Highlights:

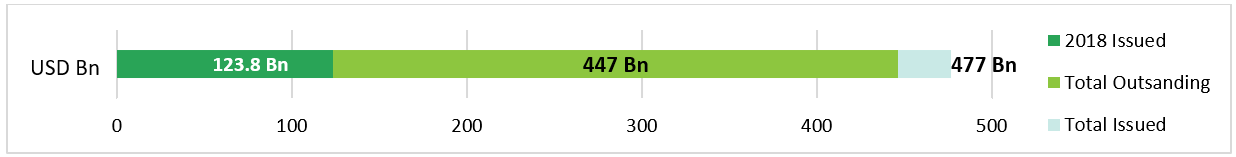

- USD13.9bn green bonds monthly volume

- Certified Climate Bonds from Société du Grand Paris and EnBW

- FIRA issues first Mexican green bond for protected agriculture projects

- Firsts from Japanese green bond issuers from the aviation, forestry & paper and consumer goods sectors

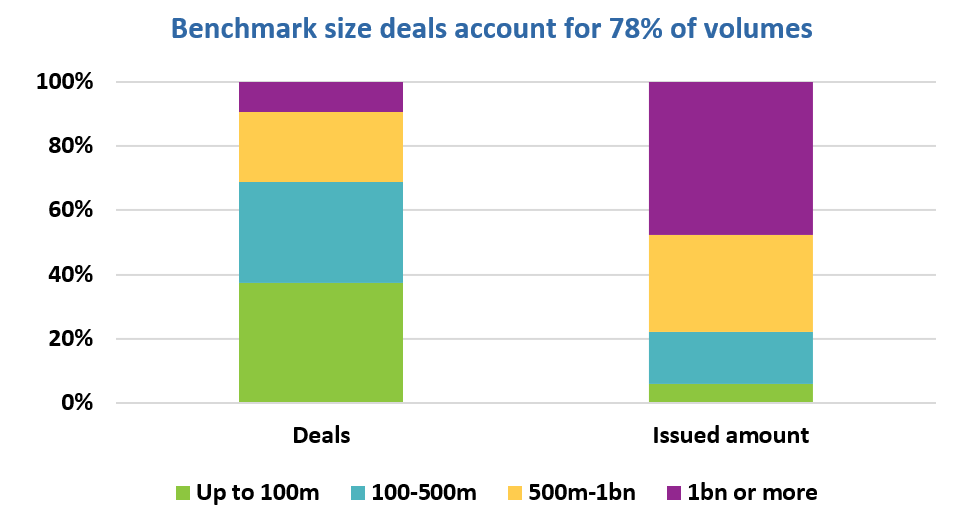

- 78% of monthly volume from benchmark deals of USD500m or above

- Holland unveils plans to issue Sovereign Green Bond. Joins Poland, France, Belgium, Ireland as EU Issuers.

Dutch Suggest Cost Saving in Belgium Sovereign? – From Global Capital 1st Nov 2018

"[Dutch Finance Minister] Hoekstra has been unusually transparent about his thinking about the costs of issuing a green bond, and how he weighs them against the potential benefits.

'The condition that a green bond should perform at least as well as a comparable standard bond in terms of price is also expected to be met,” Hoekstra said in his letter to the Parliament. “There are indications — albeit with the necessary uncertainty — that the issuer with a green bond could even achieve a modest interest benefit. My Belgian colleague has stated that with the issuance of its green bond, Belgium saves more than €1m a year in interest costs.'

The inaugural Green OLO issue was for €4.5bn, so this suggests Belgium believes it priced the bond at least 2.2bp more tightly than a normal issue."

Don’t miss:

- State of the Market Launch in Australia – Story and Pics

- Green Bond Pricing in the Primary Market Report: January – June 2018

- China Green Bond Market Q3 2018 – in English and Chinese

Go here to see the full list of new and repeat issuers in October.

