Highlights:

- USD101.1bn green bond issuance for 2018 to date

- USD3.4bn green bonds monthly volume as of 20 September

- Encavis AG issues Certified green Schuldschein

- New issuers from China, Hong Kong, Japan, Sweden

- Fannie Mae publishes Green MBS and Credit Facility deals for August totalling USD1.7bn

Don’t miss:

- Global launch of the State of the Market 2018 and of the revised Climate Bonds Taxonomy Guide at the New York Climate Week – more information on the event here.

- The two big Green Bond Pledge announcements including Mexico City signing the Pledge and the launch of the Global Green Bond Partnership at the Global Climate Action Summit in San Francisco last week.

Are you a green bond issuer, have you signed up.

Go here to see the full list of new and repeat issuers in August.

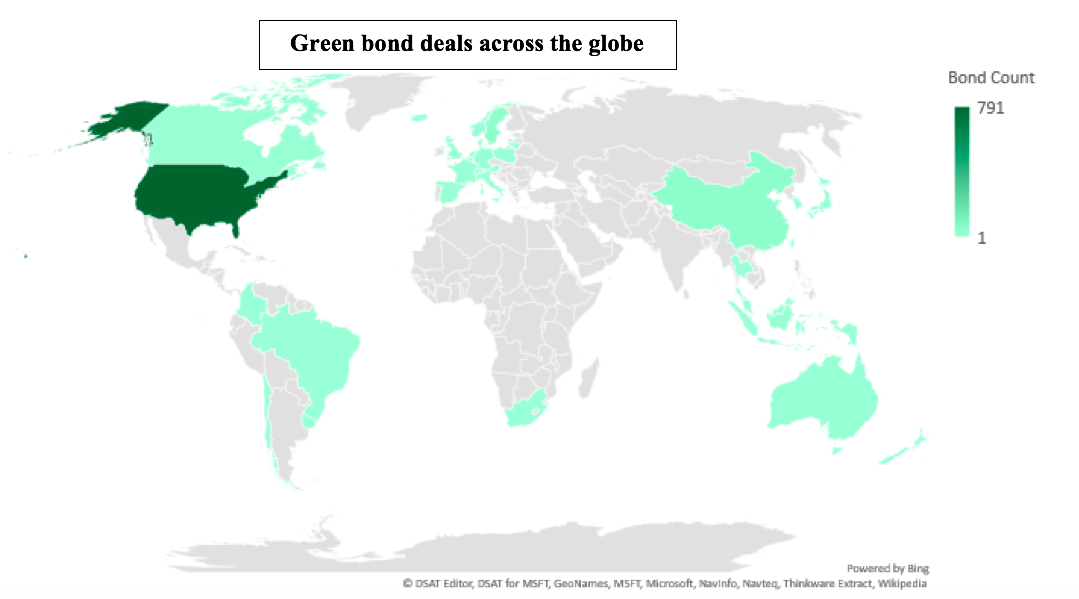

At a glance

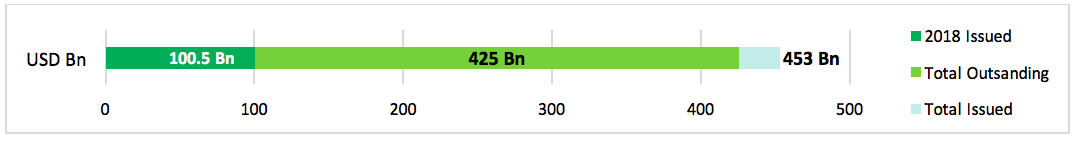

Green bond issuance for 2018 just passed the USD100bn benchmark! EIB’s EUR500m first Sustainability Awareness Bond which closed on 13 September took 2018 global figures from USD99.9bn to USD100.5bn.

The USD100bn annual benchmark was broken last year for the first time and announced at COP23 in late November.

