Highlights:

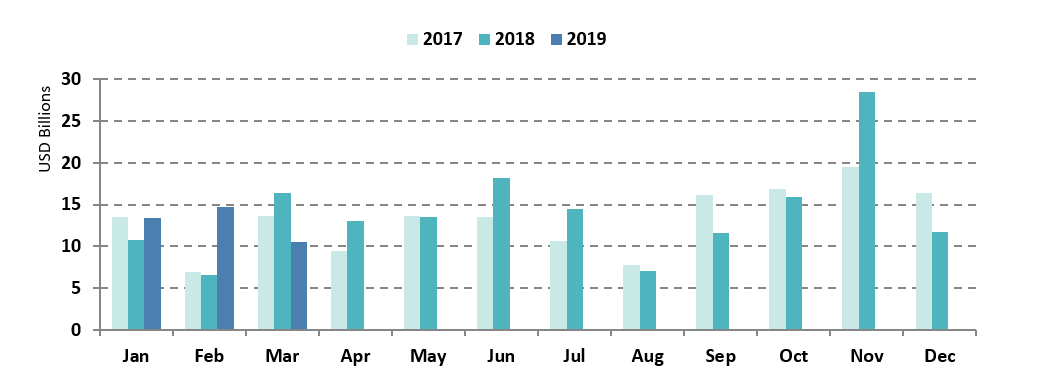

- February issuance reaches USD13.8bn, a 40% year-on-year growth

- OP Corporate Bank is first from Finland to enter GB market

- Dutch company LeasePlan enters GB market with benchmark issuance for EVs

- City of Santa Fe in firsts for New Mexico with muni water bond

- Repeat deals from QTC, Renew Power and SGP under Programmatic Certification

Don’t miss:

- The first Green Bonds State of the Market report

- The second review of Post-issuance reporting in the green bond market

- The first Japan green finance state of the market 2018

- The annual updates for China and Canada

- UBank Australia targets millennials with term deposit Certified under the Climate Bonds Standard

- Interviews from Climate Bonds Conference 2019: Kazakhstan, Australia, ADB and more...

Go here to see the full list of new and repeat issuers in February

At a glance

Monthly green bond issuance in February reached USD13.8bn, up 40% year-on-year against 2018 figures.

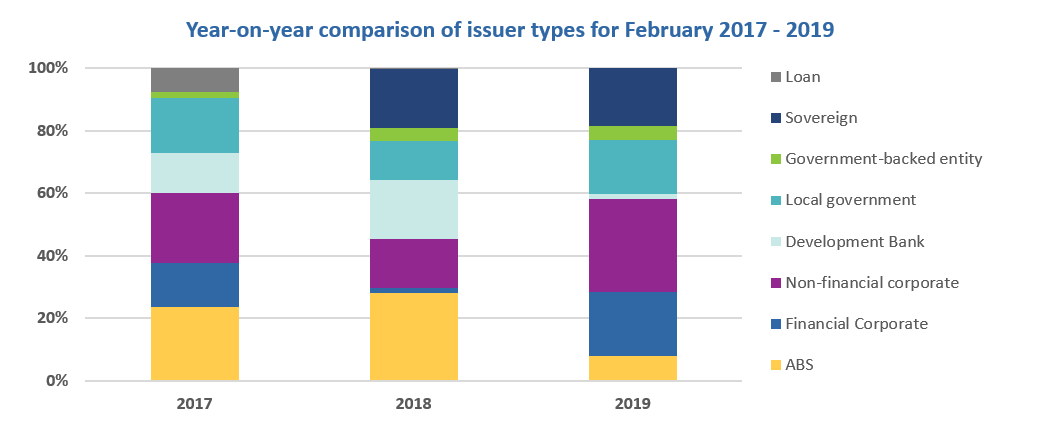

Non-financial corporates have been particularly active: nearly a third (30%) of February issuance accounts from them. Telecommunications firms Telefónica (Spain) and Verizon (USA), along with Finnish debut forestry sector issuer Stora Enso made up nearly two-thirds (63%) of non-financial corporate issuance.

