Climate Bonds Conference2020, 5-7th May, London – Green Transition - Opportunity of the Decade

Don’t miss the premier green finance event on the 2020 calendar. More information & registration is here.

Unlocking green bonds in Indonesia: A guide for issuers, regulators and investors provides practical information on overcoming some of the main hurdles to international green bond issuance. The solutions explored, while supportive to issuers, are applicable to a much wider range of stakeholders – particularly government and multilateral stakeholders.

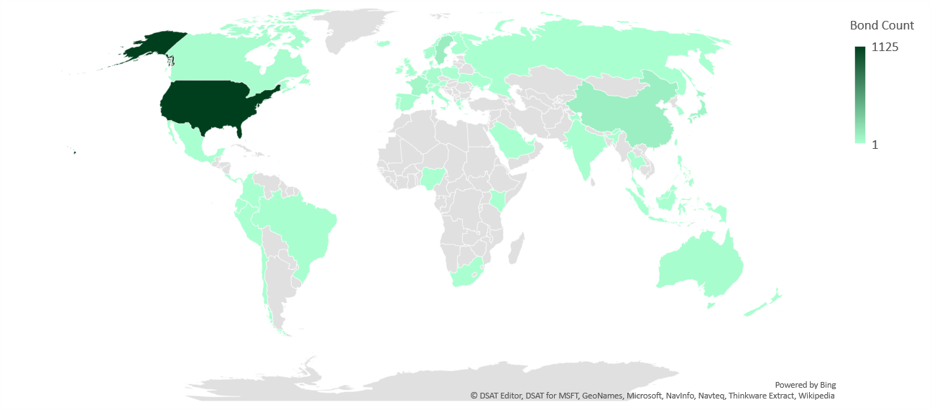

Green bond deals across the globe: 1 Jan – 31 Dec 2019

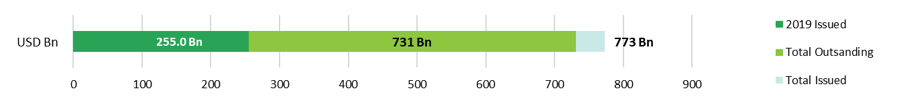

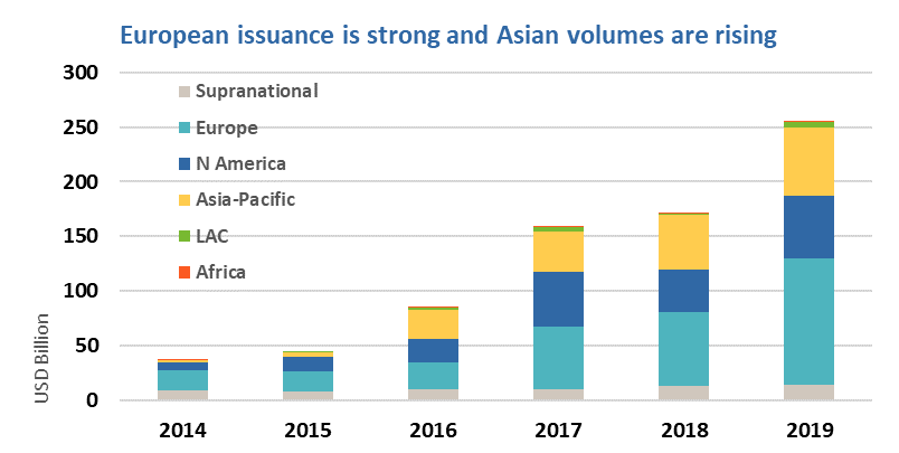

2019 marked a new record in annual issuance. Up by a third from USD171.1bn in 2018, the 2019 issuance of USD254.9bn brings the cumulative market issuance total since inception to USD773bn in CBI definitions and closer to the cumulative USD1tn mark.

As reflected in our Blog earlier this month, European issuance was the strongest and has seen constant growth in recent years. The Latin America and Caribbean market is beginning to move again with an overall volume of USD4.6bn compared to just USD1.5bn in 2018.

In general, 2019 was a strong year for Emerging Markets: the UAE (USD3.9bn), India (USD3.1bn), Chile (USD2.5bn), Philippines (USD1.5bn), Saudi Arabia (USD1.1bn) and Brazil (USD1bn) all issued over USD1bn compared to very low figures in 2018. Each country saw at least a year-over-year growth of 340%.

