Welcome to the Markets Monthly #8!

For more information on the Climate Bonds Database on Market Data email: dataenquiries@climatebonds.net

Moody's ESG Summit - Climate Scenarios. In partnership with Climate Week NYC and Climate Bonds Initiative. Live broadcast, 24th September 09.15am EST.

Catch Sean Kidney speaking on Green Finance and Climate Risk Resilience. Register here.

Latest Reports

Green bonds market summary - H1 2020

Green bonds market summary - H1 2020

The Green Bonds Market Summary – H1 2020 focuses on the latest market developments in labelled green bonds and loans.

The summary highlights issuance trends and data points for a period significantly impacted by the global COVID-19 pandemic.

Credit Suisse and Climate Bonds ‘Financing Credible Transitions – White Paper’

Credit Suisse and Climate Bonds ‘Financing Credible Transitions – White Paper’

How to ensure the transition label has impact

This Whitepaper presents a framework for identifying credible transitions aligned with the Paris Agreement. The paper has two purposes:

1. Define the concept of transition by presenting a starting point for the market to see credible green transitions as ambitious, inclusive, and aligned with the Paris Agreement (and avoiding greenwashing).

2. Put forward a framework for use of the transition label in practice and propose clearly demarcated, complementary roles for both green as well as transition labels. Full paper and Summary Note.

August at a glance

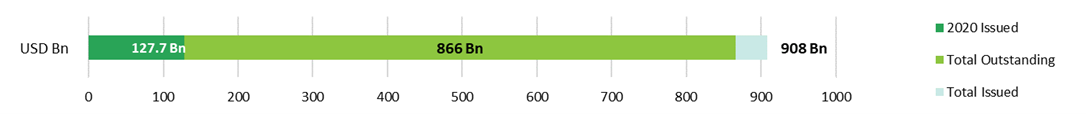

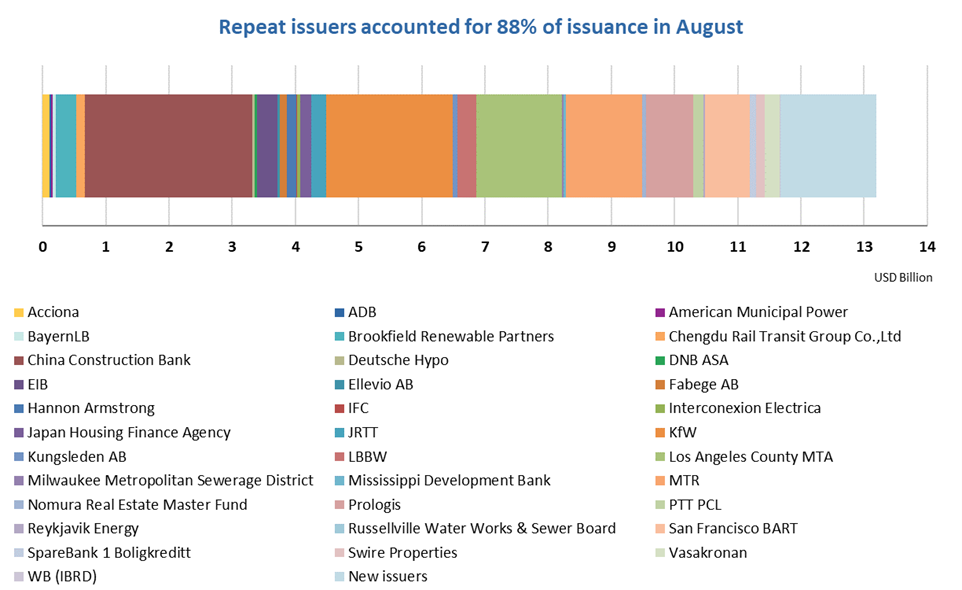

Overall, August 2020 issuance added up to USD13.2bn, breaking the USD900bn mark and bringing total cumulative green bond volume since market inception once again closer to the one-trillion milestone.

Last week saw the Climate Bonds Annual conference take place – for the first time fully online – along with marking our 10-year anniversary. The agenda centred on the theme of ’Green Transition’ with sessions spanning three days, 3200 audience members, and 49 speakers. The event reflected movement and motivation in the market that comes with formidable efforts from stakeholder groups, including regulators, investors, issuers, and civil society.

The conference acted as the backdrop for AIIB and Amundi to launch their new Climate Change Investment Framework, (CCIF) which enables the assessment of an issuer’s alignment with climate change mitigation, adaptation and low-carbon transition objectives. The Framework is endorsed by Climate Bonds.

