Latest annual conference interviews now on our YouTube Channel.

Choose your future: Enjoy this lovely little 30sec clip "My mum works at a bank & she issues green bonds".

Ruurd Brewer from TCX: “Emerging markets, currency risk & hedging.” 2:33secs.

Christiana Figures: “Green Bond Pledge, the 2020 Milestone and green infrastructure” 3:08secs.

More in the Moving Pictures section.

Highlights:

- 17 green bonds totalling USD6.3bn have been issued so far this month

- ABN AMRO issues first green bond Certified under the Marine Renewable Energy Criteria of the Climate Bonds Standard

- First Belgian logistics real estate company enters the market

- Republic of France taps Green OAT, increasing the bond size to almost EUR11bn

- 7 new issuers from 2017 reclassified and included in our green bond database following 2017 reconciliation analysis

- Updated Q1 2018 figures including Fannie Mae’s Green MBS deals: USD4.5bn for Q1

Go here to see the full list of new and repeat issuers in April

Q1 GB now at USD30.7bn

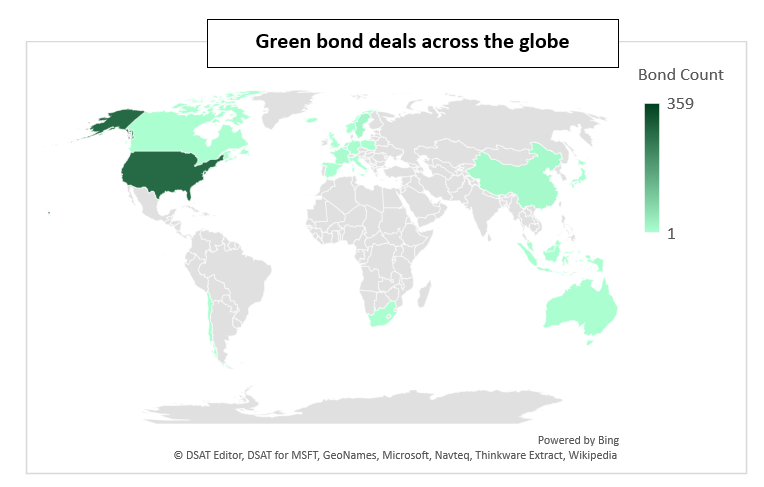

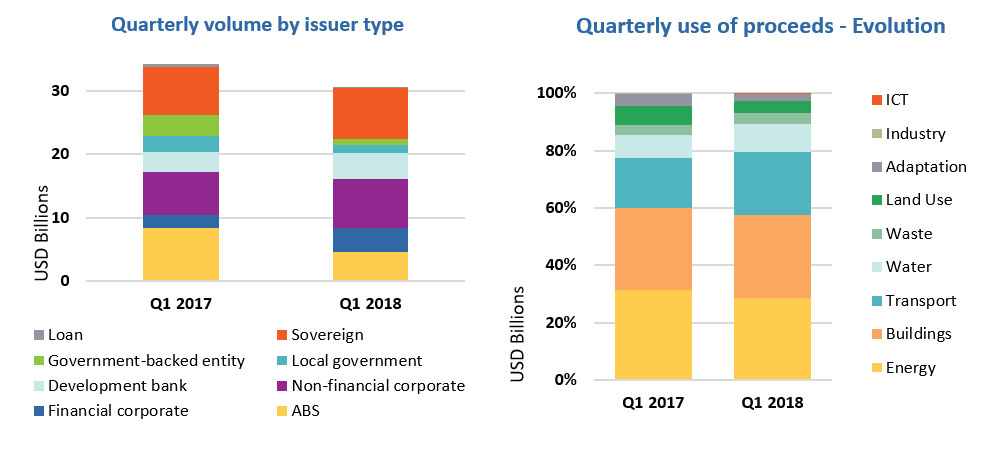

Fannie Mae has published its list of Green MBS deals for Q1 2018, taking our revised quarterly figures to a total of USD30.7bn, just 11% below Q1 2017 volume. Proceeds allocations are driven by Energy and Buildings, both at 29%, and Transport (22%). Fannie Mae’s issuance pushed the US to the top of quarterly country rankings at USD6.2bn, followed by Belgium (USD5.7bn) and China (USD2.5bn).

