Highlights:

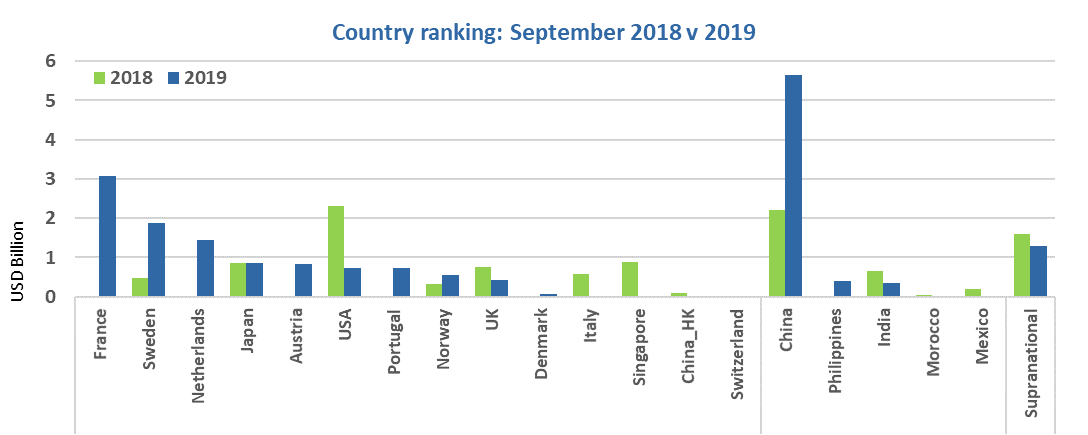

- USD20.9bn September GB issuance dominated by issuers from China (USD5.6bn) and France (USD3.2bn)

- The running total for 2019 is now USD182.5bn

- Japan’s Government Pension Investment Fund to launch an intensive green bond investment program

- Italy planning a 2020 Sovereign GB to fund environmentally friendly projects

Don’t miss!

Event: Environmental Finance Green Bonds California 2019 Conference. Santa Monica, 16 October. Climate Bonds Deputy CEO Justine Leigh Bell and US Representative Mike Paparian amongst speakers. Quote Code ‘CBI130’ for your special CBI 30% discount. Details and Registration.

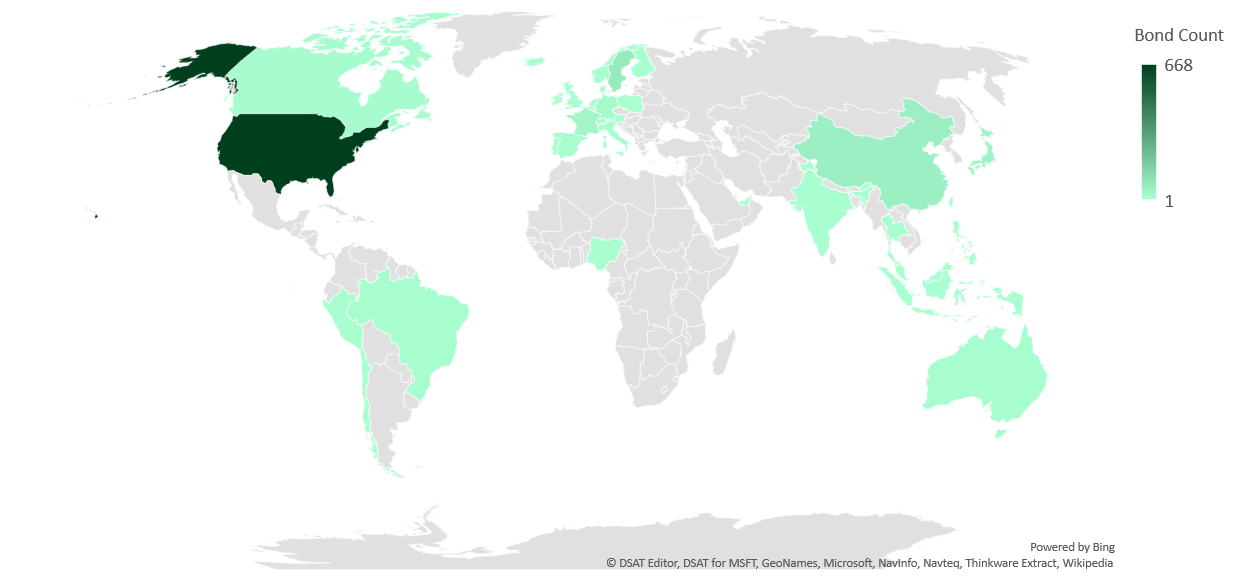

Green bond deals across the globe: 1 Jan – 30 Sep 2019

> The full list of deals here.

