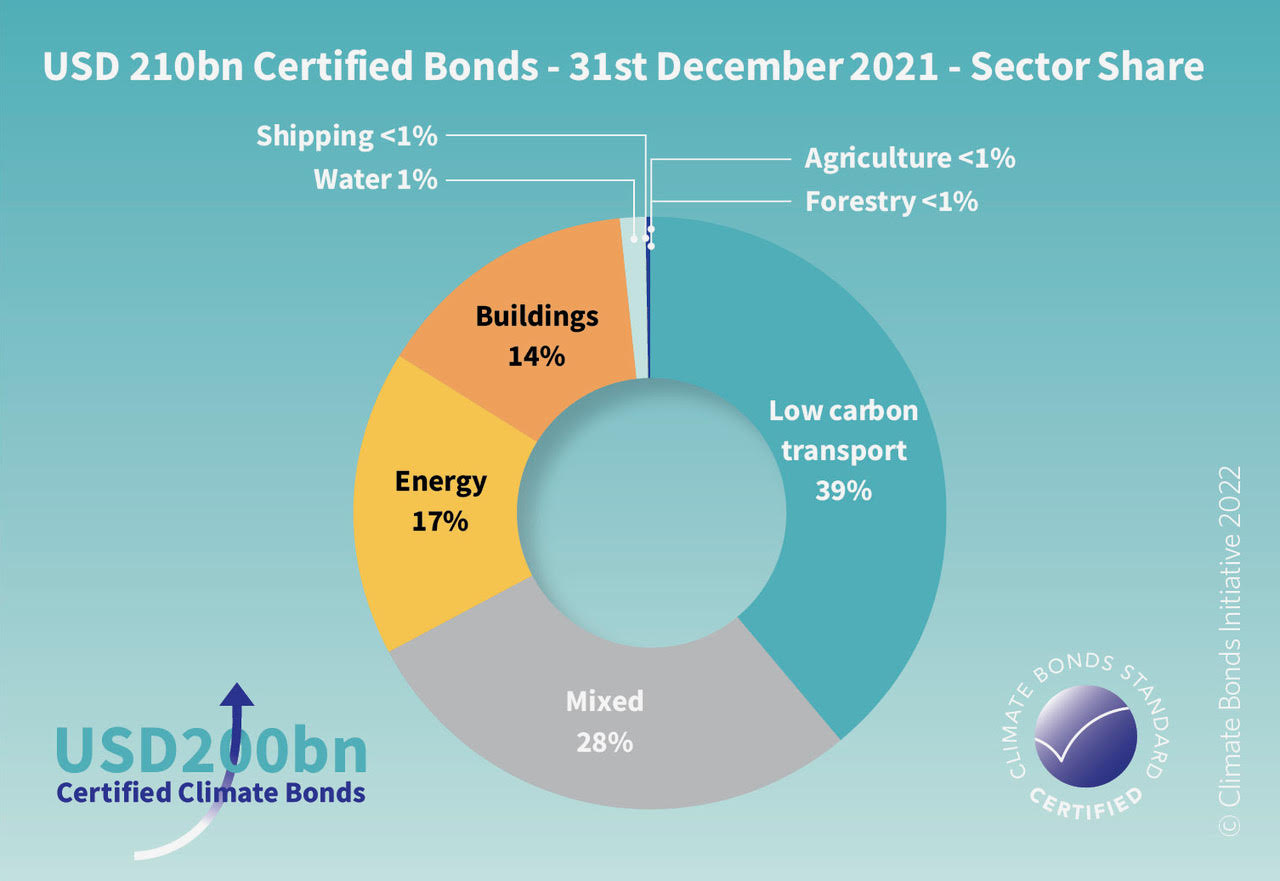

Low carbon transport has seen the largest share of Certifications with 39% of the total volume. Issuances that finance projects across 2 or more sectors are responsible for 28% of the total volume. Energy projects (17% share) and building projects (14% share) are the third and fourth largest Certified sectors respectively.

Standard reaches 6 new nations

The expansion of 2021 has also been geographical, with Certifications under the Standard in 6 new countries: Costa Rica, Dominican Republic, Finland, Hungary, Malawi, Mauritius.

They join Certified issuance from Australia, Barbados, Belgium, Brazil, Canada, Chile, China, Colombia, Dubai, France, Germany, Greece, Hong Kong, India, Italy, Ivory Coast, Japan, Kenya, Luxembourg, Mexico, Morocco, Netherlands, New Zealand, Nigeria, Norway, Panama, Peru, Philippines, Poland, Russia, Singapore, South Africa, Spain, Sweden, Switzerland, Thailand, United Arab Emirates, United Kingdom, United States and Vietnam.

More Approved Verifiers

2021 also saw additional organisations granted Approved Verifier status under the Standard, ensuring bonds and loans issuers had multiple options available for verification via increased geographic coverage and sector criteria.

New Verifiers included Block C (Brazil), BLX (United States), EY Brazil (Brazil), IENE (Greece), Instituto Totum (Brazil) and Kommunal Kredit (Austria), KPMG Hungary (Hungary), Point Advisory (Australia), PriceWaterhouseCoopers AG (Switzerland), Scope Verifiers (Across Europe), Sustain Advisory (Italy), Rating and Investment Information, Inc. (R&I) (Japan), Shenzhen CTI International Certification Co. Ltd (CTI Certification) (China).

You can find the full list of Approved Verifiers here.

Sean Kidney, CEO, Climate Bonds Initiative:

“The Climate Bonds Standard is the global benchmark for quality in green finance markets. Reaching the $200bn milestone is a testament to the market’s hunger for credible green financial products based on a robust, science-based emissions reduction foundation that aligns with the Paris Accord goals.”

“Certified issuers continue to lead development in their regional and global markets, demonstrating by example, best practice in green and sustainable investment.”

“The Climate Bonds Standard will be expanding in 2022 with the addition of new Transition Criteria creating pathways for change in hard to abate sectors. This represents the continued evolution in the labelling of financial instruments to encourage large-scale investment towards net zero.”

The Last Word – Standard reach to grow

One of the defining characteristics of the Standard's journey has been its expansion and the breadth of sectors where new Certifications have emerged. 2022 will see further additions to the suite.

2022 will see the rollout of the new Transition Criteria, marking the next evolution in the Climate Bonds Standard and Certification Scheme.

Progressively from Quarter 1, 2022 we will be releasing the first of the new Use of Proceeds based and Entity-Level Criteria for the Basic Chemicals sector, with Cement and Steel to follow later in the year.

Entity-level Certification options that encompass the growing market for SLBs and SLLs are a vital next step, enabling carbon-intensive industries greater access to investor capital to support low carbon pathways across hard- and expensive-to-abate sectors and activities.

Next for January – 2021 Review & 2022 Forecasts

Coming this January, our End of Year Blog will review a record-breaking 2021 in GSS markets and look ahead to 2022. The progress of labelled markets will be assessed in the context of acceleration to the vital target of $5trillion in annual green investment by 2025.

‘Til Next Time!

Climate Bonds