Highlights:

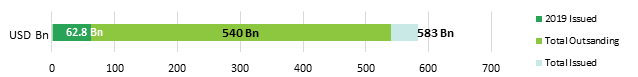

- April issuance at USD11.8bn, below the USD13bn in 2018 but pending inclusion of Fannie Mae deals

- China: Bank of Jiangsu becomes the most recent new issuer from China, issuing April’s largest bond

- Canada: RBC makes its market debut, becoming the second bank to issue a GB

- France: La Banque Postale follows its parent La Poste, issuing its first GB to finance renewable energy

- South Africa: Nedbank becomes the first South African financial corporate to issue a Certified Climate Bond

- Hong Kong Government signs Green Bond Pledge and HKMA signals green finance push

New release – Green Bond Pricing in the Primary Market: H2 2018

The 7th paper in our series analyses 34 benchmark-sized bonds, including USD21.5bn of EUR-denominated green bonds and USD7.5bn of USD green bonds. 53% of green bonds were allocated to investors declaring themselves as green.

In this edition, we spotlight the Chinese green bond market to highlight developments and opportunities for investors. China is the largest source of emerging market (EM) green bonds.

Guest author, Jason Mortimer explores whether green bonds offer better risk-return characteristics or exhibit downside risk protection, compared to vanilla equivalents in the secondary market.

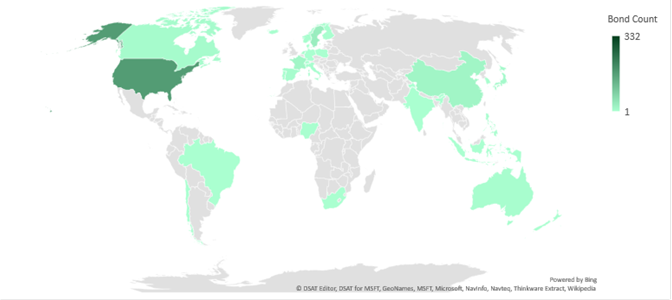

Green bond deals across the globe – 2019

Go here to see the full list of new and repeat issuers in April.

At a glance

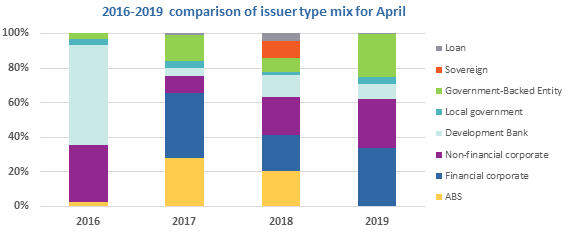

The breakdown of issuer types for April reveals a changing composition compared to previous years. As Fannie Mae figures for April have not been released yet, ABS issuance comes in at nil since there were no other securitized bonds.

Corporates appear to be gaining prominence, with both financial and non-financial corporates each representing around a third of April issuance compared to 20% last year.

- Within financial corporates, debut Chinese issuer Bank of Jiangsu issued the largest bond in April by far, for an amount of CNY10bn (USD1.5bn), whilst Nedbank issued the first Certified Climate Bond from a South African financial corporate (second ever from South Africa, following the City of Cape Town in 2017).

- The largest non-financial corporate issuers were Italian energy companies ERG SpA (a debut) and Terna, as well as Toyota Finance, each issuing about USD550m. They were closely followed by repeat issuer and paper producer Klabin (USD500m), which marked the first Brazilian green bond of 2019.

Driven by issuance from Spain (see Market Blog #24) and La Banque Postale’s debut EUR750m green bond, the share of government-backed entities grew from 8% in April 2018 to 21% this April. After France’s National Postal Service, La Poste, issued its first green bond in late 2018, its banking arm La Banque Postale has now done the same.

Local government issuance was also stronger this year, largely due to Illinois Finance Authority’s inaugural USD450m bond to finance water projects, which adds to the already diverse pool of US Muni issuers.

On the other hand, although sovereign issuance is picking up in general – with multiple new issuers expected (such as the Netherlands, Chile, Spain, Egypt) – April saw no sovereigns coming to market. May will be different, with the Republic of France having tapped the green bond market for another EUR1.9bn (USD2.3bn) on 6 May, and the Netherlands expected to close a Certified Climate Bond (its debut sovereign green bond) on the 23rd.

