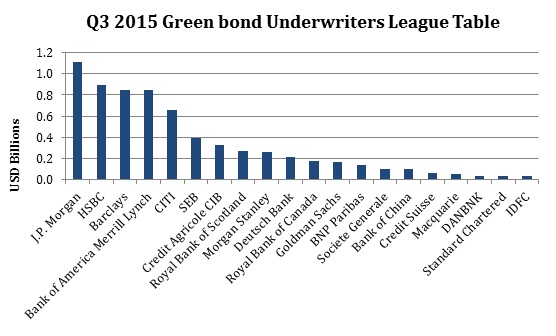

Q3 sees the biggest single issuance this year so far of $1.1bn (thanks to NWB Bank) and overall total issuance is $6.9bn for the quarter. The green bond market has slightly slowed from a high in Q2. But, it seems like the issuance is going up in size – the average in Q3 bonds ($204m) is well above the Q2 figure of ($144m).