Don’t miss!

Webinar! Climate Bonds first European Investor Survey. Results in detail. Wed, 27 Nov 2019, 11:30 – 12:30 GMT.

Green Bond European Investor Survey

In what is Climate Bonds Initiative’s first green bond investor survey in a planned series of surveys, we surveyed 48 of the largest Europe-based investment managers.

In what is Climate Bonds Initiative’s first green bond investor survey in a planned series of surveys, we surveyed 48 of the largest Europe-based investment managers.

The survey found that investors are looking for green transition opportunities and want deals with high climate impact as well as highly value green credentials and transparency. Policy is a key driver to investment and there is a widespread lack of supply.

Brazil GIIO

The Green Infrastructure Investment Opportunities - Brazil 2019 report lists the current state of the Brazilian sustainable finance market and the progress of green infrastructure projects in Brazil.

The Green Infrastructure Investment Opportunities - Brazil 2019 report lists the current state of the Brazilian sustainable finance market and the progress of green infrastructure projects in Brazil.

The report analyses investment opportunities for green infrastructure in the country and provides samples of green and/or potentially green projects in the renewable energy, low carbon transport, water infrastructure and waste management for power generation.

Available in English and Portuguese.

China Q3 newsletter

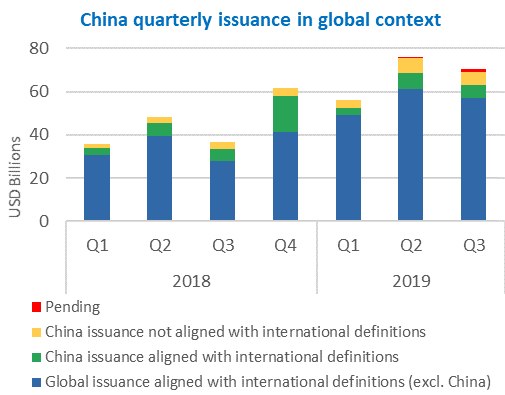

China Green Bond Market Newsletter Q3 2019 gives an overview of Chinese green bond issuance in Q3. Both global and Chinese green bond issuance has increased significantly in Q3 compared to the corresponding quarter in 2018.

China Green Bond Market Newsletter Q3 2019 gives an overview of Chinese green bond issuance in Q3. Both global and Chinese green bond issuance has increased significantly in Q3 compared to the corresponding quarter in 2018.

USD5.8bn of Q3 volume from Chinese issuers is in line with international green bond definitions. Government-backed entities had the strongest quarter on record. Financial corporates remain prolific issuers, despite not being at the top this quarter.

As the largest sector for bonds aligned with Climate Bonds definitions, Transport’s share rose to 47% of issuance volume in Q3. Water (22%) and Renewable Energy (19%) followed.

The newsletter also covers a discussion on sustainable waste management and a policy update.

Available in English and Chinese.

