Inclusive- Ambitious- Flexible – The three common features that can shape transition investment

Climate Bonds’ landmark Financing Credible Transitions (FCT) paper, released with Credit Suisse in September 2020, sets out a proposal for realising a single definition of transition. The benefits will not only be felt by investors but the market in general, avoiding potential risks around ‘greenwashing’.

While the detail may need refining, the message from investors is clear: transition must be ambitious, not greenwash or transition-wash. The basic principles and framework expressed in the FCT White paper are a solid basis for development and the core concepts need to be socialized across the market on a rapid basis.

This means that all stakeholders in the market need to encourage all types of investments that fit the parameters outlined, even if they fall outside of traditional green sectors.

Three Common Features for Transition

• Ambitious – this means in line with 1.5 degrees or has a significant emissions reduction potential

• Flexible – applicable to whole entities, everything they do, and a range of associated financial products

• Inclusive – allow all sectors and activities to participate as long as they demonstrate compliance with the principles and framework outline

Inclusivity is the Key - Every sector must play a role

Transitioning to net-zero by 2050 will require every sector to play a role. This will require entities with high emissions levels to reimagine themselves, by planning and implementing transition strategies that detail the path forward. Bonds are an important tool in financing these transitions and while large GHG emitters are familiar with bonds as a tool, they have not yet embraced the opportunities of a transition labelled bond to finance the necessary changes. Investors are keen to diversify portfolios and need the label for assurance that the assets' activities and projects, or indeed entire entities, are managing risks appropriately.

Let’s also not forget that transition offers the enormous opportunity of a new market.

Creating standards that detail what a credible plan should look like is a fundamental step in unlocking the necessary finance. Whilst the standards must be ambitious to deliver the Paris goals, and flexible enough to apply to many types of market instruments, they must fundamentally be inclusive, for everyone. All actors in all sectors need to transition and the framework presented in the FCT Whitepaper describes a way to deliver that.

This first post in our new 3 part series on Transition explores why Inclusivity is key.

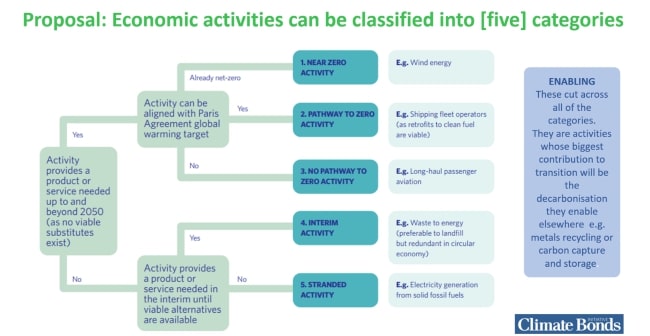

What’s in – What’s out- Economic Activities can be classified according to the changes they need to make

There is a useful distinction between activities that do not have a long-term role to play in a low carbon economy and those that do. This is the foundation of a demarcated ‘transition’ label.

In broad terms, we propose that:

The green label is used for investments that have a long-term role to play in the low carbon economy and are near zero, or following decarbonisation pathways in line with the Paris Agreement.

The transition label is used for investments that:

• are making a substantial contribution to halving global emissions by 2030 and reaching net-zero by 2050, but do not have a long-term role to play;

OR

• will have a long-term role to play, but at present, the pathway to net-zero is not certain. The following decision trees can be used to classify entities and activities within this Transition Framework.

We have identified 5 classifications:

- Near zero activities – these are often considered already green, such as wind turbines. There is still room for improvement (e.g., improving efficiency) or addressing construction or decommissioning phases to consider circularity. In general, these activities are aligned with netzero2050

- Pathway to zero – these are activities where it is possible to see a way to change, such as shifting shipping to using ammonia as the energy source rather than oil.

- No pathway to zero – activities in this category include long haul passenger aviation where a technical alternative has not yet been identified.

- Interim activities – these include where supporting systems such as a circular economy are not yet in place and until they are, these activities will continue. Many examples here are not clear cut!

- Stranded activity – there is no need for these activities and these should be phased out. For example, the combustion of fossil fuels for power can be substituted by electricity generation from renewables, so this activity is effectively stranded.