September at a glance

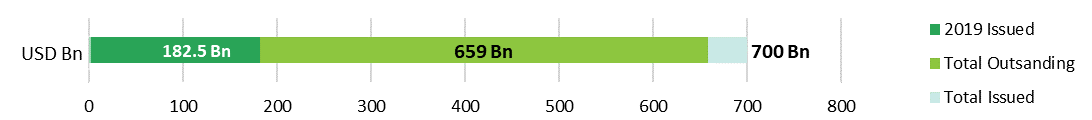

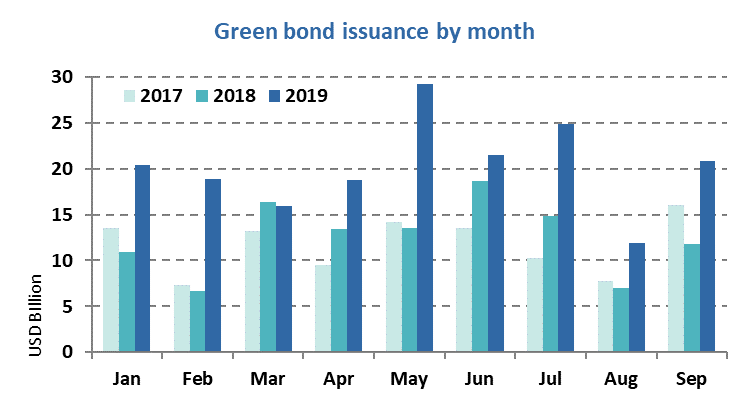

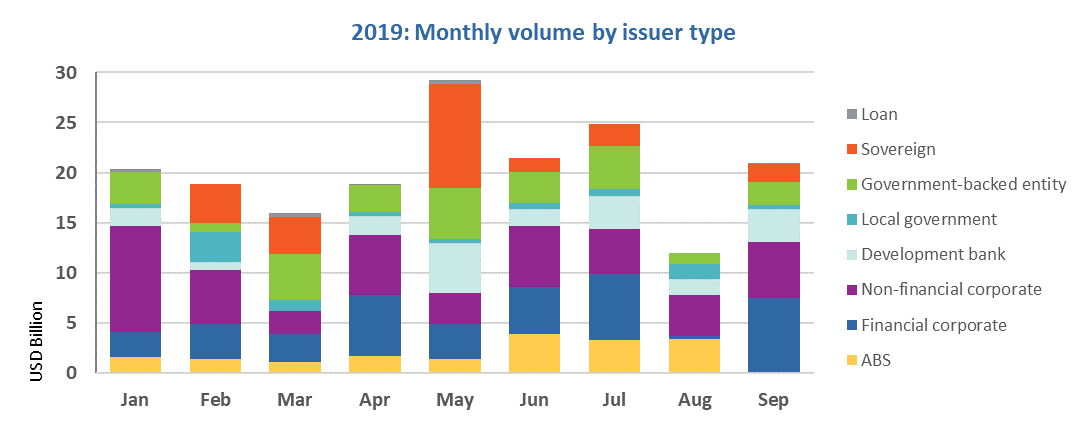

Green bond issuance reached USD20.9bn in September, translating into year-on-year growth of 77.2%.

This takes the total 2019 volume to USD182.5m and cumulative global green issuance since 2007 to USD700bn.

Issuers from China led with USD5.6bn, China’s strongest month in 2019. Emerging Markets contributed 35% of total monthly volume.

France also had a strong September, with USD3.1bn of issuance, primarily in the form of re-openings of the sovereign GB. The country is leading the way for Developed Markets, followed by Sweden (USD1.9bn) and Netherlands (USD1.4bn). DM accounted for 58% of the total monthly volume and Supranationals 7%.