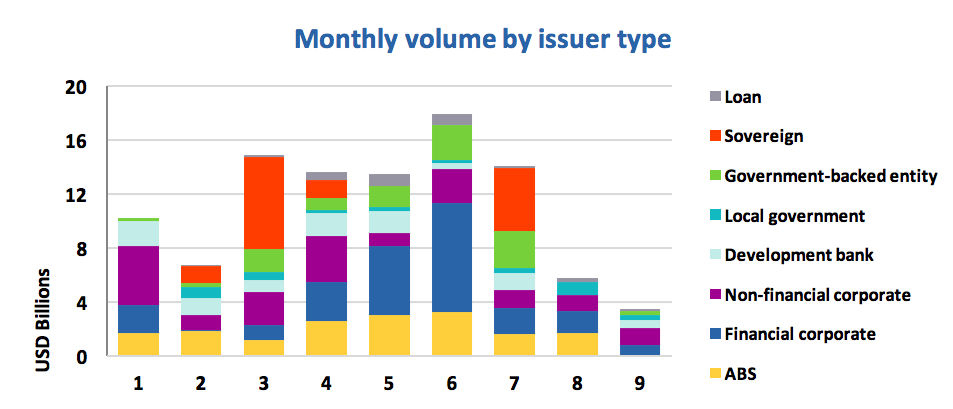

As of 20 September, monthly green bond issuance totalled USD3.4bn. 38% of issuance came from corporates, with SSE’s EUR650m second green bond accounting for over a fifth of the volume.

Developed markets led issuance at 79%, with benchmark deals including Deutsche Hypo’s EUR500m third green covered bond. Beijing Infrastructure Investment’s CNY1bn debut bond is the only deal from emerging markets, accounting for 4% of total volumes.

State of the Market 2018 - preview

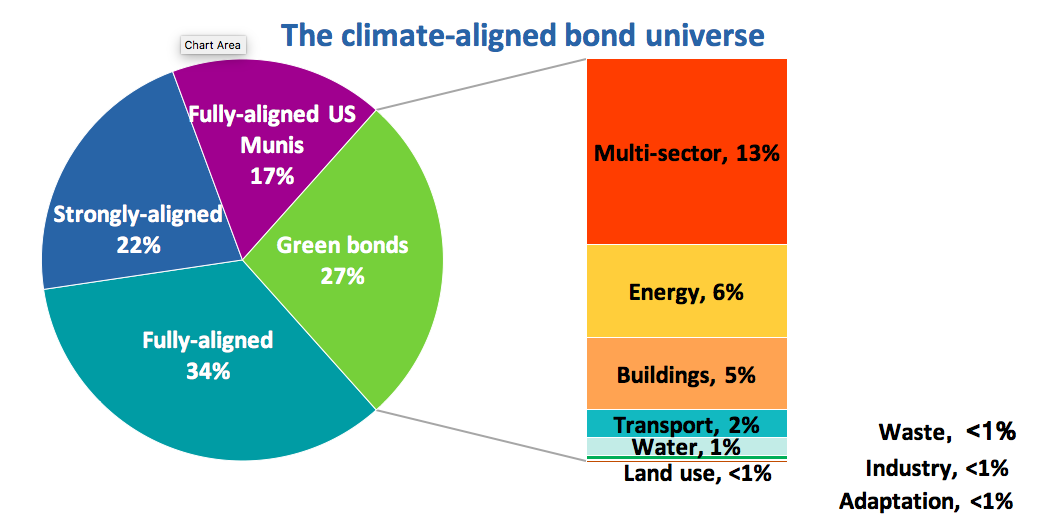

Climate Bonds Initiative’s flagship report ‘Bonds and Climate Change: State of the Market 2018' will be launched on 24 September at HSBC’s Finance for Global Change Forum at the Climate Week in New York. The report provides an analysis of the climate-aligned and labelled green bond universe, highlighting investment opportunities to finance climate-aligned assets within the following climate themes: clean energy, low-carbon transport, water management, low-carbon buildings, waste management and sustainable land use.

While previous reports focused on identifying fully-aligned issuers that derive 95% or more of revenues from ‘green’ business lines, this year we expanded the scope to include strongly-aligned issuers that derive 75-95% of revenue from green business lines. Separate research was conducted on fully-aligned US Municipal agencies to identify their total outstanding unlabelled bonds. This figure is only included in the overall climate-aligned figure and not in the remainder of the report analysis.

> The full list of new and repeat issuers here.

> Click on the issuer name to access the new issue deal sheet in the online bond library.

Certified Climate Bonds

Encavis AG (EUR50m/USD58m), Germany, issued a 10-year green Schuldschein, which obtained a Pre-Issuance Certification under the Solar Criteria of the Climate Bonds Standard. This is the third Certified green Schuldschein to come to market following deals from Nordex and Volkswagen Immobilien in March 2016 and May 2018 respectively. Proceeds will primarily be allocated to finance the acquisition of solar parks from the partnerships with Solarcentury and Power Capital and Ireland Strategic Investment Fund (ISIF), with a total generation capacity of approximately 1.3GW in the next two years. As part of the same acquisition pipeline, in March 2018 Encavis AG took over a solar park with a 44MW generation capacity in the Netherlands. ISS-oekom provided the Pre-Issuance Verification Report.

New issuers

Beijing Infrastructure Investment (CNY1bn/USD146m), China, issued a 3-year green bond, benefiting from a Zhongcai Green Financing Second Party Opinion (not publicly available). Proceeds will be fully allocated to the construction and operation of 7 different metro lines in the city of Beijing. The issuer has disclosed expected short term, medium term and long term climate and environmental impacts for each project.

Climate Bonds view: We are pleased to see Beijing Infrastructure Investment, a state-owned railway and infrastructure financing company, entering the green bond market to finance Beijing’s metro system. The issuer’s CNY10bn green bond programme has been approved by the regulator, so we are expecting to see more green bonds issued under the same framework.

Leo Paper Group Finance Limited (HKD350m/USD45m), Hong Kong, issued a 4-year green loan. According to the Green Loan Framework, proceeds will be allocated to the following project categories: Industrial efficiency (e.g. LED installation), waste gas management, reuse of industrial waste recycling of food waste, wastewater treatment, green buildings, reuse of grey water and sustainable use of natural resources. The framework was awarded the Green Finance of Pre-Issuance Stage Certificate issued by the Hong Kong Quality Assurance Agency (“HKQAA”).

Climate Bonds view: This is the first green loan from a Hong Kong issuer and first from the communications and printing sector. This raises Hong Kong’s 2018 issuance to date to USD823m.

Ricoh Leasing Company (JPY10bn/USD91m), Japan, issued a 5-year senior unsecured green bond, which obtained a Green 1 rating from the Japan Rating Agency. The deal will refinance 11 solar power generating facilities located in Japan through the repayment of previously issued Commercial Paper. The assets are expected have a total average power generation of 30,001MW and reduce emissions by 15,701t per annum.

Climate Bonds view: This is the first Japanese leasing company to enter the green bond market, taking the country’s total issuance for 2018 to USD803m. The replacement of short-term funding (commercial paper) with long-term financing (10-year green bond) is better aligned to the asset life and provides a useful example how refinancing in the green bond market can reposition financing: in this case, by extending the maturity profile.

Taishin International Bank (USD20m), Taiwan, issued a 30-year green bond in July 2018. The deal benefits from a Deloitte Assurance report (not publicly available). Bond proceeds will be fully allocated to a wide range of projects, including wind and solar farms, energy technology and industrial efficiency improvements, smart grids, green buildings, greenhouse gas reduction, waste reuse and recycling, as well as other projects that are permissible under the Taipei Exchange’s green bond catalogue, such as water efficiency, treatment and recycling.

Climate Bonds view: We excluded this bond in July due to the potential use of proceeds in controversial projects. However, the issuer has confirmed that the bond is not going to finance any projects related to clean coal or fossil fuels, which were mistakenly put into the prospectus. Accordingly, we have moved this bond to our included green bond list. Taishin International Bank has also renewed the prospectus on Taiwan’s designated information disclosure platform-Market Observation Post System (MOPS).

Urumqi City Construction Investment (group) Co., Ltd. (CNY1.5bn/USD220m), China, issued a 5-year green private placement in August 2018. The deal has limited disclosure. However, a summary of the use of proceeds published on the Wind Financial Terminal indicates that that bond is going to finance 12 projects. 11 are dedicated to bus systems in Urumqi city, including bus lane construction, bus stations/terminals, a bus signalling system, BRT, and bus parking. The other project is expected to improve the comprehensive environmental management in a natural park.

Climate Bonds view: Although the bus lane and dedicated bus parking stations don’t provide climate benefits directly, they act as essential infrastructure to support bus operations. Especially for this deal, these assets are an integral part of the overall bus projects. Therefore, we included this bond in our database and will update any new information once it’s made available.

Willhem AB (SEK800m/USD88m), Sweden, issued a two-tranche senior unsecured green bond (longest dated bond: 5-years). The deal benefits from a CICERO Second Party Opinion. Proceeds are earmarked for financing green buildings, renewable energy and clean transportation. Renewable energy projects include solar, geothermal, wind power and bioenergy. Clean transportation includes electric vehicles and related infrastructure, as well as provision of car pools. CICERO awarded the clean transportation category a “Light Green”, noting that eligible car pool projects could include fossil fuel cars.

For energy efficiency in buildings, the target is to decrease the energy use per year by 25% with respect to the benchmark required by Swedish codes and regulations, or to obtain certification from one of the following schemes: LEED (minimum Gold), BREEAM (minimum ‘Very Good’), or Miljöbyggnad (minimum Silver), Svanen, EU Green Building and Fedy-12 (Mini-energy building).

Climate Bonds view: Car pool services using fossil-fuel based vehicles are not automatically aligned to the Climate Bonds Taxonomy and are usually considered on a case-by-case basis according to whether they meet the universal gCO2/p-km (passenger per kilometre) threshold (p12 of Low Carbon Transport Criteria). Given Willhelm AB is a real estate company and car pools are just a subset of one of three eligible categories, we decided to include the bond with the assumption that less than 5% of proceeds will be allocated to this project type. However, we will closely monitor the bond’s proceed allocation and impact reporting to ensure that either the vehicles meet the universal threshold (75gCO2/p-km in this case) or that only a maximum of 5% of proceeds have been allocated to finance this project type.

Greenalia Biomass Power Curtis Teixeiro (EUR125m/USD145m), Spain, issued a green loan in July 2017. S&P Global Ratings awarded the deal an E1/77 Green Evaluation. Proceeds will be allocated to the construction of a biomass plant in the town of Teixeiro (Province of La Coruña, Spain). The plant will have the capacity of approximately 50MW and is expected to generate 324GWh per year from forest waste collected within a 100km radius of the new installation.

According to the issuer, this project will be beneficial for the maintenance of forests in the area and the prevention of fires, while encouraging the collection of small-sized waste that is normally discarded for industrial use. The biomass used by the plant will be FSC or PEFC certified. The issuer has committed to disclosing sulphur dioxide (SO2), nitrogen oxides (NOx), and carbon monoxide (CO), among other metrics, once the plant becomes operational. S&P Global Ratings notes that the deal lacks a clear project selection process based on calculations of expected environmental impacts.

Climate Bonds view: This is the second** Spanish issuer to finance a biomass project through a green loan. It’s good to see the issuer committing to reporting the environmental impacts of the project. We agree with S&P Global Ratings that providing a project selection criteria would enhance the deal’s transparency.

Repeat issuers

- Atrium Ljungberg: SEK650m/USD71m

- City and County of Honolulu: USD190m

- Deutsche Hypo: EUR500m/USD579m

- EIB: EUR500m/USD579

- Fabege: SEK200m/USD22m; SEK400m/USD44m

- Fannie Mae: DUS MBS USD1.7bn and Credit Facility USD11.4m - August

- KBN: AUD450m/USD324m

- Massachusetts Clean Water Trust: USD163m

- Mitsui O.S.K. Lines: JPY5bn/USD45m

- Rio Energy (Copacabana Geração de Energia e Participações S.A): BRL128m/USD30.9m (Certified Climate Bond) - August

- SSE: EUR650m/USD753m

- SFF: SEK920m/USD102m

- Vacse: SEK400m/USD44m

- Vasakronan: SEK750m/USD83m

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Though we support the Sustainable Development Goals (SDG) overall and see many links between green bond finance and specific SDGs, the proportion of proceeds allocated to social goals needs to be no more than 5% for inclusion in our database.

|

Issuer Name |

Amount issued |

Issue date |

Reason for exclusion/ pending |

|

Macquarie University |

AUD200m/USD142.1m; AUD50m/USD35.5m |

07/09/2018 |

Sustainability bond |

|

Independent Administrative Institution Japan Student Services Organization |

JPY30bn/USD270.2m |

07/09/2018 |

Social bond |

|

World Bank (IBRD) |

SEK1bn/USD110.4bn |

07/09/2018 |

SDG bond |

|

University of North Dakota |

USD93m |

13/09/2018 |

Not aligned |

|

Guanghzou Yuexiu Holding Ltd |

CNY1bn/USD147m |

03/09/2018 |

Working capital |

|

Bank of Hebei |

CNY2.5bn/USD365m |

10/09/2018 |

Not aligned |

|

Hunan Expressway Co |

CNY540m/USD79m |

24/08/2018 |

Not aligned |

| Iren{} | EUR500m/USD585m | 19/09/2018 | Not aligned |

|

African Development Bank (AfDB) |

BRL4.8nm/USD1.16m; BRL5m/USD1.2m; IDR30bn/USD2bn |

05/09/2018 |

Pending |

|

Bank of Guiyang |

CNY5bn/USD732m |

31/08/2018 |

Pending |

|

Fudian Bank |

CNY3.5bn/USD511m |

30/08/2018 |

Pending |

|

AFD (Agence Française de Développement) |

EUR500m/USD584m |

17/09/2018 |

Pending |

Green bonds in the market

- Brookfield Renewable Partners: CAD300m, closing 20 September

- City of Vancouver: CAD85m, closing 21 September

- Hitachi Zosen Corporation: JPY5bn, closing 21 September

- Canton of Basel Stadt: CHF231,000, closing 24 September

- China Construction Bank Corporation (Luxembourg Branch): EUR500m, closing 24 September (Certified Climate Bond)

- Sumitomo Forestry Co., Ltd: JPY10bn, closing 27 September

- Cassa Depositi e Prestiti SpA: EUR500m, closing 27 September

- State Bank of India (London Branch): USD650m, closing 28 September (Certified Climate Bond)

- City of Saint Paul, Minnesota: closing 10 October

- Encevo SA: EUR250m, closing 23 October

Investing News

CCDC launched a domestic green bond index series on the Luxembourg Stock Exchange. The series includes the ChinaBond China Climate-Aligned Bond Index, which requires either that the proceeds of the selected green bonds align entirely to the PBOC Green Bond Endorsed Project Catalogue and the Climate Bonds Taxonomy, or that at least 95% of the issuer’s main business comes from green industry projects aligned with the PBOC Green Bond Endorsed Project Catalogue and the Climate Bonds Taxonomy.

The Global Green Bond Partnership (GGBP) was launched on Thursday at the Global Climate Action Summit and aims to support efforts of sub-national entities such as cities, states, and regions, corporations and private companies, and financial institutions to accelerate the issuance of green bonds.