December 2019 at a glance

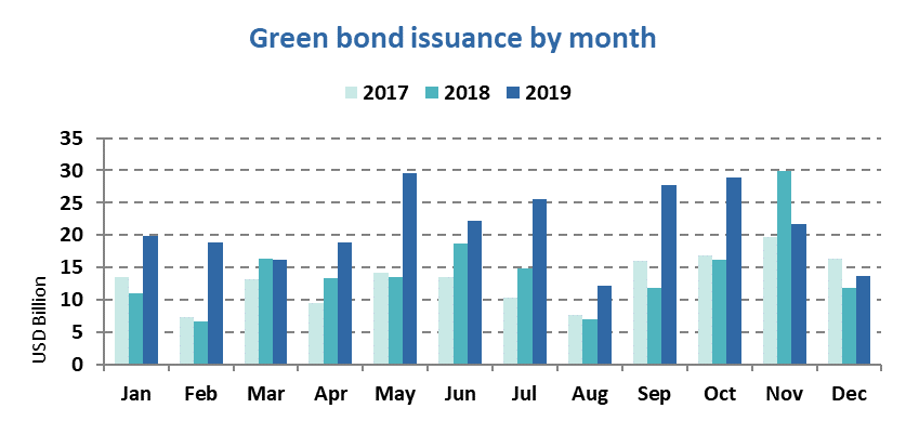

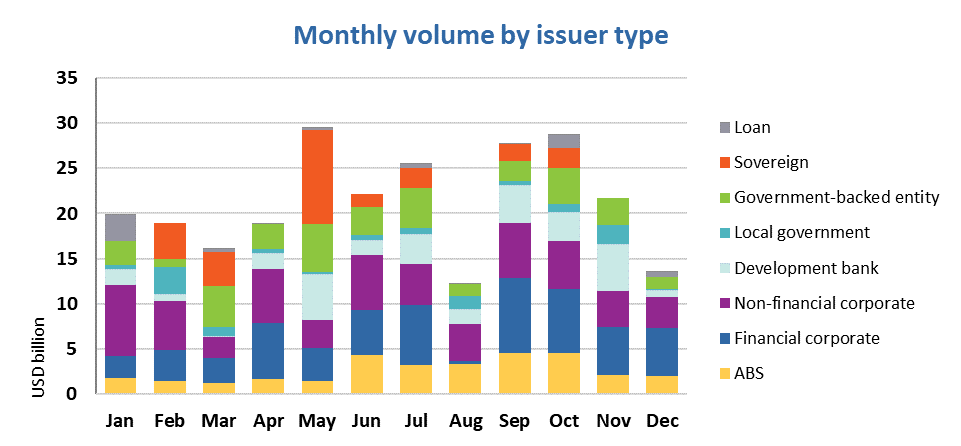

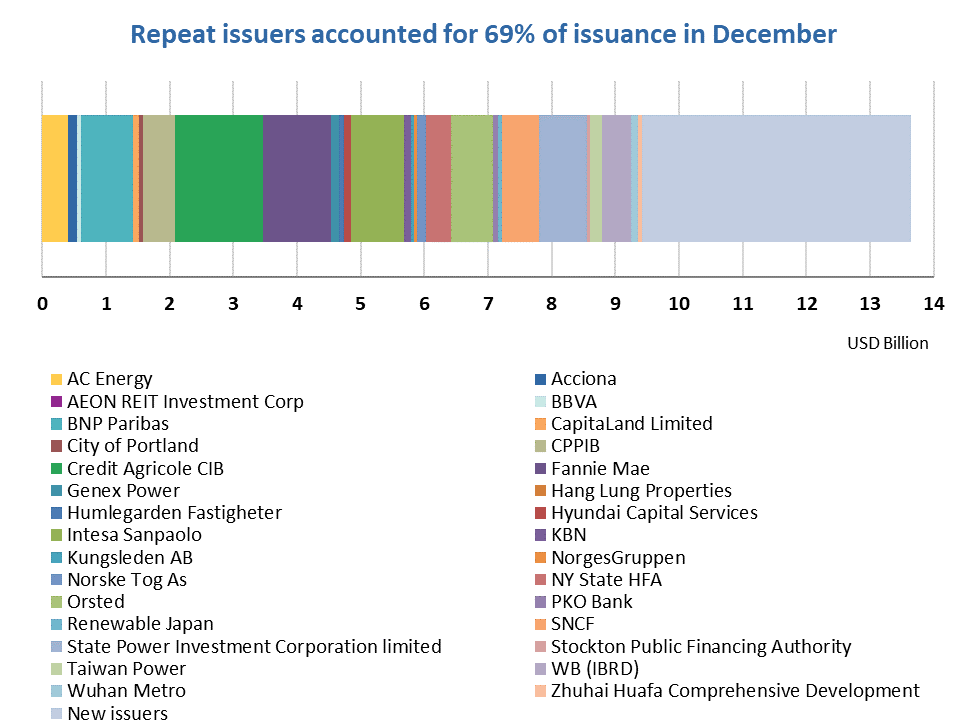

Overall issuance in December reached USD13.6bn, up by 13% from USD11.8bn in December 2018. However, the month was still the second weakest in 2019 after August. Peak issuance months in 2019 were May (USD29.5bn) and October (USD28.8bn). March and November were the only months where the market didn’t grow year-on-year.