>The full list of new and repeat issuers here.

Certified Climate Bonds

ABN AMRO (EUR750m/USD930m) is making waves, returning to the market for the third time issuing a 7-year Certified Climate Bond. This time it’s the very first green bond to be certified under the new Marine Renewable Energy Criteria of the Climate Bonds Standard! The new Criteria was launched in late 2017 and there’s more issuance on the way.

Proceeds of the deal will finance mortgage loans for energy-efficient residential buildings and four offshore wind projects – a Netherlands North Sea project of 150 turbines and three Germany North Sea projects of 80, 54 and 31 turbines.

Eligible categories under the Green Bond Framework also include commercial real estate loans for energy efficient/sustainable buildings, loans for buildings energy efficiency upgrades of at least 30%, renewable energy and loans or investments for circular economy projects/assets.

Oekom provided the Pre-Issuance Verification Statement.

New issuers

WDP (EUR100m/USD12m), Belgian logistics real estate company, issued an 11-year US private placement. This is the first green US private placement from a Belgian company and the second green bond from the logistics sector. Proceeds are earmarked for onsite renewable energy, green buildings with threshold certification levels of BREAM “Very Good” or LEED “Gold”, recycling, clean transport infrastructure and water management. In its Second Party Opinion, CICERO assessed the green buildings category at “Medium to Light Green” partly because the eligibility criteria do not specify energy efficiency thresholds (in addition to certification levels).

Climate Bonds view: We welcome increased issuance from the logistics sector. Setting green building certification requirements on the higher end of the scale is best practice. We agree with CICERO that combining this with minimum thresholds for energy efficiency improvements would improve the buildings’ green credentials.

Klövern (SEK900m/USD107m), a Swedish property company, issued a 4-year green bond to finance new and existing building projects. The deal benefits from CICERO’s Second Party Opinion. Certification thresholds for new constructions and major renovations are set at Miljöbyggnad Silver, LEED Gold, BREEAM SE Very Good, or BREEAM Very good, combined with energy performance improvements of at least 25% of Swedish building regulation. Building refurbishments must also yield an energy performance of under 100 kWh/m2 or at least 25% reductions in energy use. The green bond framework lists a range of project types that qualify under this category, such as onsite renewables, LED lighting, assets related to clean transport such as electric charging stations, recycling, and terrestrial and aquatic biodiversity conservation.

Climate Bonds view: Green building certification thresholds and minimum energy efficiency improvements of 25% are aligned with best practice.

Jernhusen AB (SEK500m/USD59.5m), a Swedish real estate company focused on the transport sector, issued a 5-year green bond. Proceeds will be allocated to renewable energy, new/existing green buildings with certification levels of Miljöbyggnad “Gold”/ “Silver” or equivalent, freight and passenger transport infrastructure and waste management. The deal benefits from Sustainalitycs’ Second Party Opinion.

Climate Bonds view: Miljöbyggnad “Gold” is the highest certification and aligns with best practice in the market. We hope to see improvements in existing buildings matching this ambition level going forward.

Pace Funding Group (USD50m), California, issued a PACE ABS secured on a pool of residential PACE loans which finance property improvements related to energy efficiency, water efficiency and renewable energy installations.

Climate Bonds view: It’s good to see the pool of PACE ABS issuers expanding. It would be good to see PACE ABS issuer commit to ongoing impact reporting.

Zhejiang Huayou Cobalt Co (CNY620m/USD99m), China’s largest cobalt chemicals producer, issued a 3-year green private placement bond. According to the news release, all proceeds will be used for the recycling of batteries and cobalt waste, efficiency improvement of wastewater treatment and comprehensive utilization of renewable resources. The deal benefits from an Assurance report from Pengyuan Credit Rating, however the document is not publicly available.

Climate Bonds view: Waste recycling and water treatment are aligned with both PBoC’s Green Bond Project Catalogue and the Climate Bonds Taxonomy. However, we do encourage issuers to disclose detailed project information to increase transparency.

