Welcome to the Markets Monthly!

For more information on the Climate Bonds Database on Market Data mail to: dataenquiries@climatebonds.net

Climate Bonds Connected – Online Programme

Climate Bonds Connected is our new online programme with all the latest transition, green & sustainable finance developments. Webinars, podcasts and more.

Coming up: Asia Green Bond Investors with GPIF, Brazil Infrastructure Minister, EU Sustainability with Martin Spolc & more events into July.

The full programme is here.

Don’t Miss!

Brazil’s Minister of Infrastructure, Tarcísio Freitas, as special Guest Speaker in our Wednesday Webinar, discussing green infrastructure pipelines. On today!

Our Markets Monthly ‘Coffee Break’ Webinar on Thursday 11th 13:00 London Time. 15 mins of May market analysis & conversation with Lea Muething.

Thursday 18th June, Tetsuya Oishi from GPIF joins speakers from UBS Asset Management & Huaxia Bank Asset Management sharing investor perspectives on Green Bonds in Asia.

Latest Reports

Japan - Green Finance State of the Market 2019

Japan - Green Finance State of the Market 2019

An updated in-depth overview of the Japanese green bond market, highlighting developments since the inaugural 2018 publication. With USD17bn in cumulative issuance at the end of 2019, Japan reached 9th place in global country rankings and 2nd in Asia-Pacific, after China.

Hong Kong Green Bond Market Briefing 2019

Hong Kong Green Bond Market Briefing 2019

Produced in partnership with HSBC, and supported by the Hong Kong Monetary Authority (HKMA) and the Hong Kong Green Finance Association (HKGFA), Climate Bonds Initiative’s second Hong Kong Briefing Paper examines a range of green bond deals from domestic issuers, and for the first time assesses their post-issuance disclosure.

Securitisation as an enabler of green asset finance in India

Securitisation as an enabler of green asset finance in India

This report discusses the role green asset backed securities (ABS) can play in helping India finance its green infrastructure and improve the lives of the poor and disadvantaged. However, we acknowledge that securitisation requires specialised structuring expertise, complex credit analysis and a specialised investor base.

May at a glance

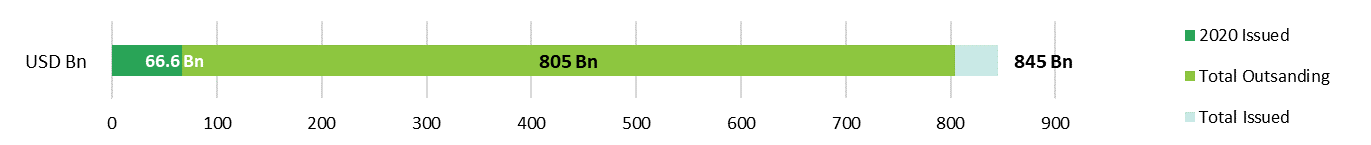

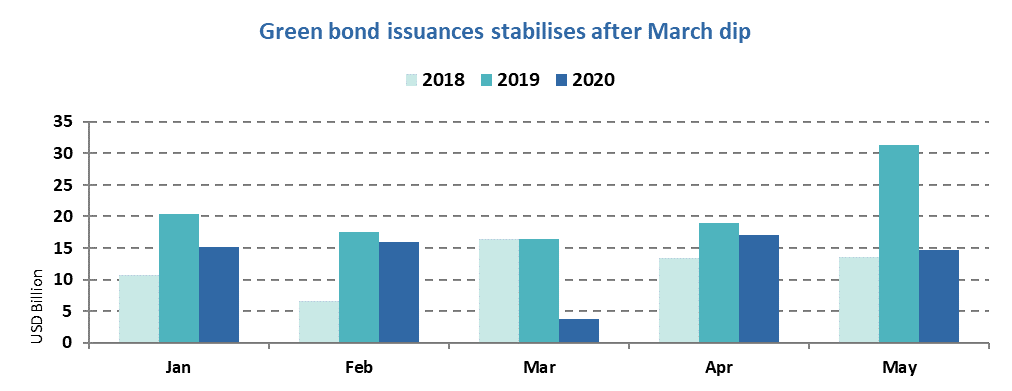

May 2020 saw green bonds worth USD14.6bn come to the market, bringing total cumulative issuance to USD845bn. Despite the monthly figure being a 53% decline year-on-year (May 2019 was last year’s peak in issuance) the figure reflects that the volume is stabilising after the sharp dip in March.