October at a glance

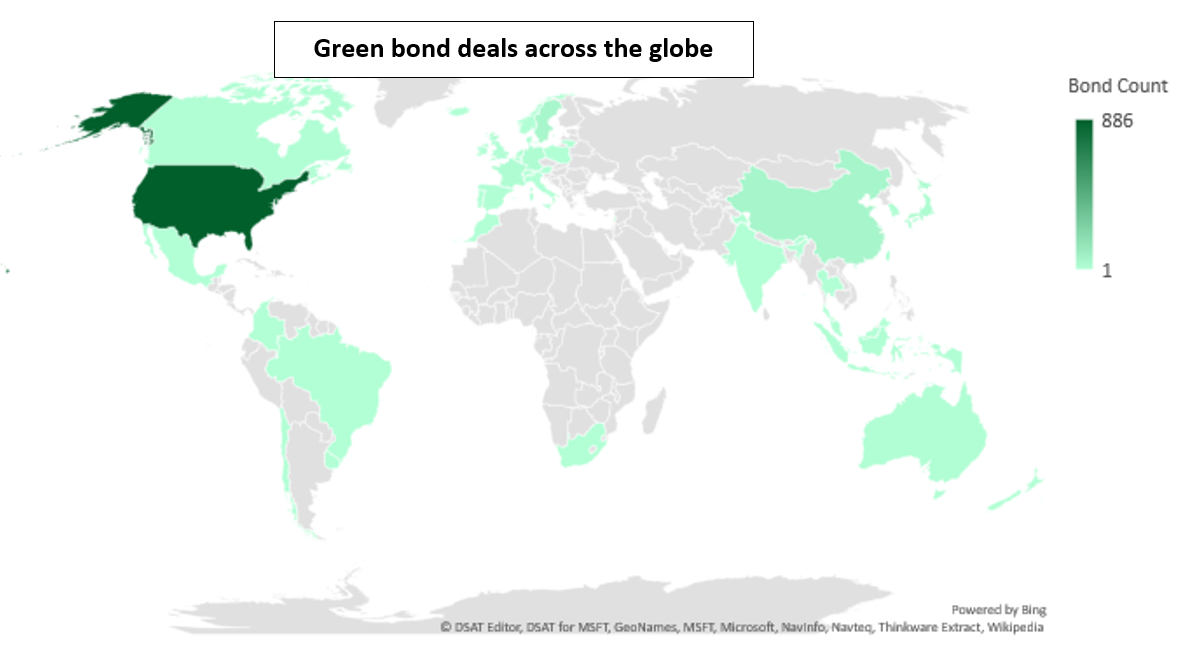

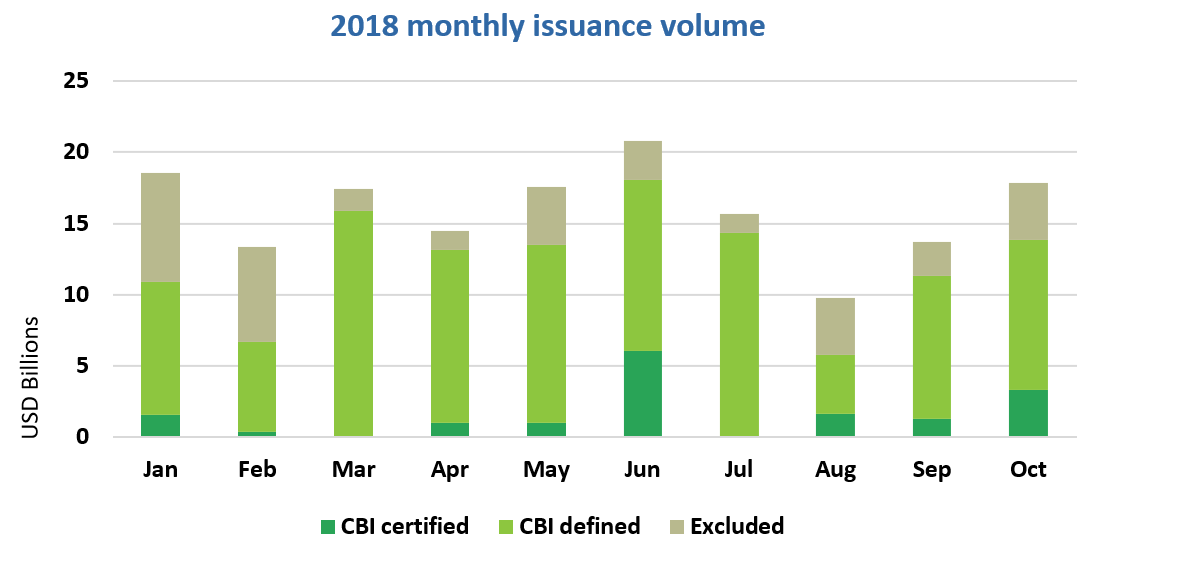

Green bond issuance totalled USD13.9bn. That is 15% below the corresponding 2017 monthly figures however Fannie Mae has yet to report and there are a number of deals on our pending list, i.e. deals about which we are seeking additional information to decide if they would be included in our green labelling database or not.