Financial Corporates comprised the largest volume in December at 38% (USD5.2bn) of the overall figures, followed by Non-Financial Corporates (USD3.5bn) and ABS (USD2.1bn). There were no Sovereign green bonds in December 2019 and minor volume from Local Governments (USD151m).

75.7% of total issuance originated from Developed Markets: France (USD3.1bn – mainly Financial Corporates, including a USD1.1bn green covered bond from Credit Agricole CIB), the USA (USD3bn – mainly ABS deals from Fannie Mae) and Denmark (USD664m - Orsted).

Emerging Markets accounted 21.1% of the total including Ecuador’s first deal of USD150m coming from the country’s largest private bank Banco Pichincha SA.

Most of the funds raised in December 2019 will finance Renewable Energy (USD6.3bn), where 35 deals dedicated at least a portion to such projects. Low-carbon Buildings (USD4bn) were the second most popular allocation target. The Industry sector saw issuance for the 4th month in a row with USD830.9m raised by Banco Pichincha SA (Ecuador) and Intesa Sanpaolo (Italy) to partly finance projects and assets related to low-carbon manufacturing. This is a welcome sign of a diversifying issuer and project base in the market.

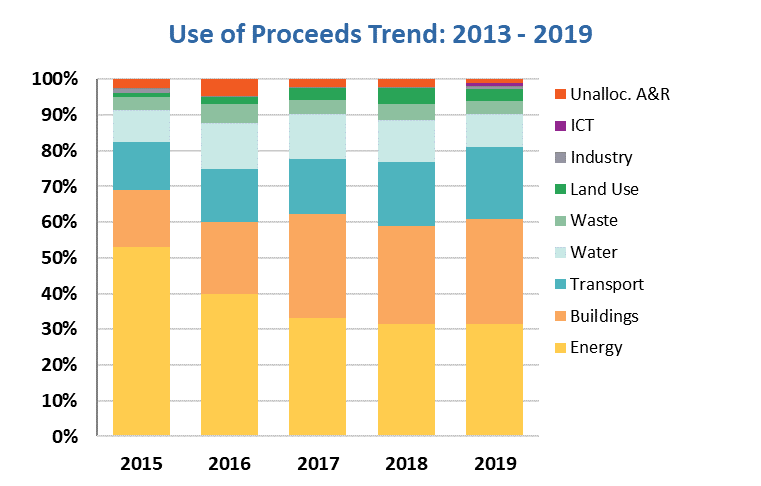

Looking at trends over recent years, the ratio of overall issuance volume going towards Low-carbon Buildings has increased, growing closer to the share of Renewable Energy: in 2015, Low-carbon Buildings accounted for only 16% of annual issuance compared to 53% for Renewable Energy. In contrast, 2019 saw Renewable Energy projects capture a 31% share of the market, whereas Low-carbon Buildings inched closer and grew to 29%. Use of proceeds allocated to the ICT sector saw their strongest year in absolute as well as relative terms with USD2bn but still only making up 1% of 2019 volume.

The largest single deal in December 2019 was a EUR1.3bn (USD1.4bn) green covered bond from Credit Agricole Home Loan SFH, France, solely allocated to entities lending green mortgages. Intesa Sanpaolo raised EUR750m (USD831m) dedicated to financing loans in the circular economy space. This covers for example solutions that extend the product life or cycles of use of goods, products and services that significantly increase effectiveness and efficiency of resource consumption. The eligible projects fall under the following categories: Renewable Energy, Energy Efficiency and environmentally sustainable management of living natural resources and land-use, biodiversity.

> The full list of new and repeat issuers here.

> Click on the issuer name to access the new issue deal sheet in the online bond library.

New issuers 14 December November to 31 December

Certified Climate Bonds

California State Teachers’ Retirement System (CalSTRS) (USD273m), United States, issued its inaugural Green Bond, maturing in 30 years’ time. It is Certified against the Low Carbon Buildings (Commercial) Criteria of the Climate Bonds Standard. The proceeds will be used to finance the expansion of the CalSTRS Headquarters is located in Sacramento, California. The new 10-storey building will add 260,000 square feet of office space to the existing building, which has a LEED Platinum rating.

