Don't miss our special China Transition Finance Webinar! Thursday 1st April - 08:00 London/1500 Beijing & Hong Kong. Register here.

Inclusive - Ambitious - Flexible - The three common features that can shape transition investment

In the final issue of our 3-part series, we look at flexibility as a core feature in shaping transition finance. Whilst bonds have been increasingly vital at attracting funds for green assets, projects and activities, there are other financial products & instruments that can be used to finance transition. The key to this will be unlocking finance for whole entities in transition.

Flexible

Albert Einstein once said, “We cannot solve our problems with the same thinking we used when we created them.” Whilst our capitalist economic system may have served many societies well for many decades, it has failed to account for the cost of the natural capital on which it relied too heavily. Tackling the climate crisis will require new thinking.

Climate Bonds has been instrumental in taking the green bond concept and shaping it into a separate asset class over the last decade; the approach to transition will need some new thinking and some flexibility in the financial products that are involved.

Financing whole entities in transition

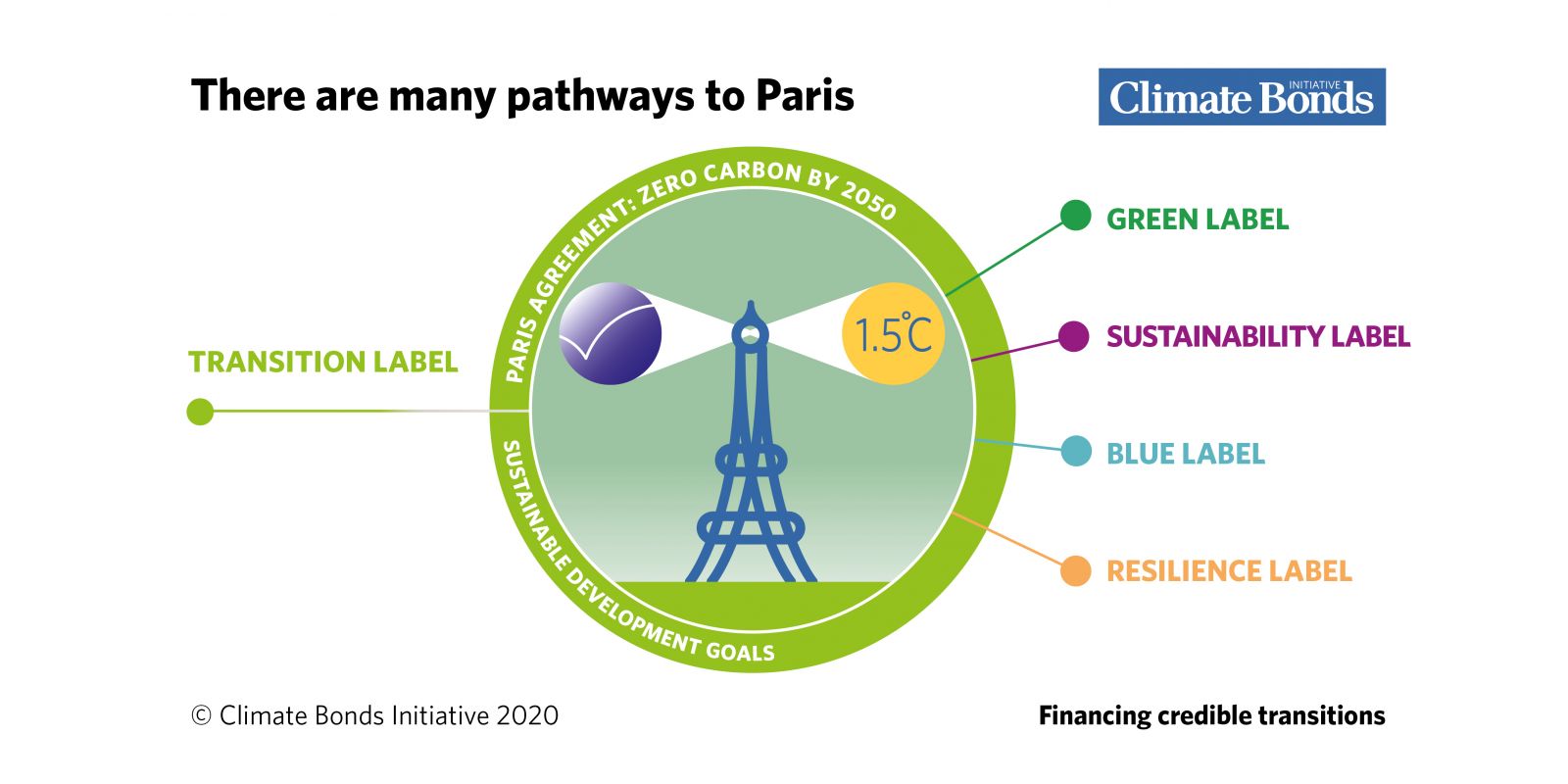

Transition will need to go beyond the Use-of-Proceeds model in the green bond market, where for example, a green label is appropriate at an activity level for an oil company building a wind farm but not appropriate for the entire entity.