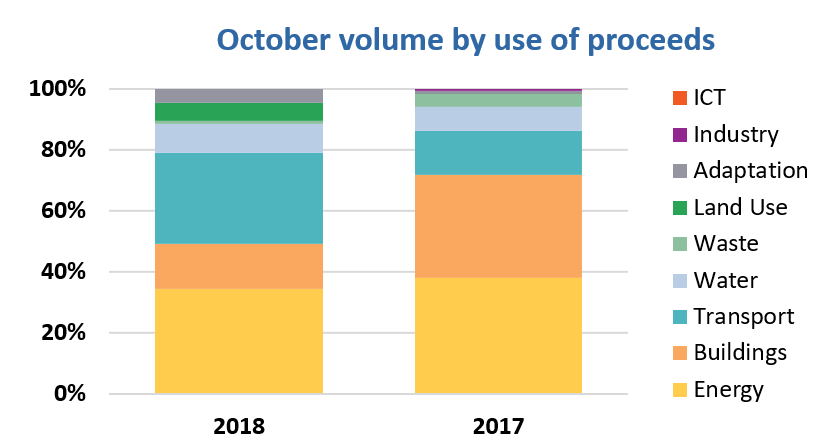

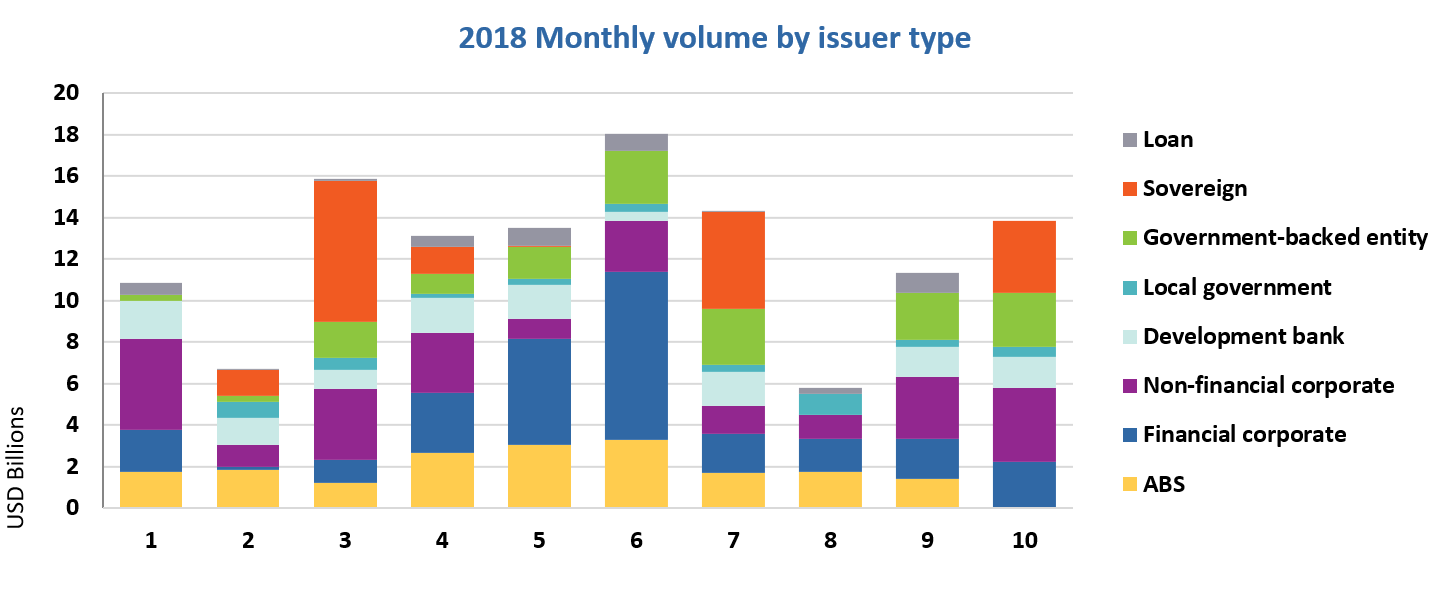

Energy again led proceed allocations at 35% and volumes allocated to transport were boosted to 30% thanks to three deals: Société du Grand Paris will use proceeds to finance the first stage of a long term upgrade to urban over ground lines in Paris, ALD SA (Germany) for electric vehicles and Sichuan Railway Investment (China) for intercity rail.

Almost 70% of corporate volumes come from benchmark sized deals of USD500m or more including issuance from EDP (Portugal), Getlink SE (France), ALD SA (Germany) and EnBW (Germany). Most banks have also issued in this size range.

The largest deal was Ireland’s sovereign green bond at EUR3bn (USD3.5bn), with government-backed Société du Grand Paris and development bank KfW also issuing deals of more than USD1bn.

Deals of USD100m or below were the most frequent (almost 40% by number). Japanese issuers Ana Holdings, Marui Group and Tokyo Century Corp all successfully issued JPY10bn (USD89m) deals in the domestic market. US Munis and other local governments also entered the market with small issues.

> The full list of new and repeat issuers here.

> Click on the issuer name to access the new issue deal sheet in the online bond library.

Certified Climate Bonds

EnBW (EUR500m/USD568), a German electricity supplier, issued a 15-year senior unsecured Certified Climate Bond, certified under the Solar, Wind, Marine Renewable Energy, and Low Carbon Transport Criteria of the Climate Bonds Standard. 93% of the proceeds will be allocated to wind projects, including two offshore wind farms located in the North Sea with a combined capacity of 160MW. The rest will go to solar (5%) and EV charging infrastructure (2%).

