National Australia Bank (NAB) - one of Australia’s four big banks - confirmed today it has joined the Climate Bonds Partners program, saying it will continue working with the Climate Bonds Initiative to grow the green bonds market.

Climate Bonds Blog

The Climate Bonds Initiative would like to invite you to the formal pre-launch of the sector-specific guidance for Agriculture, Forestry and Other Land-Use (AFOLU) under the Climate Bond Standard.

Time: Wednesday 9 September, 5-7pm

Venue: Credit Suisse Forum St. Peter’, St. Peterstrasse 19, Zurich

The event will include a presentation on the Agriculture, Forestry and other Land Use guidance. It will also include an update on the green bonds market and opportunities for the sector.

The major green bonds media story in July was the launch of our Bonds and Climate Change: the state of the market in 2015 report. The report first launched in Frankfurt with further launches in Mexico City, New York and London. Another key story was the first labelled green bond from a Chinese issuer (issued in the international dollar market). We also saw stories continuing the debate on greenwashing, pointing out the need for clear standards and transparency, as well as discussing other general market developments.

World Water Week 2015 will take place 24-28 August in Stockholm and Climate Bonds Initiative is joining the discussion! Register here to participate.

The annual event hosted by SIWI is celebrating its 25th year. Thousands of individuals and hundreds of organizations will gather to focus on the world’s water issues.

The Climate Bonds Initiative will be co-convening the session “Investment approaches to Mainstreaming Climate Adaptation.”

Help on issuing green city bonds is at hand! We've launched a Green Municipal Bonds Playbook through our US Green City Bond Coalition to give guidance to prospective issuers on how to tap into the rapidly growing green muni bond market.

Available for download, the Playbook includes:

Development Bank green bonds

IFC issued green masala bond for INR 3.15bn ($49.4m) (5-yr, 6.15%, AAA) with proceeds used to invest in Yes bank’s domestic green bond

Join us for a presentation on the updated version of the Climate Bond Standard V2.0 (now out for public consultation) and the latest developments in low carbon criteria including a discussion with NAB on their experience issuing and arranging climate bonds.

Corporate green bonds

Second green bond from TerraForm to finance wind power acquisition, $300m 10yr, 6.125% s/a coupon, BB-/B1

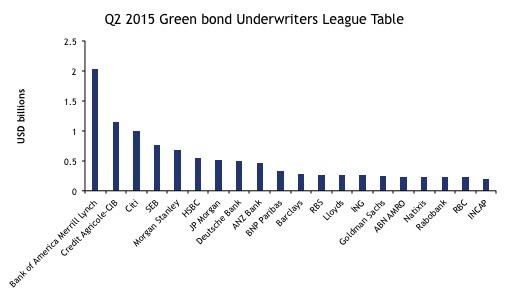

The green bond market stepped up a gear in Q2 with $11.9bn of deals; up from $7.1bn in Q1. Behind this resurgence of issuance are the underwriter banks that arrange and facilitate the green deals.

Top of the table in this busy Q2 is Bank of America Merrill Lynch, underwriting just over $2bn green bonds in the quarter. It’s not the first time BAML takes one of the leading green bond underwriter spots: last quarter the Bank was the third biggest green bond underwriter, and for 2014 as a whole it came in second.

We’re recruiting for the following positions:

1. Communications & Marketing manager

We're looking for an experienced individual to take charge of marketing and communications.

Key Tasks:

- Planning marketing

- Managing media

- Supervising social media

- + more

Read full job description here

2. Market Analyst

We're looking for another Market Analyst to assist with our green and climate bonds database and associated work streams.

Key tasks: