Welcome to the Markets Monthly #6!

For more information on the Climate Bonds Database on Market Data mail to: dataenquiries@climatebonds.net

Stay Connected with Climate Bonds

Climate Bonds Connected aims to bring you all of the latest transition, green & sustainable finance developments via Webinars, podcasts and more. Here is what’s upcoming:

Green Bond Lab: Growing a Sustainable Finance Culture: Tuesday, 14 July, 15:00 Paris / 14:00 London

This time around we have Sean Kidney in conversation with Jean-Marc Mercier, Vice-Chairman, Capital Markets at HSBC Global Banking & Markets. Registration

Don’t Miss!

Our next Monthly Market Update Broadcast on Wednesday 15th 14:00 London Time. 15 mins of June market analysis & conversation with Data Analyst Lea Muething.

Breaking News!

Registrations are now open for our Annual Conference held between the 8-10th September. Find out more on the conference website.

Latest Reports

Brazil’s Green Investment Potential for Agriculture

The report identifies a large pipeline of projects and assets eligible for green financing and marking the investment potential for Agriculture in Brazil to reach USD163bn (BRL692bn) by 2030.

China Green Bond Market 2019 Research Report

China Green Bond Market 2019 Research Report

China Green Bond Market 2019 Research Report analyses the key developments in the world’s largest source of labelled green bonds. Focusing on green bond issuance, policy development and wider market growth, available in English and Chinese, the report is the fourth in an annual series from Climate Bonds.

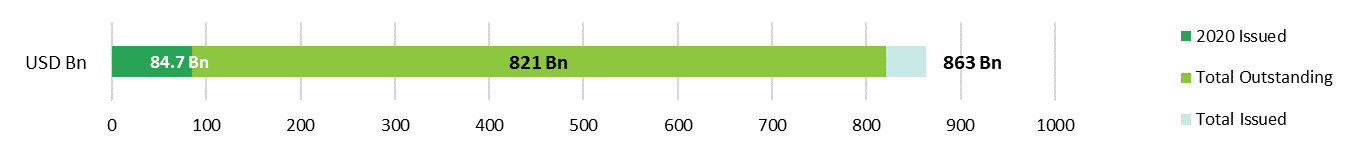

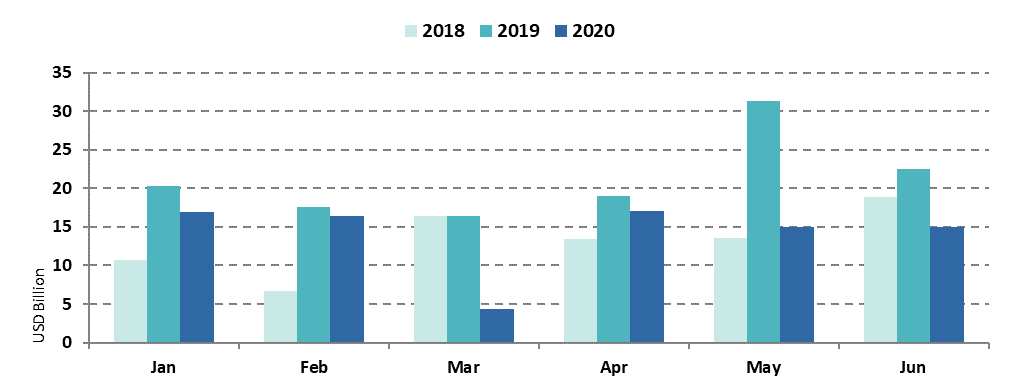

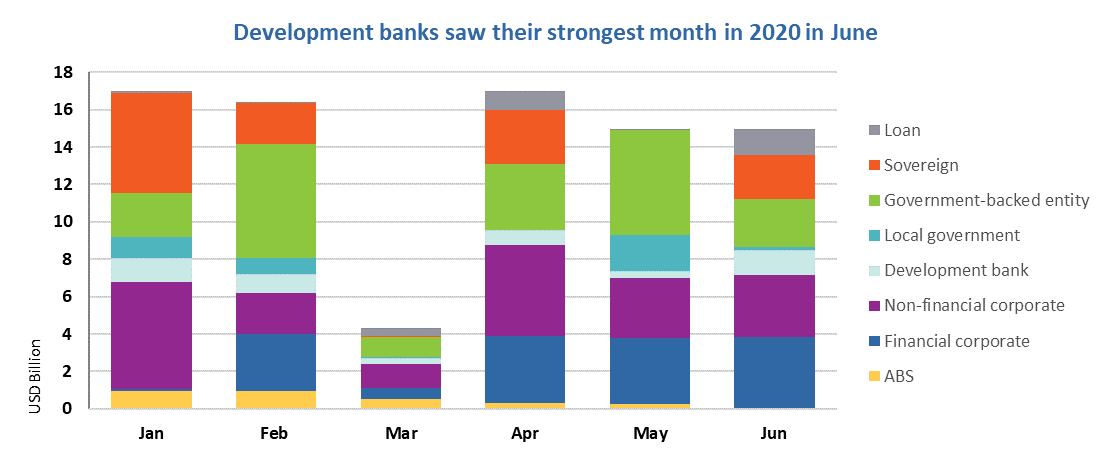

In the first half of the year the green bond market saw issuance of USD84.7bn compared to a total of USD172.2bn in the first six months of 2019. The impact of the pandemic is clear in the comparative figures. Absolute volume for each issuer type decreased by at least 29% - apart from Government-backed Entities which saw an increase of 12% (USD21.2bn 2020 against USD18.9bn in 2019).

We will have more detail in our half-year update coming out soon.

June at a glance

Overall, June 2020 issuance added up to USD14.9bn, bringing total cumulative issuance to USD863bn. It’s a 34% year-on-year decrease from last June but is still higher than the monthly average in the first half of the year – which as noted, has been impacted by COVID-19.

Credit markets saw an uptick in mid-June as the US Fed announced it would include corporate bonds in its purchasing programme causing a rally and strengthening market confidence. At the same time, the pandemic is increasingly causing companies to go bust: car rental firm Hertz and airline Flybe are only two from a long list of firms that collapsed leaving thousands jobless.

The urgency for government stimulus is to bring economies back on track. Tying this to green projects emerges as the way forward for multiple countries as an increasing number of commitments can be seen: for example the Scottish government will make a GBP5.5m (USD6.8bn) investment in local renewables and low carbon heat.

In the meantime, we saw multiple regulatory and framework developments in June, such as the European Parliament adopting the taxonomy regulation for sustainable finance; the classification system for environmentally sustainable economic activities. In an effort to establish more standardised markets, the Green & Social Bond Principles by ICMA published Sustainability-Linked Bond Principles and updated the Social Bond Principles and other key guidance. The UNDP has also drafted standards to support private equity fund managers and bond issuers that want to direct finance to meeting the Sustainable Development Goals (SDGs).

Along with other emerging instrument types, transition bonds are increasingly surfacing in the market. These controversial instruments are in need for more standardised definitions as well. Examples of recent transition bond issuers include SNAM (Italy) and CLP (Hong Kong). Due to their complexity in the context of a low carbon economy, transition bonds require additional scrutiny to ensure sufficient ambition in targets, and ultimately significant contribution to decarbonisation. An ICMA working group is expected to publish guidelines by the end of the year.