Zhuhai Huafa Comprehensive Development (CNY1bn/USD159m), China, issued a 5-year green bond that benefits from an Assurance report from Lianhe Equator (not publicly available). 94% of proceeds will be used to finance and refinance a commercial building located in the coastal city of Zhuahai. It has received the China Green Building Evaluation Standard 2-Star certification. The other 6% will be used to build an urban wetland park, which is designed to absorb excess rainfalls during storms and reduce flooding in cities.

Climate Bonds view: In China, 30 cities have signed up to the Sponge Cities Initiative which aims to ensure that 80% of each city features enough wetlands to absorb 70% of storm water runoff by 2030. With the massive scale of urbanisation happening in China, municipalities need to take climate resilience into consideration for new urban infrastructure at design stage.

We hope to see more green bonds issued by the China’s local government, water authority, or state-owned enterprise in the future.

Sihui Rural Commercial Bank (CNY100m/USD15.93m), China, issued a 3-year green bond. Funds are to be allocated to 5 waste recycling projects with design recycling capacities of 1 million tons of waste metal, 2000t of electrical motor, 30m tons of waste cable, 1460t of plastic and 4000t of aluminium respectively. The issuer also intends to finance the purchase of 36 public buses, flood control and air pollution prevention. Golden Credit provided the Assurance report.

Climate Bonds view: Although we see metro or light rail as preferable to buses for urban transit, the issuer’s detailed disclosure on the intended allocation and expected impact is encouraging. We agree on the positive climate impact that will be delivered by the 36 public buses, including providing 4.3m passenger trips and avoiding 4132t coal equivalent and a carbon emissions reduction of 10166t.

Aguas Andinas (CLF1.5m/USD68m), Chile’s largest water utility, issued a 7-year Green and Social Bond in mid-March, becoming the first Chilean green bond issuer from the water sector. The bond is listed on the Green and Social segment of the Santiago Stock Exchange and benefits from an SPO from Vigeo Eiris. Proceeds will be allocated to financing water supply, resilient infrastructure and sanitation projects in the City and Metropolitan region of Santiago.

Climate Bonds view: Improving the efficiency of water and wastewater infrastructure is a key aspect in ensuring a region’s resilience to climate change. We’d like to see to see more water and wastewater companies adopting robust reporting metrics. We note that ICMA published its Suggested Reporting Metrics for Sustainable Water and Wastewater Management Projects in 2017.

ACS SE (EUR750m/USD922.4m), a Spanish infrastructure company, issued an 8-year green bond and was awarded an E1/83 Green Evaluation from S&P Global Ratings. 59% of proceeds will be allocated to renewable energy, 20% to energy distribution, 12% to water management (including desalination) and 9% to lighting upgrades. Funded projects and assets are located across North America, South America, Asia and Africa.

Climate Bonds view: We are aware that desalinisation projects can be energy intensive and efforts to reduce energy consumption or the amount of water treated is important to limit emissions. However, as noted by S&P in the Green Evaluation, these projects will lead to system improvements in Africa, Peru and the UAE which are high water stress regions.

Star Energy Geothermal (Wayang Windu) Ltd (USD580m) issued a 15-year green bond, becoming the third Indonesian green bond issuer and the first from the geothermal energy sector. The deal benefits from Carbon Trusts’ Second Party Opinion. Proceeds will be used to finance the Wayang Windu Geothermal power plant and specifically assets with emissions of less than 100g CO2 per kWh estimated carbon intensity. Carbon Trust notes that this compares favourably to the Indonesian national average emission factor for electricity of over 730g CO2 per kWh.

Climate Bonds view: The carbon intensity threshold set by the issuer is aligned with the Geothermal Criteria of the Climate Bonds Standard, which demonstrates a high level of ambition.

Previously treated as excluded, pending or unlabelled

During our screening process, green bonds that are not aligned with the Climate Bonds Taxonomy are excluded from our green bond database. If satisfactory information to the contrary is provided by the issuer, arranger, underwriter or external reviewer, the bond will be reclassified as included. Where available information on a deal’s use of proceeds is insufficient to determine whether the bond should be included or excluded, it is marked as “Pending” and further work is undertaken to obtain or clarify information. Bonds that have a green bond assessment, green evaluation or other form of green rating are now uniformly treated as labelled green bonds.

At the end of each quarter we review unlabelled, pending and excluded deals to determine which ones should be reclassified as included. Deals from new issuers from 2017 and Q1 2018 that have been reclassified in our latest quarterly review are described below.

Hitachi Capital Management China (USD100m) issued a 5-year green bond in December 2017. The second party opinion provided by DNV GL reflects proposed allocations to water treatment and water use efficiency upgrades, solar PV, construction and upgrades of BEAM certified green buildings, and circular economy adapted production technologies and processes.

Climate Bonds view: The bond had been excluded from our database in January due to lack of clarity on circular economy related projects. Information provided by Mizuho, Green Structuring Agent and sole underwriter of the deal, confirms that the issuer has already invested over USD100m in projects under the water, renewables and green buildings categories of the green bond framework. Based on this information we have reassessed the bond and are satisfied that the proceed allocation is aligned with the Climate Bonds Taxonomy.

Hong Kong & China Gas (JPY2bn/USD18m) issued a 10-year green bond in November 2017. The deal was issued to finance wastewater treatment, waste treatment, landfill gas conversion to natural gas, biomass conversion to biofuels and other projects related to renewable energy production and energy performance improvements. The Green Bond Framework states that nuclear energy and energy efficiency improvements related to fossil fuel technologies are excluded from the eligible projects. The bond benefits from an SPO by Sustainalytics.

Climate Bonds view: The deal had previously been classified as pending due to insufficient information on proceed allocation. We have now reassessed the deal taking into account the Green Bond Framework and SPO and can confirm that the eligibility categories are aligned with the Climate Bonds Taxonomy.

Greater Orlando Aviation Authority (USD924m), Florida, issued a US muni bond in October 2017 and achieved a Green Evaluation score of E1/78 from S&P Global Ratings. The bond was issued to finance the construction of five new buildings (including additional terminal space and car park extension) and enabling works, and part of the South Terminal Complex project at Orlando International Airport. The buildings will be built to comply with the LEED Version 4 standards and are expected to obtain the Certified level of LEED ratings, which is the lowest of four levels. The issuer aims at achieving a 20% energy efficiency improvement compared to existing buildings.

Climate Bonds view: Targeting minimum levels of LEED certification is unambitious, especially in comparison to Mexico City Airport which is targeting LEED Gold and Platinum certification levels for the upgrades funded by its two green bonds. The additional energy efficiency target provides some assurance on the energy performance credentials of the buildings, but is on the low side: we prefer to see 25-30% or higher targets.

Market best practice is now set on the higher end of the scale for building certification. Climate Bonds is in the process of developing more stringent eligibility requirements for including building-related bonds in its database.

Capital Region Water (USD44m), Pennsylvania, issued a US muni bond in May 2017 and it was awarded an E1/87 Green Evaluation by S&P Global Ratings. Proceeds will refinance 2014 revenue bonds mainly funding the Advanced Wastewater Treatment Facility (AWTF) Improvement Project, as well as other improvements to water and storm water management, wastewater treatment and water quality improvements.

Climate Bonds view: It’s good to see water and wastewater mitigation, adaptation related projects leading to improvements in the efficiency of the system and increased water quality.

Argo Infrastructure Partners (USD120m), New York, issued an unlabelled bond in August 2015 to fund part of the acquisition of the Cross-Sound Cable project. In May 2017, the deal obtained an E1/87 Green Evaluation from S&P Global Ratings. The project consists of an undersea cable transmitting power generated from renewable energy sources (mainly wind and hydro) from New England to Long Island and enhancing grid stability. S&P noted that the issuer has not set a timeline for reporting emissions reductions, but had engaged market consultant ESAI who calculated that the project’s carbon savings are equivalent to around 600MW of wind capacity.

Climate Bonds view: Grid infrastructure connecting renewables and substituting fossil fuel energy sources are essential assets to achieve decarbonisation. We hope to see regular and robust reporting.

Brookfield Power NY Finance (USD305m), Canada, issued a 23-year bond in December 2017 and obtained an E1/91 Green Evaluation from S&P Global Ratings. The deal was issued to refinance a portfolio of 78 hydroelectric facilities located in New York, Pennsylvania, Maryland, and West Virginia with a total installed capacity of 872MW. Two thirds of the proceeds were allocated to refinancing small hydro.