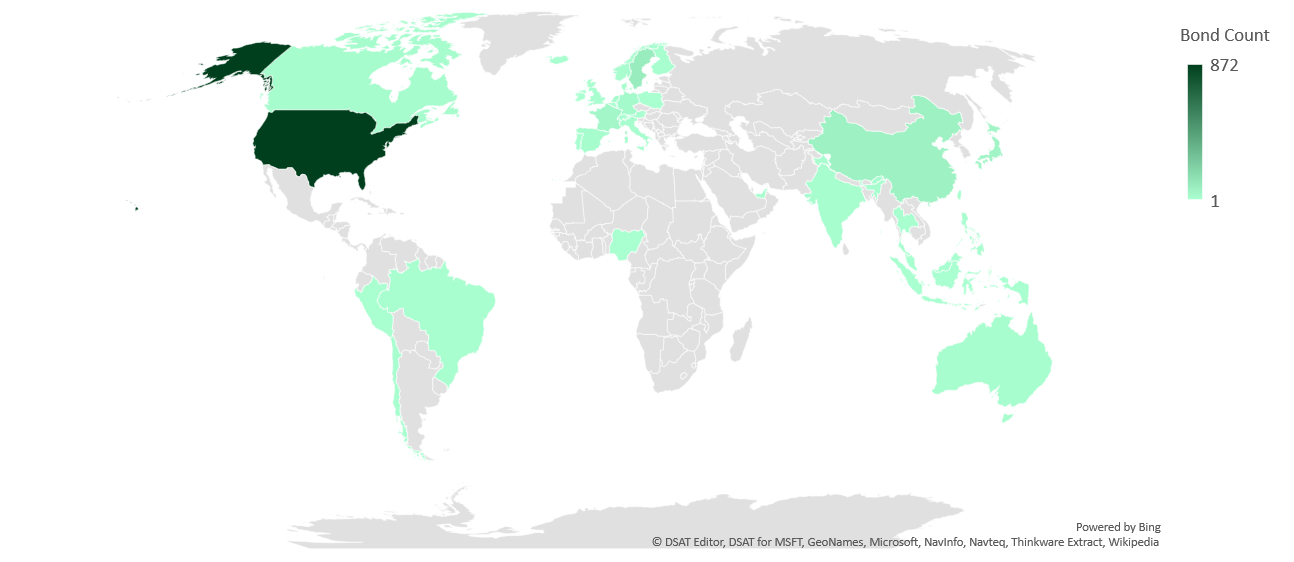

Green bond deals across the globe: 1 Jan – 15 Nov 2019

At a glance

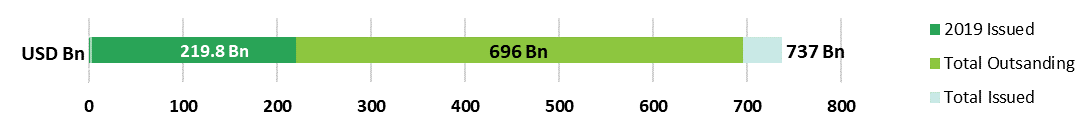

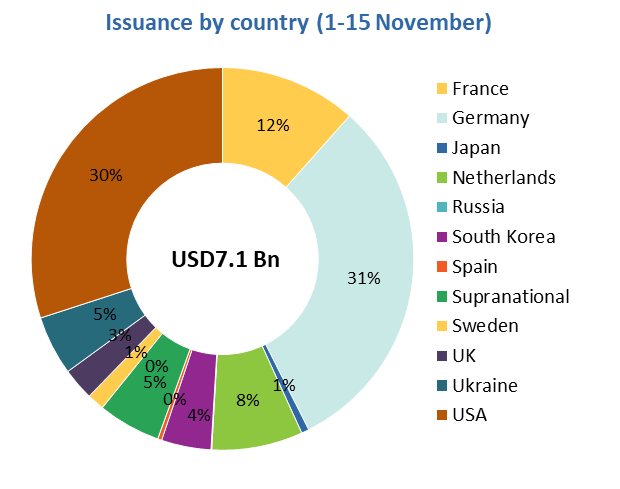

Issuance from 1 November to 15 November reached USD7.1bn, bringing the total 2019 green bond volume to USD219.8bn. Overall cumulative GB issuance since 2007 is now at USD737bn.

So far this month issuance from DM accounts for 85% with most of the deals and the largest volume coming from Germany, the USA and France.

The USA saw five new issuers with two financial corporates coming to the market: PNC Financial Services Group (USD650m) and Duke Realty (USD400m) which were the largest US deals.

There were 3 EM deals: DTEK Renewables (EUR325/USD358), the first issuer from Ukraine, Shui On Land (USD300m), China, and Center-invest Bank (RUB250/USD4m), the first financial corporate and second green bond issuer from Russia.

