Cumulative issuance under the Climate Bonds Standard has surpassed USD254bn in 2022, establishing a new milestone for international best practice in green investment

Certified debt instruments have now been issued by over 260 issuers across 50 countries, helping to establish green market investment standards and harmonised definitions in multiple jurisdictions in both developed and emerging economies.

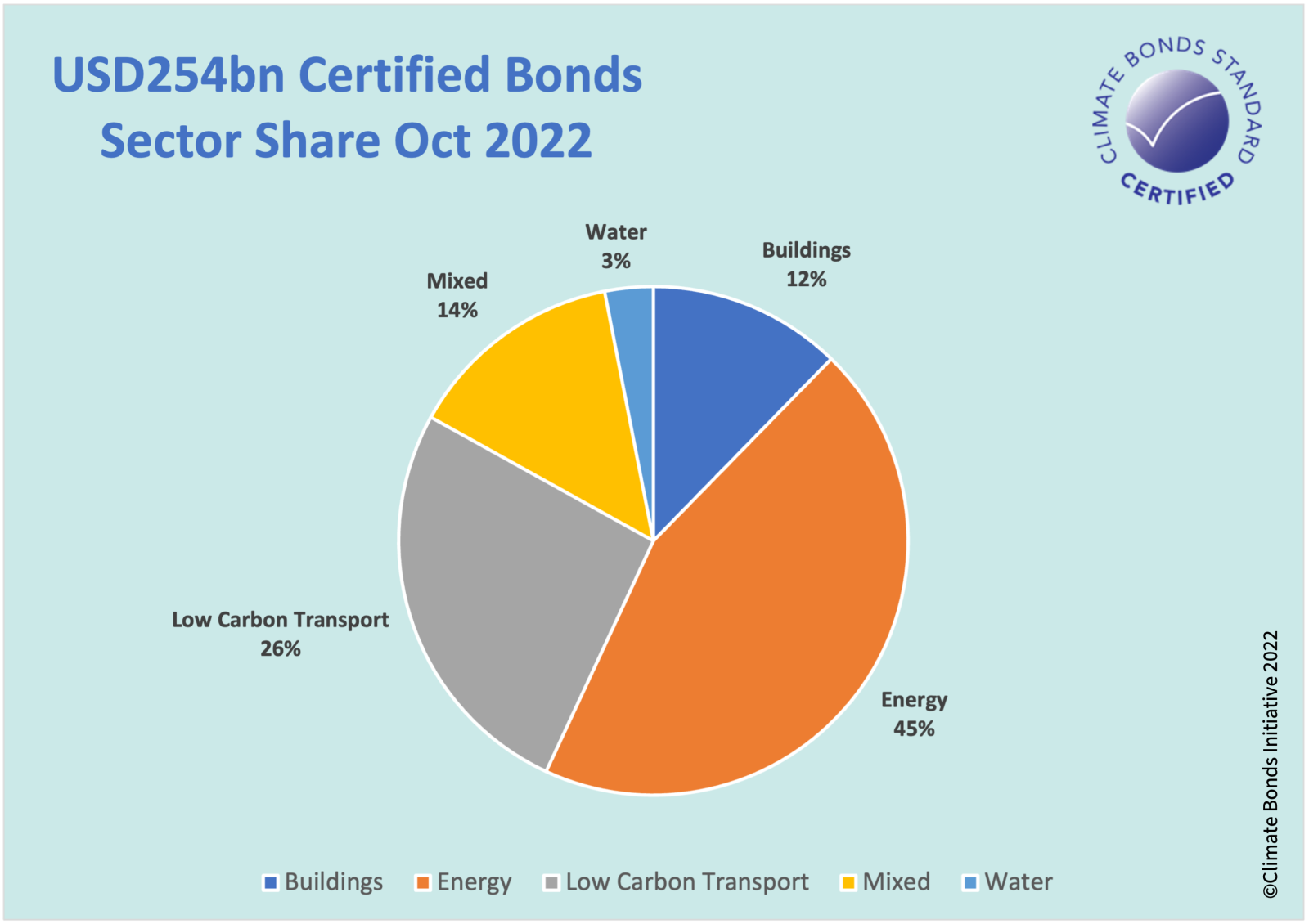

In 2022, India (13 issuances totalling USD0,9bn), Australia (11 issuances totalling USD3.9bn) and the United States (9 issuances totalling USD4.8bn) were the countries with the biggest debt instruments. Renewable energy sectors (Solar, Wind, Geothermal, Bioenergy), Low Carbon Transport and Low Carbon Buildings are the most common sectors to be certified under in 2022 so far.

Highlights in 2022 so far

2022 has seen a total of USD39bn of Certifications awarded under the Climate Bonds Standard, USD31bn of which has already been issued. The State of the Netherlands issued the single largest Certified Bond in 2022 with USD5.2bn in certified green issuance across several sectors including Solar, Wind, Marine Renewable Energy, Water Infrastructure, Low Carbon buildings and Low Carbon Transport.

China Development Bank issued their 6th and 7th bonds certified by the Climate Bonds Initiative totalling USD4.24bn in 2022 across the Low Carbon Transport, Solar and Wind sectors.

In New Zealand, Transpower issued green bonds totalling USD2.2bn with the proceeds allocated to supply renewable energy to New Zealand’s national electricity grid, certified under the Electrical Grids and Storage Criteria. Transpower’s continued issuance of green bonds under the Climate Bonds Standard has benefited from Programmatic Certification this year.

French Railway operator Societe du Grand Paris remains amongst the top 10 issuers in 2022 with USD1.9bn allocated to Low Carbon Transport in the Ile-de-France region and the Paris Metropolitan area.

Climate Bonds Standard version v4.0

In October the draft version of the Climate Bonds Standard v4.0 was launched for public consultation. This proposes the structural expansion of the Certification scheme beyond Use of Proceeds to Assets, Entities and Sustainability Linked Bonds for Corporates. This proposal was backed by the Climate Bonds’ frameworks on Transition Principles, and Tools for assessing credible transitions

