A Climate Bonds discussion paper: Transition Finance for Transforming Companies

Tools to assess companies' transitions and their SLBs

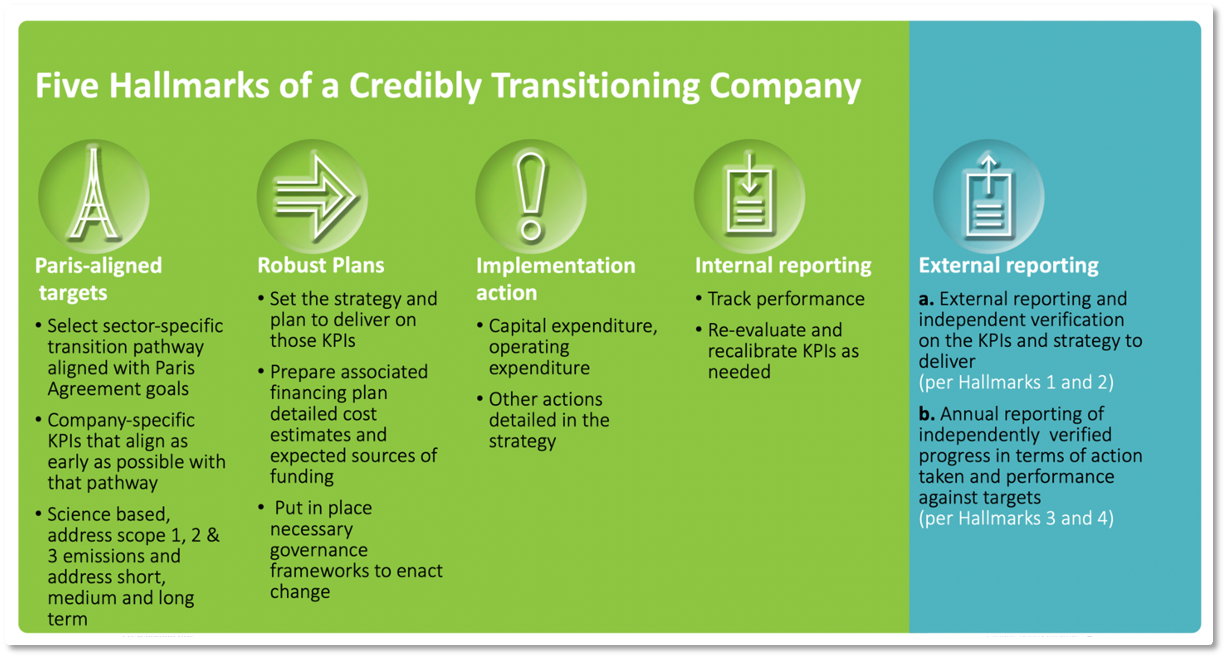

This paper explicitly addresses the challenge of the climate mitigation transition, and specifically, assessing the credibility of a company’s decarbonisation, presenting Climate Bonds’ proposal of Five Hallmarks of a Credibly Transitioning Company, i.e. a company whose transition is rapid and robust enough to align with the global goal to nearly halve emissions by 2030 and reach net zero by 2050, in line with the Paris Agreement.

Climate Bonds is developing two specific tools and offerings to support the market that use these Hallmarks as their foundation.

The first is the structural expansion of the Climate Bonds Standard and Certification Scheme, now open for public consultation, to certify, potentially with differentiated certification labels:

- Non-financial corporates that are credibly transitioning to align with 1.5 degree pathways (including those already aligned and those who will align by 2030); and

- Non-financial corporates that are already near zero (so already near alignment with 1.5 degree goals without the need for further deep transition); and

- SLBs issued by any such corporate.

The second is the expansion of Climate Bonds’ market screening capabilities (and data provision) to include all SLBs issued in the market. Further details on this will be available later this year.