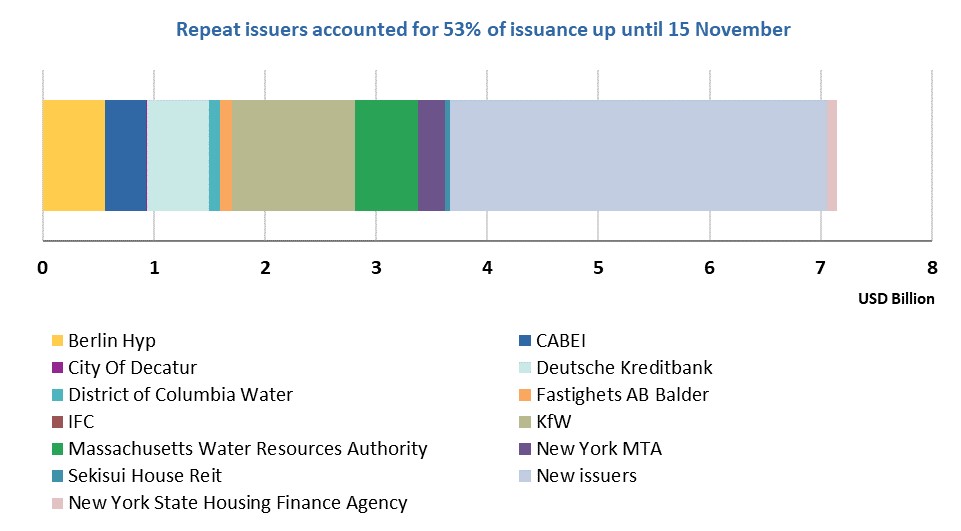

Overall, so far only 51% of the issuance in November has come from repeat issuers.

> The full list of new and repeat issuers here.

> Click on the issuer name to access the new issue deal sheet in the online bond library.

New issuers

Public sector

Caisse Française de Financement Local (Caffil) - Société de Financement Local (SFIL) (EUR750m/USD827m), France, issued the first green covered bond in France. The 10Y instrument will finance or refinance new and existing projects that are aimed at improving French social infrastructure and environmental protection. Eligible categories are clean transportation, sustainable water and sanitation management, waste management and valuation, energy efficiency, green buildings and renewable energy.

Post-issuance reporting will be made available on the SFIL website on an annual basis, until full allocation of proceeds. The allocation report will contain the total amount of proceeds allocated to each green bond by eligible green loan category and the total number of eligible green loans associated with each green bond. The impact report may be presented in generic terms due to the nature of the security as this bond consists of a number of underlying loans.

Climate Bonds view: The breadth of projects fits well with public sector investment in green infrastructure. SFIL Group also issued a social bond in March. SFIL works with La Banque Postale, a green bond issuer in its own right and one of the largest French investment groups. Green loans to French local authorities are originated by La Banque Postale and then transferred to SFIL to be refinanced through the issuance of green bonds. This allows SFIL to finance the French public sector at scale.

More issuance in the public sector:

- Benton Washington Regional Public Water Authority of the State of Arkansas (USD59m), USA, 24.9Y original term, assurance provided by BAM GreenStar.

- Mountain Regional Water Special Service District Summit County (USD26m), USA, 15.1Y original term, assurance provided by BAM GreenStar.

- Union County Improvement Authority (USD50m), USA, 24.9Y original term, no third-party review. (October 2019)

Financial corporates

Center-invest Bank (KB Tsentr-Invest PAO) (RUB250m/USD4m), Russia, issued a green bond maturing in one year. This marks the second green bond issued in the Russian market. It is also the first green bond by a Russian financial corporate and the first RUB-denominated green bond by a Russian entity. The proceeds will finance loans for a range of renewable energy, energy efficiency and clean transportation projects, as listed in the SPO.

The green bond register will be used as a basis for reporting. Information on the projects financed by the green bond’s proceeds will be included in the annual environmental report of the bank as a separate annex.

Climate Bonds view: Bank issuance is lacking in many countries, despite being one of the most powerful ways to increase green financing to projects at scale. This is therefore a positive development in a country with a currently very small green bond market, albeit with just a one-year term. We would hope that Center-invest Bank adds detail to its reporting to align with market best practice but acknowledge that reporting is expected to be minimal given the extremely short term.

More deals issued by financial corporates:

- Duke Realty (USD400m), USA, 10Y original term, no third-party review.

- PNC Financial Services Group (USD650m), USA, 5Y original term, SPO provided by Sustainalytics.

