Inclusive - Ambitious - Flexible – The three common features that can shape transition investment

In January we began a new Blog Post series on three common features of transition, starting with a focus on Inclusivity. We are now returning with ‘Ambition’ as the next feature in the spotlight in this new 3-part series, that draws heavily on the concepts contained in our Financing Credible Transitions (FCT) Whitepaper launched in September 2019.

Aiming high & well: Ambitious Transition reflects more than emissions reduction

To ensure an impactful transition, investors must be clear about transition being ambitious, not greenwash or transition-wash.

The framework and five principles expressed in the FCT White paper provide a solid basis for the rapid development of a transition bond market. This will form part of a larger and liquid climate-related market and deliver confidence for investors, clarity for bankers and credibility for issuers.

This will entail all market stakeholders encouraging all types of investments that fit the parameters outlined, even if they fall outside of traditional green sectors.

Transition needs Ambition – it must be on the pathway to Paris

Ambition can be described as enthusiasm with a purpose, and in the case of climate change, no enthusiasm could be more purposefully placed.

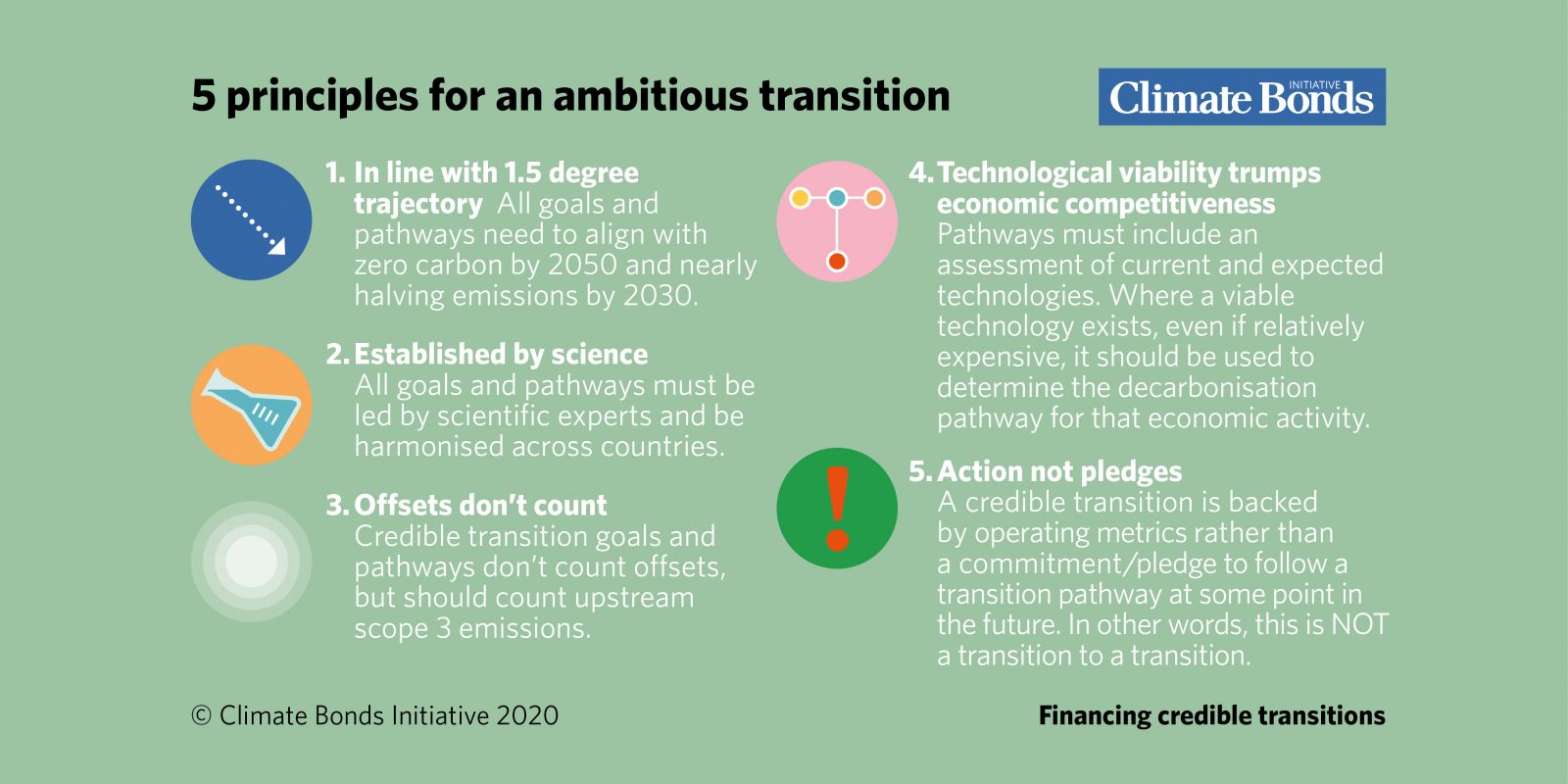

Reductions in emissions may form part of a transition plan; however, this is only credible where it is part of a truly ambitious transition plan aiming to halve emissions by 2030 and net-zero by 2050. It is likely to involve substantial shifts in an activity to completely remove all emissions or even a fundamental revision of the entire business model.