ISS-Oekom provided the Pre-Issuance Verification Report.

Société du Grand Paris (EUR1.75bn/USD2.01bn), France, issued a 10-year senior unsecured Certified Climate Bond under a EUR5bn Green EMTN programme. The issuer obtained a programmatic Certification under the Low Carbon Transport Criteria of the Climate Bonds Standard, meaning that the Certification covers all future issuance under the programme.

Proceeds will fund the construction of new metro lines and extensions to existing ones, adding almost 200km of new automatic metro lines to the 400km of existing lines in the Ile-de-France region. The bond will also finance the development of 68 stations and 7 technical centres as part of the Grand Paris Express project. All eligible assets are fully electrified and exclusively support electric assets.

Sustainalytics provided the Pre-Issuance Verification Report.

Climate Bonds view: The adoption by SGP of the streamlined Programmatic Certification process is a welcome step, particularly given the multi stage, decade long nature of this infrastructure project and proposed multiple certified green issuance. SNCF in France and in the US, SF BART and both New York and LA MTA are other large public transport operators who also certify on a programmatic basis.

New issuers

Fideicomisos Instituidos en Relación con la Agricultura (FIRA) (MXN2.5bn/USD130m), Mexico, issued a 3-year senior unsecured green bond to finance greenhouses and related irrigation infrastructure that comply with the Climate Bonds’ proposed Protected Agriculture in Mexico Criteria. The trust has thus become Mexico’s first issuer to use a green bond to finance projects exclusively related to agriculture and land use.