On the financial corporate (bank) side, repeat issuer BNP Paribas boosted the numbers with a EUR750m bond. First-time entrant from Finland, OP Corporate Bank, contributed with an inaugural EUR500m transaction. The two banks accounted for nearly half (48%) of the month’s financial corporate volumes.

Sovereigns comprised the next largest issue type with 18% of February issuance. The drivers were Republic of France’s EUR1.7bn tap of its Green OAT and Indonesia’s second sovereign green sukuk (EUR750m).

By comparison, the prevalent issuer types for February 2018 were ABS (28%) followed by sovereigns at 19% while financial and non-financial corporate issuers, taken together, captured only 18% of the market.

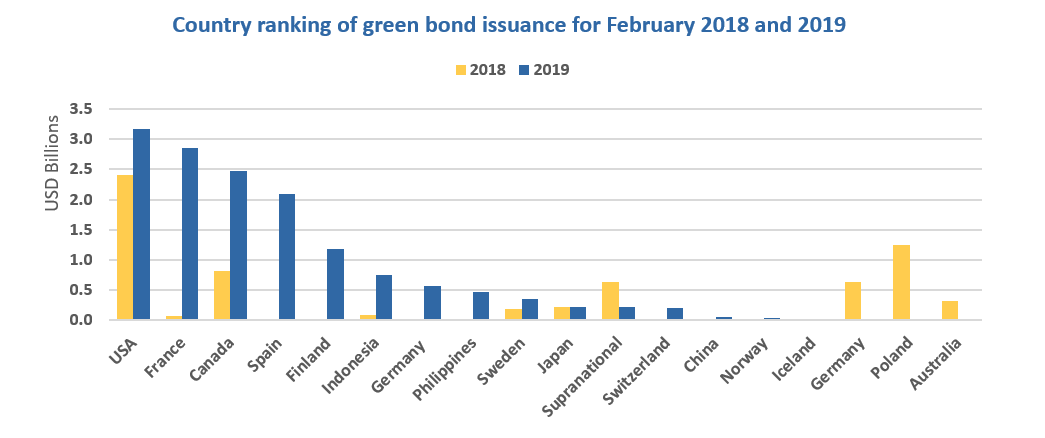

In terms of geographical market share, USA climbed up to the top spot with 22%, spurred by Fannie Mae’s MBS issuance. France captured 19% of the market and came in second largely driven by the tap of the sovereign green bond. Canada took third place with a 17% share. Spain was the only other country whose issuance exceeded USD2bn, and this placed it fourth in the monthly rankings with a 14% market share. The like-for-like comparison for February 2018 shows USA at 36%, followed by Poland (18%), Canada (12%) and Germany (9%).

Issuance from developed markets (DM) constituted 90% of volume, up from 61% in 2018. February 2019 emerging markets (EM) issuance was spurred by the Republic of Indonesia’s second green sukuk, which represented over half of EM issuance, whereas, in February of 2018, Poland’s second green sovereign bond made up 92% of EM issuance.

> The full list of new and repeat issuers here.

> Click on the issuer name to access the new issue deal sheet in the online bond library.

New issuers

FYI Properties (USD227.8m), USA, a financing vehicle of the National Development Council for Washington State IT facilities, issued 20-year US Muni green bond in the beginning of March. The proceeds refinanced a development in the Washington State Capitol Campus in Olympia. The project achieved a LEED Platinum rating and comprises the design, construction and furnishing of a six-story office block and associated wings, a large data centre and parking garage.

Climate Bonds view: The properties achieved a high-level of green building certification, which is an obvious plus. However, we strongly encourage issuers to set up clear tracking and reporting systems, as well as to seek external reviews in-line with market best practice.

Hitachi Capital Corporation (JPY10bn/USD89m), Japan, issued a 21-year project bond, which obtained a Green Bond Assessment (GA1) from R&I Japan. Proceeds will be used for new investments related to the construction of a solar power generation facility in Fukushima, Japan.