This is the first building owned by a pension fund to acquire Climate Bonds Certification for a green bond issuance.

The issuer will carry out public reporting in accordance with the Municipal Securities Rulemaking Board’s rules. The Certification Verifier will also submit statements to the Climate Bonds Standards Board to confirm the bond’s continued compliance with the Climate Bonds Standard. The issuer intends to also publish a report on the water and electricity consumption of the building on an annual basis.

Ellaktor Group (EUR600m/USD666m), Greece, entered the green bond market with a 5-year senior unsecured bond Certified under the Climate Bonds Standard against the Solar Sector Criteria. The proceeds will be used to finance and refinance solar and wind electricity generation assets in Greece.

Annual reports will be made publicly available. These reports will have information on the allocation of the proceeds, as well as quantitative impact reporting indicators, including gas the amount of renewable electricity generated.

This is the second green bond from Greece, following the Terna Energy Finance (EUR150m/USD167m) Climate Bonds Certified issuance from October 2019 (see Market Blog #35).

Public sector

Washington Suburban Sanitary District (USD54m), USA, issued its debut green bond with a tenor of 29.5 years and rated E1/80 by S&P Global Ratings. The bond will finance the planning, design and construction of improvements to water filtration facilities. The issuer has not stated any reporting commitment.

Climate Bonds view: This marks the second green Muni issuance from the state of Maryland. We welcome the third-party review in form of a rating provided by S&P Global Ratings. Of all US green Munis, only 14 (out of a total 296) have acquired a rating so far. To enhance the transparency and credibility of the green bond market, CBI continue to strongly encourage post issuance reporting.

More issuance in the public sector:

- City Of El Dorado (USD10m), USA, 12.8Y original term, assurance provided by BAM GreenStar.

- City of Richland (USD3m), USA, 13.9Y original term, assurance provided by BAM GreenStar.

- The Metropolitan Government of Lynchburg, Moore County (USD3m), USA, 24.5Y original term, assurance provided by BAM GreenStar.

Financial corporates

Banco Pichincha SA (USD150m), Ecuador, debuted with a 5-year green bond. The proceeds will support projects with measurable environmental benefits related to energy efficiency, renewable energy, clean production (manufacturing), construction and sustainable transport and waste management.

Different sources claim that “IDB Invest’s participation includes conceptual framework design and a second-party opinion verifying the bond” – if this is the case, reporting on the use of proceeds and likely on impacts can be expected. However, at the time of writing neither of these documents were available online.

Climate Bonds view: The addition of Ecuador to the list of countries with green bond markets is a welcome development –that is happening via a domestic bank is even more positive. Financial corporates have an enhanced ability to increase the visibility of green investment while funding projects in diverse sectors.

It is also worth noting that the bank had previously issued a social bond (although in Peru), demonstrating its commitment to generating positive social/environmental impacts. In both cases, IDB Invest (the private arm of the LatAm-based Inter-American Development Bank) provided part of the financing and acted as an advisor to the bank.

IDB, mainly through IDB Invest, is becoming increasingly active within the sustainable finance space in the region, including having its own support programme for public sector issuers. It announced a Green Bond Transparency Platform (Climate Bonds is one of the supporting entities to the Platform) with further rollout later in 2020. We expect IDB to continue supporting the regional market in various ways.

Finally, Latin America faces a significant green infrastructure funding gap, more so than several other regions, while also being among the most vulnerable to the effects of climate change. The development of LatAm green finance markets is one of Climate Bonds 2020 priorities. 2019 was a very active year for the region in this context. We hope more good things will come in 2020!

More deals issued by financial corporates:

- Bank of Nogoya (JPY10bn/USD92m), Japan, 10Y original term, SPO provided by Sustainalytics.

- Fana Sparebank (NOK300m/USD33m), Norway, 4.8Y original term, SPO provided by CICERO.

- ITOCHU Advance Logistics Investment Corporation (JPY1.5bn/USD14m), Japan, 5Y original term, rated Green 1 by JCR.

- Sparebanken Sogn og Fjordane (NOK500m/USD56m), Norway, 10.5Y original term, SPO provided by Sustainalytics.

- Zhejiang Changxing Rural Commercial Bank (CNY300m/USD43m), China, 3Y original term, rated GB-1 by Shanghai Brilliance Credit Rating.

ABS

- Guodian and Wind Power Development Co., Ltd (CNY560m/USD80m), China, 3Y original term, SPO provided by The iGreen Bank.