Climate Bonds view: The issuer shows a high degree of integrity by setting eligibility requirements that match the Protected Agriculture in Mexico Criteria. This particular sector Criteria is in the process of being finalised and Certification will soon be available for issuers seeking to finance protected agriculture assets.

Ana Holdings (JPY10bn/USD89m), Japan, issued a 10-year senior unsecured green bond, becoming the first airline company globally to enter the green bond market. The deal received a GA1 Green Bond Assessment from R&I. Proceeds will finance the construction of a new energy efficient building, which will be used as a training centre and is expected to open in March 2020. The property will feature various energy efficient components including solar power generation equipment, LED lighting and natural ventilation. The building is designed to achieve a 33% Energy Reduction Ratio (ERR) under the Tokyo Metropolitan Government’s Green Building Program, corresponding to a Rank 3 or the highest of three levels. This rank level is equivalent to an A-rank of the CASBEE certification.

Climate Bonds view: The Tokyo Metropolitan Government Green Building Program targets newly constructed buildings in Tokyo with a total floor area of over 5,000 m2. The system – in line with CASBEE – evaluates four fields: efficient energy use, appropriate use of resources, preservation of natural environment and mitigation of the heat-island effect. Within each field there are several items, such as the ERR, which are rated using a 3-point rating scale, 3 being the highest.

Comprehensive Assessment System for Built Environment Efficiency (CASBEE) is a method for evaluating and rating the environmental performance of buildings and the built environment. It is a comprehensive assessment of the quality of a building, evaluating features such as interior comfort and scenic aesthetics, in consideration of environment practices that include using materials and equipment that save energy or achieve smaller environmental loads. The CASBEE assessment is ranked in five grades: Superior (S), Very Good (A), Good (B+), Slightly Poor (B-) and Poor (C). We would like to see more buildings ranked A or S being funded by green bonds.

Marui Group Co Ltd (JPY10bn/USD89m), Japan, issued a 5-year senior unsecured green bond – the first green bond from a Japanese issuer in the retail sector. Sustainalytics provided the Second Party Opinion. Proceeds will be used to finance solar and wind power generation, as well as to source 100% of its electricity from renewables and to fund the switch to LED and guidance lights that aim to achieve at least 40% reduction in energy consumption, air conditioning, hot and cold water dispensers and cooling water pumps, escalators and elevators targeting at least 30% reduction and transformers that aim to achieve at least 50% reduction.

Climate Bonds view: We welcome corporates in the retail business financing solutions to reduce their carbon footprint from energy consumption. We hope to see more issuers from the sector entering the market.

Daio Paper Corporation (JPY20bn/USD178m), Japan, issued a two-tranche senior unsecured green bond (longest dated bond: 10 years), becoming the first Japanese green bond issuer from the Forestry & Paper sector. DNV GL provided the Second Party Opinion. Proceeds will finance hard-to-recycle recovered paper facilities as well as a biomass boiler and power generating facility. The waste produced during the process of extracting raw materials from hard-to-recycle paper will be incinerated and the resulting heat will be reutilised for power generation and in the drying process of papermaking. The biomass boiler and power plant will exclusively use “black liquor” as a source, which is a waste fuel generated from the pulp extraction process.

Climate Bonds view: Daio Paper Corporation was identified as being climate aligned and a potential green issuer in the Land use sector in our Q3 2018 Market Summary and this move is welcomed. As all biomass sources come from waste sources, it is aligned with our updated Taxonomy.

City of Minneapolis, Minnesota (USD96m), USA, issued a 24-tranche green US Muni (longest dated bond: 28 years). This is the second US Muni green bond from a Minnesota issuer in 2018 after repeat issuer City of Saint Paul came to market in early October. The deal received an external review from Kestrel Verifiers (not publicly available). Proceeds are earmarked for a new Public Service Center, which will provide accommodation for the police department and other public services departments, and a new East Side Storage and Maintenance Facility used for solid waste and recycling operations, as well as for vehicle maintenance. The issuer has committed to obtaining a LEED Gold certification for both buildings.