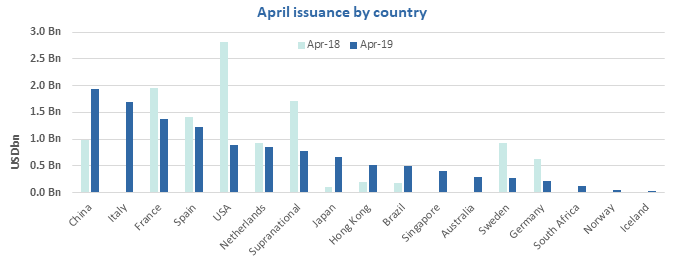

China came in at the top last month, fuelled by Bank of Jiangsu. Three European green bond markets follow, each with more than USD1bn. The USA comes in fifth place (although this excludes Fannie Mae numbers). EM issuance accounted for 22% but with a lack of issuer variety, since the vast majority came from only two issuers (Bank of Jiangsu and Klabin).

We also saw a relatively large volume of excluded deals in April, totalling USD7.4bn (compared to USD2.6bn in 2018). 70% of this came from China, driven by a large deal from China Three Gorges Group (CNY20bn/USD2.9bn) – excluded due to nearly a third of proceeds being earmarked for working capital – and one from Bank of Guangzhou (CNY5bn)/USD745m), which was excluded due to 10% funding fossil fuel-based combined heat and power (CHP) plant.

As expected, there has been an increasing volume of bonds with a social component (including sustainability bonds), especially from Europe. Whilst this is a positive trend, we often have to exclude such bonds from our green bond database (see CBI green bond database methodology). In April, for example, we excluded a EUR750m/USD845m sustainability bond from Belgian local government Flemish Community, a GBP350m bond from British Yorkshire Water and a EUR250m deal from German Otto Group (see Pending and Excluded below).

> The full list of new and repeat issuers here.

> Click on the issuer name to access the new issue deal sheet in the online bond library.

Certified Climate Bonds

Nedbank (ZAR1.66bn/USD116m), South Africa, issued its debut green bond in 2012 and has now issued its first Certified Climate Bond, verified by the Carbon Trust. The proceeds of the bond will be used to finance four new solar and wind energy generation assets in South Africa that are currently under construction. Netbank will make annual reports available to bondholders, which will include information on the allocation of proceeds per project and the amount of electricity generated.

We welcome this bond for several reasons. It is the first Certified Climate Bond from a South African corporate – the only other one from the country was issued by the City of Cape Town in 2017 – and the second of the kind in Africa, following Nigerian Access Bank’s in March. That Nedbank has now decided to obtain Certification is also positive for best practice in early market development.

More broadly, financing renewable energy in South Africa is crucial. In 2018, the Government announced a 2030 target of 26% of its electricity generation to come from wind and solar generation, as the majority currently comes from coal. There is significant potential for South Africa's green bond market to develop and we hope Nedbank increases the visibility of green finance options especially given its high profile.

New issuers

Bank of Jiangsu (CNY10bn/USD1.5bn), China, has made its market debut with a 3-year green bond, which will finance 89 projects related to energy production, buildings, clean transport, water/wastewater and waste management, several of which have a component of adaptation. The issuer has provided a detailed list of projects which includes the project’s name, location and amount to be raised via the green bond.

A third-party agency will confirm the projects’ expenditures and associated environmental benefits. Bank of Jiangsu will disclose the use of proceeds on a quarterly basis and will provide an annual green bond report by 30 April 2020.

Climate Bonds view: It’s always positive to see new issuers, including financial corporates which have the power to deliver large impacts by simultaneously funding many projects, as in this case. Some projects are fossil fuel-based, but they only represent 1.8% of proceeds which falls within our 5% limit, so the bond is included in our database.

City of Starkville (USD10m), USA, issued a 20-year green bond to finance improvements to water and sewer services provided to residents of the Municipality and some outside its incorporated area. The bond was independently reviewed under the BAM GreenStar Assessment. The City has agreed to provide annual information to BAM regarding the status of the project until completion, which will be reflected in BAM’s Credit Profile for the bond.

Climate Bonds view: As the US Muni green bond market continues to expand, the BAM GreenStar Assessment has increasingly been provided as an external review for bonds issued by entities active in the water and/or wastewater management in the USA. BAM is a CBI Approved Verifier.

La Banque Postale (EUR750m/USD841m), France, issued a debut 10-year green bond to finance/refinance 47 loans dedicated to renewable energy projects. The initial EUR1.2bn renewables portfolio identified by the bank is split 55/45 between wind and solar projects. According to Carbone 4, the environmental consultancy which advised on the issuer’s framework, their capacity is equivalent to an estimated 35,800 tonnes of CO2 avoided per year.

As stated in it's Green Bond Framework and Vigeo Eiris SPO, La Banque Postale will provide annual reports until bond maturity, including information on allocation of proceeds and environmental impacts at an aggregate category level.

