2020 marks another record year for Japan, growing by a third as the market gets green light on Covid-recovery: Latest Collaboration with Green Bond Issuance Promotion Platform

Climate Bonds’ latest iteration of the flagship State of the Market series offers insights and commentary on the growing Japanese green bond market. The report demonstrates the increasing strength of the nation’s green bond market, in conjunction with a labelled bond universe that signals sustainability could be a real feature of post-Covid recovery in Japan.

Climate Bonds continues its collaboration with Japan’s Green Bond Issuance Promotion Platform, with the release of the third edition of the Japan Green Finance State of the Market Report. The report provides an in-depth overview of the Japanese green bond market and the broader labelled universe, while highlighting opportunities to boost green finance with unlabelled climate-aligned bonds and new policy developments. The report has been developed with the support of the Institute for Global Environmental Strategies (IGES).

Market Highlights

- Japan ranks 9th in cumulative global country rankings (USD26.15bn) and 7th in 2020 rankings (USD10.6bn)

- Japan Housing Finance Agency is the top 2020 issuer (USD1.8bn)

- Green bond market growth expected from public transport projects and land use

- Japan’s unlabelled climate-aligned outstanding debt amounts to USD13.3bn

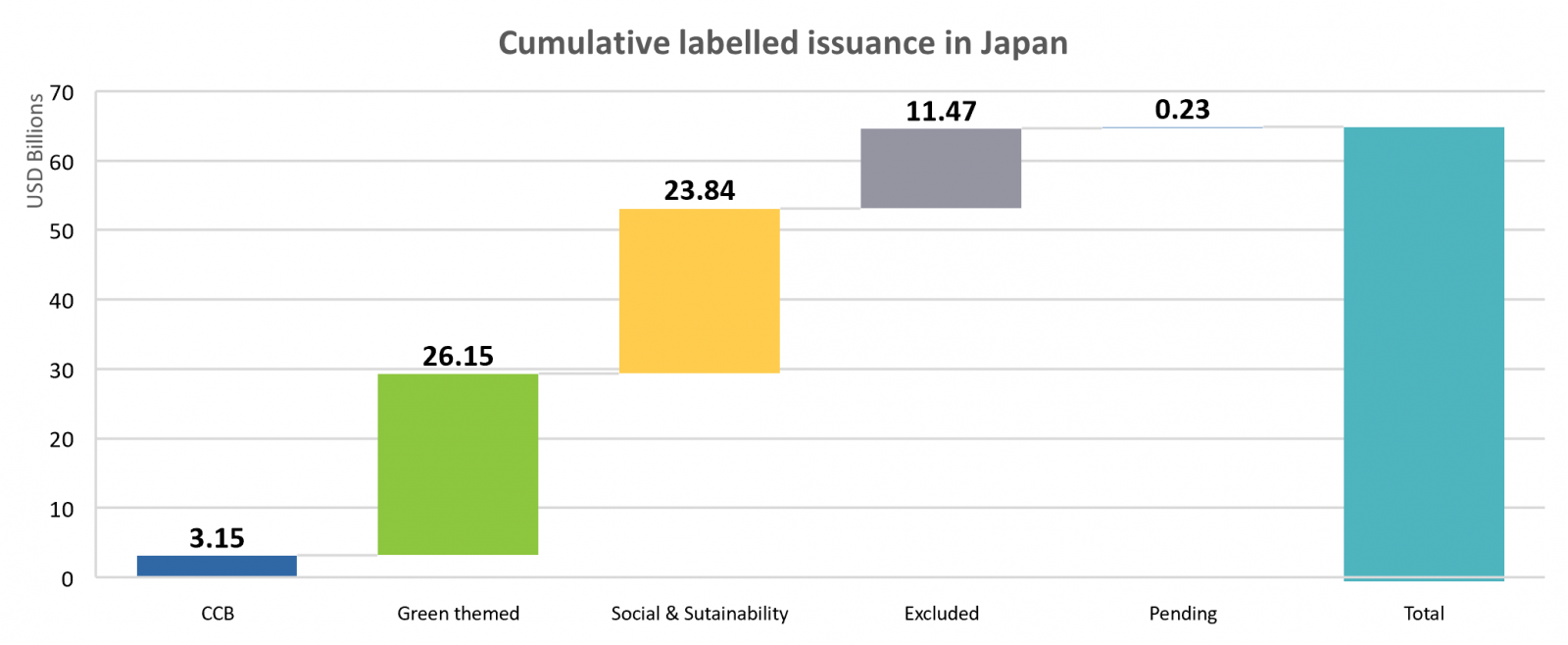

- The overall Japanese labelled bond universe amounts to USD64.8bn, with substantial growth experienced from the Social & Sustainability bond universe.