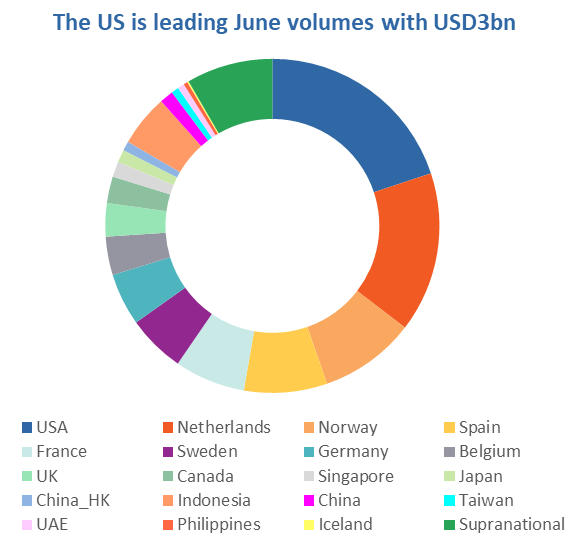

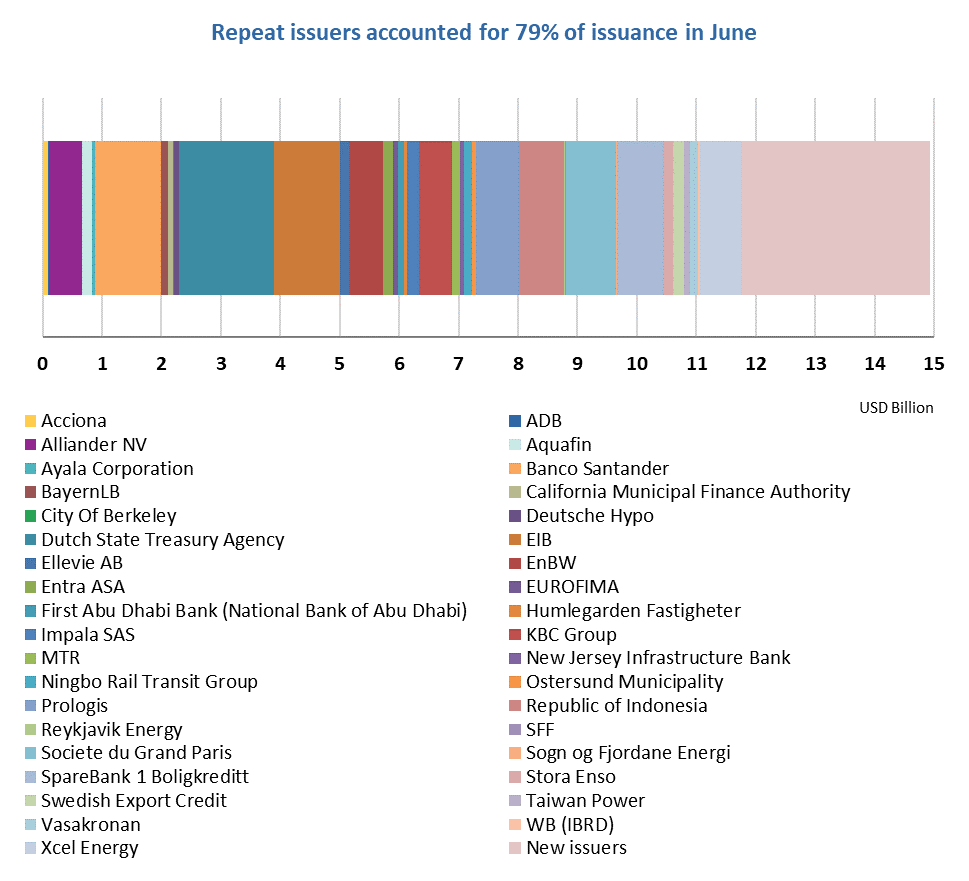

Emerging Markets made up 8% of June 2020 issuance. Among the deals was repeat issuer First Abu Dhabi Bank (National Bank of Abu Dhabi – UAE) - the first institution from the UAE to issue back in 2017 - which came to the market for the third time with a USD96.5m deal. Taiwan Power (Taiwan) also returned, issuing TWD3.2bn (USD108m) and adding to Taiwan’s total volume of USD2.2bn.

Developed markets’ volume accounted for 83% of the overall figure with the US (USD3bn), Netherlands (USD2.3bn) and Norway (USD1.4bn) leading the country ranking. The largest deal from the US came from Calpine Corporation which took out a USD900m green loan to fund geothermal power (see New issuer spotlight – Certified Bonds). There was also a total of nine US Muni deals, four of which came from newcomers to the market.

Sovereign issuance picked up again in June due to the Netherlands (Dutch State Treasury Agency) returning with another Certified Climate Bond borrowing EUR1.4bn (USD1.6bn) as well as the Republic of Indonesia with USD750m. Financial Corporates maintained a steady issuance volume over the last quarter with June volume contributing a total of USD3.9bn – the highest monthly figure in 2020 so far.

For the second consecutive month there was a new issuer debuting with a covered bond: SSB Boligkreditt (Norway) will finance mortgages for energy efficient residential buildings with NOK300m (USD31m). On the non-financial corporate side, less common structures are also starting to appear more. Neoen SA (France) issued Europe’s second green convertible taking out EUR170m (USD189m).

Development Banks saw their strongest month in 2020 so far with USD1.3bn. The primary share came from the EIB with USD1.2bn (EUR1bn) and the residual amount from the Asian Development Bank, Swedish Export Credit and the World Bank.