Veolia, a waste management company, plans to include two fully-electric bin lorries in its vehicle fleet. The lorries will be charged with power derived from waste collected by the company.

Luxembourg Green Exchange and Mexico City are the latest signatories to the Green Bond Pledge. Local Government Super (LGS), the industry pension fund for NSW local government employees, also joined the US state treasuries' of California, New Mexico and Rhode Island and the cities of Asheville, San Francisco and King County as founding signatories to the Green Bond Pledge.

The Nairobi Securities Exchange (NSE) rolled out a legal framework to support green bond issuance.

Eleven companies - including Tesco, Sky and Siemens - have pledged to power their London-premises with 100 per cent renewable energy, as Sadiq Khan announces the first London Climate Action Week.

Green Bond Gossip

Vodafone recently published a Green Bond Framework, which obtained a Sustainalytics Second Party Opinion.

Ireland published a Green Bond Framework for Irish sovereign green bonds and Sustainalytics provided the Second Party Opinion. The roadshow for the first sovereign is planned for coming weeks.

Tokyo Century developed a green bond framework which obtained an G1 Green Bond Assessment and a Second Party Opinion from R&I.

Region Occitanie obtained a Vigeo Eiris Second Party Opinion for its Green Bond Framework.

Korea Land & Housing Corporation developed a Green Bond Framework which benefits from a Sustainalytics Second Party Opinion.

Sustainalytics has provided a Second Party Opinion for Mitsubishi UFG Financial Group’s new Green Bond Framework.

BBVA Bancomer plans to issue a green bond under BBVA’s SDG Bond Framework. Sustainalytics provided a Second Party Opinion to ensure the eligibility categories align with BBVA’s framework, as well as the Green Bond Principles.

The Canadian Imperial Bank of Commerce (CIBC) developed a CIBC Women in Leadership Bond Framework which benefits from a Sustainalytics Second Party Opinion.

DKB Bank developed a new Social Bond Framework and is planning its inaugural social covered bond. ISS-oekom provided the Second Party Opinion.

DZ Bank AG is planning to issue EUR250m labelled green bond. S&P Global Ratings assigned the deal an E1/85 Green Evaluation.

Reading and Reports

Read the Closing Media Statement from the Global Climate Action Summit (GCAS), summarising major announcements. Scroll down to Transformative Investments for the green finance and investor content.

Latest Harvard Business Review podcast/article: Should US companies still care about the Paris climate change agreement.

Volans recently released the white paper Our Carbon Future: reversing global warming while delivering shared prosperity, highlighting pathways to scale up the transition to a new carbon economy.

EIB’s report Financing innovation in clean and sustainable mobility finds that green mobility in Europe has an annual financing gap of between EUR5.5bn and EUR13bn.

Corporate Knights in Canada have just released a new report detailing the benefits of investing in low carbon and sustainable companies. It’s all in Capitalizing on Sustainable Finance: A growth opportunity for Toronto’s financial sector.

The Insurance Bureau of Canada has just released Combatting Canada’s Rising Flood Costs: Natural infrastructure is an underutilized option.

Moving Pictures

Watch how cities around the world are using plastic bottles as a means of payment for public transport.

Take 1:24mins to discover how Dutch neighbourhoods are producing power from renewable energy.

Watch how China is ramping up its renewable energy capacity.

A quick report from Justine Leigh-Bell, our Director of Market Development, on last week's GCAS in San Francisco. 0:52 secs.

'Till next time,

Climate Bonds

**Editor's Note: The original post listed Greenalia Biomass Power Curtis Teixeiro as the first Spanish issuer to finance a biomass project through a green loan. This is incorrect. The first was Ence Energia. They (Greenalia) are the second.

{}The original post included Iren as a repeat issuer. Upon further analysis they have now been reclassified as excluded due to more than 50% of bond proceeds allocated to natural gas cogeneration. The repeat issuer list and monthly figures have been adjusted to reflect this change.

Apologies for any inconvenience this may have caused.