The effects of the COVID-19 pandemic remain omnipresent. The interest rate environment is still at an all-time low after cuts in the major markets including the US and the UK, as the Fed and the Bank of England have slashed rates to stimulate lending. These circumstances have also made it possible for the UK to print its first negative-yielding government bond. Nevertheless, the credit market has been supported by different quantitative easing measures, such as the ECB Pandemic Emergency Purchase Programme which started in mid-March this year.

The social and sustainability bond rally continues, with the French agency Unédic raising EUR4bn (USD4.4bn) – one of the largest social bonds ever issued. In the meantime, institutional investors such as BlackRock are targeting the pandemic with impacts funds focusing on COVID-19 and the SDGs.

Measures to support a green recovery from the pandemic are starting to materialise. Companies in Canada will have to disclose climate impacts in order to qualify for Covid-19 relief and Norway has proposed a package of NOK3.6bn (USD370m) to support green technology projects. Germany announced the largest set of green recovery measures so far (EUR130bn/USD145bn) this week, including support for electric vehicles and R&D on green hydrogen, among others. The EU’s recovery package will also have a green component. However, work remains to be done, as the Guardian reports that most of the post-COVID stimulus – as much as USD500bn equivalent – remains tagged to brown industries.

At the same time, companies aren’t shying away from further commitments: Southern Company (USA) has just announced its goal to a transition to net zero carbon emissions by 2050. On the financial side, Citigroup (USA) said it is launching a new business unit called Sustainability & Corporate Transitions.

The transition agenda is advancing on government level as well: China has removed ‘clean coal’ from its list of eligible projects for green bonds. Japanese experts propose a national ‘transition taxonomy’ for finance and the government is establishing an online platform along with a high-level international political meeting to discuss green transitions and recovery from the pandemic. Support from third-parties is headed in that direction as well as Sustainalytics recently launched its transition bonds Second Party Opinion service.

Third-party reviews remain key in the green bond market. After a dip in March, Climate Bonds Certifications have seen an increase in issuance volume passing the cumulative $120bn milestone. Certified Climate Bonds amounted to USD2.6bn in May 2020 compared to USD1.5bn in April and USD1bn in March 2020. A high-profile Certification came from Eurogrid, a non-financial corporate from Germany, which completed its debut green issuance with a deal worth EUR750m (USD834m – see New issuer spotlight).

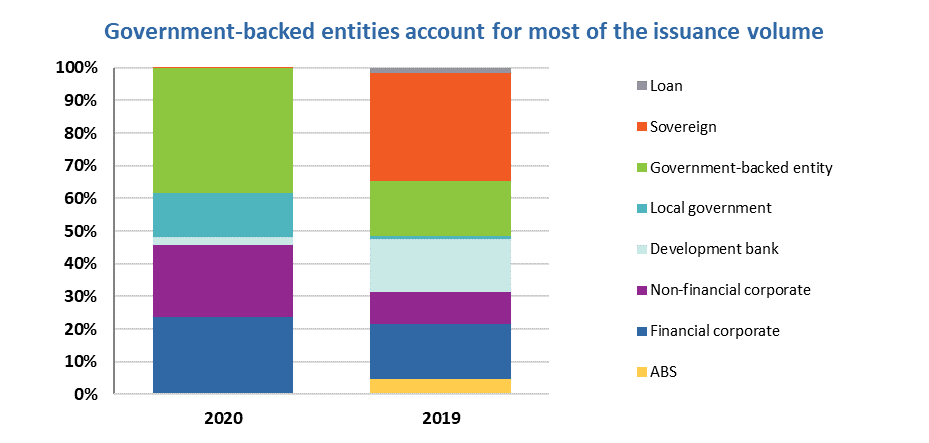

In May, Non-financials as well as Financial corporates issued relatively more than other issuer types compared to last year; Non-financial corporates also in absolute terms. Of the latter, Asja Ambiente Italia SPA (Italy) issued its third deal raising EUR1m (USD1m) in order to finance the development of new high-quality biomethane production plants. With its debut issuance, Credit Suisse (Switzerland) included Equity as an asset class that is eligible for green funding. On a similar note, K2A (Sweden) has created a green Equity framework. Also, on the debt side, different bond structures keep appearing in the green space: the hydrogen engines and fuelling solutions provider Plug Power Inc. from the USA issued the country’s first green convertible.