Climate Bonds view: Another US Muni issuer seeking an external review is a positive in this market. We encourage issuers to make these documents publicly available to enhance transparency.

Commerzbank (EUR500m/USD573m), Germany, issued a 5-year senior non-preferred green bond, which benefits from a Sustainalytics Second Party Opinion. Proceeds will be allocated to financing and refinancing loans related to solar and onshore and offshore wind projects. For a loan to be eligible, the first drawdown must have happened within three years prior to the green bond’s settlement date.

Climate Bonds view: This is the fifth German issuer to enter the green bond market in 2018 and the second commercial bank after DZ Bank earlier in October. The country’s cumulative total stands at USD32.1bn to date.

Encevo SA (EUR250m/USD289m), Luxembourg, issued a 15-year green Schuldschein – the first from a Luxembourg green bond issuer. Proceeds will finance renewable energy projects, grid infrastructure construction and efficiency improvements, smart metering, green buildings which have obtained at least a DGNB Gold certification (such as the Bové and Bettembourg projects), as well as hybrid and electric vehicles and related infrastructure such as EV charging stations.

Climate Bonds view: The deal is the largest green Schuldschein issued in 2018 so far, taking the total volumes for the year to USD599m, or almost a fourth of the USD2.5bn cumulative volumes.

UGE International (USD0.5m), USA, issued a 5-year privately placed secured green bond as part of a wider financing structure. Net proceeds from the bond will be used to finance eligible solar projects of UGE through UGE Project HoldCo Ltd, a wholly-owned subsidiary of the Company. The deal is secured against the issuer’s projects.

Climate Bonds view: Solar assets are easily identifiable as green. Nevertheless, issuers are always encouraged to create a green bond framework and seek an external review to provide clarity on their selection of projects, management of proceeds and reporting methods.