In a similar vein, whilst the adoption of best in class or Best Available Techniques (BAT) might be admirable, they may not necessarily deliver net-zero by 2050. To this end, efforts to support research and development, or to enable pilot scale testing on facilities may need to form part of the long-term strategy.

References or alignment to a country's Nationally Determined Contribution (NDC) is not necessarily a credible proxy. This is because it is known that even if all NDC's were delivered, the improvements would still fall short of delivering the Paris Agreement: businesses and consumers must play an additional role, not solely a contributory one.

A Transition label could be used for all investments that are making a substantial contribution towards these goals.

Guidance on what qualifies as appropriate climate action, assets or activities can be established by market-led e.g. Climate Bonds Initiative Taxonomy or regulatory-driven e.g. EU Taxonomy initiatives. Such initiatives establish the concepts and thresholds necessary to defining eligible transition investments across different sectors.

Along with aiming high, it needs to be done well

The novelist Joseph Conrad once wrote that ‘All ambitions are lawful except those which climb upwards on the miseries or credulities of mankind’. Accusations of greenwashing that befall attempts to secure green investors are the credulities of green finance.

In order to be credible, there are a couple of aspects that must be addressed. The first is that real reductions should be made in emissions. It is not sufficient for an activity to continue the status quo whilst simply purchasing a mechanism to absorb those carbon emissions. Whilst carbon offsets and Natural Climate Solutions (NCS) will undoubtedly play a role in addressing climate change, to be used in this way only serves to stifle action and perpetuate outdated, highly polluting activities.

Secondly, it is easy to talk about possibilities and make plans about plans. However, to be truly credible, it is important that transition finance is targeted where it is clear how progress will be measured. Building on the adage ‘what gets measured gets managed’ transition plans must be backed by operating metrics and tools to track progress.

The Climate Bonds’ Financing Credible Transitions paper summarised all these points into 5 principles:

If a bond meets these principles, it’s important to also check if:

If a bond meets these principles, it’s important to also check if:

- there is sufficient information to enable an informed decision to be made;

- that it doesn’t contribute to locking in GHG intensive infrastructure.

Page 17 of the FCT paper contains explanatory notes on what to look for.

Examples

Repsol green bond, 2017: Proceeds funded energy efficiency projects and technologies to reduce fugitive methane emissions from refineries. However, neither the use of proceeds nor the corporate strategy was at the time aligned with the Paris Agreement. In 2019, Repsol committed to being net-zero carbon by 2050. This means either the transition or green label may be applicable for future bonds depending on the detail and alignment with the 5 Principles put forward in this paper.

Cadent transition bond, 2020: Proceeds were directed to adaptation of the gas network for hydrogen as an energy carrier. The company explicitly aligned with the EU (draft) Taxonomy. It excluded natural gas network expansion and applied tight EU thresholds for biogas. Such explicit alignment with the EU (draft, at the time) taxonomy has not yet happened often and is an important contribution to transitioning to near-zero activities, subject to addressing fugitive emissions.

Etihad Airways transition bond, 28 Oct 2020: Etihad Airways sold USD600 million in a five-year “transition” sukuk to help fund the shift to a greener future. Etihad’s plans include using more fuel-efficient planes and eliminating single-use plastics. The focus on single use plastics used during flights is not materially significant and this issuer did not show how the fuel-efficient planes would align with a net-zero trajectory.

The Last Word - Ambitious means it has to be material

Green & Sustainable debt markets have grown at an incredible pace over the last decade, an increasing number of sovereign entities and corporates are engaging with investors to finance debt while making an environmental or social impact. However, this market has not seen significant and sustained participation from the largest carbon emitters.

Financing Credible Transitions is only the beginning. It provides a starting point for a much wider development process & presents an opportunity for investors, industry sectors and individual companies to cooperate in developing sustainable transition models as part of the shift to zero carbon.

Ambitious means:

Aiming high: aligning activities with a pathway that gets to net-zero by 2050, consistent with the Paris goals.

Aiming well: ensuring that reductions are real (no offsets) and plans are real (not just a plan to have a plan).

In our third Blog Post of the series coming in March, the focus will be on the other key feature of financing credible transitions – the need for flexibility beyond the world of bonds.

'Till next time,

Climate Bonds