The transition commitments were tangible as AIIB President Jin Liqun also used the platform to eschew future thermal coal and related financing; a landmark announcement making waves across the industry.

Elsewhere, the CFA Institute published a consultation paper in August on ESG disclosure standards for investment products aiming to provide transparency and comparability of the ESG-related features of investment products. The UN is calling for action to harness digitalisation in creating a citizen-centric financial system aligned to the SDGs.

In the meantime, corporates keep ploughing ahead with more low-carbon commitments: Suncorp (Australia) targets phasing out existing thermal coal exposures by 2025, as well as ceasing oil and gas-related underwriting by 2025 and direct investment in them by 2040. In addition, UniCredit is eyeing zero coal exposure by 2028, whereas BP committed to cutting oil and gas production by 40% by 2030 and considerably upping spending on renewables to hit emissions targets.

Also, third-party reviews are broadening their spectrum as ISS ESG launched its transition bond second party opinion service, following Sustainalytics’ lead from June. On another indicator around best practice, green bonds and loans Certified against the Climate Bonds Standard reached USD5.1bn for the month of August, making up an impressive 39% of overall monthly issuance. Out of the 15 Certified deals, 11 followed the Low-Carbon Transport Criteria.

Meridian Energy (New Zealand) used a different approach to many organisations issuing Certified Climate Bonds: the company opted to retrospectively Certify their deals from 2016, 2017 and 2018 that financed wind projects. Meridian also issued a green bond financing hydro projects, which carries an SPO.

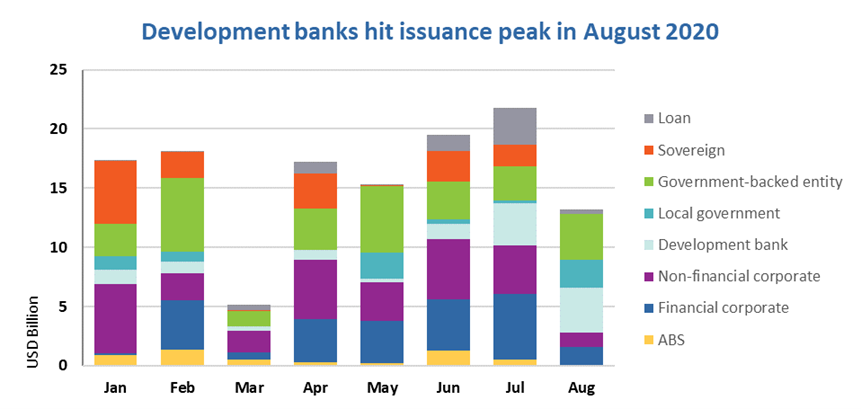

In August 2020, Development bank issuance peaked, driven once again by Germany’s KfW with a large deal (USD2bn) after last month’s record figure, as well as multiple issuances from China Development Bank. For the first time in 2020 there was no Sovereign issuance – although early September has already provided contrast with two green sovereign debuts (see Sovereign Green Bond Club section below). Local governments also hit their 2020 record, with all volume coming from seven US Munis of which four were from new issuers.

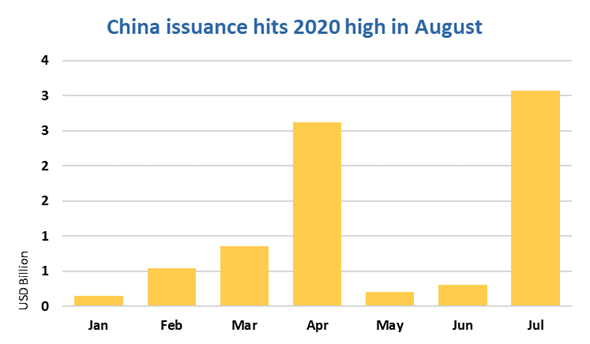

China issuance hit its 2020 record with USD3.1bn mainly coming from China Development Bank with an equivalent of USD2.6bn. The deals were issued in USD (China Construction Bank – Hong Kong) and CNY (China Development Bank), all Climate Bonds Certified and financing low carbon transport projects. There were also two new issuers: Datang Henan Power Generation Co., Ltd and Great Wall Guosing Financial Leasing Co Ltd, both financing Renewable energy. The rebound comes after a May/June low and the April record, as China started to recover from the market shocks earlier this year.