Elsewhere, green loans are picking up again and also saw their strongest month in 2020 with two large Certified deals: in addition to Calpine Corporation financing geothermal projects, Kincardine Offshore Windfarm (Cobra – UK) took out a GBP380m (USD481m) loan to finance the world’s largest floating offshore windfarm.

> Check out the full list of new and repeat issuers.

> Click on the issuer name to access the new issue deal sheet in our online Bond Library.

Worth reading

Hong Kong Exchange said it will launch a sustainable finance platform which will be the first of its kind in Asia - HKEX

…and:

- World Investment Report 2020 – UNCTAD (Green finance section – start at page 197)

- Changing Gear: Alignment of major auto manufacturers with the goals of the Paris Agreement – 2 Degrees Investing

- Growing for Profit – Planet Tracker

New issuer spotlight - Certified Climate Bonds

Kincardine Offshore Windfarm (GBP380m/USD481m), United Kingdom, took out its inaugural green loan Certified against the Marine Renewable Energy criteria. The first of its kind to obtain Certification, the loan’s proceeds will be used to finance a floating wind farm located 15km off the coast of Aberdeen and planned for commissioning in late 2020. So far, the six-turbine farm is the largest floating offshore wind power facility in the world. Floating turbines are the next step in the evolution of offshore wind technology. Annual reports will be made available to the lenders.

Transbay Joint Powers Authority (USD271m), USA, had its debut green issuance with a 29-year US Muni that will refinance the issuer’s expenditure on the development of the Transbay Transit Center: a new landmark transport development that will serve as a public transport hub in downtown San Francisco. The instrument is Certified against the Low-Carbon-Transport criteria of the Climate Bonds Standard and replaces the older Transbay Terminal. The issuer will report annually and publicly on the allocation of proceeds through the EMMA reporting framework.

Geysers Power Company (USD900m), USA, took out its debut green loan Certified against the Geothermal criteria. It will refinance investments in the firm’s geothermal plants, as well as ongoing expenditures. The instrument will mature in 7 years. GPC is the single largest geothermal power producer in the United States and contributes 10% of the renewable energy generated in California. Annual reports will be made available to the lenders.

Ma'anshan Rural Commercial Bank (RMB400m/USD56m), China, issued its debut green bond Certified against the Water Infrastructure and Solar Criteria. The instrument will mature in 3 years’ time. Proceeds will be used to refinance the bank’s lending to projects located in Anhui province. This includes one solar photovoltaic generation facility with a capacity of 40 MW and 11 sewage treatment plants. They include 10 plants for municipal wastewater and one plant for industrial wastewater. Annual reports with details of the allocation of proceeds will be made available publicly on the issuer’s website before April each year.

New issuer spotlight

Cadent Gas Limited (EUR500m/USD555.8m), United Kingdom, came to market with an inaugural 12-year instrument issued in March 2020. DNV GL provided an SPO on the company’s framework. Cadent names four eligible project categories: retrofit of gas transmission and distribution networks, renewable energy, clean transportation, and energy efficient buildings. Types of projects within each category have been outlined and selection criteria are in place. These are aligned with the relevant thresholds set out in the EU Sustainable Finance Taxonomy.

Impact and allocation reporting will be available within one year from issuance and annually thereafter until full allocation in a standalone publication, including reporting on any material changes. The allocation report will comprise a list of eligible projects (re)financed, the aggregated amount of allocation of the net proceeds at category level, the proportion of net proceeds used for financing versus refinancing, and the balance of any unallocated proceeds. Where feasible, there will be impact reporting against a range of KPIs.

Climate Bonds view: Business transitions to low-carbon activities, and therefore transition bonds, play an increasingly important a role in the debt capital markets. There have been few such bonds so far, with Marfrig (Brazil) being the first issuer last year in September to use this particular label.

Cadent’s deal marks the first of its kind in the UK and the small number of transition bonds in the market underscores the fact that transition instruments remain in still rather uncharted, although rapidly evolving, territory. Whilst the subject is somewhat controversial and heavily debated in the finance community, transition bonds present significant potential to facilitate climate change mitigation projects in hard-to-abate industries. As such, Cadent’s bond is a good example for financing projects that are ambitious enough to be classified as green under the Climate Bonds Taxonomy. By doing so, the deal also contributes to the UK’s National Adaption Plan.