Climate Bonds view: It’s positive to see issuers disclosing the share of proceeds financing new projects versus refinancing in pre-issuance documents. We encourage other issuers to follow suit to increase transparency of proceed allocations.

Konan Ultra Power (JPY110m/USD1m), Japan, is a public-private sponsored regional power producer, established in Konan City, Shiga Prefecture. The company issued a 15-year deal earmarked for rooftop solar installations at two logistics facilities and LED installation at four schools, all in Konan City.

The Green Bond Assessment (GA1) provided by R&I discloses clear and detailed characteristics of the financed projects - such as a number of panels, annual power generation and number of LED lamps – as well as some expected impact metrics, including annual CO2 emission reductions. The company is also committed to reporting on key metrics related to use-of-proceeds and impact annually through its website.

Climate Bonds view: The company is a welcome addition to Japan’s pool of green bond issuers. The granularity of information presented in the Green Bond Assessment demonstrates the issuer’s commitment to comply with best practice disclosure.

LeasePlan (EUR500m/USD560m), Netherlands, issued a 30-year senior unsecured green bond in early March. LeasePlan is Mobility- or Car-as-a-Service (“MaaS”, “Caas”) provider, and the proceeds will solely finance the acquisition of battery-powered electric vehicles (BEVs). Sustainalytics provided a Second Party Opinion for the bond.

Climate Bonds view: The benchmark issuance from LeasePlan is an encouraging development, as it indicates a commitment from the automotive industry to address climate change. The benefits in LeasePlan’s case extend to their sharing economy-focused business model. In-line with best practice, the firm has also obtained an external review and expressed its commitment towards post-issuance reporting, including impact metrics.

OP Corporate Bank (EUR500m/USD570m), Finland, issued a five-year, benchmark-sized bond that includes a number of eligible sectors including wind, solar, hydro, waste-to-energy, non-fossil fuel energy efficiency, green buildings, pollution prevention, sustainable water management and low-carbon transport. “Eco-efficient and/or circular economy adapted products, production technologies and processes” are a specific sub-category. Sustainalytics provided a Second Party Opinion.

In its annual Green Bond Report, the issuer will include the amount of net proceeds allocated to each eligible sector, a description of the types of businesses and projects financed, the origination timeframe and maturity profile of the loans by sector, as well as the balance of any unallocated proceeds. Indicative environmental performance indicators have been listed in the framework.

Climate Bonds view: To date, there has been limited green bond issuance from Finland despite a healthy demand for Nordic green debt, as evidenced by the participation of more than 100 investors in OP’s debut GB. As one of the largest corporate lenders in the country, OP has set a precedent for other Finnish banks.

OP’s green bond framework is robust and covers a broad set of sectors. The issuer’s commitment to detailed reporting (including several environmental impact indicators for each eligible sector) is a positive sign. We hope to see a similar level disclosure from other Nordic issuers going forward.

Oregon School District (USD45m), USA, issued a US Muni green bond with a 20-year tenor in early March. The District is currently designing a new elementary school to serve its growing student population. It will be the first “net zero” school constructed in the State of Wisconsin. The school will use a combination of building energy efficiency and on-site energy generation so that over a one-year period there is no net carbon released into the atmosphere to operate the building.

Climate Bonds view: The construction of the first net-zero carbon school in Wisconsin is a commendable effort, as is the issuer’s commitment to reporting on the use-of-proceeds and environmental indicators of the bond. Obtaining external reviews and verification to align with best practice in the market is encouraged.

Renewable Japan (JPY7.9bn/USD71m), Japan, a developer and operator of photovoltaic (PV) power plants, issued a 22-year green bond. Proceeds are expected to be allocated to the construction of a PV power plant in Noboribetsu City, on the Japanese island of Hokkaido. The status of the proceeds allocation and reduced CO2 emissions by project will be disclosed once a year in the issuer’s CSR report or company website.