Overall, 58 deals closed in September. Of these, 38 are to fund Energy, and six of them will deploy 100% of the proceeds for renewable energy projects. Buildings came in second with USD5.5bn, where the largest contributors were German KfW (USD1bn) and Swedish Vasakronan (USD790m). Transport projects quadrupled compared to September last year rising from only USD1bn in 2018 to USD4bn this year.

Financial corporates had their strongest month in 2019 with USD7.5bn: by comparison, September 2018 issuance amounted to USD2.3bn. They made up 36% of total September issuance, driven by ICBC. The Chinese bank issued the largest deal for September (USD2.5bn), and two further bonds, amounting to a total of USD3.2bn. The next largest issuers are China Zheshang Bank with USD1.5bn and Raiffeisen Bank International AG with USD825m.

Non-financial corporates followed with 26% of total monthly volume. Development banks accounted for 16% (USD5bn), picking up from a slow August. September was their second strongest month in 2019 after May. The bounce back was primarily due to Germany’s KfW with a USD2bn deal, representing two-thirds of development bank volumes.

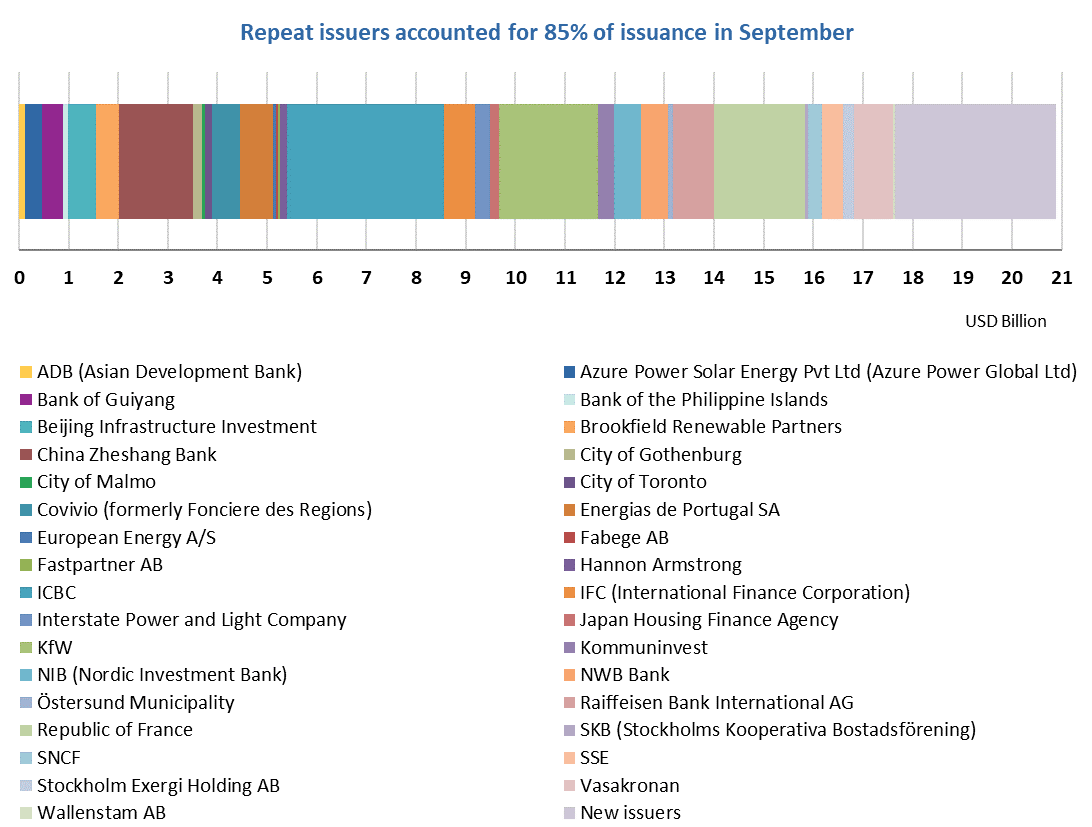

Repeat issuers accounted for 85% of issuance in September. We saw 17 debut issuers in total.

> The full list of new and repeat issuers here.

> Click on the issuer name to access the new issue deal sheet in the online bond library.

New issuers

Public sector

Porter Special Utility District (USD13m), USA, debuted with a 26-year US Muni. The AA rated (S&P) instrument benefits from BAM Green Star assurance and will fund different projects around water infrastructure such as water wells and waterline relocation. There is no reporting commitment stated.

