H1 green bond issuance down 26% on H1 2019: 85 new market entrants: Despite COVID-19 impacts, investor demand and transition momentum driving market

First six months of 2020 reflect the pandemic impact

Climate Bonds has released the Green Bonds Market Summary – H1 2020 report, focussing on the latest market developments in labelled green bonds and loans.

The summary highlights issuance trends and significant data points for a period significantly impacted by the global COVID-19 pandemic.

At a Glance: Global green bond market:

- Labelled green bond issuance: USD91.6bn down 26% year-on-year (up 48% on H1 2018)

- Sub-sovereign issuers lead with 29% of volume, most coming from government-backed entities

- Non-financial corporates comprise a further quarter of H1 green bond volume

- Developed markets make up most (82%) of issuance with the US in the lead

- Sovereign issuance remains steady: 5 repeat issuers keep this key segment’s share at 14% of total

- A significant pointer to growing diversity in the wider sustainability market, USD94.4bn of other labelled bonds funding green and social projects, including pandemic response

- Largest deals come from railway operators, utilities and commercial banks

- The Chilean and Dutch governments issue Certified Climate Bonds

H1 2020 highlights: Behind the numbers:

-

A new market milestone achieved with 85 market entrants from 24 countries bringing the total number of GB issuers over the 1,000 mark to 1,056

-

221 issuers from 34 countries during the first 6 months of 2020

-

439 deals* with 145 from the USA, 56 from Sweden, 34 from Japan and 27 from Germany

-

Five of the 12 current sovereign green bond issuers returned to the market: Chile, France, Indonesia, Lithuania & the Netherlands

-

Green bonds from government-backed entities totalled USD21.9bn up from USD18.9bn in H1 2019, a 9% increase.

-

Rail transport operators and multiple green bond issuers Société du Grand Paris, SNCF & New York again prominent during H1

-

Amongst non-financial corporates, E.ON from Germany, EDP in Portugal & Spanish based Iberdrola prominent

-

Energy as the most popular use of proceeds category at 34% (H1 2019: 32%) followed by Transport 29% (H1 2019: 22%) and Buildings at 25% (H1 2019: 28%)

Certified Climate Bonds

- Certified Climate Bonds (CCBs) accounted for a quarter of the half-year volume (+6% year-on-year)

- Certification came via issuers in 17 countries, with 12 first time issuers (see the Certification Database for more information)

- Top 3 Certified bond issuers in H1 included multiple sovereign issuances from Chile (USD3.8bn) and the Netherlands (USD3.4bn). Together they constituted nearly half (48%) of H1 2020 Certified bond volume

- The largest H1 Certification came from Société du Grand Paris (USD2.7bn) using Climate Bonds streamlined Programmatic Certification process. SNCF and New York MTA also prominent as programmatic issuers.

Cumulative Green - Major Regions

On a regional basis total cumulative green issuance for Europe has reached USD362.7bn, with France leading on USD102.0bn followed by Germany on USD57.8bn and Netherlands on USD44.3. Sweden on USD33.4bn and Spain on USD31.4bn round out the top 5.

In Asia-Pacific, regional total cumulative sits at USD194.1bn with China well in front at USD111.7bn then a gap to Japan on USD19.3bn, Australia on $12.7bn with India at USD11.4bn and South Korea at USD8.3bn comprising the remaining top 5 nations.

Total cumulative issuance for LATAM is USD17.9bn at 30 June. Chile leads at USD7.0bn followed by Brazil usd5.7bn, Mexico USD2.1bn and Peru on USD886mn and Argentina on USD 637mn filling 4th and 5th spots respectively.