- Guodian Ningxia New Energy Development (CNY560m/USD80m), China, 3Y original term, SPO provided by The iGreen Bank.

- Guodian Power Hebei New Energy Development (CNY277m/USD40m), China, 3Y original term, SPO provided by The iGreen Bank

- HECIC New-Energy Co.,Ltd (CNY300m/USD43m), China, 2.8Y original term, no third party review.

These deals are backed by the feed-in-tariff of electricity which is mainly generated from solar and wind. The Feed-in Tariff (FIT) scheme is a government programme designed to promote the uptake of renewable and low-carbon electricity generation technologies.

Climate Bonds view: These are all good examples of renewable energy asset aggregation with transparent disclosure of the asset pool. The deals are backed by feed-in tariffs linked to wind (and solar farms). There was only one deal with this structure issued before (in November 2018 issued by State Power Investment Corporation).

Non-financial corporates

Nexity (EUR240m/USD267m), France, completed its debut issuance with a senior unsecured green bond maturing in 8 years. The deal benefits from an SPO by Vigeo Eiris. Eligible Green Projects include the development and construction of residential properties located in metropolitan areas of France. The assets must meet criteria including the level of energy performance belonging to the top 15% of overall residential stock in France, and alignment with CBI Taxonomy requirements.

There will be public annual allocation and impact reporting available on Nexity’s website until the proceeds have been fully allocated. The first report will be based on data from 31 December 2020. Reporting indicators for the proceeds side include for example eligible projects financed, allocated amounts, and the share of financing and refinancing. The impact reporting will comprise estimated annual GHG emission reductions (tCO2e) compared to a 2015 Nexity baseline.

Climate Bonds view: France is at the forefront of green bond issuance in the real estate space after Sweden, so we welcome another French issuer to the market. Nexity has a CSR strategy in place that is based on five commitments, one of which is to design sustainable cities. They also aim to reduce CO2e emissions per home by 2030 compared to 2015; the assets that this bond finances directly contribute to this target. The post-issuance reporting looks to be very detailed and we are pleased to see the CBI Taxonomy being used as a guideline in selecting eligible green assets.

More deals issued by non-financial corporates:

- Alerion Clean Power (EUR200m/USD223m), Italy, 6Y original term, SPO provided by DNV GL.

- Alupar (BRL530m/USD131m), Brazil, 25Y original term, SPO provided by Sitawi.

- Huzhou Municipal Construction Investment Group (CNY520m/ USD74.3m), China, 5Y original term, SPO provided by China Bond Rating.

- Sagax AB (SEK750m/USD80m), Sweden, 3.5Y original term, SPO provided by CICERO.

- Tess Engineering (JPY8bn/USD74m), Japan, 21Y original term, rated GA1 by R&I (Japan).

Visit our Bond Library for more details on December deals.

Repeat issuers December (not previously included)

- Acciona: EUR111.5m/USD124.6m

- BNP Paribas: EUR750m/USD830.9m

- CapitaLand Commercial Trust Management Limited: JPY10bn/USD91.4m

- CPPIB (Canada Pension Plan Investment Board): USD500m

- Credit Agricole CIB: MXN70m/USD3.7m

- Credit Agricole Home Loan SFH (Credit Agricole): EUR1.3bn/USD1.4bn

- Ermewa (SNCF): EUR528m/USD585m - Certified Climate Bond

- Fannie Mae: USD1.1bn (35 deals)

- Garanti BBVA: USD50m

- Genex Power: AUD175m/USD120m - Certified Climate Bond

- Genex Power: AUD17m/USD11.7m

- Humlegarden Fastigheter AB: SEK250m/USD26.4m

- Humlegarden Fastigheter AB: SEK500m/USD52.5m

- Norske Tog As: NOK400m/USD43.9m

- Renewable Japan: JPY6.9bn/USD63.2m

- State Power Investment Corporation limited: CNY2.6bn/USD365.9m

- State Power Investment Corporation limited: CNY2.7bn/USD384.7m

- Taiwan Power: TWD5.9bn/USD193.4m

- World Bank (IBRD): DKK3bn/USD444.8m

- World Bank (IBRD): MXN40m/USD2.1m

Repeat issuers: January – November 2019 (not previously included)

- ADB (Asian Development Bank): NOK23.7m/USD2.6m - October 2019

- Agricultural Development Bank of China: CNY2.5bn/USD356.8m - November 2019

- BNP Paribas: EUR50m/USD55.1m - September2019

- CapitaLand Mall Trust Management Limited: SGD200m/USD144.7m - October 2019

- China Construction Bank: CNY4.4bn/USD624.2m - October 2019

- Credit Agricole CIB: EUR30m/USD33.1m - September2019

- Credit Agricole CIB: EUR3m/USD0.4m - November 2019

- Credit Agricole CIB: PLN29.78m/USD7.9m - July2019

- EBRD (European Bank for Reconstruction and Development): EUR750m/USD820.5m - September2019

- Fannie Mae: USD1.7bn - November 2019 (68 deals)

- Hangzhou United Rural Commercial Bank Co.,Ltd.: CNY300m/USD42.6m - September2019

- Hebei Xingtai Rural Commercial Bank Co., Ltd.: CNY250m/USD35.4m - May2019

- Mosaic Solar Loan Trust 2019-2: USD208.5m - November 2019

- Northern States Power Company (Xcel Energy): USD600m - September2019

- NWB Bank: SEK200m/USD21.2m - July2019

- Wuhan Metro Group Co.,Ltd: USD300m - September2019

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Although we support the Sustainable Development Goals (SDGs) overall and see many links between green bond finance and specific SDGs, in particular SDGs 6, 7, 9, 11, 13, 14 and 15, the proportion of proceeds allocated to social goals should be no more than 5% for inclusion in our database.

|

Issuer Name |

Amount issued |

Issue date |

Reason for exclusion/ pending |

|

Ahold Delhaize |

EUR600m/USD672.4m |

19/06/2019 |

Excluded (Sustainability/Social bond) |

|

Bank of Liuzhou |

CNY1bn/USD149.2m |

12/04/2019 |

Excluded (not aligned) |

|

Beijing Enterprises Clean Energy Group Limited |

CNY500m/USD71m CNY500m/USD71m |

12/06/2019 12/06/2019 |

Excluded (not aligned) Excluded (Working Capital) |

|

California Municipal Finance Authority |

USD6.4m USD15.9m USD26.3m |

19/12/2019 19/12/2019 19/12/2019 |

Excluded (Sustainability/Social bond) Excluded (Sustainability/Social bond) Excluded (Sustainability/Social bond) |

|

Changsha Wangcheng City Urban Construction Investment Group Co.,Ltd |

CNY280m/USD40m CNY360m/USD51.4m |

20/12/2019 20/12/2019 |

Excluded (working capital) Excluded (working capital) |

|

China Development Bank |

CNY5.7bn/USD648m |

12/06/2019 |

Excluded (alignment) |

|

China Three Gorges Corporation |

CNY3bn/USD426.7m CNY3.5bn/USD509.2m |

29/11/2019 05/07/2019 |

Excluded (not aligned) Excluded (not aligned) |

|

Chuzhou City Tongchuang Construction Investment Co.,Ltd. |

CNY500m/USD71m |

12/06/2019 |

Excluded (working capital) |

|

Datang Environment Industry Group Co., Ltd. |

CNY600m/USD86.1m |

16/12/2019 |

Excluded (working capital) |

|

EBRD |

EUR75m/USD83.5m EUR50m/USD55.1m EUR500m/USD552.4m |

13/12/2019 13/11/2019 17/10/2019 |

Excluded (not aligned) Excluded (not aligned) Excluded (not aligned) |

|

FMO |

USD36m |

19/12/2019 |

Excluded (Sustainability/Social bond) |

|

Fujian Yongrong Holding Group Co.,Ltd |

CNY300m/USD300m |

16/10/2019 |

Excluded (working capital) |

|

Fuyang Yingquan Rural Commercial Bank Company Limited. |

CNY200m/USD28.4m |

12/10/2019 |

Excluded (not aligned) |

|

GEPIC Energy Development Co., Ltd. |

CNY500m/USD71.5m |

18/12/2019 |

Excluded (not aligned) |

|

Guangxi Beibu Gulf Bank Co., Ltd. |

CNY1bn/USD142.2m CNY2bn/USD283m |

29/11/2019 15/10/2019 |

Excluded (Not aligned) Excluded (Not aligned) |

|

Guangzhou Metro Group Co.,Ltd. |

CNY1.5bn/USD214.1m |

19/12/2019 |

Excluded (Working capital ) |

|

Guangzhou Water Investment Group Co.Ltd |

CNY1bn/USD141.9m |

12/06/2019 |

Excluded (working capital) |

|

Guizhou Water Investment Group Co., Ltd. |

CNY3.2bn/USD454.8m |

27/11/2019 |

Excluded (Working capital) |

|

Hubei Yiling Economic Development Group Co.,Ltd |

CNY1bn/USD142.2m |

12/02/2019 |

Excluded (Working Capital) |

|

Hunan Provincial Expressway Group Co.,Ltd |

CNY2.1bn/USD305.6m |

11/07/2019 |

Excluded (not aligned) |

|

Huzhou Zhili urban construction investment and operation group Co.,Ltd |

CNY700m/USD101.5m |

02/08/2019 |

Excluded (working capital) |

|

Jiangsu Eastern Shenghong Co.,Ltd. |

CNY1bn/USD1bn |

30/09/2019 |

Excluded (not aligned) |

|

Jiaxing Xiuhu Development Investment Co.,Ltd |

CNY1bn/USD145.2m |

07/10/2019 |

Excluded (not aligned) |

|

Jinneng Science&Technology Co.,Ltd |

CNY1.5bn/USD1.5bn |

14/10/2019 |

Excluded (not aligned) |

|

Linghua Group Limited Company |

CNY100m/USD14.6m |

07/12/2019 |

Excluded (Insufficient information) |

|

OCBC |

AUD500m/USD341.9m |

05/12/2019 |

Excluded (Sustainability/Social bond) |

|

Qingdao Metro Group Co.,Ltd |

CNY2bn/USD284.3m |

12/12/2019 |

Excluded (not aligned) |

|

Quzhou Communications Investment Group Co., Ltd |

CNY500m/USD71.1m |

12/09/2019 |

Excluded (Working capital) |

|

Republic of Korea |

USD500m USD1bn |

19/06/2019 19/06/2019 |

Excluded (Sustainability/Social bond) Excluded (Unlabelled) |

|

Rizhao Water Affairs Group Co.,Ltd. |

CNY500m/USD71.3m |

24/12/2019 |

Excluded (working capital) |

|

Royal Dutch Shell |

USD10bn |

13/12/2019 |

Excluded (not aligned) |

|

Shandong Meichen Ecology & Environment Co.,Ltd. |

CNY700m/USD700m |

24/10/2019 |

Excluded (working capital) |

|

Shinhan Bank |

EUR500m/USD551.2m |

16/10/2019 |

Excluded (Sustainability/Social bond) |

|

Shouguang Huinong New Rural Construction Investment Development Co., Ltd. |

CNY400m/USD56.8m |

12/10/2019 |

Excluded (Working Capital) |

|

Sinohydro Bureau 8 Co.,Ltd. |

CNY700m/USD99.2m |

12/12/2019 |

Excluded (Working capital) |

|

SOSiLA Logistics REIT, Inc. |

JPY295bn/USD2.7bn |

10/12/2019 |

Excluded (not aligned) |

|

Sun Life Insurance |

CAD750m/USD566.8m |

13/08/2019 |

Excluded (Sustainability/Social bond) |

|

Taizhou Huangyan District State-owned Assets Management Co.,Ltd |

CNY900m/USD129.1m |

16/12/2019 |

Excluded (Working Capital) |

|

The Nature Conservancy |

USD62m USD40m |

02/12/2019 02/12/2019 |

Excluded (not aligned) Excluded (not aligned) |

|

Xinhua Hydropower Company Limited |

CNY1.5bn/USD1.5bn |

22/10/2019 |

Excluded (working capital) |

|

Zhejiang Rongsheng Environmental Protectionpaper Joint Stock Co., Ltd. |

CNY330m/USD48m |

23/07/2019 |

Excluded (alignment) |

|

Zhuhai Port Holdings Co,.Ltd |

CNY600m/USD85.9m |

17/12/2019 |

Excluded (Working capital ) |

|

Zhuzhou Xiangjiang Construction Development Group Co.,Ltd. |

CNY1.5bn/USD211.9m |

16/10/2019 |

Excluded (working capital) |

|

AUGA Group |

EUR20m/USD22.3m |

17/12/2019 |

Pending (Insufficient information) |

|

Banca del Mezzogiorno Spa |

EUR300m/USD331.5m |

17/10/2019 |

Pending (Insufficient information) |

|

BYD Company Limited |

CNY3.7bn/USD521.5m |

26/08/2019 |

Pending (Insufficient information) |

|

Chengdu Tianfu Water Town Urban and Rural Water Construction Co.,Ltd |

CNY930m/USD130.8m |

24/09/2019 |

Pending (Insufficient information) |

|

Garant-Invest |

RUB500m/USD8m |

17/12/2019 |

Pending (Insufficient information) |

|

Huaneng Tiancheng Financial Leasing Co.,Ltd. |

CNY1bn/USD142.1m |

25/11/2019 |

Pending (Insufficient information) |

|

Jefferson County |

USD13.1m |

13/11/2019 |

Pending (Insufficient information) |

|