National University of Singapore (SGD300m/USD222m), Singapore, completed its inaugural issuance with a 10-year instrument assured by EY. The framework covers eligible projects falling under green buildings/precinct; renewable energy and energy efficiency infrastructure and systems; sustainable water and wastewater management; pollution prevention and control; as well as environmentally sustainable management of living natural resources and land use.

Starting from the first anniversary of its inaugural issuance, the National University of Singapore will report on an annual basis until full allocation. For loans there will be a report available to the lenders upon request.

Climate Bonds view: This is the first university in Asia to issue a green bond. The framework is very informative and comprehensive, providing a good level of transparency for investors. Not many universities have issued green bonds and most of the volume currently comes from the US and Australia. The National University of Singapore has raised one of the largest amounts of funding among all the universities active in the green bond market.

Statnett SF (NOK1.3bn/USD129m; SEK2.3bn/USD241m), Norway, had its debut issue with two green senior unsecured bonds, both maturing in 3 years and benefitting from an SPO supplied by CICERO. The bonds will finance projects associated transmission grid infrastructure, including grid reinforcements and upgrades to connect new renewable power production and to enable the efficient use of clean energy, as well as interconnectors between regions or countries to increase the market for renewable energy.

There will be an annual green bond investor newsletter, which will include a list of projects financed with a brief description and expected impact (where feasible), split between financing versus refinancing and a summary of the company’s green bond development.

Climate Bonds view: Whilst renewable energy generation plays an important role in climate change mitigation, transmission grids are a crucial part in realising the benefits by connecting these renewable sources to the grid and distributing it to where the demand is. Grids can also be made more efficient so that less energy gets lost whilst travelling from the source to the end-user. More companies are recognising this potential and are making such amendments. We welcome Statnett SF to the market with two bonds as inaugural issuance: one SEK and one NOK denominated instrument.

SSB Boligkreditt (NOK300m/USD31m), Norway, issued its first green covered bond with a 5-year original tenor. Sustainalytics provided an SPO on the framework. The funding will go towards financing/refinancing loans for new residential buildings belonging to the top 15% most energy efficient buildings of the local building stock. Refurbished residential buildings that achieved energy savings of at least 30% compared to the baseline can also qualify. There are three criteria that must be fulfilled in order to be considered eligible.

There will be impact and allocation reporting on an at least annual basis on the company website until full allocation. The allocation report will include the total amount of proceeds allocated, the number of loans in the portfolio, the amount and percentage of financing versus refinancing, and unallocated proceeds. Potential impact reporting indicators include, for example, estimated ex-ante annual energy consumption and estimated annual greenhouse gas emissions reduced.

Climate Bonds view: There is only a small list of countries from which green covered bonds have been issued. Norway takes up almost a third of this issuance. Scandinavia has a large covered bond market and Norway’s volume currently adds up to USD150bn. Covered bonds are considered a very secure investment and are therefore popular amongst certain investor groups. Marrying this structure with green proceeds is a very valuable combination, which has the potential to extend the issuer’s the investor base beyond the “vanilla scope”.

Granite REIT Holdings (CAD500m/USD384m), Canada, entered the market with a seven-year senior unsecured green debut benefitting from an SPO provided by Sustainalytics. The following categories are eligible under the framework: green buildings, resource efficiency and management, clean transportation, renewable energy, pollution prevention and control and biodiversity and conservation.

Until full allocation Granite will provide allocation and impact reporting on an annual basis on its website or annual report. The allocation report will include a list of the eligible green projects and the respective amounts and a balance of unallocated proceeds. The impact report will consist of the level of green building certifications attained, as well as other impact metrics where feasible (e.g. annual energy saved, renewable energy generated).

Climate Bonds view: This is the first REIT from Canada to issue a green bond. It is good to see that the framework covers a broad spectrum of categories – this is rather rare for REITs, which typically focus on financing green buildings or renewable energy projects. The reporting the company has committed to is very detailed, which we encourage and applaud.

New issuers continued...

Public Sector

- Borough of Grove City (USD9m), USA, 29.5Y original term, assured by BAM GreenStar.

- Park City (Utah) (USD76m), USA, 19.5Y original term, SPO provided by Kestrel Verifiers.

- Massachusetts Housing Finance Agency (USD122m), USA, 10Y original term, no third-party review provided.

Non-Financial Corporates

- Cibus Nordic Real Estate (SEK600m/USD63m), Sweden, 3Y original term, SPO provided by Sustainalytics.