Climate Bonds view: La Banque Postale’s green bond issuance follows La Poste’s – its parent group – which debuted in late 2018. Unlike other French financial sector issuers, La Banque Postale is ultimately state-owned and adds to the roster of sovereign, subsovereign and agency (SSA) deals, which is very welcome.

Royal Bank of Canada (EUR500m/USD560m), Canada’s largest bank, made its market debut by issuing a 5-year senior unsecured green bond. RBC's Framework (reviewed by Sustainalytics) identifies six project categories. RBC will provide annual reports containing information regarding allocation and impacts until maturity.

Climate Bonds view: This is the first issuance from a Canadian bank in 2019, and the second from the sector, following TD Bank’s two green bonds. Large financial institutions have the power to considerably scale up financing to green projects and this deal should help propel more issuance from North American financial institutions. Our Canada green finance state of the market report from earlier this year profiles this market and its possibilities.

Sunseap Group (SGD50m/USD37m), Singapore, obtained its first green loan, with ING as the sole lender. The proceeds will finance a portfolio of approx. 50MW of rooftop solar projects, ranging from about 100kW to 5MW in size and benefitting from long-term PPAs with more than 20 international and domestic commercial and industrial corporates such as PSA.

Sunseap Group, which offers clean energy solutions – including financing, designing, installation, and maintenance services – to customers in various Asia-Pacific countries, will publish an annual report with information on allocation and environmental impacts.

Climate Bonds view: This marks Singapore's fourth green issuance in 2019, after only four in 2018, demonstrating healthy growth. It is also the first green loan in the ASEAN region to finance rooftop solar projects and ING’s first transaction financing such projects in Asia-Pacific. Whilst it is always positive to see new issuers enter the market, we would also welcome issuance to finance other types of assets apart from energy and buildings, such as transport, water and waste (given the country’s urban nature).

New issuers issued prior to April 2019

Eólica Mesa La Paz (USD303m), Mexico, issued a 26-year bond in June 2018 to finance the construction of a 306MW onshore wind farm project, which it operates. Eólica Mesa obtained an E1/91 Green Rating from S&P.

The project consists of 85 turbines in the state of Tamaulipas and is expected to commence operations by September 2019. It will benefit from a 25-year PPA with Fuentes de Energia Peñoles that will ultimately be guaranteed by its parent, metals producer Industrias Peñoles.

Climate Bonds view: We are pleased to see non-financial corporate issuance growing, especially from EMs. The project fits well within the Mexican Government’s energy plans, which include increasing electricity generated from clean sources to 35% by 2024 and 50% by 2050, and to reduce GHG emissions by 30% by 2020.

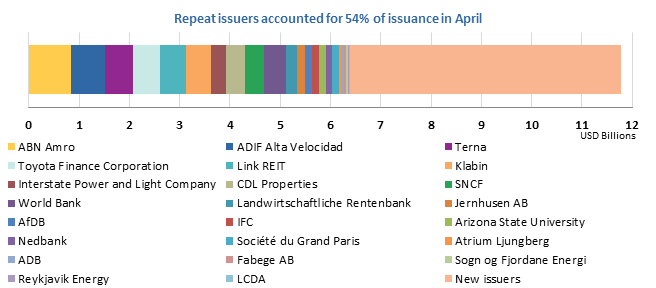

Repeat issuers – April

- ABN Amro: EUR750m/USD848m – Certified Climate Bond

- ADIF Alta Velocidad: EUR600m/USD668m

- ADB (Asian Development Bank): SEK500m/USD53m

- African Development Bank (AfDB): SEK1.25bn/USD135m

- Arizona State University: USD125m

- Atrium Ljungberg: SEK500m/USD54m

- CDL Properties: SGD100m/USD74m

- CDL Properties: SGD400m/USD295m

- Fabege AB: SEK400m/USD43m

- IFC: EUR18m/USD20m

- IFC: EUR113m/USD126m

- Interstate Power and Light Company: USD300m

- Jernhusen AB: SEK1.5bn/USD161m

- Klabin: USD500m

- Landwirtschaftliche Rentenbank: SEK2bn/USD216m

- LCDA (Louisiana Community Development Authority): USD10.4m

- Link REIT: HKD4bn/USD510m (convertible)

- Nedbank: ZAR1.66bn/USD116m – Certified Climate Bond

- Reykjavik Energy: ISK2.11bn/USD18m

- SNCF: EUR250m/USD282m (tap) – Certified Climate Bond (Programmatic Certification)

