$1Trillion Annual Green Bond Milestone Tipped for end 2022 – New Market Survey

$5Trillion Annual by 2025 is new Global Target says CEO Sean Kidney

London 28/10/2021: 11:00AM GMT +1: Green bond investment in a single year is set to double and reach the $1trillion milestone for the first time by the end of Q4 2022, according to a new Climate Bonds market survey conducted in late October.

Climate Bonds surveyed a pool of market actors drawn from the following categories: corporates, asset owners, asset and investment managers, development banks, regulators, ratings and verification service providers.

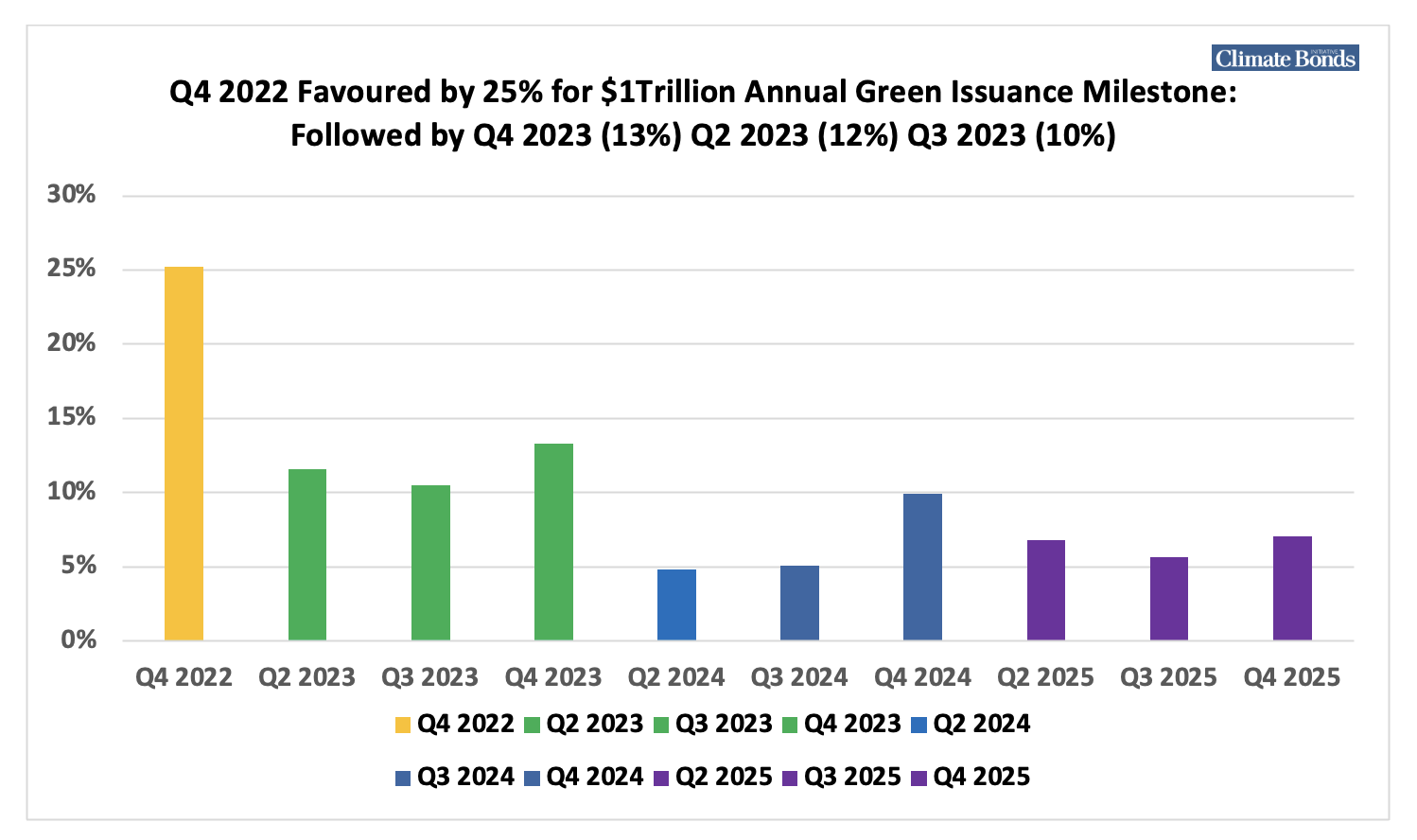

In a range from 2022 to 2025, Quarter 4 of 2022 was selected by the largest group of respondents (25%) as the quarter when green bond investment would pass $1trillion for the first time in a single year. Quarter 4 of 2023 (13%), Quarter 2 of 2023 (12%) and Quarter 3 of 2023 (10%) were the next most popular responses. (See Table 1)

Sean Kidney, CEO, Climate Bonds Initiative:

“The long-awaited $1trillion milestone is now a market reality, whether at the end of 2022 or during 2023. But the climate crisis grows. It’s time to lift our sights and aim higher. $5trillion in annual green investment by 2025 must be the new mark for policy makers and global finance to achieve.”

“Capital allocation towards clean energy, resilient infrastructure, green transport, buildings and sustainable agriculture needs to accelerate into the multiple trillions, every year, rippling through both developed and emerging economies.”

“The climate capital gap still remains. $5trillion in annual green investment by 2025 is a real economy investment benchmark to judge progress in greening the financial system.”