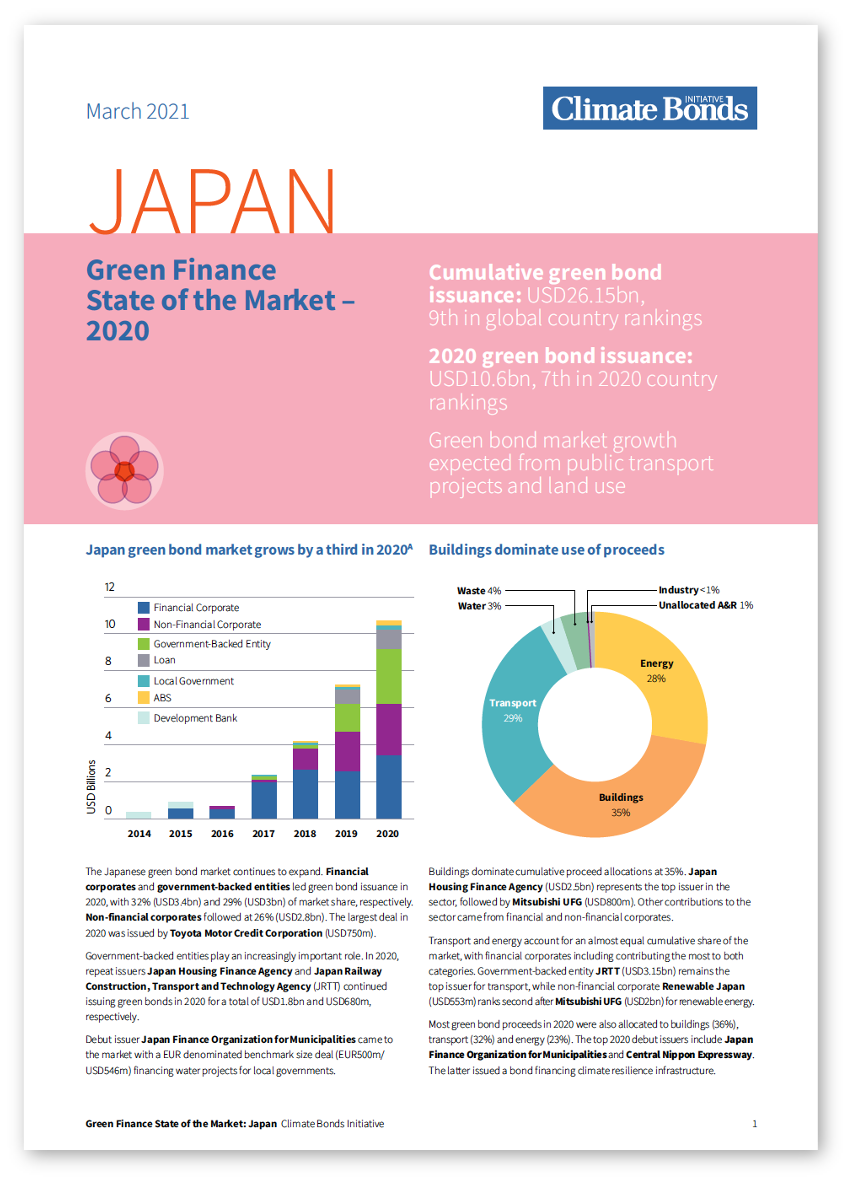

Market growth by issuer type

Financial corporates and government-backed entities led green bond issuance in 2020, as the Japanese green bond market continues to expand.