Government-backed entities dominated issuance volume in May. With newcomers Swisscom (Netherlands – watch out for a special blog post coming this week) and Sacramento Municipal Utility District (USA) with EUR500m/USD556m and USD400m, respectively (see New issuer spotlight), total volume from this issuer type added up to USD5.6bn. Dutch public sector specialist bank NWB Bank (Netherlands) is using its USD500m deal proceeds on for example funding energy recovery and the extraction of phosphorus from wastewater.

As opposed to this time last year, there was little Sovereign issuance in May 2020. Repeat issuer Republic of Lithuania raised a total of EUR28m (USD31m) for green projects.

The US is leading country rankings this month with USD5.2bn, which is more than a third of the total volume. This came mainly from multiple US Muni bonds making up 52% (USD2.7bn) of that figure and marking the second highest monthly volume of that instrument type after December 2017.

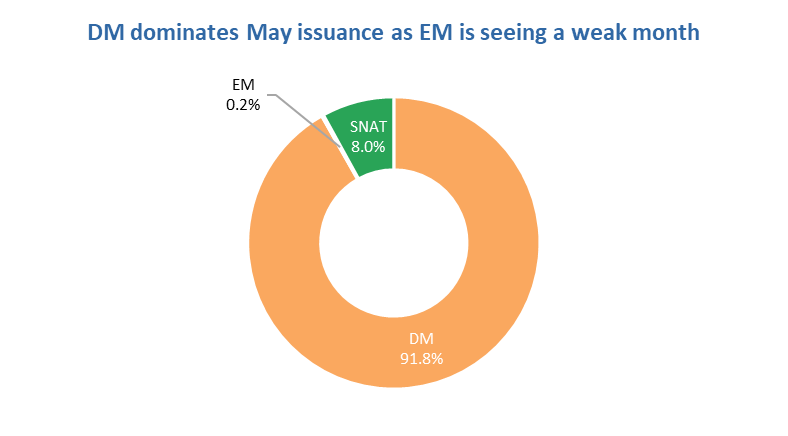

The US was followed by France (USD3.1bn), Germany (USD1.4bn) and multiple other countries belonging to developed markets, making this segment comprise 91.8% of all May issuance. Only the Lithuanian Sovereign can be credited to emerging markets. Nevertheless, Luxembourg – appearing less frequently in the country list- saw CPI Property Group return to the market financing Green Buildings, Renewable Energy and Land Use.

> Check out the full list of new and repeat issuers.

> Click on the issuer name to access the new issue deal sheet in our online Bond Library.

Worth reading

ICMA published a report in which it lays out definitions for sustainable finance. The Paris Agreement is part of these definitions - ICMA

…and:

- From the European Action Plan to the renewed strategy on sustainable finance – Finance for tomorrow

- Roadmap for ASEAN sustainable capital markets – ASEAN Capital Markets Forum

- Emerging Markets Green Bonds Report – Amundi Asset Management

- Implications of the Covid-19 pandemic for global sustainable finance - UNEP

- Keeping Green and Impact in Focus - Monetary Authority of Singapore

New issuer spotlight - Certified Climate Bonds

Eurogrid (EUR750m/USD812m), Germany, had its inaugural green bond issuance with a 12-year instrument. The assets are Certified against the Marine Renewable Energy criteria under Climate Bonds Standard V3. The proceeds will be used to finance and refinance two offshore connections, Ostwind 1 and Ostwind 2, which connect to wind farms in the Baltic Sea. Collectively the farms have an installed capacity of approximately 1.5GW and are situated 90km from the German mainland. Ostwind 1 was completed in 2019, and Ostwind 2 is currently in development. This deal is the first green bond explicitly linked to offshore wind in the Baltic Sea, and offshore wind transmission infrastructure.