Climate Bonds view: It is always a pleasure to welcome another municipality entering the green muni bond market – though small, this issuance pushes the Lone Star state of Texas closer to the top 10 Muni issuers. We do encourage allocation and impact reporting in order to be more transparent to investors and other stakeholder groups.

Financial corporates

Tokyu Land Capital Management (JPY7.3bn/USD68m), Japan, brought a 20.9-year green bond to market. The bond benefits from a rating (GA1) and an SPO provided by R&I. The proceeds will go towards renewable energy projects such as PV, wind and biomass power plants.

Information on the allocation of proceeds will be provided by project once a year on the website until all the funds are allocated. The issuer will also provide impact reporting using metrics such as amounts of annual power generation as well as reduction in CO2 emissions for each project.

Climate Bonds view: Tokyu Land Capital Management is the 14th Japanese issuer in the REIT space. Japan is the second largest market for green bond issuance by REITs, after the USA. So far, REITs from five countries have issued green bonds.

Non-financial corporates

September saw debut issuance from four non-financial corporates after 20 September, of which Grupo Pestana and Offentliga I norden AB allocate 100% of the proceeds to Buildings:

- Grupo Pestana (EUR60m/USD66m), Portugal, 6Y original term, SPO provided by DNV GL

- Offentliga I norden AB (SEK500m/USD51m), Sweden, 3.5Y original term, SPO provided by CICERO.

- PostNL (EUR300m/USD331m), Netherlands, 7Y original term, SPO provided by Sustainalytics.

In addition to Buildings, Post NL will also fund clean transportation as well as various renewable energy projects.

Climate Bonds view: As a large share of emissions comes from buildings, it is an encouraging development to see smaller real estate companies like Offentliga I Norden AB alongside large issuers such as Vasakronan and Fabege.

Similarly, hotel company Grupo Pestana is taking on technologically advanced projects to deliver significant environmental benefits, indicating a commitment to improving environmental performance. The tourism sector is hugely important in Portugal, so we welcome more issuance from companies operating in the sector as it continues to grow.

Demonstrating a strong corporate responsibility strategy and ambitious targets, we also welcome PostNL to the green bond market. With the growing e-commerce sector and increasing adverse environmental impacts it is great to see that PostNL is taking the next step in their commitment to a more environmentally friendly business.

The Conservation Fund (USD150m), USA, is a non-profit organisation and aims to protect natural and cultural resources such as parks, forest and farms. It issued a senior unsecured 10-year green bond which benefits from a Sustainalytics SPO. The proceeds will go towards land conservation and working forest protection. This entails mainly acquiring property and managing it until protection is in place. The forest land will then be handed over to government agencies or third parties.

There will be allocation reports and impact reports published on the fund’s website or its annual report. This will include details on projects funded, amounts allocated, date of funding and expected outcomes. Impact reporting may cover qualitative and quantitative indicators such as (but not limited to) permanently protected land and waters or greenhouse gas emissions sequestered.

Climate Bonds view: A non-profit organisation raising capital for green bonds is a good example of how investors as well as the community can benefit from such deals. We encourage the concept of the Conservation Fund raising funds in order to leverage their expertise and then pass on projects to governments or other third parties.

Green loans

Mitsubishi Electric Credit Corporation (JPY2bn/USD19m), Japan, has taken out a 5-year loan, which has been rated Green 1 by Japan Credit Rating Agency. The proceeds will refinance loans to entities, which own and develop solar power facilities. The lenders will be provided with a report containing information on the list of projects, power generated by the eligible projects and CO2 emissions reduced by green eligible projects.

Climate Bonds view: It is great to see the green loan market growing, with Japan being the country with the highest number of issuers so far, while Spain and the USA have the largest volume of issuance.

Visit our Bond Library for more details on September deals.

Bonds issued before September 2019

Activia Properties (JPY5bn/USD46m), Japan, 5Y original term, came to the market in July with a senior unsecured bond that benefits from a second party opinion provided by Sustainalytics. The proceeds of the green bond will be allocated to acquire the existing or new buildings or refurbishments that meet certain eligibility criteria.