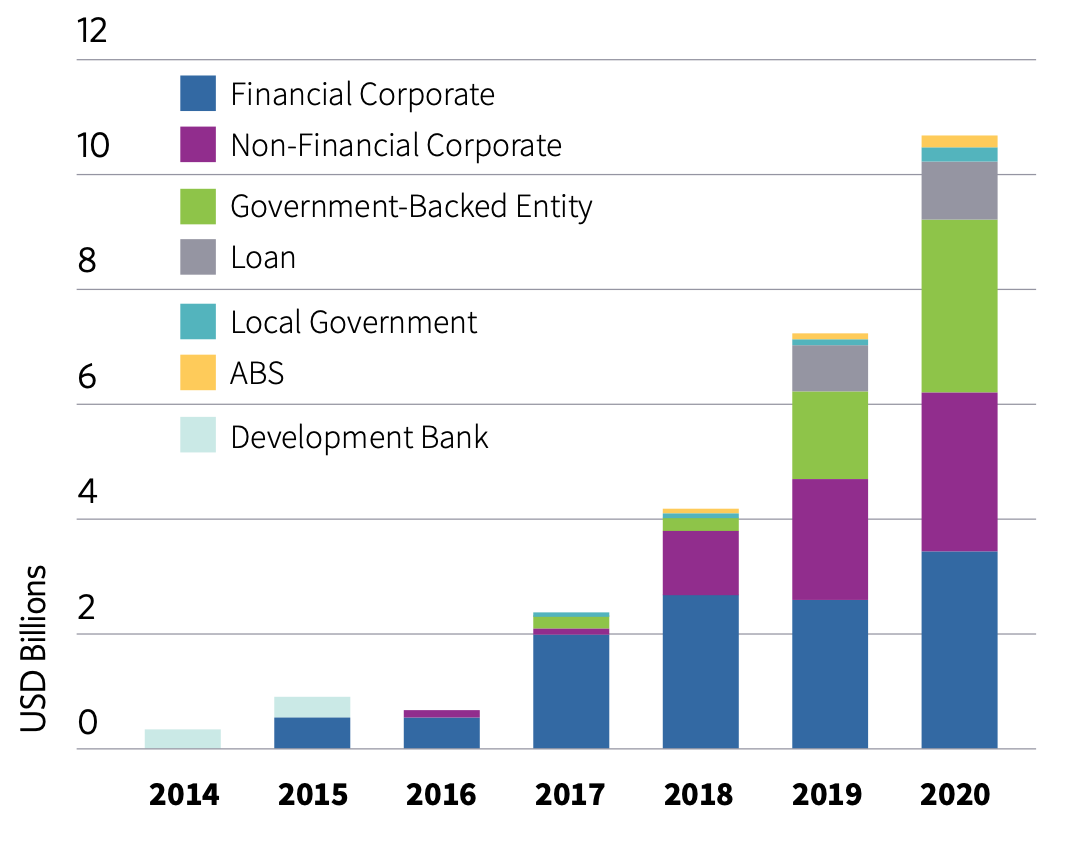

Use of proceeds by sector

Buildings dominate cumulative proceeds allocations at 35%, followed by transport and energy.