-

转型金融助力企业低碳转型(Chinese) - Sep 2021

Hallmarks of a credible company transition

This framework consists of five hallmarks of a credibly transitioning company (the ‘Hallmarks’). The Hallmarks address:

-

The requisite ambition in terms of company-level performance targets set; and

-

The company’s willingness and ability to deliver on those forward-looking targets.

The Hallmarks complement existing ESG frameworks and methodologies but go beyond them. They emphasise key governance elements that are important indicators of a company’s willingness and ability to deliver on its decarbonisation targets, but also add the granularity needed to ensure that those targets are ambitious and in line with the agreed climate goals.

They move away from a world of relative measures such as ‘best in class’, ‘sector benchmarking’ or ‘improvements compared to a historic baseline’, to the more absolute measures tied to transition pathways that are common to all actors in the sector. This approach has worked well in the green UoP market and is reflected in the upsurge in green or sustainability taxonomies worldwide.

-

Paris-aligned targets

-

Robust plans

-

Implementation action

-

Internal monitoring

-

External reporting.

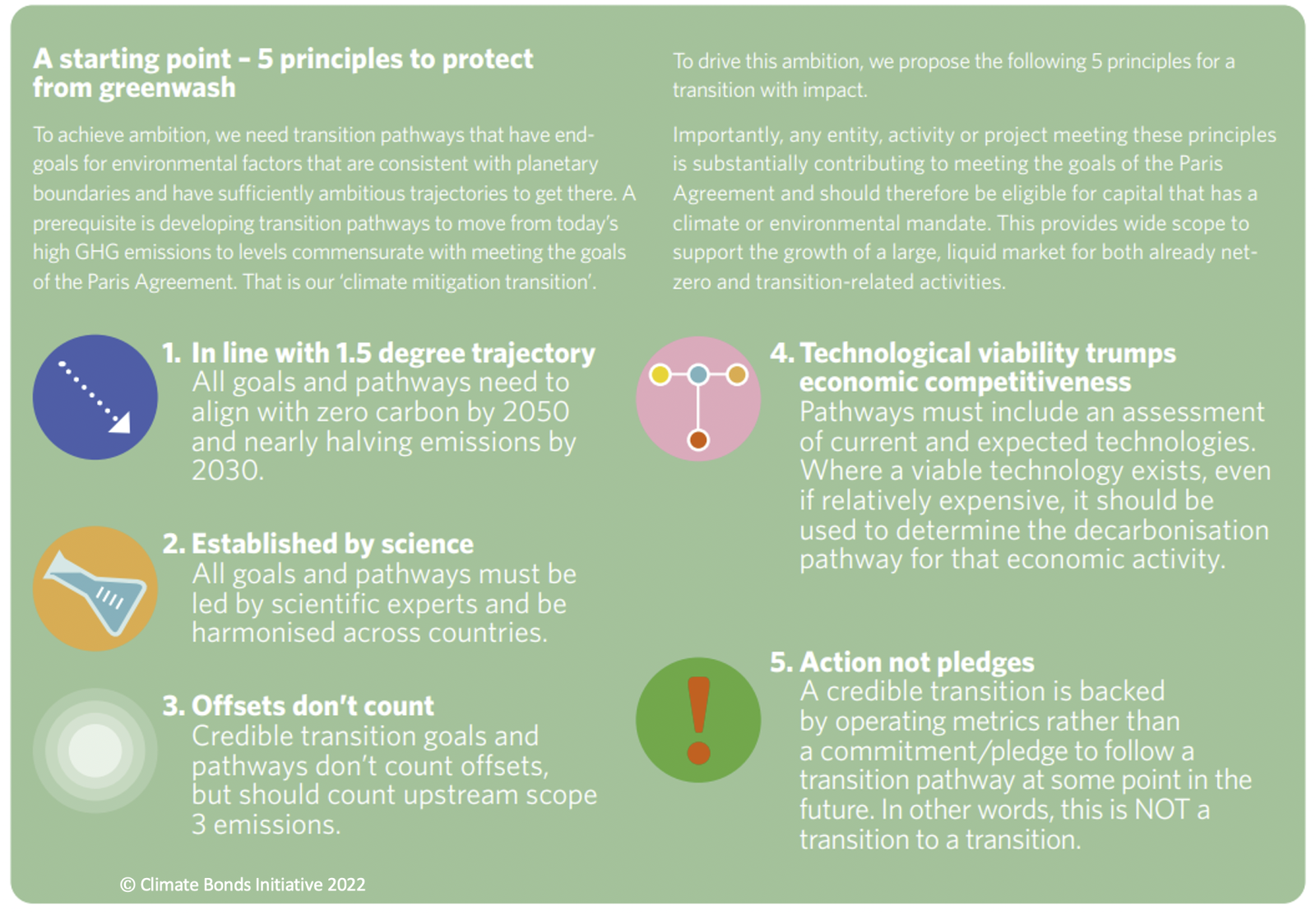

'Transition Finance for Transforming Companies' is a companion piece to the ‘Financing Credible Transitions’ paper, produced by Climate Bonds Initiative in partnership with Credit Suisse in September 2020. In ‘Financing Credible Transitions’ Climate Bonds articulated its Five Transition Principles.

Figure below provides an overview of these Principles:

Companies’ transitions and their SLBs

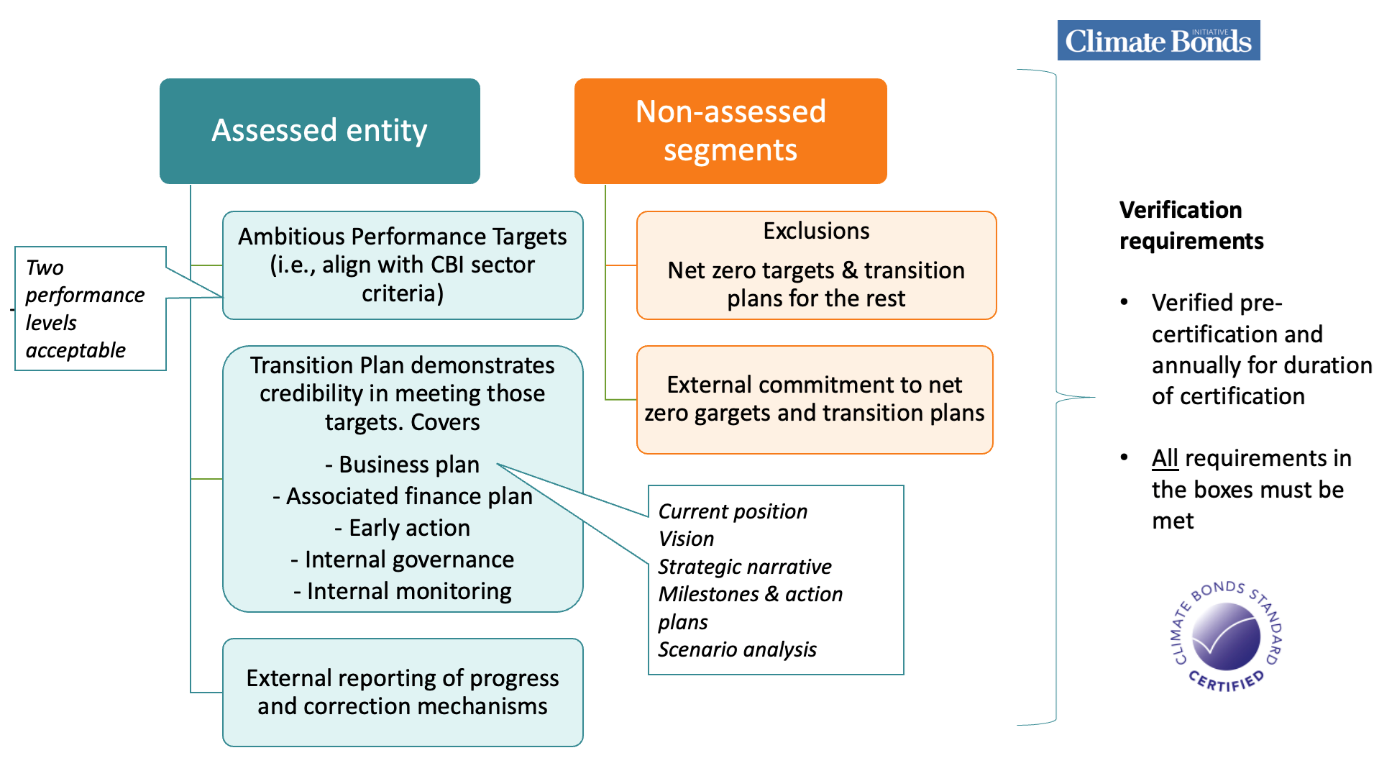

Given the increasing attraction of SLBs and corporate net zero targets, to issuers, investors and underwriters alike, in order to support market growth, Climate Bonds is expanding its certification to encompass the certification of credibly transitioning entities (or parts of them) and any Sustainability Linked Bonds (SLBs) they issue.

These proposals for certification are rooted in and align with the Hallmarks but provide greater precision as is necessary for incorporation into a Standard and Certification Scheme, one of the objectives of which is ensuring consistent assessment and evaluation across all certified entities and instruments. SLBs and company certifications will follow the basic pillars established for UoP bonds, namely a standardised (common) rule set, binary assessment, simplicity, transparency, and science-based criteria.

High emitting sectors that are critical to a successful economy-wide transition, including industrial sectors and fossil fuel dependent sectors, have emerged prominently in the SLB market. This is perhaps operators in these sectors are at an earlier stage of their transition and see greater potential to engage with investors via forward-looking SLBs.

Given their forward-looking targets, all SLBs are inherently about transition, whether a climate, broader green, and/ or social transition. For a decarbonisation transition, they represent a fantastic opportunity for companies’ net-zero targets to be linked up with access to sustainable finance. Proceeds of SLBs are usually not allocated to specific projects, assets or activities but used for general purposes.