Repeat issuers – 20 to 30 September

- Azure Power Solar Energy Pvt Ltd (Azure Power Global Ltd): USD350.1m

- Bank of the Philippine Islands: CHF100m/USD100.9m

- City of Gothenburg: SEK1.8bn/USD185.1m

- City of Toronto: CAD200m/USD150.7m

- European Energy A/S: EUR60m/USD65.6m

- Fastpartner AB: SEK300m/USD30.9m

- Interstate Power and Light Company: USD300m

- NIB (Nordic Investment Bank): EUR500m/USD550m

- NWB Bank: EUR500m/USD546.8m

- Raiffeisen Bank International AG: EUR750m/USD825m

- SKB (Stockholms Kooperativa Bostadsförening): SEK600m/USD61.2m

- SNCF: EUR250m/USD275.1m – Certified Climate Bond

- SSE: GBP350m/USD432.1m

Repeat issuers: Jan – Aug 2019 (not previously included)

- Alexandria Real Estate Equities: USD250m – May 2019

- Atrium Ljungberg AB: SEK400m/USD42.3m – July 2019

- EIB (European Investment Bank): AUD150m/USD101.5m – August 2019

- IFC (International Finance Corporation): SEK1.4bn/USD148.8m (7 bonds)

- Japan Housing Finance Agency: JPY10bn/USD92.1m – August 2019

- Mill City Solar Loan: USD217.9m – July 2019

- Modern Land: USD200m – February 2019

- Modern Land: USD300m – April 2019

- World Bank (IBRD): EUR250m/USD280.8m – May 2019

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Although we support the Sustainable Development Goals (SDGs) overall and see many links between green bond finance and specific SDGs, in particular SDGs 6, 7, 9, 11, 13, 14 and 15, the proportion of proceeds allocated to social goals should be no more than 5% for inclusion in our database.

|

Issuer Name |

Amount issued |

Issue date |

Reason for exclusion/ pending |

|

National Bank of Canada |

USD750m |

09/10/2019 |

Excluded (Sustainability/Social bond) |

|

SK Energy |

KRW300bn/USD249m |

26/09/2019 |

Excluded (Not aligned) |

|

Tus Environmental Science and Technology Development Co., Ltd. |

CNY500m/USD70.2m |

26/09/2019 |

Excluded (Working capital) |

|

Jiangxi City Prosperous Province Pingxiang City Investment Company Limited |

CNY680m/USD95.5m |

26/09/2019 |

Excluded (Working capital) |

|

Huangshi State-Owned Assets Management Co.,Ltd. |

CNY650m/USD91.4m |

24/09/2019 |

Excluded (Working capital) |

|

Wuhan Metro Group Co.,Ltd |

CNY2bn/USD281.3m |

24/09/2019 |

Excluded (Working capital) |

|

Guangzhou Metro Group Co.,Ltd. |

CNY2bn/USD281.8m CNY2m/USD0.3m |

23/09/2019 23/09/2019 |

Excluded (Working capital) |

|

Chongqing Rail Transit (Group) Co.,Ltd. |

CNY2bn/USD281.9m |

20/09/2019 |

Excluded (Working capital) |

|

Qilu Bank Co.,Ltd |

CNY3bn/USD422.8m |

20/09/2019 |

Excluded (Working capital) |

|

Guodian Technology & Environment Group Corporation Limited |

CNY5bn/USD701.9m |

16/09/2019 |

Excluded (Working capital) |

|

China Three Gorges Corporation |

CNY3bn/USD424.5m CNY500m/USD70.8m |

11/09/2019 11/09/2019 |

Excluded (Working capital) |

|

Solo Sole |

EUR5.3m/USD6m |

13/05/2019 |

Excluded (Not aligned) |

|

Zug Estates |

CHF100m/USD100.3m |

02/10/2019 |

Pending (Waiting for more info) |

|

EBRD |

EUR750m/USD820.5m |

27/09/2019 |

Pending (Waiting for more info) |

|

NCC |

SEK750m/USD77.3m SEK850m/USD87.6m |

25/09/2019 25/09/2019 |

Pending (Waiting for more info) |

|

Port of LA |

USD7.85m USD7.85m |

18/09/2019 18/09/2019 |

Pending (Waiting for more info) |

|

Wuhan Metro Group Co Ltd |

USD300m |

17/09/2019 |

Pending (Waiting for more info) |

|

Fuyo Lease |

JPY5bn/USD46.4m |

22/07/2019 |

Pending (Waiting for more info) |

|

Franshion Brilliant Ltd |

USD145m |

14/06/2019 |

Pending (Waiting for more info) |

Green bonds in the market

- Assicurazioni Generali - closed 1 October

- Harris County Municipal Utility District No1 - closed 1 October

- MUFG - closed 1 October

- Vellinge Municipality - closed 1 October

- Acorn Holding - closed 2 October (Certified Climate Bond)