Climate Bonds view: This is the 3rd Japanese issuer from the renewable energy sector to debut in the green bond market in 2019, taking this year’s pool of new entrants to five at USD318m. Don’t miss our recently published Japan green finance state of the market 2018 report for a detailed overview of the Japanese green bond market.

New issuers issued prior to January 2019

Nanjing Pukou Construction Group Co., Ltd. (CNY1bn/USD148m), issued a green private placement bond under its CNY2.3bn (USD340m) green PPN (private placement note) programme, registered with the National Association of Financial Market Institutional Investors in 2018. The deal is intended to finance affordable housing, which has received or is going to receive at least a 2-star certification against China’s Green Building Standards. The whole programme will deliver quantifiable annual climate impacts.

Climate Bonds view: This is the first green bond from China that use all proceeds for affordable housing with a certain green building certification. Despite the deal being a private placement, the issuer has disclosed details on the use-of-proceeds and expected climate impact. We hope to see more private placement deals with a similarly high-level of disclosure on the green credentials of the project(s).

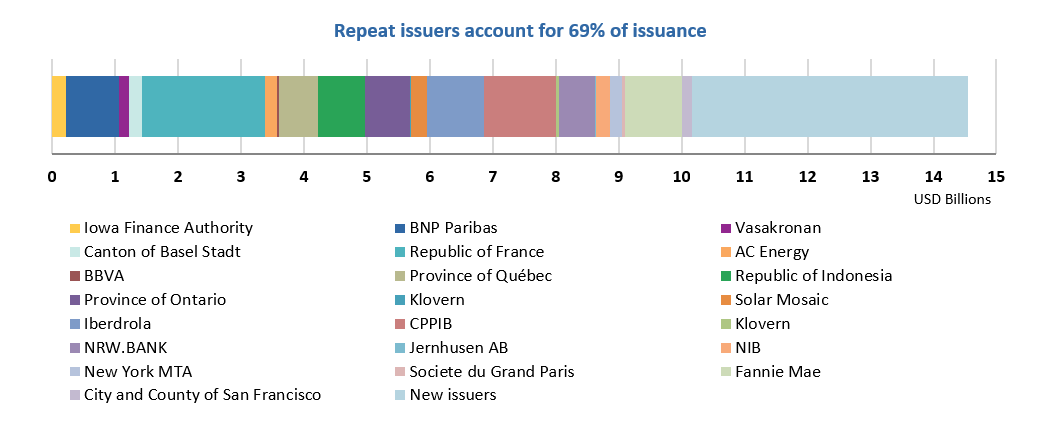

Repeat issuers - February

- BNP Paribas: EUR750m/USD853m

- City and County of San Francisco: USD157.3m – Certified Climate Bond

- Contact Energy: NZD100m/USD67m – Certified Climate Bond (Programmatic Certification)

- Iowa Finance Authority: 24 tranches for a total of USD216m

- Vasakronan: SEK500m/USD53.7m

- Vasakronan: SEK400m/USD43.1m

Repeat issuers – March

- Chengdu Rail Transit Group Co., Ltd: CNY3bn/USD447m

- China Suntien Green Energy Company Limited: CNY910m/USD136m

- Digital Realty Trust (tap): EUR225m/USD254m

- DNB Boligkreditt AS: SEK5.5bn/USD590m

- Duke Energy Progress LLC: USD600m

- Kungsleden AB: SEK400m/USD42m

- Nanjing Metro Group Co., Ltd: CNY2bn/USD298m

- Queensland Treasury Corporation: AUD1.2bn/USD892m – Certified Climate Bond (Programmatic Certification)

- Renew Power: USD375m – Certified Climate Bond (Programmatic Certification)

- Republic of Poland: two tranches for a total of EUR2bn/USD2.2bn

- Sichuan Railway Investment: CNY1.5bn/USD224m

- Société du Grand Paris (SGP): EUR2bn – Certified Climate Bond (Programmatic Certification)