China issuance hit its 2020 record with USD3.1bn mainly coming from China Development Bank with an equivalent of USD2.6bn. The deals were issued in USD (China Construction Bank – Hong Kong) and CNY (China Development Bank), all Climate Bonds Certified and financing low carbon transport projects. There were also two new issuers: Datang Henan Power Generation Co., Ltd and Great Wall Guosing Financial Leasing Co Ltd, both financing Renewable energy. The rebound comes after a May/June low and the April record, as China started to recover from the market shocks earlier this year.

Developed Market (DM) issuance in August 2020 was dominated by the USA, Germany, and Hong Kong with an equivalent of USD4bn, USD2.4bn and USD1.3bn of green volume, respectively. The USA and Germany saw 17 deals each, with the former mainly coming from US Munis, including one large Certified deal (USD1.4bn) by Los Angeles County MTA. The latter included another deal by KfW (USD2bn). Further, Hong Kong’s MTR Corp issued a USD1.2bn green bond.

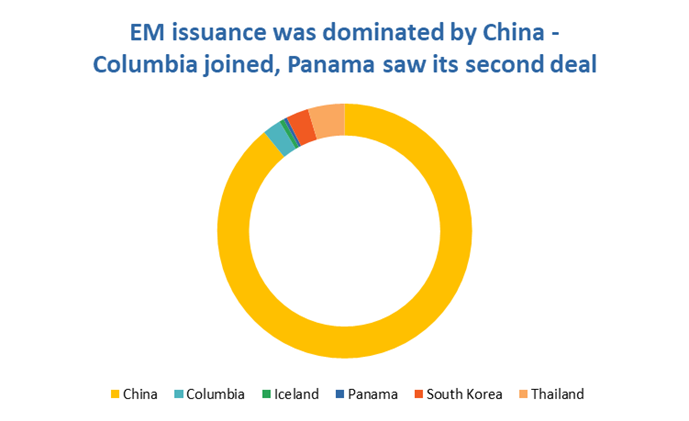

Emerging Markets (EM) made up 26% of total issuance. Part of this comes from Colombia with Interconexion Electrica having tapped the market twice on the same day to finance projects around Renewable energy generation and transmission. Panama also saw its second-ever green bond from first-time issuer Panasolar Group, whose deal was Certified against the Solar Criteria of the Climate Bonds Standard (see New issuer spotlight).

Thailand saw more green bond issuance from repeat issuer Global Power Synergy (PTT PCL), which brought a total of three deals to market in August 2020. Reykjavik Energy (Iceland) once again returned to the market amongst others financing a project whereby CO2 is captured and stored as rock in the subsurface as well as support for smart grid applications.

> Check out the full list of new and repeat issuers.

> Click on the issuer name to access the new issue deal sheet in our online Bond Library.

Worth reading…

‘How Green Finance could Arrive in the Winner’s Circle after the Pandemic’ – International Banker

…and:

- 'The Role of Natural Gas in the Energy Transition' – Sustainalytics

- 'Transition Finance Completes the Picture of Greener Goals' – The Asset

- 'Pandemic Shows why Climate Change is Major Economic Risk, says Europe’s Schnabel' – Insurance Journal

- Total Cumulative green bond issuance as at 30th June by region/nation. Europe, Asia-Pac and LATAM.

Don’t miss this highlight of our Conference! Lord Adair Turner, Chair of the Energy Transitions Commission in full flight on the very latest developments in clean technology and transition to net zero. A fascinating full hour, available here.

New issuer spotlight - Certified Climate Bonds

Panasolar Group (USD15m), Panama, came out with a seven-year instrument Certified against the Solar Criteria of the Climate Bonds Standard 3.0. The proceeds will be used to finance a solar power plant located in Aguadulce district, province of Coclé, Republic of Panamá. The facility currently boasts 9.9MW installed capacity, and the bond will support its expansion. The facility is registered under the Gold Standard, which allows energy generated at the plant to be used for carbon credits. This is the first Certification in Panama.

New issuer spotlight

Datang Henan Power Generation Co., Ltd (CNY1bn/USD144m), China, completed its inaugural issuance of a three-year unsecured green bond. The main share of the proceeds will go towards 14 wind farm projects and a small allocation will be made towards paying back a portion of debt of two subsidiaries.

There will be a report with information on the use of proceeds and the process of green projects on a semi-annual basis until maturity.

Climate Bonds view: Climate Bonds welcomes Datang Henan Power Generation’s green bond and its commitment to post-issuance reporting, as well as the independent external review at issuance. The prospectus estimated that the wind farms will save 993,700 tonnes of coal equivalent of electric energy, which is equivalent to avoided emissions of 2,716,900 tonnes CO2, 646 tonnes SO2, 614 tonnes NOx and 12,922 tonnes dust when compared with coal-fired electricity generation. Wind power will continue to turbocharge the world’s largest coal consumer country’s transition into renewable energy and a greener economy.

GPSS Holdings (JPY300m/USD2.8m), Japan, issued its debut green instrument in July. The bond, which was rated Green 1 by JCR, will mature in three years. The proceeds will be used for capital expenditures of 14 solar power generation facilities currently under construction. The 14 solar plants have a projected annual electricity generation of 48,155MWh, which can be converted to 24,655t-CO2.

Reporting is planned to be disclosed to investors in terms of both the proceeds allocation that will last a year and the environmental benefits (i.e. CO2 emissions, power generation, and reduced household-equivalent figures).

Climate Bonds view: Climate Bonds welcomes the inaugurate corporate green bond from GPSS and applauds the added transparency arising from the independent external review by Japan Credit Rating Agency, who assigned it the highest green score.

Climate Bonds encourages the renewable energy sector to follow the example of GPSS to work towards grid parity (i.e. equalizing the levelized cost of electricity production from renewable energy vis-à-vis current power grids) through technological innovation. Green bonds offer funding solutions to developing clean energy infrastructure over the long term. They will continue to play a pivotal role in financing a resilient and low-cost renewable energy mix for a sustainable society.

The City of Seattle (USD198m), USA, issued its first green bond with a 30-year original tenor. Kestrel Verifiers provided an SPO and the proceeds will go towards capital improvements to and conservation programs for the municipal light and power plant and system. This includes improvements to Seattle’s electric utility system, ranging from hydroelectric power generation, transmission, and distribution infrastructure for renewable energy to improving grid reliability and preparing city infrastructure for the future of sustainability energy.

Climate Bonds view: This is the first green US Muni issuance from the state of Washington. The number of electricity grids being connected to renewable energy sources and boosting transmission is increasing, and commonly financed with green bonds. Also seen in the non-financial corporate space, it is great to note US Muni issuers are starting to do the same.

Interconexion Electrica (COP140bn/USD38m), Colombia, entered the market with a green bond benefitting from an SPO provided by Sitawi. The funds will go towards the construction of energy transmission infrastructure. The two specific projects are located on the north coast of Colombia, which will allow the connection of renewable energy (wind and solar) to the National Interconnected System.

Interconexion will publish reports containing financial and environmental information until the bond matures to ensure that proceeds are allocated to projects described in the document. Environmental benefits, including the amount of non-conventional renewable energy exchanged (MW), will be reported annually in the company’s sustainability report. This report will also include the identification of impacts on protected areas and community resettlement.

Climate Bonds view: This is the first ever Colombian green bond to finance grid infrastructure, which also underpins the importance of energy transformation of the country. Not only is producing renewable energy crucial for this development, but also connecting the sources to the end users is pivotal.

K2A Knaust & Andersson (SEK400m/USD42.3m), Sweden, came out with its maiden green bond with a three-year tenor and benefitting from an SPO provided by CICERO. It is a senior unsecured instrument that will finance Green buildings (Nordic Swan Ecolabel and Miljöbyggnad Gold / Silver) and energy efficiency (LED, heating/cooling).

K2A commits to report allocation and impact annually on its website for as long as there are funds outstanding.

Climate Bonds view: Climate Bonds hails the maiden green bond from K2A, which in June 2020 heralded in a new era of green-labelled equity by launching the first green equity framework. The bond was oversubscribed by more than three times thanks to great interest from especially Nordic institutional investors.

New issuers continued...

Public Sector

- Brighton Township Municipal Authority (USD5.9m), USA, 20.9Y original term, assured by BAM GreenStar.

- City of Laurel, Mississippi (USD5m), USA, 19.9Y original term, assured by BAM GreenStar.

- Great Wall Guosing Financial Leasing Co Ltd (CNY1bn/USD144m), China, 3Y original term, SPO provided by CCXI.

- North Texas Municipal Water District (USD35.1m), USA, 30Y original term, SPO provided by Kestrel Verifiers.

- Spanish Fork City (USD73m), USA, 20.1Y original term, assured by BAM GreenStar.

- The Wilkinsburg-Penn Joint Water Authority (USD26.2m), USA, 19.1Y original term, assured by BAM GreenStar.

Financial Corporates

- Ascendas Real Estate Investment Trust (SGD100m/USD103m), Singapore, 10Y original term, assured by EY.