Both allocation as well as impact reporting will be available to investors within one year from the date of issuance until full allocation.

Banco Votorantim (BRL250m/USD50m), Brazil, debuted in March 2020 with a green bond Certified against the Solar and Wind Criteria of the Climate Bonds Standard, maturing in four years’ time. The proceeds will be used to finance new loans for solar PV and wind energy systems to retail customers (homes and other small buildings) in Brazil. This deal marks several firsts for Certification in Brazil. Read more in our Banco BV blog post.

The issuer is committed to reporting annually on all assets and projects funded with the bond, for both segments.

New issuer spotlight

Swisscom (EUR500m/USD556m), Netherlands, came to market with an inaugural 8.5-year green senior unsecured instrument. Sustainalytics provided an SPO on the company’s framework. Three eligible project categories are included: Energy Efficiency (network development, network operations, Internet of Things networks, products and solutions, and energy efficiency improvements in buildings); Renewable Energy (installation of off-grid energy solutions, including solar panel installation and biomass heating that complies with EU Taxonomy criteria); and Clean Transportation (reducing the carbon footprint of the company’s fleet).

An annual allocation report will be published on Swisscom’s website until full proceed allocation. This includes the total amount of investments and expenditures, the share of financing vs refinancing and the balance of unallocated proceeds (if any). Where feasible, Swisscom will also report on the environmental impact of its green funding or refer to existing sustainability reporting. This reporting will be produced annually on a project portfolio basis.

Climate Bonds view: In early May 2020, Swisscom became the sixth organisation in the Communications industry to issue a green bond. Swisscom managed to accumulate EUR5bn worth of interest in the bond, translating into a book that was ten times covered. It is clear that investor confidence in credit overall has been supported by the ECB Pandemic Emergency Purchase Programme since mid-March, but even in this context, interest of this magnitude is notable, and points to the fact that issuers from this sector remain a rarity in the green bond market. Investors evidently welcome the opportunity to add much needed industry diversification to green bond portfolios, which tend to be heavily biased towards utility, financial, and real estate issuers.

Credit Suisse London (EUR500m/USD541m), Switzerland, entered the market with a five-year senior unsecured green debut benefitting from an SPO from ISS-oekom. The proceeds will go towards financing or refinancing projects in the Renewable Energy (Solar), Low Carbon Buildings and Clean Transportation (Electric Vehicles) space.

The framework also covers Energy Efficiency, Conservation Finance, Sustainable Waste Management, Sustainable Water Infrastructure and Circular Economy. Excluded projects include those involving coal-fired power generation, defence, large-scale hydropower, gambling, mining, nuclear energy, oil and gas, palm oil, tobacco, and wood pulp.

Eligible financial products comprise debt (e.g. bank, bridge and construction loans, bonds, warehouse facilities, mezzanine debt, back leverage, revolvers, and corporate debt) and equity (e.g. tax, project, corporate).

Until funds are fully allocated, Credit Suisse will publish an annual monitoring report. This will include the total amount of proceeds allocated and unallocated, as well as qualitative and, where possible, quantitative indicators of the projects’ environmental impact.

Climate Bonds view: It’s positive to see another global bank joining the green bond market. Financial corporates have great potential to scale up green finance as they provide capital in smaller increments. This framework covers multiple different financial instrument types spanning both the equity and debt space. Such breadth and detail are almost unprecedented and set a good example for peers. Also, the wide range of eligible project categories is positive, as it offers much needed diversity and access to capital for different borrowers.

Groupe BPCE (EUR1.3bn/USD1.4bn), France, completed its inaugural issuance with a 10-year instrument benefiting from an SPO from Vigeo Eiris. The proceeds are secured on mortgages to properties in the top 15% of energy efficiency in France and will finance further eligible green mortgage loans for green buildings. The company clearly defines in their Methodology Note for Green Bonds/Green Buildings what types of assets are eligible, for example certain building certifications and carbon efficiency targets.

Allocation as well as impact reporting will be published on the company’s website on an annual basis.