Non-financial corporates

DTEK Renewables (EUR325m/USD358m), Ukraine, issued its first green bond maturing in 5 years’ time. This is the first green bond from a Ukrainian issuer. Its bond will finance new or existing projects with the aim to increase the production, connection and distribution of onshore wind and solar power in Ukraine.

An allocation report will be made available on the company’s website on an annual basis until the proceeds are fully allocated. This includes a list of eligible projects, the amounts of financing and refinancing as well as the remaining balance. There will also be an impact report with relevant metrics such as installed power capacity and annual renewable electricity generated. In addition to that, a third-party auditor will verify allocation and impact reporting.

Climate Bonds view: It is encouraging to see more organisations from emerging markets printing green bonds especially considering the size of this inaugural issue. The Ukraine’s energy mix is dominated by fossil fuels – only a fraction comes from renewable energy. This inaugural issuance represents a step in the right direction which hopefully encourages more investments and issuance in the renewable energy space.

More deals issued by non-financial corporates:

- Grenergy Renovables (EUR22m/USD24m), Spain, 5Y original term, SPO provided by Vigeo Eiris.

- Porterbrook (GBP150m/USD194m), UK, SPO provided by DNV GL (not publicly available).

- Shui On Development (Holding) Limited (USD300 m), China, 4Y original term, SPO provided by Sustainalytics.

- Stedin Holding NV (EUR500/USD550m), Netherlands, 10Y original term, SPO provided by ISS-Oekom.

Visit our Bond Library for more details on October deals.

Repeat issuers 1 – 15 November

- Berlin Hyp: EUR500m/USD558.2m

- CABEI (Central American Bank for Economic Integration): USD375m

- City of Decatur: USD5m

- Deutsche Kreditbank (DKB): EUR500m/USD553.8m

- District of Columbia Water: USD104.01m

- Fastighets AB Balder: SEK500m/USD51.9m and SEK500m/USD52.2m

- IFC (International Finance Corporation): USD4.91m

- KfW: EUR1bn/USD1.1bn

- Massachusetts Water Resources Authority: USD570.575m

- New York MTA: USD241.745m

- New York State Housing Finance Authority: USD87.3m

- San Francisco Bay Area Rapid Transit (BART): USD80.3m

- Sekisui House REIT: JPY5bn/USD46.2m

Repeat issuers: January – October 2019 (not previously included)

- Alpha Trains: EUR340m/USD377.3m - October 2019

- EBRD: EUR750m/USD820.5m - September2019

- Entra ASA: NOK200m/USD22m - October 2019

- Greenko: USD85m - October 2019

- KfW: NOK2bn/USD218.8m - October 2019

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Although we support the Sustainable Development Goals (SDGs) overall and see many links between green bond finance and specific SDGs, in particular SDGs 6, 7, 9, 11, 13, 14 and 15, the proportion of proceeds allocated to social goals should be no more than 5% for inclusion in our database.