- SNCF: EUR100m/USD112m (tap) – Certified Climate Bond (Programmatic Certification)

- Société du Grand Paris: EUR70m/USD79m – Certified Climate Bond (Programmatic Certification)

- Société du Grand Paris: EUR55m/USD62m – Certified Climate Bond (Programmatic Certification)

- Sogn og Fjordane Energi: two bonds, each NOK200m/USD23m

- Terna: EUR500m/USD562m

- Toyota Finance: JPY60bn/USD536m

- World Bank: EUR250m/USD281m

- World Bank: AUD200m/USD154m (tap)

Pending and excluded bonds

We only include bonds with at least 95% proceeds dedicated to green projects that are aligned with the Climate Bonds Taxonomy in our green bond database. Although we support the Sustainable Development Goals (SDGs) overall and see many links between green bond finance and specific SDGs, in particular, SDGs 6, 7, 9, 11, 13, 14 and 15, the proportion of proceeds allocated to social goals should be no more than 5% for inclusion in our database.

|

Issuer Name |

Amount issued |

Issue date |

Reason for exclusion/ pending |

|

Government of Navarre |

EUR50m/USD56m |

30/04/2019 |

Excluded (sustainability bond) |

|

Indorama Ventures Public Company Limited (x2) |

USD100m EUR100m/USD112m |

29/04/2019 |

Excluded (Impact/ESG loan) |

|

Chengdu Xingrong Environment Co., Ltd. |

CNY800m/USD119m |

29/04/2019 |

Excluded (working capital) |

|

Yangzhou Green Industry Investment Development Holding (Group) Co., Ltd. |

CNY1bn/USD149m |

24/04/2019 |

Excluded (working capital) |

|

Huaneng Tiancheng |

CNY500m/USD75m |

19/04/2019 |

Excluded (working capital) |

|

Qingdao Metro Group |

CNY1bn/USD149m |

19/04/2019 |

Excluded (working capital) |

|

Shenzhen Energy Nanjing Holding Co., Ltd. |

CNY1bn/USD149m |

29/04/2019 |

Pending (waiting for more information) |

|

Midsummer AB |

SEK200m/USD21m |

25/04/2019 |

Pending (waiting for more information) |

|

ICBC (x4) |

USD600m, USD900m, EUR500m/USD557m, CNY1bn/USD148m |

25/04/2019 |

Pending (waiting for more information) |

Green bonds in the market

- Republic of France: EUR1.89bn (tap) – closed May 6

- California Infrastructure and Economic Development Bank: USD84m – closing May 9

- Majid Al Futtaim: USD600m – closing May 14

- Lidl Austria: CHF300m (3 tranches, each 100m) – closing May 15

- Dutch State Treasury Agency: EUR4-6bn – Certified Climate Bond – closing May 23

- United Urban Investment Corporation: JPY10bn – closing May 23

- New Jersey Infrastructure Bank: closing May 23

- New Jersey Infrastructure Bank: closing June 6

- UGE International: multiple closings

Investing News

Europe’s top markets and insurance regulators have proposed amendments to the EU’s financial regulations that will push banks, investment firms and insurers to consider the impact of sustainable finance when offering products to customers.

The UK Parliament recently declared a climate emergency. The Committee on Climate Change added that the UK should achieve net-zero carbon emissions by 2050, although red tape is still holding back the development of renewables. Investors are now calling for green gilts.

Hong Kong’s Government has become the first Asian signatory to the Green Bond Pledge as it attempts to green its financial sector. The Hong Kong Monetary Authority (HKMA) also announced it has launched new measures to promote green finance, echoing China’s plan to support Hong Kong in becoming a green finance hub for the Greater Bay Area.

At a time when many central banks are increasingly looking for ways to address climate risks, the US’s Fed Chairman Jerome Powell has stated the Fed is taking steps in the same direction. However, the announcement lacked concrete measures. The Fed was one of the few large central banks that did not join the Network for Greening the Financial System (NGFS).

The success of the Spanish Socialist Workers’ Party in the recent general election is likely positive for Spain’s climate action programme and may support the potential issuance of a debut sovereign green bond from the country.

Franklin Templeton, the asset management firm, has launched what it claims is the first actively-managed EUR green bond ETF. Its Franklin Liberty Euro Green Bond UCITS ETF will reportedly invest at least 70% of its net assets in green-labelled bonds, with the balance made up of unlabelled 'climate-aligned' bonds.

27 firms from around the world, including large banks such as Crédit Agricole, Deutsche Bank and UBS, have backed a set of Green Investment Principles (GIPs) that aim to incorporate low carbon development into projects in the Belt and Road countries. The region represents approximately 40% of the Earth's land area and 55% of CO2 emissions.