Background

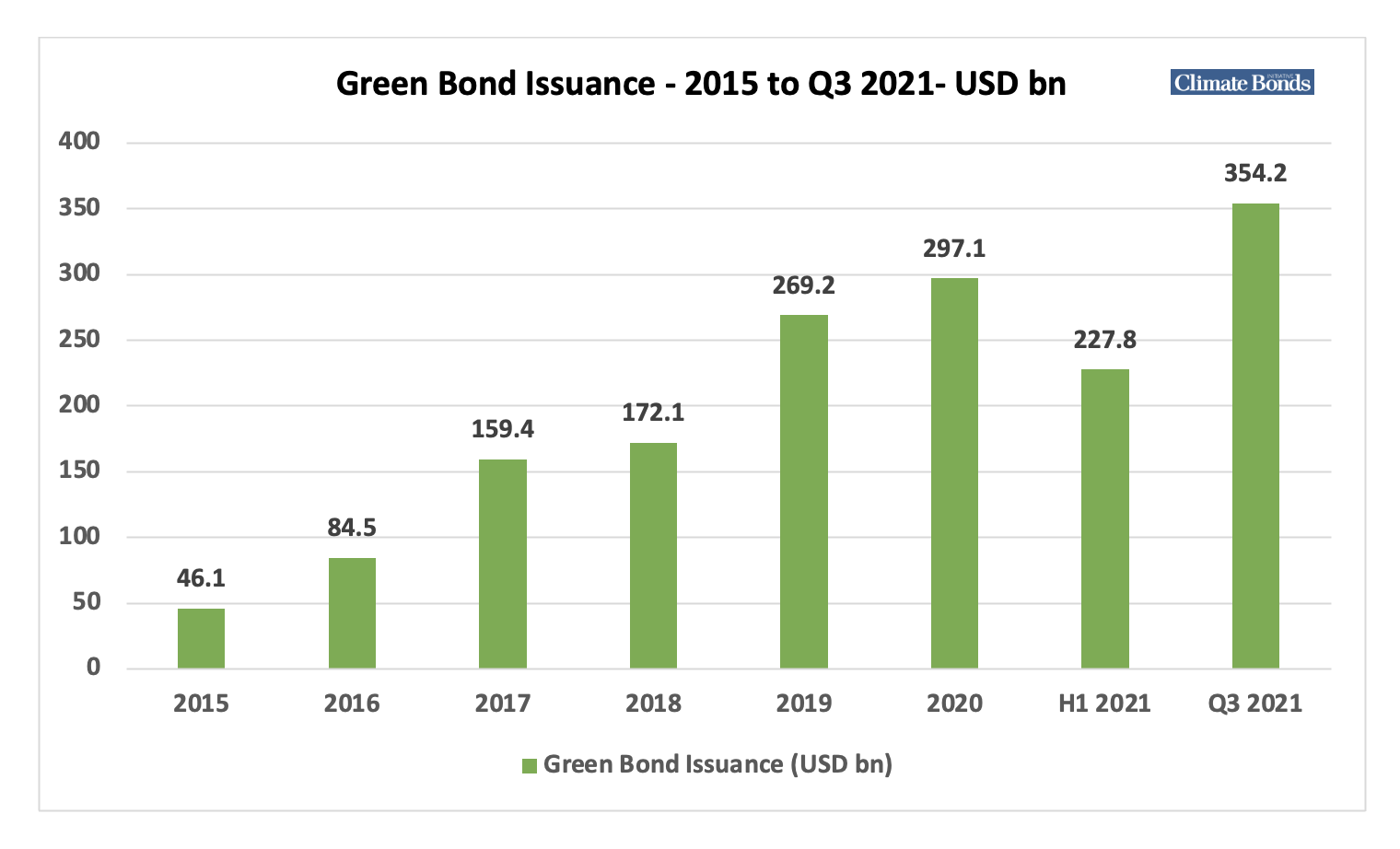

Total annual green investment (green bonds, green loans & green sukuk) in 2020 reached $297bn.

Climate Bonds Market Data for H1 2021 recorded green bond issuance at a new half-year record of $227.8bn.

At end Q3 2021, green bond issuance for the calendar year stood at $354bn. Climate Bonds is forecasting green bond issuance to reach a record half-trillion ($500bn) for CY 2021, an increase of our early January 2021 forecast of $400-450bn. (See Table 2)

Transition to a net zero global economy necessitates a huge shift in capital across all sectors. Climate Bonds Initiative has long held the first annual trillion of green investment to be a crucial milestone in these efforts.

<Ends>

For more information:

Senior Communications & Digital Manager,

Climate Bonds Initiative (London)

+44 (0) 7593320198

Notes for Journalists:

About the Climate Bonds Initiative: The Climate Bonds Initiative is an investor-focused not-for-profit, promoting large-scale investment in the low-carbon economy.

Climate Bonds undertakes advocacy and outreach to inform and stimulate the market, provides policy models and government advice, market data and analysis, and administers an international Standard & Certification Scheme for best practice in green debt product issuance. More information on our website here.

Survey Background:

Participants to Climate Bonds annual conference of September 2021 were surveyed in from the following categories: corporates, asset owners, asset and investment managers, development banks, regulators, ratings and verification service providers. The survey period was Thursday 21st October to COB Tuesday 26th October 353 responses were received.

From a selection of Quarters commencing Quarter 4 2022 to Quarter 4 2024, respondents were asked to nominate the Quarter they assessed annual green issuance would first reach $1trillion in a single year. Only one choice was allowed. No multiple choice option.

Responses aggregated by year: 2022 [25%], 2023 [35%], 2024 [20 %], 2025 [20 %].

All amounts in this communication are expressed in USD.

Table 1: Survey Responses by Quarter 2022-2025

Table 2: Annual Green Bond Market Issuance 2015 to Q3 2021:

ENDS