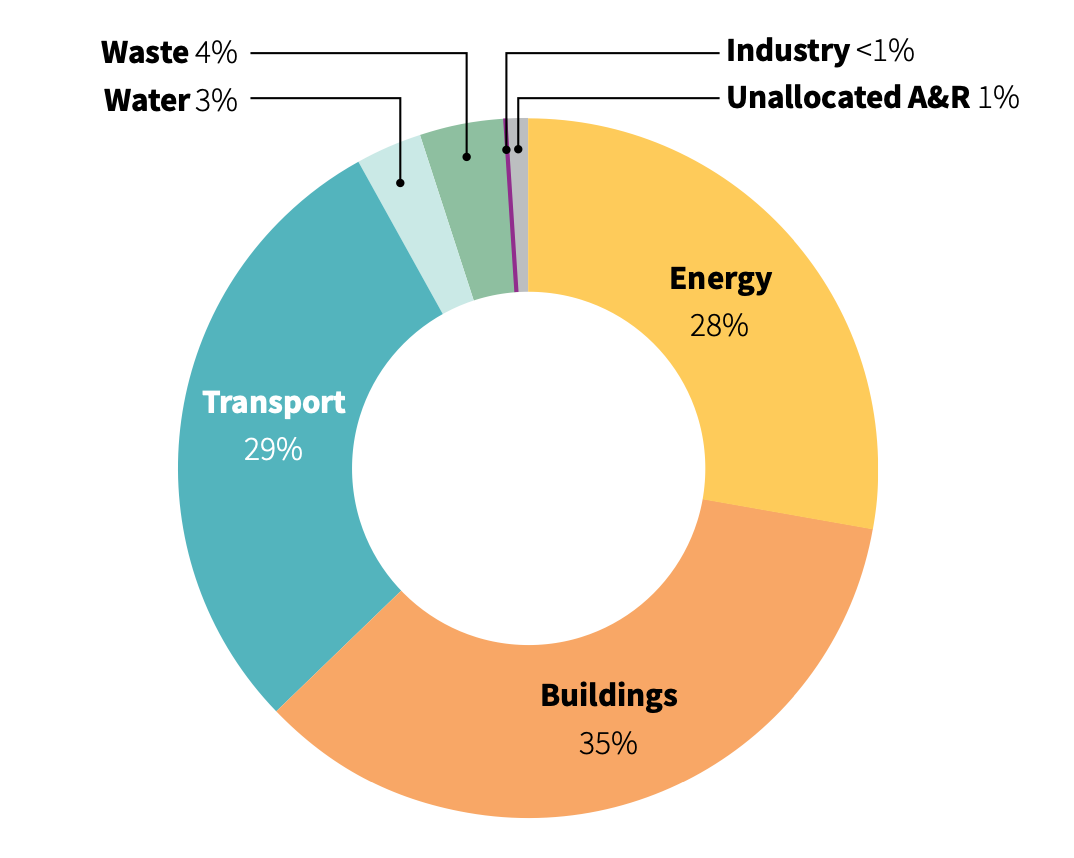

External review

The Japanese green bond market continues to have an outstanding record of external reviews (86% of issuance): 50% of cumulative deals by volume benefit from a Second Party Opinion (SPO), 24% from a green bond rating and 12% from Certification under the Climate Bonds Standard.

Climate Bonds Certifications Increase

Certifications increased by 4% in 2020, reaching a total of USD1.7bn of new Certified Climate Bonds. The share of Certified bonds stood at 16% of the market, a positive uptake in best practice and a signal from leading domestic issuers that they are aligning with global standards.

High profile issuers during the year included repeat Programmatic Issuer JRTT funding rail upgrades, Penta Ocean Construction in offshore wind, Tohoku Electric Power Co. funding multiple clean energy sources and Tokyo Gas Co. Ltd with solar generation. All up, a range of Certifications in Low Carbon Transport, Solar, Wind, Marine Renewables & Geothermal.

Of particular note during the year was PET Refine Technology Co. Ltd with a world-first Certification under the Waste Management Criteria and the first Verification under the Climate Bond Standard by Japan Credit Rating Agency.

PET Refine Technology's issuance is unique as the proceeds from the bond will be used to finance the recycling of PET (polyethylene terephthalate) bottles. Using an innovative chemical process to recycle PET materials to the same quality as virgin PET materials.