Climate Bonds view: Refinancing hydro is in line with our current database eligibility criteria, but we would like to see issuers reporting power density and emissions values.

Ence Energia (EUR220m/USD258m), Spain, issued a project finance loan in December 2017 with the benefit of a Green Evaluation score of E1/79 from S&P Global Ratings. Proceeds will be used to refinance existing debt and finance the expansion of the issuer’s biomass energy business. Part of the loan will finance the acquisition of a biomass complex with a combined generation capacity of 27MW in Andalucía.

Climate Bonds view: The issuer is committed to sourcing only sustainable biomass, which aligns to our taxonomy.

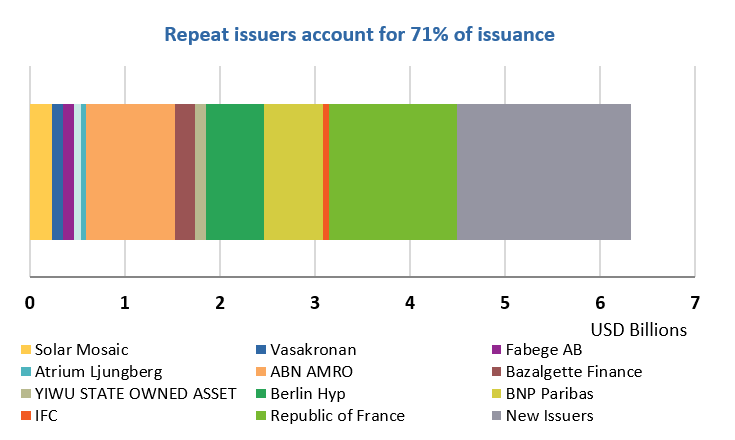

Repeat issuers

- Atrium Ljungberg: SEK500m/USD59.5m

- Bazalgette Finance: GBP150m/USD213.6

- Berlin Hyp: EUR500m/USD620.5m

- BNP Paribas: EUR500m/USD620.5m

- Fabege AB: SEK500m/USD59.8, SEK200m/USD54.4m

- IFC: SEK500m/USD60m

- New York State Housing Finance Agency: USD68.9 (Certified Climate Bond)

- Republic of France: EUR1.2bn/USD1.3bn (tap)

- Solar Mosaic: ABS, USD235m

- Swedbank: SEK2bn/USD244m

- Vasakronan: SEK1bn/USD118m

- Yiwu State-Owned Capital Operation: CNY700m/USD112m

- Fannie Mae published their Green MBS numbers for Q1 2018 last week: DUS MBS USD4.3bn, Credit Facility USD147m (not included in repeat issuers chart below)

Q1 trends comparison

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Though we support the Sustainable Development Goals (SDG) overall and see many links between green bond finance and specific SDGs, the proportion of proceeds allocated to social goals needs to be no more than 5% for inclusion in our database.

|

Issuer Name |

Amount issued |

Issue date |

Reason for exclusion/ pending |

|

Council of Europe Development Bank |

EUR500m/USD614m |

27/03/2018 |

Sustainability/Social bond |

|

BPCE |

JPY49.4bn/USD451m, JPY2.3bn/USD21m |

25/01/2018 |

Sustainability/Social bond |

|

Land NRW |

EUR2bn/USD2.5bn |

13/03/2018 |

Sustainability/Social bond |

|

Weihai City Commercial Bank Co LTD |

CNY2bn/USD315.7m |

19/03/2018 |

Not aligned |

|

Hesteel Co LTD |

CNY700m/USD111.3m |

26/03/2018 |

Working capital |

|

Shaanxi Financial Holding Group Co LTD |

CNY1bn/USD158.1m |

21/03/2018 |

Working capital |

|

Yancheng South District Development |

CNY1bn/USD157.9m |

19/03/2018 |

Working capital |

|

Hubei Western Area Eco-cultural Tourism Investment co., Ltd |

CNY800m/USD127.2m |

26/03/2018 |

Not aligned |

|

Meridiam |

EUR288m/USD318.4m |

11/10/2016 |

Sustainability/Social bond |

|

Credit Agricole CIB |

USD25m |

19/10/2017 |

Insufficient information |

|

Credit Agricole CIB |

EUR0.8m/USD1m |

04/12/2017 |

Insufficient information |

|

Credit Agricole CIB |

EUR10m/USD12m, EUR2.5m/USD2.9m |

22/12/2017 |

Insufficient information |

|

BDO Unibank |

USD150m |

11/12/2017 |

Insufficient information |

|

Virginia Small Business Financing Authority |

USD40m |

29/12/2017 |

Insufficient information |

|

SPIC Ronghe Financial Leasing |

CNY1bn/USD156m |

19/01/2018 |

Insufficient information |

|

IFC |

SEK100m/USD12m |

28/12/2017 |

Pending |

|

Verbund AG |

EUR100m/USD123.4m |

19/03/2018 |

Pending |

|

Kungsleden AB |

SEK1.3bn/USD152.1m, SEK1.3bn/USD152.1m |

21/03/2018 |

Pending |

|

Banco Galicia |

USD100m |

23/03/2018 |

Pending |

|

Linhai Rural Commercial Bank |

CNY100m/USD15.9m |

29/03/2018 |

Pending |

|

Paprec |

EUR575m/USD707.3m, EUR225m/USD276.8m |

29/03/2018 |

Pending |

|

EXPORT-IMPORT Bank of China |

CNY2bn/USD308m |

04/01/2018 |

Pending |

Green bonds in the market

- Rhode Island Infrastructure Bank – closing 25th April

- District of Columbia Water -closing 30th April

- EIB – closing 25th April

- World Bank – closing 26th April

- City of Tampa, Florida – closing 26th April

- Zuricher Kantonalbank – closing 8th May

Investing News

Luxembourg Stock Exchange and Shanghai Clearing House have agreed on a mechanism that will enable international investors easier access China’s green bond market.

Fiji lists its first international green bond on the LSE.

Abu Dhabi hosted the world’s first Green Business Summit.

BNP plans an emerging markets green bond fund.

Gecina concludes first sustainability performance-linked loan indexed on its GRESB Rating.

Copenhagen Infrastructure III (CI III) fund closes at USD3.5bn.

Lots of Green Gossip

Lithuania’s government announces plan to issue a sovereign green bond.

Hanover City plans to launch a Green Schuldschein – it would be the first German city to issue a green bond.

City of Toronto has obtained a Sustainalytics' second party opinion to looks set to bring a green bond to market.

Japanese company Nippon Yusen Kaisha (NYK) to plans to issue the first green bond where proceeds will be allocated to projects/assets in the shipping industry.

Taipower aims to return to market with more green bonds in mid-May.

Mendoza Province is set to issue green bonds, becoming the third Argentinian province to come to market.

Empresa de Energía del Pacífico is planning to issue green bonds.

Caisse Francaise de Financement Local and La Banque Postable state their intention to issue green bonds in 2019.

Kenyan fund plans to issue a USD15m green bond to finance water projects.

Barclays plans to launch UK’s first green mortgage.

Reading and Reports

The UNEP Enquiry into the Design of a Sustainable Financial System has released its final report. Don’t miss “Making Waves”.

The UK Green Finance Taskforce has published its latest report.

United Nations International Maritime Organisation adopted an initial strategy to curb emissions from international shipping.

Climate Landscape for Aotearoa New Zealand is another pointer to the growing interest in green finance from the Shaky Isles.

Our CEO Sean Kidney makes an impression in Mexico:

Inversionistas cierran filas ante cambio climático

México, el ausente en bonos soberanos verdes

More annual conference interviews now on our YouTube Channel:

- Choose your future: “My mum works at a bank & she issues green bonds” O: 30secs

- Choose your future: “My aunt helps people make buildings for the cities of the future” 0:31secs

- Ruurd Brewer from TCX: “Emerging markets, currency risk & hedging.”2:33secs.

- Christiana Figures: “Green Bond Pledge, the 2020 Milestone and green infrastructure” 3:08secs.

‘Till next time,

Climate Bonds

Disclosure: Organisations named or linked to in this post are Climate Bonds Partners. A full list of Partners can be found here.