- Vasakronan: SEK63.3m/USD6.8m

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Although we support the Sustainable Development Goals (SDGs) overall and see many links between green bond finance and specific SDGs, in particular, SDGs 6, 7, 9, 11, 13 and 15, the proportion of proceeds allocated to social goals should be no more than 5% for inclusion in our database.

|

Issuer Name |

Amount issued |

Issue date |

Reason for exclusion/ pending |

|

Link Asset Management (Link REIT) |

HKD4bn/USD510m |

08/03/2019 |

Pending |

|

Bank of Shangrao Co., Ltd. |

CNY1.5bn/USD223m |

07/03/2019 |

Pending |

|

Tibet Development Investment Group Co., Ltd. |

CNY300m/USD45m |

06/03/2019 |

Pending |

|

Bank of Liuzhou Co., Ltd |

CNY1bn /USD149m |

06/03/2019 |

Working capital |

|

Tus-Sound Environmental Resources Co., Ltd. |

CNY600m/USD90m |

27/02/2019 |

Pending |

|

Korea Western Power |

CHF200/USD200m |

27/02/2019 |

Sustainability/social bond |

|

North South Power Company |

NGB8.5bn/USD23.6m |

28/02/2019 |

Pending |

|

Hyundai Capital Services |

CHF200/USD200m |

26/02/2019 |

Pending |

|

Qingdao Conson Development (Group) Co., Ltd |

CNY1.05bn/USD157m |

26/02/2019 |

Pending |

|

China Three Gorges Corporation |

CNY500m/USD75m |

26/02/2019 |

Working capital |

|

China Three Gorges Corporation |

CNY2.5bn/USD373m |

26/02/2019 |

Working capital |

|

Sociedade Bioeletrica Do Mondego |

EUR50m/USD57m |

25/02/2019 |

Pending |

|

SNAM |

EUR500m/USD565m |

21/02/2019 |

Not aligned |

|

SFIL |

EUR1bn /USD1.1bn |

19/02/2019 |

Sustainability/social bond |

|

Region Skåne |

SEK700m/USD77m |

05/02/2019 |

Pending |

|

Region Skåne |

SEK300m/USD33.4m |

05/02/2019 |

Pending |

Green bonds in the market

- UGE International: USD5m – multiple closings

- Danske Bank: EUR500m – closed March 15

- Tokyo Tatemono: JPY50bn – closed March 15

- Access Bank: NGN15bn – Certified Climate Bond – closed March 18

- Hayward Unified School District: USD20m – closed March 20

- City of Santa Fe, New Mexico: USD14m – Certifed Climate Bond - closed March 20

- Alexandria Real Estate Equities, Inc: USD350m– closing March 21

- NYSERDA: USD16m- closing March 21

- Fabege AB: SEK250m – closing March 22

- Baseload Capital AB Sweden: SEK500m – closing March 22

- Hysan MTN Limited: HKD500m – closing March 22

- New York State HFA: USD125m – Certified Climate Bond - closing March 26

- Argosy Property Limited: NZD100m – closing March 27

- UBank launched a consumer green deposit product targeted at millennials – Certified Climate Bond

Investing News

The European Commission-mandated Technical Expert Group on Sustainable Finance (TEG) published proposals for an EU Green Bond Standard (EU GBS). The Standard endorses regulating second opinion providers and a proposes a requirement for post-issuance impact reporting. The call for feedback will close on April 3rd, 2019.

A French-led expert group published a draft treaty for a European Finance-Climate Pact. It would establish a green subsidiary for the European Investment Bank, which would provide concessional loans worth up to 2% of each EU Member State’s GDP to finance climate projects.

China has published its first nationally unified guidelines on green finance, the Green Industry Guidance Catalogue. The document outlines green definitions for six sectors and more than 200 project types that can be financed with green bonds. The Catalogue includes “clean coal”, which is not aligned with the Climate Bonds Taxonomy. People’s Bank of China (PBoC) is updating its Green Bond Endorsed Project Catalogue, which will be launched in the near future. PBoC is interested in harmonising its guidelines with international best practice.