EIB is reportedly planning to launch a new development bank – tentatively called the European Bank for Sustainable Development – aimed at financing projects outside the EU. Its creation would effectively transfer EIB’s non-EU business to a new entity that will focus on financing sustainable projects.

Several investors have welcomed the announcements by chemicals giant BASF and German utility RWE to review their lobbying activities on climate change. The moves come in response to investor pressure as part of the Climate Action 100+ collaborative engagement initiative, and as the discussion around the role of green bonds in the transition to a low carbon economy intensifies.

Green Bond Gossip

In line with its objective to become a green finance hub in Asia, Hong Kong is planning to issue its first sovereign green bond in the coming weeks as part of its HKD100bn (USD13bn) green bond programme.

Following Chile’s announcement of a potential first sovereign green bond from Latin America, Peru could become the next country in the region to issue one, although there are no firm plans to do so yet.

The New Mexico Finance Authority announced plans to issue roughly USD12m in green bonds to complete efficiency and renewable energy upgrades on several state buildings in Santa Fe.

Dutch bank De Volksbank is preparing to issue green bonds to finance green buildings and/or energy efficiency projects. It has received pre-issuance Certification under the Climate Bonds Standard and obtained an SPO from ISS-oekom.

Orsted, a Danish power company, is planning to issue its third green bond in GBP. It debuted in late 2017 with a deal comprising two green bonds. The proceeds will finance an offshore wind farm.

Hemfosa Fastigheter AB, a Swedish real estate company, has announced intentions to issue a debut green bond.

Värmevärden, a Swedish district heating firm providing energy services to commercial and residential customers, has developed a green finance framework, under which it is planning to issue green bonds and/or loans.

Pakistan’s Water and Power Development Authority (WAPDA), a state-run utility, aims to issue up to USD500m of green bonds to fund two long-stalled hydro projects. WAPDA has planned four to five bond tranches, tapping the market with about USD100m each year for the next five-year period.

India’s Azure Power and Hero Future Energies, both repeat issuers and renewable energy producers, are each looking to raise about USD500m through the sale of green bonds to overseas investors.

Readings & Reports

Partnering with several other organisations, the International Union for the Conservation of Nature (IUCN) has released a report on blue bonds and how to increase financing for coastal resilience. It comes as the Asian Development Bank launches a USD5bn Action Plan for Healthy Oceans and Sustainable Blue Economies for the Asia-Pacific region.

C40 Cities has partnered with the Overseas Development Institute (ODI) to look at how green city projects can be funded at the required scale. The paper Financing the Sustainable Urban Future: Scoping a Green Cities Development Bank calls for the creation of a new institution, combining elements of development banks with the green bank model.

Amundi has released a report focusing on the growth potential of emerging market green bonds, highlighting that capital flow from developed to emerging markets has a critical role to play in addressing climate change. Amundi estimates that the outstanding volume of green bonds could increase from the current USD136bn to USD210-250bn by 2021.

In their joint report Assessing physical risks of green bonds: a case study, Swiss environmental consultancy South Pole and London-based Affirmative Investment Management assessed potential threats to a green bond issuer’s ability to produce goods or services, create value and generate revenue as a result of the physical impacts of climate change. One of the main conclusions is that green bond issuers should improve reporting on how they plan to adapt to potential physical risks posed by climate change, given the low level of disclosure of such risks that were found.

The IFC’s recent Creating Impact: The Promise of Impact Investing study has estimated that as much as USD26tn from both public markets and private sources are available for impact investing globally, although multiple key challenges remain.

Through its Insurance AM Survey 2019, Goldman Sachs Asset Management has found that only 5% of insurers globally consider ESG and/or impact investing a primary investment consideration, with 57% regarding it as one of several. There are significant differences by region, although the apparent lack of consistent definitions of ESG investing may be an issue.

A substantial and growing share of asset managers are asking that big oil companies realign their businesses with the Paris Agreement by moving away from fossil fuels, a new survey has found. Although oil companies may no longer appeal to investors unless they adopt different business models, few asset managers have set deadlines or thought about how they will tackle the problem if oil companies fail to comply.

Upcoming events

Two big conferences coming up in London for green finance and sustainable investment aficionados. Responsible Investor’s RI Europe Conference 11th -12th June and Environmental Finance’s ESG in Fixed Income featuring Green Bonds Europe on 17th June. Pick one or go to both.

‘Till next time,

Climate Bonds

Disclosure: Some of the organisations mentioned in this communication are Climate Bonds Partners. A list of Partners is available here.