Climate Bonds view: This is the second covered bond from France and one of the largest of its kind globally so far. The deal bumps France up to third in terms of volume issued through green covered bonds, which now stands at a total of USD2.2bn for the country.

This deal tries to meet the increasing demand for green bonds and in particular covered bonds, which are advantageous for investors due their high rating. In addition to being the second longest-dated green covered bond in the market, it marks the second instrument of this type in 2020. We hope to see more covered green bonds in the remainder of this year.

IndoSpace Core (INR1bn/USD14m), India, took out its first green loan which will finance and refinance green buildings that have achieved the EDGE green building certification developed by the IFC.

Climate Bonds view: This is the first green loan issued by an Indian entity and the third instrument from India to finance green buildings. As in emerging markets in general, green debt instruments most commonly finance renewable energy projects, such as solar and wind power. It is therefore great to see that funding is being directed also towards other areas that are needed for sustainable and resilient economies. We hope this encourages more emerging markets issuers to finance similar projects.

New issuers continued...

Public Sector

- City of Marysville (USD40m), USA, 28.7Y original term, assured by BAM GreenStar.

- Midway City (USD5m), USA, 20.1Y original term, assured by BAM GreenStar.

- Sacramento Municipal Utility District (USD400m), USA, 30.3Y original term, SPO provided by Kestrel Verifiers.

- Sewerage District No. 1 of the Parish of Tangipahoa (USD5m), USA, 29.4Y original term, assured by BAM GreenStar.

- Southern California Public Power Authority (USD55m), USA, 3.9Y original term, no third-party review.

- State of Wisconsin (USD80m), USA, 19.1Y original term, no third-party review.

Loans

- LYS Energy (SGD14m/USD10m), Singapore, tenor not disclosed, no third-party review – issued in April 2020.

- Wereldhave N.V. (EUR100m/USD110m), Netherlands, 2Y original term, SPO provided by ISS-oekom – issued in April 2020.

Visit our Bond Library for more details on May deals and a full history of debut green issuances going back to 2017.

Green bond outlook – selected deals

|

Issuer Name |

Country |

Closing Date |

Source |

|

SpareBank 1 Boligkreditt AS |

Norway |

02/06/2020 |

|

|

Neoen SA |

France |

02/06/2020 |

|

|

Svensk Fastighetsfinansiering AB |

Sweden |

03/06/2020 |

|

|

Vasakronan |

Sweden |

03/06/2020 |

|

|

National University of Singapore |

Singapore |

03/06/2020 |

|

|

Hungary |

Hungary |

tbc |

|

|

BASF |

Germany |

05/06/2020 |

|

|

Deutsche Bank AG |

Germany |

10/06/2020 |

|

|

Bayerische Landesbank |

Germany |

18/06/2020 |

June already saw multiple issuances coming mainly from Germany and Sweden. The deals range from issuers that have multiple green bonds outstanding, such as Vasakronan and Svensk FastighetsFinansiering (SFF), to market newcomers.

Deutsche Bank AG (Germany) has successfully placed its first green bond. Similarly, the National University of Singapore (Singapore) has raised green funds for the first time, becoming the first university in Asia to issue a green bond. To top it off, after recently establishing a framework for financing instruments based on sustainability criteria, BASF (Germany) had its debut green bond issuance (more on these deals in the next Markets Monthly). Also, the green bond rumour mill keeps spinning. Aquafin (Belgium) might be readying another deal.

Sovereign Green Bond Club

Hungary was the latest newcomer to the Sovereign Green Bond Club and Nigeria is still eyeing a green bond as part of their increased borrowing plans. The Swedish Debt Management Office launched a green bond framework and confirmed its debut issuance will be completed sometime in August. Egypt is currently exploring the possibility of green bonds to finance projects such as electric trains. Spain has also signalled that its sovereign green bond remains on the agenda. Read more in our LinkedIn round up.