- Eurus Energy Holdings Corporation (JPY10bn/USD93m), Japan, 4Y original term, rated Green 1 by JCRA.

- Asahi Kasei Corp (JPY10bn/USD92m), Japan, 5Y original term, SPO provided by Sustainalytics.

Visit our Bond Library for more details on June deals and a full history of debut green issuances going back to 2017.

Green bond outlook – selected deals

|

Issuer Name |

Country |

Closing Date |

Source |

|

Metropolitan Life Global Funding I |

USA |

02/07/2020 |

|

|

Ghelamco Invest |

Belgium |

03/07/2020 |

|

|

Hyundai Capital Services |

South Korea |

06/07/2020 |

|

|

Sparebanken Vest |

Norway |

08/07/2020 |

|

|

Bayerische Landesbank |

Germany |

16/07/2020 |

|

|

Reginn |

Iceland |

23/07/2020 |

|

|

Connecticut Green Bank |

USA |

29/07/2020 |

Multiple institutions have issued green bonds in July already. Amongst them are newcomers such as Metropolitan Life Global Funding (USA) and Sparebanken Vest (Norway). Ghelamco Invest (Belgium) returned with its second green bond. Further scheduled deals will come from two more financial institutions: Bayerische Landesbank (Germany) and Connecticut Green Bank (USA).

Additional issuance potential exists as well. For example, Daimler (Germany) has published its Green Finance Framework and Japanese machinery manufacturer Komatsu Ltd is planning to issue a green bond soon, potentially this month.

Sovereign Green Bond Club

Bhutan may be added to the member list as it has been getting technical assistance for issuing a green bond – which may take place as soon as this year. This would make it the first least developed and landlocked developing country to issue such a bond. At the same time, Uzbekistan is considering issuing a green sukuk. The Sovereign will likely be the first green bond to come from the nation.

Germany has announced that its long-awaited green debut will be a 10-year instrument hitting the market in September with potentially more to follow this year. Austria is eyeing a green Sovereign in 2020 as well.

Data and references

Repeat issuers in June

Repeat issuers: January to May 2020 (not previously included)

- Deutsche Hypo: EUR50m/USD55.6m - May 2020

- Dutch State Treasury Agency: EUR1.4bn/USD1.5bn - January 2020

- EIB (European Investment Bank): EUR250m/USD277.9m - January 2020

- Fannie Mae: USD250.6m (11 deals) - May 2020

- Guangdong Electric Power Development Company: CNY300m/USD43.2m - April 2020

- Huaneng Tiancheng Financial Leasing Co.,Ltd.: CNY500m/USD71.4m - March 2020

- Nanjing Metro Group Co.,Ltd: CNY2.8bn/USD398.1m - February 2020

- Vasakronan: EUR10m/USD11.1m - May 2020

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Although we support the Sustainable Development Goals (SDGs) overall and see many links between green bond finance and specific SDGs, in particular SDGs 6, 7, 9, 11, 13, 14 and 15, the proportion of proceeds allocated to social goals should be no more than 5% for inclusion in our database.