- Piedmont Operating Partnership (USD300m), USA, 10Y original term, no third-party review.

- Reconcept GmbH (EUR10m/USD11m), Germany, 5Y original term, no third-party review.

Non-Financial Corporates

- Leader Energy (MYR260m/USD60.9m), Malaysia, 18Y original term, no third-party review – issued in July 2020.

- Tucson Electric Power (USD300m), USA, 10Y original term, no third-party review.

Loans

- Ichigo ECO Energy (JPY2.2bn/USD20.2m), Japan, 1.5Y original term, no third-party review.

- M&C Tottori Hydroelectric Power Co., Ltd. (JPY15.7bn/USD144.3m), Japan, 23.2Y original term, rated GA1 and SPO provided by R&I (Japan) – issued in July 2020.

- M&G Real Estate Asia (KRW11.5bn/USD98.5m), Korea, no third-party review.

- Murra Warra II, Australia, no third-party review.

Visit our Bond Library for more details on August deals and a full history of debut green issuances going back to 2017.

Green bond outlook – selected deals

|

Issuer Name |

Country |

Closing Date |

Source |

|

Renova Inc |

Japan |

03/09/2020 |

|

|

CAF |

SNAT |

04/09/2020 |

|

|

Mediobanca Banca di Credito Finanziario SpA |

Italy |

08/09/2020 |

|

|

Toda Corp |

Japan |

08/09/2020 |

|

|

CRE Logistics REIT Inc |

Japan |

08/09/2020 |

|

|

Federal Republic of Germany |

Germany |

09/09/2020 |

|

|

Sweden Government International Bond |

Sweden |

09/09/2020 |

|

|

Daimler AG |

Germany |

10/09/2020 |

|

|

China Merchants Bank Co Ltd/Hong Kong |

China |

10/09/2020 |

|

|

Bayerische Landesbank |

Germany |

10/09/2020 |

|

|

Zhenro Properties Group |

China |

11/09/2020 |

|

|

Daiwa Office Investment Corp |

Japan |

11/09/2020 |

|

|

Sumitomo Mitsui Auto Service Co Ltd |

Japan |

11/09/2020 |

|

|

Mercury NZ Ltd |

Netherlands |

14/09/2020 |

|

|

Big River Steel LLC / BRS Finance Corp |

USA |

18/09/2020 |

September has already seen multiple deals coming in. Amongst many repeat issuers, newcomer Daimler AG (Germany) is on the list with an order book 4.2x oversubscribed. Direct competitor Volkswagen (Germany) is poised to follow soon after launching its green bond framework in March. Asahi Group Holdings (Japan) will also be tapping the green bond market in October financing mainly procurement of recycled PET and biomass plastics, purchase of renewable energy, and forest conservation activities at the company forest.

The green bond country list is also steadily growing and Kazakhstan might be the newest addition: Entrepreneurship Development Fund “Damu” which is a subsidiary of Baiterek is planning to issue a KZT200m (USD0.5m) financing small-scale RES investment projects undertaken by small and medium businesses.

Sovereign Green Bond Club

The long-awaited new addition to the Sovereign Green Bond Club, Germany has launched an innovative “twin bond”, where the green coupon, interest payment dates and maturity are identical to a conventional “twin”. They differ in amount outstanding and time of issuance. The bond also allows a swap from the green issuance to the conventional bond for liquidity purposes.

Sweden’s green debut of SEK20bn (USD2.3bn) has finally settled at the beginning of September. The ten-year instrument raised funds which will be linked to budget expenditures that contribute to achieving Sweden’s environmental and climate objectives.

There are more potential newcomers to the club that are currently considering green bonds: Brazil may finance Amazon-related projects with the sale of green bonds and Ghana has announced its first green loan to support rural and peri-urban water projects. The first European sovereign to do so, Luxembourg has established a sustainable bond framework and Hungary is planning a green Samurai bond (a JPY-denominated bond issued outside of Japan.)