Data and references

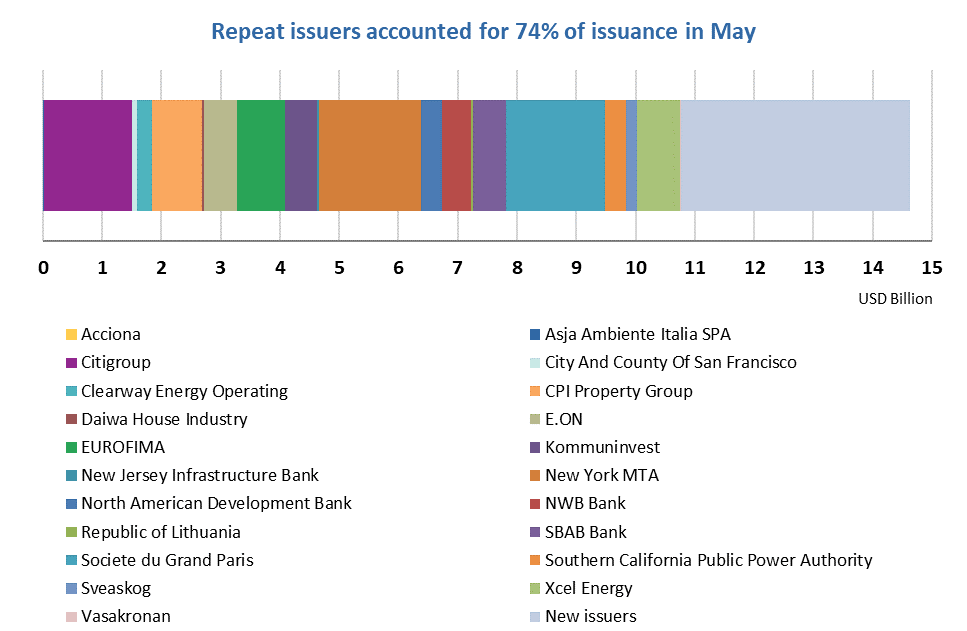

Repeat issuers in May

Repeat issuers: January to April 2020 (not previously included)

- FMO: SEK1.5bn/USD158.6m - March 2020

- Fannie Mae: USD329.9m - April 2020 (12 deals)

- Neoenergia Itabapoana Transmissao de Energia SA: BRL300m/USD54.2m - April 2020

- Province of Québec: CAD500m/USD384.1m - Febuary 2020

- Republic of Lithuania: EUR20m/USD22.2m - March 2020

- Societe du Grand Paris: EUR50m/USD55.6m - April 2020

- State Bank of India: USD100m - March 2020

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Although we support the Sustainable Development Goals (SDGs) overall and see many links between green bond finance and specific SDGs, in particular SDGs 6, 7, 9, 11, 13, 14 and 15, the proportion of proceeds allocated to social goals should be no more than 5% for inclusion in our database.

|

Excluded |

|||

|

Issuer Name |

Amount issued |

Issue date |

Reason |

|

Sinohydro Bureau 8 Co.,Ltd. |

CNY680m/USD97.9m |

29/04/2020 |

Working capital/General needs |

|

Changzhou Binjiang Economic Development Zone Investment Development Group Co., Ltd. |