Jiangxi Provincial Water Conservancy Investment |

USD300m |

05/12/2019 |

Pending (Insufficient information) |

|

KEXIM |

USD50m |

11/10/2019 |

Pending (Insufficient information) |

|

Lejonfastigheter AB |

SEK250m/USD26.1m |

29/11/2019 |

Pending (Insufficient information) |

|

Orsted A/S |

TWD8bn/USD262.2m TWD4bn/USD131.1m |

19/11/2019 19/11/2019 |

Pending (Insufficient information) Pending (Insufficient information) |

|

Qingdao International Shipping Building Management Co., Ltd. |

CNY1.9bn/USD270.1m |

27/11/2019 |

Pending (Insufficient information) |

|

Zhuhai Da Heng Qin Invest Co |

CNY800m/USD113.7m |

27/11/2019 |

Pending (Insufficient information) |

Green bonds in the market

- Mowi – closing 23 January

- Ferde AS – closing 23 January

- MünchenerHyp – closed 20 January

- E.ON – closed 16 January

- Klabin – closed 15 January

- KfW - closed 13 January

- New York MTA – closed 10 January

- Public Utilities Commission of the City and County of San Francisco - closed 9 January

Investing news

BlackRock joined Climate Action 100+, the institutional investor group led by the PRI and regional climate bodies pushing companies to report on the anticipated effects of climate change on their business. In conjunction, in his letter to the CEOs of portfolio companies, BlackRock CEO Larry Fink calls for better corporate disclosure and transparency on climate change-related risks.

The International Finance Corporation (IFC) invested USD50m in a green bond issued by Banco Pichincha SA. The bond will finance renewable energy projects, sustainable buildings as well as green mortgages, clean mobility and energy efficiency.

Before the year ended, BoE governor Mark Carney reiterated his warning that unless companies shift towards more sustainable business models, there will be irreversible changes to the economy as well as the environment.

Extreme weather-related events can have an impact on Municipalities’ economic output, as described by the FT’s Billy Nauman. Muni issuers may not be able to pay back their debt due to lower sales tax revenue as a result of climate change. Nauman argues that in future, investors will scrutinise the adaptation strategies and plans of cities and local governments as a key part of their due diligence process.

In an effort to attract more foreign investments, China’s authorities are urging companies to disclose more information about ESG-related risks. Stakeholders are hoping for more consistency and clarity in reporting to enable decision-making on a more quantitative rather than a purely qualitative basis.

Green bond gossip

Arthaland, Philippines, is planning to issue a green bond before the end of January being the first non-financial corporation to issue such an instrument in the Philippines. The proceeds will go towards green buildings.

Is Egypt about to join the sovereign green bond club? This latest news story suggests a USD500M offering around June.

Readings & reports

The EU Commission’s Executive Vice-President Frans Timmermans stresses the necessity of major policy adjustments to prepare for the upcoming major shifts in the transition to a green economy, e.g. carbon neutrality by 2050. He points out that inaction from policy makers will not prevent these shifts from happening and that massive public and private investments will be needed.

Transition bonds issued by companies in order to help “brown businesses” become greener are gaining more attention. There is ample controversy around these instruments: according to sceptics, they can be used for “boosting” companies’ green images. However, they could also help meet the high demand for sustainable investments and help facilitate the first steps of high-polluting industries’ transition towards net zero.

The European Sting explains how green investments are able to help Latin America fight climate change. In 2019 green bonds worth USD5bn were issued in Latin America and the Caribbean and are on the way of becoming a mainstream investment in that region.

The IMF in its new edition of the “Finance & Development” magazine states that the world needs to “stop runaway climate change” and that a new sustainable financial system is crucial for making this happen.

The Official Monetary and Financial Institutions Forum (OMFIF) points out that green bonds are no longer a niche market but the urgency for more standardisation in order to scale up the market persists.

Abu Dhabi has announced formation of a ‘Green Bond Accelerator’ program and has foreshadowed the objective of “establishing Abu Dhabi as a regional hub for the issuance of green bonds and green sukuk for sustainable projects in the Emirate as well as across the Middle East and Africa.”

Everyone is now talking ‘Green Swans’. The BIS report that has them all honking is here.

Don’t forget, registrations are now open for Climate Bonds Conference2020!

This is our last Market Blog covering 2019. Our next Market Blog will cover January and will be published in the second week of February. Stay tuned for some exciting updates to our blog format and coverage – we look forward to continuing to provide you with the most up-to-date green bond insights!

Till next time,

Climate Bonds