The UK’s Financial Conduct Authority (FCA) and the Prudential Regulatory Authority (PRA) hosted the inaugural meeting of their new Climate Financial Risk Forum on 8 March. The committee also includes 25 financial services companies including asset managers, banks and insurers.

According to a Bloomberg article, central banks such as the Federal Reserve maintain a cautious attitude to climate change, viewing it as an operational rather than systemic risk.

Zurich Insurance Group collaborated with BlackRock to develop an impact measurement framework that enables aggregating key environmental and social impact metrics across asset classes. The framework will be released for public use to catalyse further development of impact measurement standards and metrics.

Oil company Shell set its first ever short-term emission reduction targets, pledging to reduce its net carbon footprint by 2-3% by 2022 compared to 2016. Top executive remuneration is tied to achieving the goal. Investors welcomed the development with expectations rising for other fossil fuel companies to follow suit.

A group of investors with a combined USD30tn (EUR26.6tn) in assets has demanded the steel industry update its practices in an attempt to slow man-made climate change, which risks increasing global temperatures to dangerous levels.

The Norwegian government announced plans to divest its USD1 trillion sovereign wealth fund. If passed, the legislative proposal would see the fund give up NOK70bn (USD8bn) worth of shares in 134 companies that are purely focused on fossil fuel exploration and production.

Green Bond Gossip

Malaysian firm Pasukhas Green Assets (PGA) issued an ASEAN Green SRI Sukuk framework for a RM200m (USD49m) Medium-Term Note Programme. RAM Consultancy provided a Second Party Opinion. The proceeds of the sukuk will finance renewable energy assets in Malaysia.

Swedish home appliance manufacturer Electrolux plans to embark on a green bond programme. Funds will be spent on reducing the environmental impacts of the company’s products and operations, including e.g. improved energy or water efficiency at factories as well as increased use of renewable energy. CICERO has provided a Second Party Opinion for the green bond framework.

Readings & Reports

Even if all carbon emissions were to be halted immediately, the Arctic region would still warm by more than 5°C by the century’s end, compared with the baseline average from 1986 to 2005, according to a new study from UN Environment. (summary article)

On a lighter note, another new UN study prepared by GRID-Arendal titled “Playing for the Planet, How Video Games Can Deliver for People and Environment” extracts six recommendations for the video game industry, gamers and policymakers to provoke new thinking, new collaborations, new games and real-world impact.

While 17% of current investment by large public corporations is already green, there’s an urgent need to mobilise even more capital to help build a lower-carbon and more sustainable economy, according to a report by Corporate Knights Research and the Climate Bonds Initiative. Global corporate green investment and the UN sustainable development goals look at how green bonds can help close the funding gap.

Climate Bonds reports

- Green bonds: state of the market 2018

- Post-Issuance Reporting In The Green Bond Market

- China annual green bond market report

- Hong Kong green bond market briefing

- Canada green finance market update

- Japan green finance market report

Moving Pictures

We had the opportunity to interview participants at the Climate Bonds Conference earlier this month.

Here are our first picks:

- Assel Nurakhmetova, Head of Green Finance, Astana International Finance Centre (AIFC) (2:33secs) from Kazakhstan.

- David Jenkins, Head of Sustainable Finance, National Australia Bank (2:31secs) a leading green bond issuer in Australia.

- Carl Hartack, Senior Portfolio Manager Fixed-Income ACTIAM (2:32secs) sharing his views on the green market in 2018 and discuss issues on growing the market.

- Ariyo Olushekun, CEO Capital Assets Limited (5:43secs) giving the news of the second Nigerian sovereign issue

- Lastly, Tim Meaney, Principal Infrastructure Finance Specialist, Asian Development Bank (ADB) (3:19secs) sharing insights on the bank’s aims of supporting climate-related development in the ASEAN region

‘Till next time,

Climate Bonds