CNY500m/USD72m |

27/04/2020 |

Working capital/General needs |

|

BBVA |

EUR1bn/USD1.1m |

04/06/2020 |

Sustainability/Social bond |

|

Umweltbank |

EUR40m/USD46.8m |

20/07/2018 |

GB not aligned |

|

Oregon Metro |

USD90m (10 tranches) |

30/04/2020 |

Sustainability/Social bond |

|

City of Phoenix |

USD393m (24 tranches) |

09/04/2020 |

Sustainability/Social bond |

|

New York State Housing Finance Agency |

USD24.9m USD55.8m |

31/03/2020 31/03/2020 |

Sustainability/Social bond Sustainability/Social bond |

|

California School Finance Authority |

USD19m (4 tranches) |

26/02/2020 |

Sustainability/Social bond |

|

Bank of America |

USD1bn |

19/05/2020 |

Sustainability/Social bond |

|

EIB |

AUD350m/USD240.2m USD1bn |

26/05/2020 19/05/2020 |

Sustainability/Social bond Sustainability/Social bond |

|

Unédic |

EUR4bn/USD4.4bn |

25/05/2020 |

Sustainability/Social bond |

|

World Bank (IBRD) |

UYU434.5m/USD10.1m UYU1.5bn/USD35.4m UYU4.3bn/USD98.4m UYU1.1bn/USD24.9m UYU1.2bn/USD27.3m UYU1.2bn/USD27.3m INR330m/USD4.6m EUR3bn/USD3.3bn GBP1.5bn/USD2bn USD3.5bn IDR450bn/USD31.5m TRY750m/USD122.3m EUR35m/USD38.9m EUR2.5bn/USD2.8bn GBP1.8bn/USD2.3bn NZD600m/USD398.4m SEK750m/USD79.3m GBP1.5bn/USD2bn RUB2bn/USD32.4m ZAR500m/USD35.1m IDR2tn/USD137.1m USD1.6bn USD4bn |

07/05/2020 07/05/2020 30/04/2020 14/04/2020 18/03/2020 18/03/2020 04/05/2020 24/04/2020 22/04/2020 11/03/2020 09/03/2020 25/02/2020 25/02/2020 21/02/2020 21/02/2020 19/02/2020 14/02/2020 04/02/2020 03/02/2020 30/01/2020 12/10/2018 19/06/2019 14/05/2020 |

Sustainability/Social bond Sustainability/Social bond Sustainability/Social bond Sustainability/Social bond Sustainability/Social bond Sustainability/Social bond Sustainability/Social bond Sustainability/Social bond Sustainability/Social bond Sustainability/Social bond Sustainability/Social bond Sustainability/Social bond Sustainability/Social bond Sustainability/Social bond Sustainability/Social bond Sustainability/Social bond Sustainability/Social bond Sustainability/Social bond Sustainability/Social bond Sustainability/Social bond Sustainability/Social bond Sustainability/Social bond Sustainability/Social bond |

|

National Bank of Canada |

EUR20m/USD22.2m |

19/03/2020 |

Sustainability/Social bond |

|

Instituto de Credito Oficial |

EUR500m/USD555.8m |

13/05/2020 |

Sustainability/Social bond |

|

African Development Bank |

SEK2.5bn/USD264.4m |

14/04/2020 |

Sustainability/Social bond |

|

Cassa Depositi e Prestiti (CDP) |

EUR750m/USD820.2m |

11/02/2020 |

Sustainability/Social bond |

|

BNG Bank |

USD75m SEK1.5bn/USD158.6m |

11/05/2020 04/05/2020 |

Sustainability/Social bond Sustainability/Social bond |

|

Housing New Zealand |

NZD500m/USD332m NZD1.2bn/USD825.4m NZD300m/USD199.2m |

24/04/2020 12/06/2018 01/05/2020 |

Sustainability/Social bond Sustainability/Social bond Sustainability/Social bond |

|

CPC |

USD100m |

31/01/2020 |

Sustainability/Social bond |

|

NTPC |

JPY40bn/USD367.9m |

04/02/2020 |

Not aligned |

|

IBRD |

AUD150m/USD102.9m |

01/05/2020 |

Sustainability/Social bond |

|

Changxing County Yongxing Construction Development Co.,Ltd. |

CNY700m/USD100.8m |

16/04/2020 |

Working capital/General needs |

|

Yichang Xingfa Group Co.,Ltd |

CNY1bn/USD144m |

13/04/2020 |

Working capital/General needs |

|

Guizhou Water Investment Group Co., Ltd. |

CNY1bn/USD144m |

12/03/2020 |

Not aligned |

|

Huaneng Tiancheng Financial Leasing Co.,Ltd. |

N/A N/A |

02/03/2020 02/03/2020 |

Working capital/General needs Working capital/General needs |

|

Ningxiang Economic and Technological Development Zone Construction Investment Co.,Ltd. |