- Ficolo - closed 2 October

- SNCF - closed 2 October

- World Bank (IBRD) - closed 3 October

- Acciona - closed 4 October

- Banco Santander - closed 4 October

- AES Gener - closed 7 October

- City of Hot Springs, Arkansas - closed 8 October

- SR Boligkreditt - closed 8 October (Certified Climate Bond)

- Franklin Township Sewer Authority - closed 9 October

- PepsiCo – closing 10 October

- AEON REIT Green Trust - closing 21 October

- Renewable Japan - closing 31 October

- Ricoh Leasing Company - closing 31 October

Investing news

The world’s largest pension fund, Japan’s Government Pension Investment Fund (GPIF), intends to allocate a substantial amount of funds to corporate and government green bonds. It will create a dedicated framework for such investments. CBI identified GPIF as a key player that can influence investment in green bonds in the Japan: Green finance state of the market 2018 report.

The European Investment Bank has been urged to deliver on its proposal to stop fossil fuel lending by 30 businesses, investment groups and scientific institutions.

A set of European Union standards to determine which financial products qualify as “green” should be delayed until the end of 2022, EU governments agreed on Wednesday, stirring concern because the guidelines might end up including investments in nuclear power, reports Reuters.

Green bond gossip

Italy’s finance minister Roberto Gualtieri is planning to issue green bonds next year in order to finance environmental friendly projects.

The National Treasury Management Agency (Ireland) started selling green bonds, aiming to raise up to EUR1.5bn (USD1.7bn) to fund Ireland's low-carbon goals in its National Development Plan. NTMA debuted in the GB market in 2018.

Noor Energy 1 is the first GCC project to be funded with a Certified Climate Bond. Noor Energy 1 is the largest single-site Concentrated Solar Power (CSP) and single hybrid solar power project in the world. It is a collaboration between Dubai Electricity and Water Authority (UAE), ACWA Power (Saudi Arabia) and Silk Road Fund (China), and aims to support the Dubai Clean Energy Strategy 2050.

Marine transportation service provider Teekay Shuttle Tankers (Bermuda) is planning to raise USD150m to finance their new E-Shuttles. Teekay’s green bond framework benefits from a CICERO SPO. The vessel technology sounds promising for emissions reductions and improving energy performance. Unfortunately, the tankers will transport oil, so the bond will not qualify for inclusion in CBI’s green bond database, which excludes transport if fossil fuel freight represents 50% or more of the business or project.

Readings & reports

The Bank for International Settlements broaches the topic of the lack of consistent definitions what a “green bond” is and an overflow of labels and certification schemes in the green bond market. The research finds that green bonds are priced at a premium compared to conventional bonds but their performance in the secondary market is similar.

The Bank for International Settlements gives a perspective on what role green bonds can play in central bank’s reserve management. As central banks show interest in incorporating environmental sustainability objectives into their reserve management frameworks, BIS finds amongst others that sustainability as a reserve management objective needs to be balanced against liquidity, safety and return. The Reserve Bank if New Zealand is leading with a good example as it recently decided to invest in USD100m green bonds.

Moody’s Investor Service has published a framework to assess carbon transition risk for corporate sectors which is a tool to analyse the carbon transition risk. The rating agency also published a range of research papers alongside the framework looking at the growing exposure to heat stress mitigated by economic and fiscal strengths and utility and power companies’ pace to achieve a 27% reduction in CO2 emissions by 2030.

The Inter-American Development Bank discusses how to transform green bond markets in Latin America and the Caribbean. IDB looks more closely at the risk profiles of green bonds and their transaction costs related to issuance and reporting, and proposes enhanced regulation, education and leveraging new technologies in order to lower reporting and monitoring costs. CBI recently published Latin America and Caribbean: Green finance state of the market 2019.

‘Till next time,

Climate Bonds