|

Excluded |

|||

|

Issuer Name |

Amount issued |

Issue date |

Reason |

|

Shenzhen Metro Group Co.,Ltd. |

CNY1bn/USD144m |

24/03/2020 |

General operating expenditure |

|

Suining Hedong Development Construction Investment Co., Ltd. |

CNY400m/USD57.6m |

23/06/2020 |

General operating expenditure |

|

Liuzhou Investment Holding Co.,Ltd |

CNY1bn/USD144m |

22/06/2020 |

General operating expenditure |

|

Gongan County Urban Construction Investment Co.,Ltd. |

CNY800m/USD115.2m |

19/06/2020 |

General operating expenditure |

|

Mitsubishi UFJ |

EUR500m/USD555.8m |

09/06/2020 |

Sustainability/Social bond |

|

CREDIT MUTUEL ARKEA |

EUR750m/USD833.6m |

11/06/2020 |

Sustainability/Social bond |

|

China Resources and Environment Co.,ltd. |

CNY15m/USD2.2m CNY285m/USD41m |

05/06/2020 05/06/2020 |

General operating expenditure General operating expenditure |

|

Guangzhou Metro Group Co.,Ltd. |

CNY1.5bn/USD216m CNY1.5bn/USD216m |

27/05/2020 27/05/2020 |

General operating expenditure General operating expenditure |

|

Huadian Fuxin Energy Corporation Limited |

CNY3bn/USD432m |

22/05/2020 |

General operating expenditure |

|

Huaneng Lancang River Hydropower Inc. |

CNY500m/USD72m |

20/05/2020 |

GB not aligned |

|

Beijing Jingneng Clean Energy Co., Limited |

CNY1.5bn/USD216m |

19/05/2020 |

GB not aligned |

|

Yushen Energy Development Construction Co. Ltd. |

CNY1.2bn/USD172.8m CNY1.2bn/USD172.8m |

07/05/2020 07/05/2020 |

General operating expenditure General operating expenditure |

|

China Three Gorges Corporation |

CNY1bn/USD144m CNY2bn/USD288m |

30/04/2020 30/04/2020 |

GB not aligned GB not aligned |

|

Beijing Enterprises Clean Energy Group Limited |

CNY900m/USD129.6m |

29/04/2020 |

General operating expenditure |

|

CAF |

EUR700m/USD778.1m |

03/06/2020 |

Sustainability/Social bond |

|

BBVA |

EUR1bn/USD1.1bn |

04/06/2020 |

Sustainability/Social bond |

|

Region Wallonne Belgium |

EUR1bn/USD1.1bn |

05/06/2020 |

Sustainability/Social bond |

|

Pending |

|||

|

Issuer Name |

Amount issued |

Issue date |

Reason |

|

Deutsche Hypothekenbank AG |

EUR10m/USD11.1m |

30/06/2020 |

Insufficient information |

|

Aargauische Kantonalbank |

CHF100m/USD103m |

29/06/2020 |

Insufficient information |

|

Xylem INC |

USD500m USD500m |

26/06/2020 26/06/2020 |

Insufficient information Insufficient information |

|

Niagara Mohwak Power |

USD600m |

25/06/2020 |

Insufficient information |

|

Livent Corp |

USD225m |

23/06/2020 |

Insufficient information |

|

Hypo Neo |

EUR500m/USD564.3m |

25/06/2020 |

Insufficient information |

|

Grieg Seafood ASA |

NOK1bn/USD104.4m |

25/06/2020 |

Insufficient information |

|

NTT Finance Corp |

JPY40bn/USD374.8m |

25/06/2020 |

Insufficient information |

|

LBBW |

EUR24m/USD27.1m EUR24m/USD26.7m EUR24m/USD26.7m EUR24m/USD26.7m |

25/06/2020 04/06/2020 04/06/2020 04/06/2020 |

Insufficient information Insufficient information Insufficient information Insufficient information |

|

Swire Property |

HKD380m/USD49m HKD750m/USD96.8m |

22/06/2020 18/06/2020 |

Insufficient information Insufficient information |

|

Castle Peak Power Finance Company Ltd |

USD350m |

22/06/2020 |

Insufficient information |

|

Natixis |

EUR15m/USD16.8m |

19/06/2020 |

Insufficient information |

|

Forest Company do Brasil Participacoes SA |

BRL39.4m/USD9.6m |

17/09/2019 |

Insufficient information |

|

BK Brasil Operação e Assessoria a Restaurantes SA |

BRL18.6m/USD4.5m |

01/09/2019 |

Insufficient information |

|

Echoenergia |

BRL40m/USD9.7m |

31/07/2018 |

Insufficient information |

|

Micro, Small & Medium Enterprises Bonds (Symbiotics) |

LKR1.4bn/USD7.7m |

12/06/2020 |

Insufficient information |

|

Yalong River Hydropower Development Company, Ltd. |

CNY1bn/USD144m |

28/05/2020 |

Insufficient information |

|

Huaneng Lancang River Hydropower Inc. |

CNY1bn/USD141.1m |

19/06/2020 |

Insufficient information |

|

Chengdu Xinjin Shuicheng Water Investment Co.,Ltd |

CNY500m/USD70.5m |

16/06/2020 |

Insufficient information |

|

Fujian Yongrong Holding Group Co.,Ltd |

CNY300m/USD42.5m |

16/04/2020 |

Insufficient information |

|

Chongqing Rail Transit (Group) Co.,Ltd. |

- |

27/02/2020 |

Insufficient information |

|

Snam SpA |

EUR500m/USD564.9m |

17/06/2020 |

Insufficient information |

|

Town of Wareham |

USD13.5m (20 Tranches) |

18/06/2020 |

Insufficient information |

|

Credit Agricole |

ZAR250m/USD14.5m JPY409m/USD3.8m JPY590m/USD5.4m USD10m USD10m |

18/06/2020 01/06/2020 01/06/2020 05/06/2020 04/06/2020 |

Insufficient information Insufficient information Insufficient information Insufficient information Insufficient information |