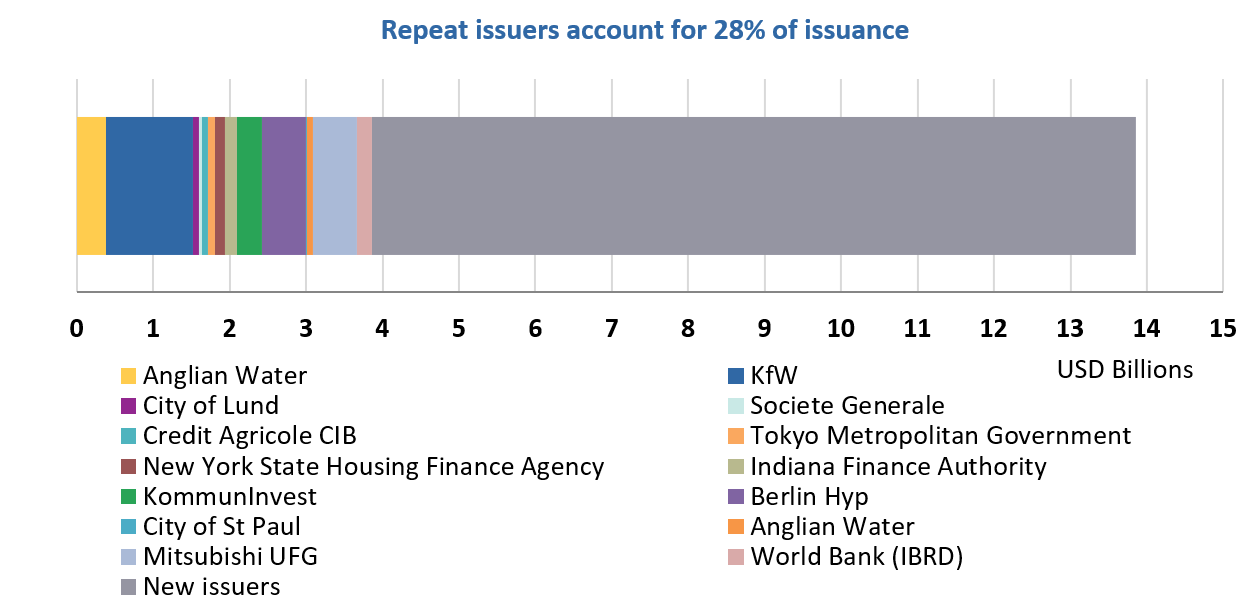

Repeat issuers

- Anglian Water: GBP300m/USD384.7m

- Berlin Hyp: EUR500m/USD573m

- City of Lund: SEK600m/USD66.1m

- Credit Agricole CIB: USD70m

- Indiana Finance Authority: 16 tranches for a total of USD153m

- KfW: EUR1bn/USD1.14bn

- KommunInvest: SEK3bn/USD333m

- New York State Housing Finance Agency: 34 tranches for a total of USD136m (Certified Climate Bond)

- Société Generale (Taipei branch): 3 tranches for a total of TWD1.6bn/USD52m

- Tokyo Metropolitan Government: 2 tranches for a total of JPY10bn/USD89m

October trends

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Though we support the Sustainable Development Goals (SDG) overall and see many links between green bond finance and specific SDGs, the proportion of proceeds allocated to social goals needs to be no more than 5% for inclusion in our database.

|

Issuer Name |

Amount issued |

Issue date |

Reason for exclusion/ pending |

|

KasikornBank |

USD100m |

30/10/2018 |

Sustainability bond |

|

Gunvor |

USD745m |

15/10/2018 |

Sustainability/Social bond |

|

DP World |

USD2bn |

17/10/2018 |

Sustainability/Social bond |

|

Shanxi Jinhua Yumei Coal Chemical Industry |

CNY620m/USD92m |

18/07/2018 |

Not aligned |

|

AGRICUL DEV BANK CHINA |

CNY3bn/USD450m |

02/07/2018 |

Not aligned |

|

Hangzhou Yuhang Toursism Group |

CNY600m/USD87m |

31/10/2018 |

Working capital |

|

CHINA THREE GORGES CORP |

CNY4bn/USD577m |

31/10/2018 |

Working capital |

|

Korean Housing Finance Corporation |

EUR500m/USD568.2m |

30/10/2018 |

Social covered bond |

|

Kookmin Bank |

USD300m |

23/10/2018 |

Sustainability bond |

|

UGE International |

USD0.7m |

23/10/2018 |

Not aligned |

|

Taixing Jiangsu Rural Commercial Bank |

CNY300m/USD43.2m |

18/10/2018 |

Not aligned |

|

Ormat Technologies Inc. |

USD114.7m |

31/10/2018 |

Unlabelled |

|

Masdar |

N/A |

11/10/2018 |

Pending |

|

The Republic of Seychelles |

USD15m |

29/10/2018 |

Pending |

|

Umweltbank |

EUR40m/USD46.8m |

20/07/2018 |

Pending |

|

Obayashi |

JPY10bn/USD89m |

25/10/2018 |

Pending |

|

Småkraft AS |

EUR50m/USD57.3m |

22/10/2018 |

Pending |

|

Agrosuper |

USD100m |

30/10/2018 |

Pending |

|

Naturgy Energy Group SA (formerly Gas Natural Fenosa) |

BRL130m/USD35m BRL265m/USD71m |

31/10/2018 |

Pending |

Green bonds closed in early November

- Japan Real Estate Investment Corporation: JPY10bn - closed 1st November

- University Properties of Finland: closed 2nd November

- Fuyo General Lease Co., Ltd.: JPY10bn – closed 2nd November

- Royal Schipol Group NV: EUR500m – closed 5th November (Certified Climate Bond)