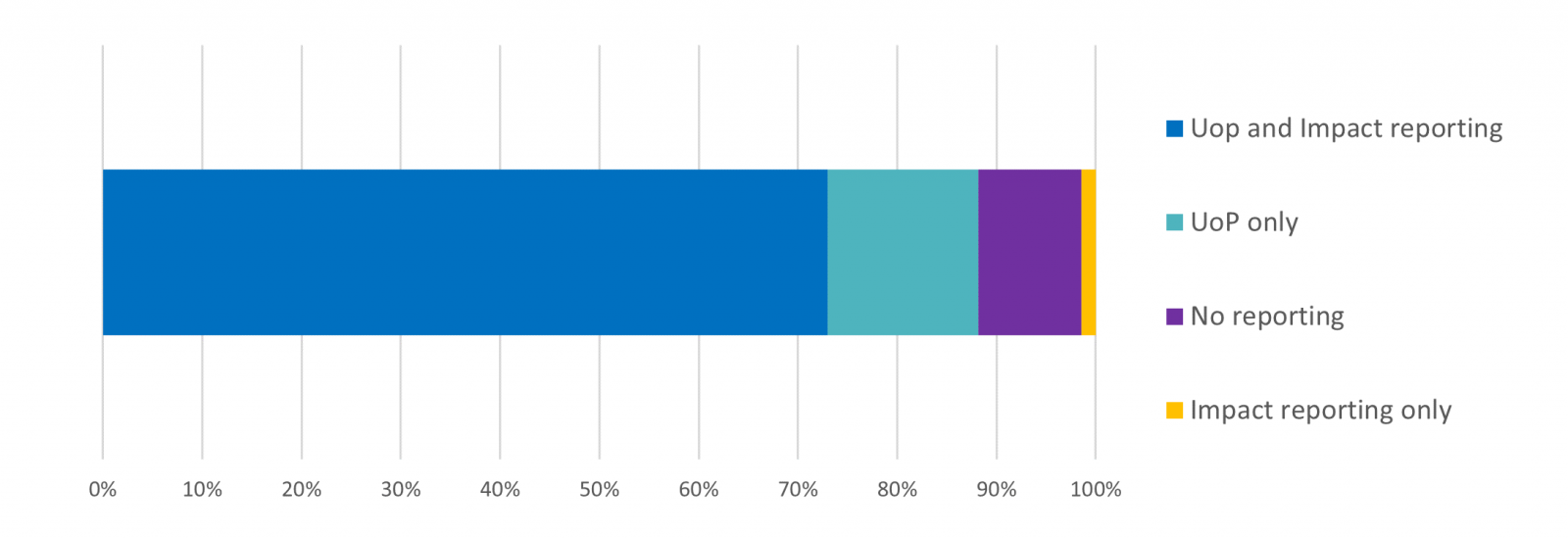

Post-issuance reporting

Nearly three-quarters (73%) of green bond issuance benefits from both use of proceeds, as well as impact reporting; 15% of issuance benefits from use of proceeds reporting only, while 10% has no post-issuance reporting.

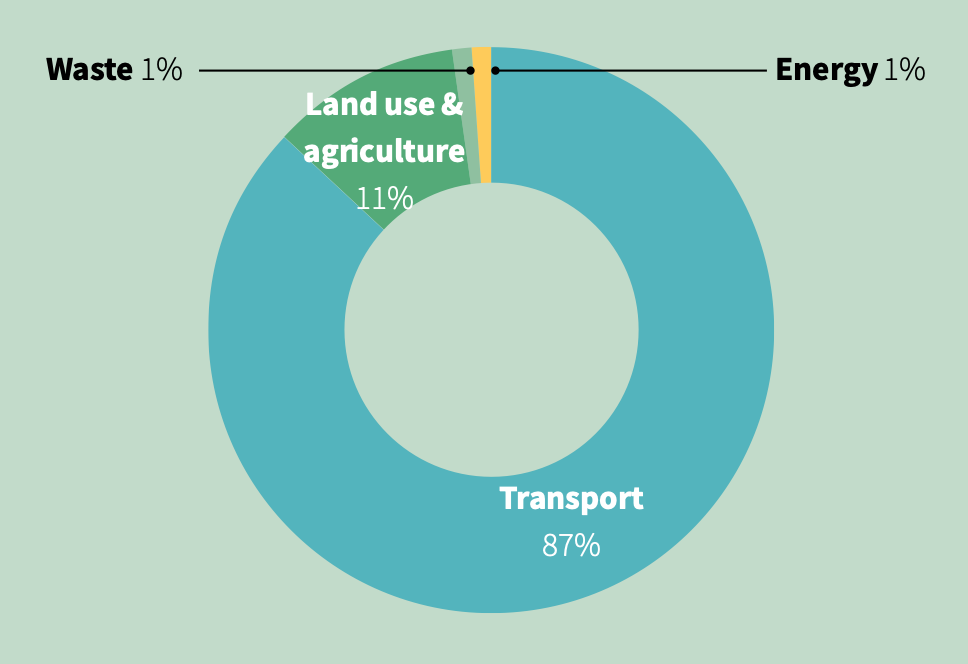

Unlabelled climate-aligned bonds

The unlabelled climate-aligned (CA) universe highlights investment opportunities that are not explicitly labelled as ‘green’ by the issuer, but finance climate-aligned assets and activities. Climate-aligned bonds are identified at the issuer level and can be categorised as 'fully-aligned' or 'strongly-aligned': Bonds from 'fully-aligned' issuers derive 95% or more of revenues from climate-aligned business lines & bonds from 'strongly-aligned' issuers derive 75-95% of revenue from climate-aligned business lines.

With 114 bonds issued, Japan’s outstanding climate-aligned debt amounts to USD13.3bn. Transport is the top climate-aligned sector, with three large public transport issuers being responsible for the whole sector’s climate-aligned debt.

The Broader Labelled Universe

The overall Japanese labelled bond universe amounts to USD64.8bn. Social and sustainability themed bonds issued in Japan have experienced exceptional growth in recent years - a positive signal for economic recovery from the Covid-19 pandemic.

The Last Word

- Low-carbon transition: Japanese authorities are working to formulate basic principles for transition finance in Japan, with a particular focus on transition bonds and loans.

- Market development: The Green Finance Portal was introduced to support and educate green finance stakeholders, including issuers and investors on the latest market developments. A new subsidy scheme has also been launched to boost the issuance of green loans and bonds for adaptation projects.

- Improving climate data: The Practical Handbook for ESG Disclosure was published with the objective of setting ESG reporting practices for listed companies.

‘Til next time,

Climate Bonds