In addition, there will be new activities that will speed up or enable transitions. These could be critical technologies such as the production of hydrogen from renewable energy or enabling input such as batteries for electric vehicles of fuelling stations.

Defining classifications is not an exact science and we acknowledge that the full life cycle of an asset and some geographic variability may blur the edges. However, once classified, it will enable a clearer discussion on transition and how to decarbonise as fast as possible. The classifications accomplish a framework for all parts of an economy, allowing every sector to see how they fit into a transitioning world and identify what steps they need to take.

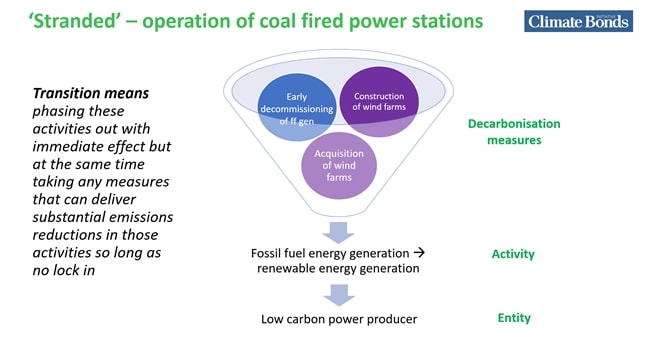

Transition means phasing out activities in line with the appropriate future sunset date for that activity. In the meantime, decarbonize them as fast as possible along appropriate transition pathways

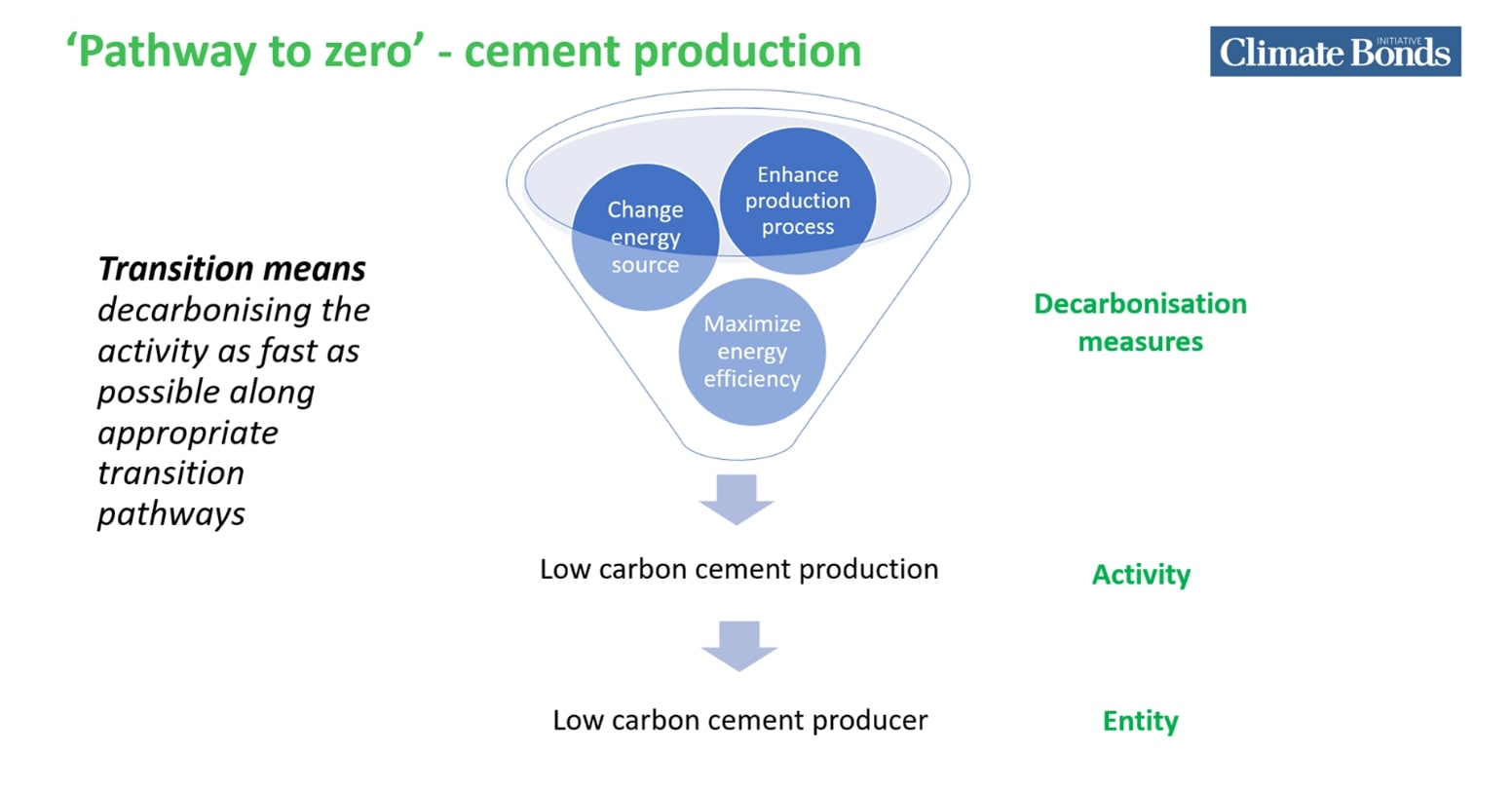

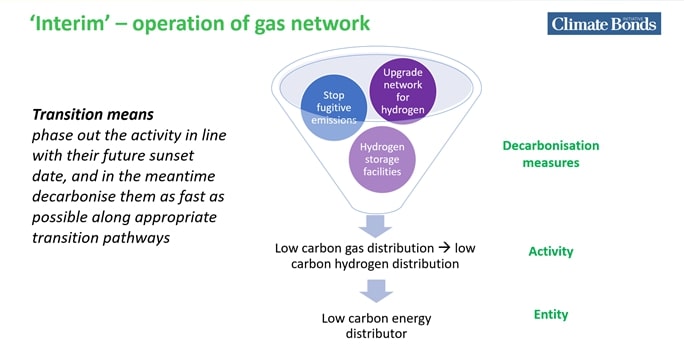

Three examples are provided that show what a transition could look like.

For the measures here:

The Blue Circle indicates activities you might take to decarbonise in the interim; and the Purple Circles are measures you might take to start moving towards transitioning towards a completely different activity.

Example 1- Pathway to Zero

Example 2 An Interim Activity:

This graphic shows that the activity is switching from gas to hydrogen.

Example 3 Coal. Need to phase out with immediate effect:

The graphic demonstrates the phasing out of coal.

ff gen' = Fossil fuel generation

There will be some measures that could contribute to a reduction in emissions. An example is improving the energy efficiency of a power generator on a facility producing oil. Caution must be exercised to ensure focus does not centre on technologies that would lock in activities that need to be phased out. There may be some actions that can make a substantial contribution though– particularly to the halving of emissions by 2030.

Ultimately, each classification starts to build a frame from which organisations can consider what addressing climate change entails for their activity, their projects, or their wider entity.

The Last Word

Climate Bonds has produced a framework in the Financing Credible Transitions White Paper to enable every sector across the economy to determine what a transition pathway might begin to look like for them. Tackling the climate crisis is simply not possible without tackling the high emitting sectors.

Financing Credible Transitions is only the beginning. It provides a starting point for a much wider development process involving investors, industry sectors and individual companies. Transition requires everyone: some will need to be more efficient whilst others will require a fundamental reshaping of their very business.

Transition activities also create new market and investment oportunities. Inclusivity is an umbrella principle, purposively spanning all activities and sectors. Coupled with Ambition aimed at 1.5°C and Flexibility in the application to whole entities and the instruments that finance them, some initial definitions around transition style investment are emerging.

We’ll discuss ambition and then flexibility in Blogs 2 and 3 in the series.

Beyond that, Transition will figure prominently our 2021 activity program.

Expansion of our green criteria, analysis of the growing social and sustainability bonds sector and in time, new criteria that supports transition.

All with the objective of supporting new investment to address the climate crisis.

It’s a market that’s reached its first trillion. Just the beginning.

'Till next time

Climate Bonds