For transition, the concept will apply to whole entities if the entire company is on a transition pathway. Within this approach, a broader range of financial products can be applied such as equity investments, sustainability-linked loans and general-purpose bonds. For activities, this includes asset-backed securities and Use of Proceeds bonds that are already well used in the current green bond market.

What activity is being financed

There is a distinction between those activities that do not have a long-term role to play in a low carbon economy (due to their high emissions) and those that do (despite their high emissions). The transition label is only for those activities that have a long-term role to play.

Green continues to be used for eligible investments where activities or entities have a long-term role to play,- and- are either already near zero or following decarbonisation pathways in line with the halving of emissions by 2030 and Net Zero by 2050.

Transition label should be applied to those activities or entities that are making a substantial contribution to the halving of emissions by 2030 and reaching net-zero by 2050, but will not have a long-term role to play

OR

Will have a long-term role, but the pathway is not certain.

Transition calls for credible change that can be seen clearly. An Issuer has the flexibility to label the bond transition or green, sustainability-linked, blue or resilience as a signal to investors and the market, but all activity must be aligned with the Paris Agreement.

New sectors start to become available to investors

An entity’s current emission levels are largely immaterial, what matters is whether there is a plan to make credible changes. All sectors that have a long-term role must be included - simply excluding entire sectors from market support is a blunt tool that does not drive change.

There is some apprehension in those sectors that have never issued green bonds (e.g., cement), but conceptually they are not so different to those sectors where it is already accepted that they are not at zero emissions currently but are on that pathway to zero. The building sector is an obvious example of this, there are still huge emissions in the building sector and a lot of buildings that are financed with green bonds are not at zero emissions .

Confidence in the transition pathways and the governance principles behind them is crucial for inspiring investor confidence. For many, the use of the word transition rather than green, avoids the criticism that they are not green yet, but also conveys something very positive: that they are moving in the right direction and have a plan in place. This signalling of intent communicates to the investor that the entity is committed to making a practical shift. This not only reduces the longer-term risk to the investor but differentiates that entity to the market showing that there’s something special going on.

The Transition label has the potential to bring new players into the market, offering an important outlet for diversification of portfolios.

Pathways and indicators are what’s needed

Like the green bond universe, transition-based investment will require metrics and indicators. The work to map out specific transition pathways for whole entities and determine credible indicators for their transitions is still at a nascent stage. Climate Bonds will expand it’s successful Standard and Certification Scheme certifying green investments by adding a new series of criteria for sectors in transition such as cement and iron & steel.

Alongside that definitional work, we want to work with governments and regulators to inform and shape policies that will be needed to enable transition finance to fully play a role.

The Last Word

To summarise the need for flexibility in transition:

This is broader than UoP so the market needs to unleash creativity to develop transition specific financial products. New sectors bring new opportunities for investors and those entities that have a clear plan to align with the Paris Agreement goals are going to be more investable than those without.

A transition to a low-carbon economy is an enormous challenge. We must stay committed to the target but stay flexible in our approach.

If you have missed the first two blogs, in our 2021 Transition Series you can find them here: 1. Inclusive 2. Ambitious.

‘Til next Time,

Climate Bonds

Transition Finance Webinar Series

To find out more about Transition Finance register for one of our upcoming Transition Finance Webinars!

The series explores the opportunities a Transition Label provides in reaching international climate targets. Each episode explores Transition in a particular regional context:

China in focus. 08:00 London / Beijing 15:00. 1st April. Register here

Asia-Pacific in focus. 10:00 London / 16:00 Jakarta, Bangkok, Hanoi / 17:00 Singapore, Kuala Lumpur, Manila 8th April. Register here

LATAM in focus. 10:30 São Paulo & Santiago / 07:30 Mexico City / 08:30 Bogota. 14th April. Register here