The sustainability angle comes from the issuing entity, making forward commitments to future delivery of sustainability outcomes, often in the form of company level key performance indicators (KPIs). In some cases, the cost of capital is linked to achievement of those KPIs. Certification of SLBs will provide guidance to these issuers and assurance to investors around the credibility of these instruments, which at present, prove difficult to evaluate due to lack of consistency in metrics, targets and transition plan information used and shared by different issuers.

Proposals for this expansion are open for public consultation. You can provide feedback on the Draft of Climate Bonds Standard Version 4.0 from now until 4th November 2022 by clicking here.

Key features of the Corporate and Corporate SLB certification:

- Ambition: The goal of transition is to deliver no more than 1.5-degree global warming. This is a key test for eligibility for certification.

- Inclusivity: The collective goal of global net zero emissions will not be met without decarbonising the highest emitters as well as building up low or zero carbon alternatives. Certification is designed to support all transition, provided the goals, the path and the pace are suitably ambitious.

For this reason:

- Corporates and SLBs from all sectors will be eligible for certification (once relevant sector-specific criteria are available).

- Corporates and SLBs from those already on 1.5-degree pathways are eligible for certification as are those who will align with those pathways by 2030 at the latest (so long as they can demonstrate the ambition of their future Performance Targets and the credibility of their Transition Plan to deliver on those Targets).

- Granular simplicity: Bridges the gap between existing market guidance tailored specifically to SLBs which have good uptake but are lighter touch in detail[1], and the deeper company-level assessment frameworks available that are more comprehensive but perhaps too complex for wide market uptake.