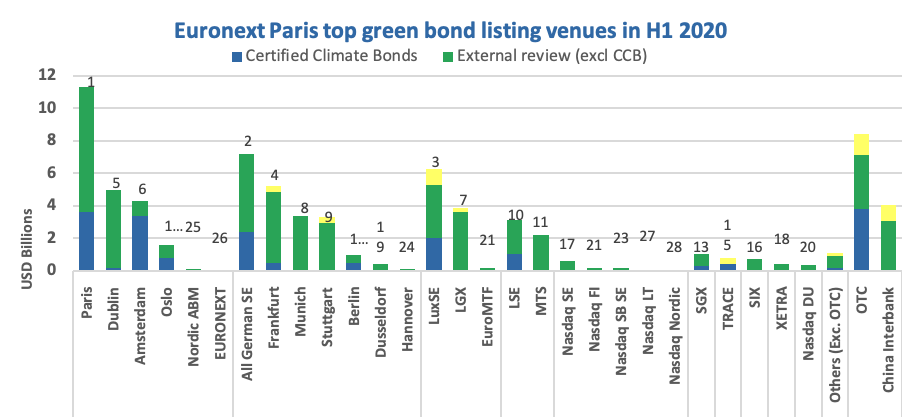

Trading venue league tables

The H1 2020 trading venue league tables saw the Euronext group maintain its leading position, with Euronext Paris in the No1 spot. The largest listed deal was the reopening of the Republic of France’s green sovereign (EUR2.6bn/USD2.9bn).

All German Stock Exchanges came in second place in the groupings with just over USD20bn of green bonds listed in the first half of the year.

The remainder of the top listing venue league table was very similar to H1 2019: LuxSE and LSEG again took 3rd and 4thplaces, respectively, whereas Nasdaq Nordic returned the top 10 bumping the SGX down from 5th to 6th place.

A further 14% of green bonds traded in over the counter (OTC) markets in H1 2020, including the China Interbank Bond Market (CIBM).

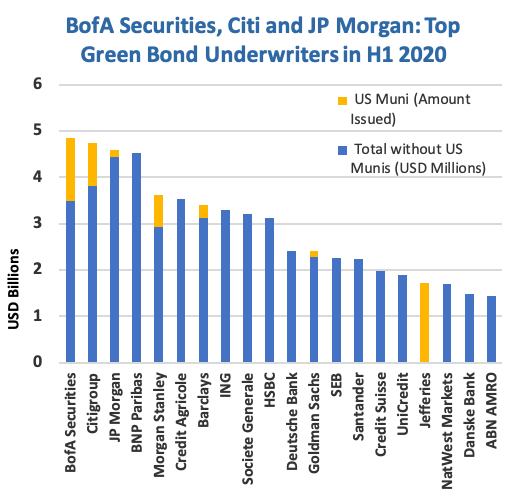

Underwriter league tables

In H1 2020 green bond underwriting, Bank of America Securities (BofA) rose to take the top spot from BNP Paribas, who in turn moved down to 4th place. The largest underwritten deals for BofA included a EUR1bn (USD1.1bn) deal from Canada’s CPPIB Capital and Dutch NXP BV’s USD1bn green bond.

Citigroup shifted by six rungs from 8th to 2nd spot, followed by JP Morgan – also up from 4th place. Moving up from 7thplace, Morgan Stanley completed the top 5.

The largest green US Muni underwriter in the first half of 2020 was Jefferies with USD1.7bn.

In the Certified Climate Bonds Space, the top rank was occupied by France’s Crédit Agricole and Société Générale, the senior and junior bookrunners of the Chilean sovereign green program.

The Last Word

Notwithstanding the slower growth in 2020 than previously anticipated, Climate Bonds remains confident that underlying institutional investor demand, leadership from sovereigns, regulatory enhancements, mooted bond issuance programs, and increased urgency around transition and climate finance will provide underlying impetus throughout the remainder of 2020 and into next year.

Climate Bonds’ January estimate of USD300bn to USD350bn in annual green issuance for 2020 remains, with a further review set for early Q4 looking again at the above drivers. We’ll give you another update in October.

The rise of other sustainability products in the first half of the year has also been widely noted, we’ll have more to say on these emerging labels in Q4.

‘Till next time,

Climate Bonds

Download Green Bonds Market Summary – H1 2020

Last chance:

Just five days to go! Still, time to register for Climate Bonds Conference 8-10th September. Online.

Find out more on our Conference Page.