Data and references

Repeat issuers in August

Repeat issuers: January to July 2020 (not previously included)

- Citigroup: EUR10m/USD11.1m - May 2020

- City of Ottawa: CAD300m/USD230.4m - May 2020

- EUROFIMA: EUR800m/USD889.2m - issued from January to July 2020 (6 deals)

- Fannie Mae: USD174.3m - July 2020 (9 deals)

- LBBW Landesbank Baden-Wuerttemberg: EUR120m/USD133.4m - issued from March to June 2020 (5 deals)

- PACE Funding 2020-I (PACE Funding Group): USD107.035m - June 2020

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Although we support the Sustainable Development Goals (SDGs) overall and see many links between green bond finance and specific SDGs, in particular SDGs 6, 7, 9, 11, 13, 14 and 15, the proportion of proceeds allocated to social goals should be no more than 5% for inclusion in our database.

|

Excluded |

|||

|

Issuer Name |

Amount issued |

Issue date |

Reason |

|

Teekay Shuttle |

USD75m |

28/08/2020 |

Not aligned |

|

GS Caltex |

KRW80bn/USD68.5m KRW50bn/USD42.8m KRW130bn/USD111m KRW140bn/USD120m |

13/02/2020 13/02/2020 13/02/2020 13/02/2020 |

GB not aligned GB not aligned GB not aligned GB not aligned |

|

Arizona Industrial Development Authority |

USD183.9m |

10/03/2020 |

Insufficient information |

|

Deutsche Bank |

EUR500m/USD555.8m |

10/06/2020 |

GB not aligned |

|

Consolidated Edison Company of New York |

USD600m USD1bn |

31/03/2020 31/03/2020 |

GB not aligned GB not aligned |

|

Prudential Financial |

USD500m |

10/03/2020 |

GB not aligned |

|

Changxing Communications Investment |

CNY650m/USD93.6m |

25/08/2020 |

General opex |

|

Shaanxi Coal and Chemical Industry Group Co Ltd |

CNY3bn/USD432m |

26/08/2020 |

Not aligned |

|

Yunnan Water Investment Co Ltd |

CNY500m/USD72m |

14/08/2020 |

General opex |

|

Changde Dingcheng Jiangnan New City Construction Investment Co Ltd |

CNY600m/USD86.4m |

14/08/2020 |

General opex |

|

Guangzhou Water Investment Group Co.Ltd |

CNY500m/USD72m |

14/08/2020 |

General opex |

|

Pending |

|||

|

Issuer Name |

Amount issued |

Issue date |

Reason |

|

Coca Cola FEMSA |

USD705m |

01/09/2020 |

Insufficient information |

|

Vasakronan |

SEK100m/USD10.6m |

02/09/2020 |

Insufficient information |

|

Sichuan Province Airport Group Co Ltd |

CNY1bn/USD144m |

28/08/2020 |

Insufficient information |

|

China Resources Financial Leasing Co Ltd |

CNY1.8bn/USD256.5m |

27/08/2020 |

Insufficient information |

|

China Longyuan Power Group Corporation Limited |

CNY1bn/USD144m CNY1bn/USD144m |

28/08/2020 28/08/2020 |

Insufficient information Insufficient information |

|

Linköping Stadshus AB |

SEK500m/USD57m |

26/08/2020 |

Insufficient information |

|

Huaneng Tiancheng Financial Leasing Co Ltd |

CNY1bn/USD144m |

20/08/2020 |

Insufficient information |

|

National Finance Authority |

USD39.4m |

20/08/2020 |

Insufficient information |

|

Hannon Armstrong |

USD375m |

21/08/2020 |

Insufficient information |

|

Thailand |

THB30bn/USD988.3m |

19/08/2020 |

Insufficient information |

|

Asian Development Bank |

HKD200m/USD25.7m |

19/08/2020 |

Insufficient information |

|

Visa |

USD500m |

17/08/2020 |

Insufficient information |

|

Damu Fund |

KZT200m/USD0.5m |

11/08/2020 |

Insufficient information |

|

AKBANK TAS |

USD50m |

05/08/2020 |

Insufficient information |

|

Yuzhou Group Holdings Caompany Limited |

USD300m |

12/08/2020 |

Insufficient information |

|

Adecoagro |

USD17.8m |

24/07/2020 |

Insufficient information |

|

CPI Hungary Investments |

HUF30bn/USD102.9m |

07/08/2020 |

Insufficient information |

|

Credit Agricole |

TRY29m/USD4.9m |

06/08/2020 |

Insufficient information |

|

United States International Development Finance Corp |

USD7m |

05/08/2020 |

Insufficient information |

|

Micro, Small & Medium Enterprises Bonds (Symbiotics) |

USD3.5m |

04/08/2020 |

Insufficient information |

As always, your feedback is welcome!

Watch this space for more market developments. Follow our Twitter or LinkedIn for updates. E-mail data requests to dataenquiries@climatebonds.net.

‘Till next time,

Climate Bonds

Disclosure: Some of the organisations mentioned in this communication are Climate Bonds Partners. A list of Partners is available here.