|

Issuer Name |

Amount issued |

Issue date |

Reason for exclusion/ pending |

|

Suzhou high tech tram Group Co., Ltd |

CNY300m/USD42.9m |

08/11/2019 |

Excluded (Not aligned) |

|

Housing New Zealand |

NZD900m/USD572.6m |

08/11/2019 |

Excluded (Sustainability/Social bond) |

|

Royal Bank of Scotland |

EUR750m/USD825.5m |

15/11/2019 |

Excluded (Sustainability/Social bond) |

|

Nanjing Metro Group Co., Ltd. |

CNY2bn/USD282.1m |

19/09/2019 |

Excluded (Not aligned) |

|

China Three Gorges Corporation |

CNY2bn/USD279.2m |

29/08/2019 |

Excluded (Not aligned) |

|

Mori building |

JPY15bn/USD137.7m |

14/11/2019 |

Pending (Waiting for more info) |

|

SKF |

EUR300m/USD330.2m |

15/11/2019 |

Pending (Waiting for more info) |

|

Owens-Illinois Group |

EUR500m/USD551.5m EUR500m/USD551.5m |

12/11/2019 12/11/2019 |

Pending (Waiting for more info) |

|

Apple |

EUR1bn/USD1.1bn EUR1bn/USD1.1bn |

15/11/2019 15/11/2019 |

Pending (Waiting for more info) |

|

EBRD |

EUR50m/USD55.1m |

13/11/2019 |

Pending (Waiting for more info) |

|

Shangyu District Shaoxing Municipal Water Group Co., Ltd. |

CNY800m/USD800m |

31/10/2019 |

Pending (Waiting for more info) |

|

Agricultural Development Bank of China |

CNY2.5bn/USD2.5bn |

06/11/2019 |

Pending (Waiting for more info) |

|

Porterbrook |

GBP100m/USD129.4m |

01/11/2019 |

Pending (Waiting for more info) |

|

Guangxi Beibu Gulf Bank Co., Ltd. |

CNY2bn/USD283m |

15/10/2019 |

Pending (Waiting for more info) |

|

China Construction Bank Corporation |

CNY4.4bn/USD624.4m |

29/10/2019 |

Pending (Waiting for more info) |

|

Linköping Stadshus AB (Linköping Municipality) |

SEK500m/USD51.9m |

22/10/2019 |

Pending (Waiting for more info) |

Green bonds in the market

- KommuneKredit – closed 19 November

- Orsted – closed 19 November

- BNG Bank – closed 20 November

- CAF – closed 20 November

- Kommuninvest – closed 20 November

- ANZ Bank – closed 21 November

- T Corp – closed 21 November

- National Housing Finance and Investment Corp (NHFIC) – closing 27 November

- Renewable Japan – closing 30 November

- Swiss Life Holding – closing 6 December

Investing news

MSCI has launched two series of provisional climate indices designed to meet the minimum standards for the “EU Climate Transition benchmark” and “EU Paris-aligned benchmark”.

The Monetary Authority of Singapore is planning to launch a USD2bn programme aiming to accelerate the growth of Singapore’s green finance ecosystem. The Green Investments Programme will fund public market investment strategies with a green focus and asset managers which are committed to strengthen green finance activities.

Green bond gossip

Denmark’s central bank is considering issuing green bonds targeted towards funding its goal to reach a 70% carbon emissions reduction by 2030.

The Islamic Development Bank has announced it will launch its a green bond and has put a framework in place.

The Egyptian Financial Regulatory Authority (FRA) is planning to issue green bonds in 2020.

The city of Kyoto (Japan) is considering issuing a green bond that will help meet funding toward the UN’s sustainable development goals.

Portland, Maine (USA) is planning to issue its first airport green bond deal.

Prada is taking out a EUR50m (USD43m) sustainability loan which allows alteration on the interest rate in the case of achieving certain eco-friendly objectives.

Nidec (Japan) is planning to issue a USD900m bond with proceeds going towards the development of electric-vehicle motors.

Neo Industrial, Finland, a cable manufacturer, may issue a USD10-15m green bond.

Readings & reports

The Nigeria Green Bond Market Development Program, a joint partnership launched in June 2018 between FMDQ Securities Exchange (FMDQ), Climate Bonds Initiative and Financial Sector Deepening, Africa (FSD Africa) has released its first progress report.

According to a research paper published by the London School of Economics and Social Science, only 13 out of the 132 largest energy companies have plans to reduce their GHG emissions to net zero.

MSCI discusses the monetary damage that climate change can cause. It points out the difficulties quantifying the risk of climate change on assets, infrastructure, businesses and supply chains and examines how corporates are approaching this.

Climate economics researchers have often underestimated the costs of damages resulting from climate change. That’s the conclusion of a new report written by a team of climate and Earth scientists and economists from the Earth Institute at Columbia University, the Potsdam Institute for Climate Impact Research, and the Grantham Research Institute on Climate Change and the Environment.

Bloomberg outlines the challenge of the green bond market to find eligible projects and assets to fund. They describe the rise of alternative labels such as transition bonds and sustainability linked bonds which can also be used by organisations which may not be able to issue green bonds.

Responsible Investor profiles sustainable investment developments in Kenya including the nations inaugural green bond from Acorn, arising from the multi-partner Kenya Green Bond Program.

‘Till next time,

Climate Bonds