|

Enexis Holding NV |

EUR500m/USD564.9m |

17/06/2020 |

Insufficient information |

|

Muenchener Hypothekenbank eG |

EUR10m/USD11.3m |

17/06/2020 |

Insufficient information |

|

Shenzhen Guofu Baoli Co.,Ltd. |

CNY96m/USD14m |

06/06/2019 |

Insufficient information |

|

Jiangsu Shengze Investment Co.,Ltd |

CNY200m/USD28.8m |

10/01/2020 |

Insufficient information |

|

Huaneng Tiancheng Financial Leasing Co.,Ltd. |

CNY500m/USD72.3m |

13/01/2020 |

Insufficient information |

|

Shouguang Huinong New Rural Construction Investment Development Co., Ltd. |

CNY500m/USD71.1m |

25/02/2020 |

Insufficient information |

|

Huadian Power International Corporation Limited |

CNY1.5bn/USD211.5m |

13/02/2020 |

Insufficient information |

|

Zhuzhou Geckor Group Co.,Ltd |

CNY0m/USD0.3m |

27/02/2020 |

Insufficient information |

|

Datang Financial Leasing Co.,Ltd. |

CNY0m/USD0.3m |

03/03/2020 |

Insufficient information |

|

Laiwu Minsheng Industrial Co.,Ltd. |

CNY500m/USD70.7m |

17/04/2020 |

Insufficient information |

|

Telia |

SEK750m/USD79.3m |

10/06/2020 |

Insufficient information |

|

KEPCO |

USD500m |

15/06/2020 |

Insufficient information |

|

Deutsche Bank |

EUR500m/USD555.8m |

10/06/2020 |

Insufficient information |

|

Chongqing Changshou Ecological Tourism Development Group Co.,Ltd. |

CNY0m/USD0m |

29/05/2020 |

Insufficient information |

|

Soochow Jinqiang New Materials Co., Ltd. |

CNY20m/USD2.9m |

28/05/2020 |

Insufficient information |

|

Zhejiang Deqing Transportation Investment And Construction Co., Ltd |

CNY900m/USD129.6m |

06/05/2020 |

Insufficient information |

|

Taizhou, Zhejiang Expressway Group Co., Ltd. |

CNY60m/USD8.6m |

06/05/2020 |

Insufficient information |

|

Wuhan Chedu Sishui Co-Governance Project Management Co., Ltd. |

CNY1bn/USD144m |

29/04/2020 |

Insufficient information |

|

Taizhou Vincellar Culture Industry Development Co.,Ltd. |

CNY400m/USD57.6m |

29/04/2020 |

Insufficient information |

|

Shuntai Leasing Company Limited |

CNY59m/USD8.5m CNY42m/USD6m CNY17.7m/USD2.5m |

29/04/2020 29/04/2020 29/04/2020 |

Insufficient information Insufficient information Insufficient information |

|

Beijing China Oversea Plaza Business Development Co., Ltd. |

CNY1m/USD0.1m CNY3.7bn/USD532.8m |

28/04/2020 28/04/2020 |

Insufficient information Insufficient information |

|

Hungary |

EUR1.5bn/USD1.7bn |

05/06/2020 |

Insufficient information |

|

Mtr Corp Ltd |

CNY220m/USD31.7m |

05/06/2020 |

Insufficient information |

|

BASF |

EUR1bn/USD1.1bn |

05/06/2020 |

Insufficient information |

|

City of Gothenburg |

SEK500m/USD52.9m |

03/06/2020 |

Insufficient information |

As always, your feedback is welcome!

Watch this space for more market developments. Follow our Twitter or LinkedIn for updates. E-mail data requests to dataenquiries@climatebonds.net.

Don’t forget, registrations have just opened for Climate Bonds Conference 8-10 September 2020! All online. More information here.

‘Till next time,

Climate Bonds

Disclosure: Some of the organisations mentioned in this communication are Climate Bonds Partners. A list of Partners is available here.