Reports

-

Overview of Public Incentives for Methane Abatement Practices in Brazilian Agriculture

This brief will present a comprehensive analysis of the panorama of public incentives related to agricultural methane abatement currently in force in Brazil.

-

Agrifood Transition Plan Assessment Framework

The agrifood sector sits at the heart of both the climate crisis and the pathway to a livable future. Agriculture is a massive global emitter, but also one of the first sectors to feel the heat. From droughts to floods, farmers are already feeling the effects of a changing climate. In order to preserve global agrifood systems, the sector will need to transition to more sustainable and resilient practices.

-

Guidelines for the issuance of thematic labelled financial instruments

The Guidelines for the Issuance of Thematic Labelled Financial Instruments, developed by Latinex in collaboration with the Climate Bonds Initiative and IDB Invest, provide a framework for issuing green, social, sustainable, and sustainability-linked (GSS+) financial instruments in Latin America. By aligning with international standards like the Green Bond Principles (GBP) and the Climate Bonds Standard, the Guidelines aim to enhance market integrity and investor confidence.

-

Transparency & Reporting in the GSS Bond Market

The Transparency & Reporting in the GSS Bond Market Report is a comprehensive study of post-issuance reporting in the GSS bond market, aimed at enabling a healthy and transparent market.

With support from the Inter-American Development Bank (IDB), International Finance Corporation (IFC), Singapore Exchange (SGX Group), The Global Methane Hub and reviewed by S&P Global Ratings. The report assesses GSS deals priced from 2020-2023, totalling USD1.4tn issued.

-

The Transition to Net Zero: Banks Can Do Better

The Transition to Net Zero: Banks Can Do Better

Banks have a pivotal role to play in the net-zero transition. As financial intermediaries, they can steer their customers to plan and implement their own transition by financing and facilitating today for investment in the future. Hence, banks are at the centre of the transition of the economy to net zero.

-

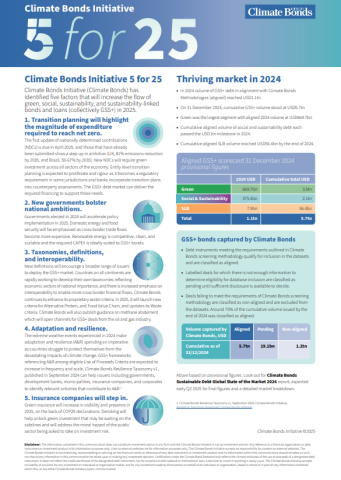

Climate Bonds Initiative 5 for 25

Climate Bonds Initiative (Climate Bonds) has identified five factors that will increase the flow of green, social, sustainability, and sustainability-linked bonds and loans (collectively GSS+) in 2025.