CNY620m/USD88m |

28/02/2020 |

Working capital/General needs |

|

Changxing County Traffic Construction Investment Company |

CNY1.5bn/USD216m CNY650m/USD93.3m |

18/02/2020 02/01/2020 |

Working capital/General needs Working capital |

|

Guangzhou Metro Group Co.,Ltd. |

CNY1.5bn/USD216m |

10/01/2020 |

Working capital |

|

Bank of Dongguan Co.,Ltd. |

CNY2bn/USD292.2m |

24/08/2018 |

Not aligned |

|

Changzhou Binjiang Economic Development Zone Investment Development Group |

CNY500m/USD1.1bn |

27/04/2020 |

Working capital |

|

Pending |

|||

|

Issuer Name |

Amount issued |

Issue date |

Reason |

|

Procredit Holding |

EUR11m/USD12.2m |

29/05/2020 |

Insufficient information |

|

Triview Metropolitan District |

USD16m (18 tranches) |

27/05/2020 |

Insufficient information |

|

Deutsche Hypo |

EUR50m/USD55.6m |

26/05/2020 |

Insufficient information |

|

Swedavia |

SEK250m/USD25.8m |

26/05/2020 |

Insufficient information |

|

Beijing Jingneng Clean Energy |

CNY15bn/USD2.2bn |

19/05/2020 |

Insufficient information |

|

Huaneng Lancang River Hydropower |

CNY500m/USD72m |

20/05/2020 |

Insufficient information |

|

Asian Development Bank |

HKD115m/USD14.8m |

13/05/2020 |

Insufficient information |

|

RBS Group |

USD600m |

22/05/2020 |

Insufficient information |

|

Copenhagen Infrastructure Partners |

TWD90bn/USD3bn |

01/04/2020 |

Insufficient information |

|

Sustainable Energy Utility Inc |

USD53m (15 tranches) |

21/05/2020 |

Insufficient information |

|

Plug Power |

USD200m |

18/05/2020 |

Insufficient information |

|

Mtr Corp Ltd |

HKD200m/USD25.8m USD50m |

18/05/2020 14/05/2020 |

Insufficient information Insufficient information |

|

Dublin Unified School District |

USD123m (25 tranches) |

13/05/2020 |

Insufficient information |

|

Power Authority of the State of New York |

USD1.1bn (5 tranches) |

12/05/2020 |

Insufficient information |

|

LBBW |

EUR24m/USD26.7m |

13/05/2020 |

Insufficient information |

|

Citigroup |

EUR10m/USD11.1m |

11/05/2020 |

Insufficient information |

|

Schaeffler |

EUR350m/USD389m |

11/05/2020 |

Insufficient information |

|

City of Ottawa |

CAD300m/USD230.4m |

11/05/2020 |

Insufficient information |

|

Madrid |

EUR700m/USD778.1m |

08/05/2020 |

Insufficient information |

|

Bancomext |

USD200m |

17/04/2020 |

Insufficient information |

|

Kiatnakin Bank |

USD100m |

20/04/2020 |

Insufficient information |

|

Münchener Hypothekenbank eG |

EUR15m/USD16.7m |

07/05/2020 |

Insufficient information |

|

NXP BV/NXP Funding/ NXP USA (NXP Green innovation) |

USD1bn |

01/05/2020 |

Insufficient information |

|

Aggregated Micro Power Infrastructure |

GBP11.5m/USD15.1m |

06/05/2020 |

Insufficient information |

|

Yapi ve Kredi Bankasi AS |

USD50m |

21/01/2020 |

Insufficient information |

|

Guizhou Water Invest Grp Co |

CNY800m/USD115.2m |

17/01/2020 |

Insufficient information |

|

Modern Land (China) Co Ltd |

USD200m |

26/02/2020 |

Insufficient information |

|

Sumitomo Mitsui Fin & Leasing |

JPY1.5bn/USD13.8m |

05/03/2020 |

Insufficient information |

|

Asian Development Bank |

HKD300m/USD38.6m |

24/01/2020 |

Insufficient information |

|

EBRD |

EUR30m/USD33.3m |

31/01/2020 |

Insufficient information |

|

Landesbank Baden-Wuerttemberg |

EUR1bn/USD1.1bn |

18/02/2020 |

Insufficient information |

|

Clarion Funding Plc |

GBP350m/USD458.4m |

22/01/2020 |

Insufficient information |

As always, your feedback is welcome!

Watch this space for more market developments. Follow our Twitter or LinkedIn for updates. E-mail data requests to dataenquiries@climatebonds.net.

‘Till next time,

Climate Bonds

Disclosure: Some of the organisations mentioned in this communication are Climate Bonds Partners. A list of Partners is available here.