- Qilu Bank: CNY3bn - closed 5th November

Green bonds in the market

- China Industrial Bank: CNY30bn - closed 1st November

- City of Gothenburg: SEK1bn – closed 5th November

- Bank of Jiujiang: closing 6th November

- California Educational Facilities Authority: USD39.6m – closing 7th November

- Bank of Chongqing: closing 7th November

- MünchenerHyp: EUR500m – closing 8th November

- BNG Bank: USD500m – closing 8th November

- Prologis International Funding II SA: EUR300m – closing 14th November4

- City of Los Angeles: USD220.5m – closing 15th November5

- New Jersey Infrastructure Bank (New Jersey Environmental Infrastructure Trust) – closing 29th November

- City of Bloomington – closing 5th December

Investing News

Ormat Technologies Inc., a US-based vertically integrated company engaged in geothermal and recovered energy generation, closed a USD114.7m first tranche of a project finance agreement with OPIC totalling up to USD124.7m. The loan will be used to finance the 35MW Plantares geothermal power plant in Honduras. As the deal was not labelled as green and has not obtained an external review or green bond rating it has been excluded from our green bond database, but it is a good example of a deal that could be labelled.

German asset manager DWS launched the DWS Invest Green Bonds, a new euro-denominated sustainability-focused fixed income fund.

FIM Asset Management launched Finland's first Green Bond fund in early October.

The UK government earmarked GBP60m to fund R&D projects tackling air quality and climate change impacts as part of its Strategic Priorities Fund. It has also committed an additional GBP20m to the Clean Growth Fund, which will invest in companies developing technologies to reduce GHG emissions.

Mexico's president-elect has said he will respect the result of a referendum that rejected a partly built new airport for Mexico City, effectively ending the USD13 billion project. Details about how the outstanding green bonds will be treated have yet to be released.

Green Bond Gossip

The Netherlands is planning to come to market with a sovereign green bond in 2019, more details to come in early December. In the Treasury’s press release, the Finance Minister is quoted as saying: “Up till now, Dutch pension funds, insurance companies and banks looking for green investments in safe sovereign bonds had to look abroad. I have decided to issue a green bond because I think sustainable investments and a further boost to the green capital market in the Netherlands are important goals.” The decision comes after a feasibility study found that EUR3.5-5bn of government spending could be earmarked as green annually.

Japan headquartered Daiwa Securities Group developed a Green Bond Framework which obtained a Sustainalytics Second Party Opinion.

Flemmish Community is set to start investor meetings in November for its debut sustainability bond.

Finnish OP Financial Group is planning a green bond issuance after obtaining a Sustainalytics Second Party Opinion on its Green Bond Framework.

Rhode Island Infrastructure Bank (RIIB) is the latest signatory to the Green Bond Pledge.

KFW have now issued more than 20 green bonds since 2014. Their latest 2018 green bond PPT overview is here. The gap between those banks who’ve issued and those in the slow lane grows larger.

Reading and Reports

The Government of Canada released its Interim Report on the Expert Panel on Sustainable Finance.

Carbon Brief developed an interactive tool to show how global warming is projected to affect the world and its regions.

Climate Strategies published three Insight Briefings on the IPCC Special Report on Global Warming of 1.5°C (SR15).

The full SR15 Report and associated documents are now available in a single 792 page PDF. Happy reading!

Latest IEA reports:

- Energy Efficiency 2018 - Analysis and outlooks to 2040

- Outlook for Producer Economies – Critical questions for the world’s largest oil and gas producers

- Renewables 2018 – Market analysis and forecast from 2018 to 2023

Sean Kidney writes on the role of Taxonomies in Foresight Climate and Energy.

Climate Bonds Reports

Green Bond Pricing in the Primary Market: January – June 2018

China Green Bond Market Q3 2018 – in English and Chinese

Moving Pictures (and Sound)

Watch how India is building one of the world’s most sustainable cities.

Take 1:12 mins to learn how hydrogen trains work.

Get a snapshot of the US green muni market with these Bloomberg Radio interviews broadcast from the BAM America offices.

‘Till next time,

Climate Bonds

PS Watch out for the launch later today of our new Forestry Criteria, expanding the reach of green bond Certification under the Climate Bonds Standard.