Fast-track Certification

A new platform was developed in Q4 of 2022 which facilitates Certification for Issuers and Verifiers by expediting the Certification process. This tool makes it easier for issuers and verifiers to connect and provides users with a customised list of documents needed to obtain Certification in any given sector criteria.

|

TOP 10 Certified Climate Bond Issuers 2022 (up to October) |

||

|

Issuer name |

Issue size (USD) million |

No. debt instruments |

|

Netherlands sovereign |

5,208 |

1 |

|

China Development Bank |

4,245 |

2 |

|

Transpower New Zealand Limited |

2,288 |

3 |

|

Societe du Grand Paris |

1,904 |

1 |

|

Geysers Geothermal |

1,770 |

1 |

|

Volkswagen AG |

1,577 |

1 |

|

New York Metropolitan Transport Authority |

1,481 |

2 |

|

National Australia Bank |

1,408 |

2 |

|

Reliance Rail Finance Pty Limited |

1,344 |

1 |

|

Sweihan PV Power Company PJSC |

701 |

1 |

The Last Word

2022 has been a difficult year for global fixed income markets including sustainable finance. That said, Certified Issuance has maintained growth volumes with issuances across 50 countries with issuers adopting market best practice that sets the global standard in mobilising capital for climate solutions.

Climate Bonds will continue to support the development of a strong, credible green finance market. We have our Transition Criteria for Cement and Basic Chemicals now available for Certification, and Steel and Hydrogen are on their way before the end of the year.

Under the Climate Bonds Standard v4.0, Corporate Entity-level and SLB Certification is on track to bring Climate Bonds Standard into new arenas, and Fast Track certification facilitates the application process for issuers and verifiers.

With new tools and new industries joining sustainable debt space each year we will continue to work hard on providing the definitions and development pathways that can unlock the trillions necessary to meet the annual sustainable debt issuance target of USD5tn by 2025.

‘Til next time.

Climate Bonds