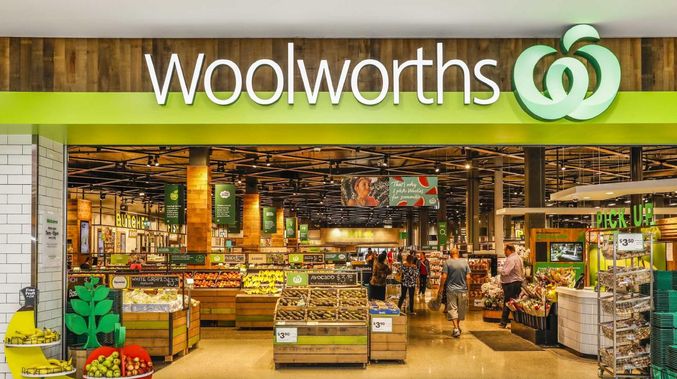

Strong demand marks Woolworths move to green network of supermarkets: Australia continues innovation and best practice in green finance

Woolworths & Supermarkets Certification

ASX listed, food and liquor retail giant, Woolworths Group raised AUD400 million from more than 90 investors with their first Certified Climate Bond under the Low Carbon Buildings – Commercial Criteria.

The proceeds will fund initiatives such as installing solar panels, supermarket retrofits, refrigeration upgrades with hybrid and HFC free systems and a host of other measures.

The Australian Financial Review reported strong interest from both domestic and Asia based investors, with the bond 5 times oversubscribed and orders over AUD2bn.

Supermarkets - A New Segment of the Low Carbon Buildings Criteria

The Low Carbon Buildings (LCB) Criteria defines what property assets are eligible for Certification under the Climate Bonds Standard.

Originally launched in 2015, the Criteria scope includes commercial buildings, residential buildings and upgrade projects.

Climate Bonds has developed a new supermarkets segment, within the existing LCB Criteria with Woolworths as the first Certification.

You can find our newly developed emissions thresholds for the Supermarkets Segment here.

David Marr, Chief Financial Officer, Woolworths Group:

David Marr, Chief Financial Officer, Woolworths Group:

“At Woolworths we are continuing to work hard to minimise our long-term impact on the environment, and as Australia’s largest retailer we understand we have a responsibility to take the lead in this space.”

“We know the investment community is also looking to support those who are committed to sustainability driven projects to minimise environmental impact. The issuing of Green Bonds is another step towards meeting our environmental commitment, while allowing our investors to support projects that are important to them.”

Sean Kidney, CEO, Climate Bonds Initiative:

Sean Kidney, CEO, Climate Bonds Initiative:

“We applaud Woolworths for taking further steps to improve their environmental footprint via the issuance of the first Certified Green Bonds by a supermarket."

“We hope their leadership will encourage other companies, both ASX listed, and more widely, to invest further in projects and assets that deliver positive environmental and climate outcomes, while also contributing to the development of green finance and green bond markets.”

“Purpose driven investors now have another opportunity to put their money to work in mitigating long-term environmental and carbon-related risks."

Green Finance and Investment in Low Carbon Buildings (LCB)

The expansion of the LCB Criteria to supermarkets is not an isolated step. We announced proxies to support investment in green buildings in Mexico City last week.

We also launched our 'Financing for Low Carbon Buildings' paper for the Japan Green Bond Issuance Promotion Platform in March.

Recent LCB Certifications include DNB Group in Norway, New York State HFA, (now into double figures for multiple green bond issuance) US based Kilroy Realty and Royal Schiphol Group NV in the Netherlands.

Expect to see more posts from us over the next few weeks, particularly looking at cities and regions in Europe and Asia; where the LCB Criteria has application.

The Last Word

Australia has been a testbed for green financial innovation since NAB issued the first domestic Certified green bond in 2014. The momentum has been maintained since including green Certified ABS in Solar, Monash University issuing a world first, more recently green bond and loans deals from property group Investa and sub sovereign issuer Queensland Treasury Corporation adopting Programmatic Certification for multiple green issuance.

On the deposit side, November saw Westpac launching the first Climate Bonds Certified deposit product for institutional investors and Ubank followed earlier this year with a Certified term deposit for retail customers, aimed squarely at millennials.

Against this backdrop, Woolworths Group have taken a new step in environmental responsibility and sustainability and as an iconic household brand amongst the ASX, giving green finance in Australia a solid nudge further into the mainstream.

Well done!

‘Till next time,

Climate Bonds